koto_feja/iStock via Getty Images

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on October 20, 2022.

Beware the investment activity that produces applause; the great moves are usually greeted by yawns. – Warren Buffett

In biotech investing, you can see that certain small companies can lose most of their value after a negative binary event (be it regulatory or clinical). Usually, most of those companies then lose their NASDAQ listing and thereby go to the forgotten land of OTC stocks. Nevertheless, certain firms are determined to forget their past and thereby work diligently to make a huge comeback under a new identity.

PDS Biotech (NASDAQ:PDSB) is one such company that did not let obstacles stop it from growing. After a failure in the neuroscience space, PDS is now highly focused on the immuno-oncology sector. In the past month, this stock has garnered roughly 40%. Interestingly, there is a big catalyst that can catapult the shares to a new high. In this research, I’ll present a fundamental analysis of PDS and share with you my expectation of this interesting equity.

Figure 1: PDS Chart

About The Company

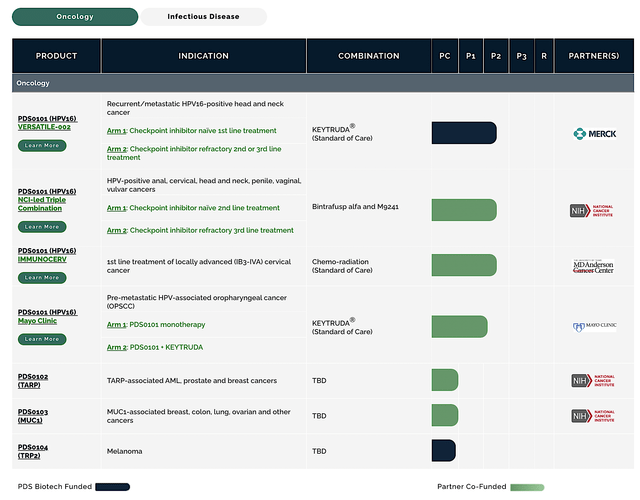

As usual, I’ll present a brief corporate overview for new investors. If you’re familiar with the firm, I suggest that you skip to the next section. Operating out of Florham Park, New Jersey, PDS Biotech is a clinical-stage company focusing on the innovation and commercialization of drugs to treat deadly cancers. Leveraging its two technology platforms (Versamune and Infectimune), PDS is brewing a deep/broad pipeline of interesting molecules as shown below.

Figure 2: Therapeutic pipeline

Pessimism to Optimism

Formerly known as Edge Therapeutics, PDS lost most of its value back in 2018. That is to say, the company was developing a very narrow pipeline of only two drugs (EG1962 and EG1964). Due to EG1964’s failed Phase 3 data, the pipeline crumbled. Thereafter, the company rebranded itself into PDS Biotech. Asides from the brand name, PDS is now focused on cancers rather than neurological bleeds. With its Versamune platform, PDS is now able to advance a diversified pipeline as shown in the previous figure.

Mechanism of Action (MOA): Versamune Platform

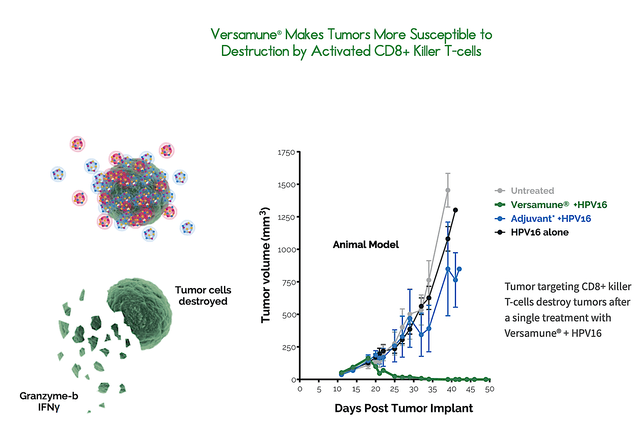

Shifting gears, let us walk through the various fundamental developments pertaining to PDS. Given that the success of PDS is closely tied to Versamune, you should assess its underlying science. By mastering its science, you’d better appreciate its mechanism of action (i.e., MOA) which helps you “read the tea leaves” in future data reports.

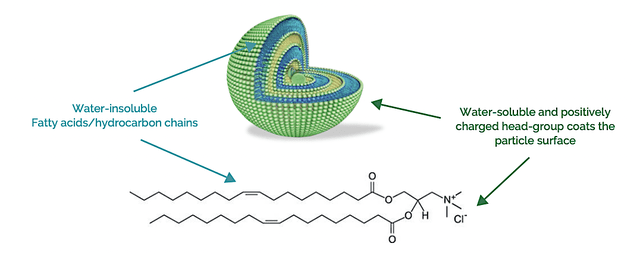

As a platform technology, Versamune is essentially a delivery vehicle that is positively charged which helps it hold tumor antigens inside. As such, Versamune’s structure made the body thinks it’s an artificial virus. As you can imagine, the body’s natural defense (i.e., immune) system would engulf such viral-like particles Versamune.

Figure 3: Versamune vehicle

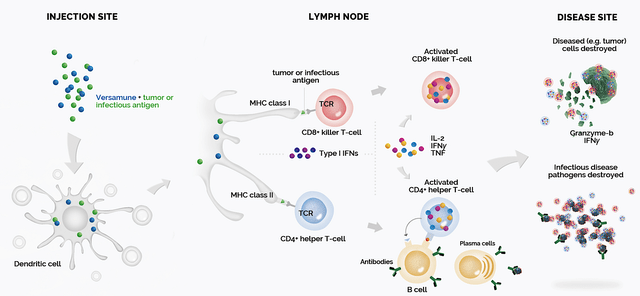

As you can appreciate, the ingenious aspect of Versamune is that it holds the antigen (of various cancers) which then triggers key immune cells. They include the T-cells — both CD4+ (T-helpers) and CD8+ (killer T-cells) — that function like “the Generals” of the body’s natural defense (i.e., immune) system.

Of those cells, killer T-cells are involved in the direct destruction of cancers. As to T-helper cells, these guys coordinated the “memory formation” which enabled the body’s immune system to recognize cancers. With intelligence/recognition, the body then amplifies/copies more T-cells, B-cells (i.e., the Commanding Officers), and other cells to eradicate cancers. More importantly, those memories can prevent certain relapses.

Figure 4: Versamune MOA

Disease Context (i.e., DC): Various Cancers

As you can imagine, the MOA fits perfectly with the Disease Context of cancers. You’ve heard that cancers are so difficult to cure. Moreover, they tend to always come back (i.e., relapses). That’s because as cancers grow, they release chemicals that suppress the immune environment. Simply put, cancers put the body’s defense system to sleep.

With Versamune being able to wake up the immune system and rally the troops, you can see that there is excellent efficacy. Here, the MOA and DC fit perfectly like matching puzzle pieces.

Early Supporting Data

Even when the MOA and DC fit perfectly together, there is no guarantee that the data would turn out positive. As such, you have to check up on the available data to see if your thesis works out. Viewing the figure below, you can see that Versamune treatment leads to the best tumor reductions compared to various controls.

Figure 5: Early preclinical results

More Supporting Data

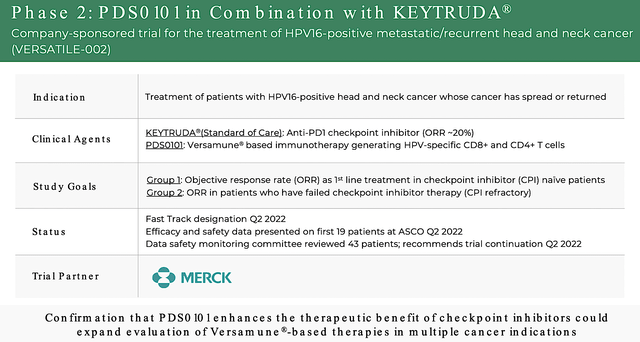

Beyond early data, PDS recently presented more advanced data at the 2022 American Society of Clinical Oncology (i.e., ASCO). It is interesting that PDS0101 treatment resulted in 76.5% of patients having clinical efficacy. You can view that efficacy as the sum of the 41.2% objective response rate (i.e., 0RR) plus 35.3% stable disease.

Figure 6: Phase 2 (VERSATILE-002) study

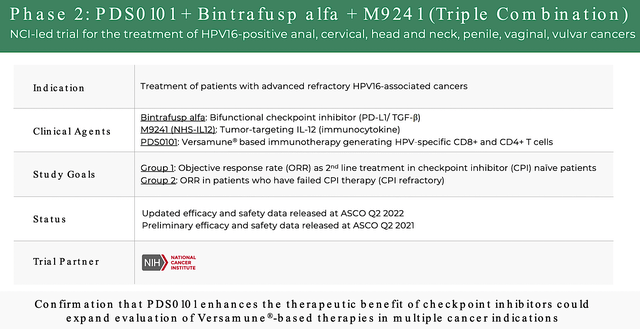

During ASCO, PDS also presented the results for the 30 patients who enrolled in the Phase 2 triple-combo trial that assessed PDS0101 in refractory HPV-positive cancers. Specifically, 88% of the patients who had not got any checkpoint inhibitor (i.e., CPI-Naive) achieved an overall response rate (i.e. ORR) of tumor shrinkage by over 30%. Historically, patients treated with CPI alone only experience an ORR ranging from 13% to 24%.

Figure 7: Phase 2 NCI-Led Triple Combo study

For patients who are already resistant to CPI therapy, the majority (i.e., 77%) are still alive at 12 months. On October 11, PSD also reported more data for this trial. Specifically, 66% of these patients remained alive at the 16-month follow-up which is extremely strong. You can appreciate that this is highly significant because historical CPI treatment only averages 3-4 months of survival. Commenting on the development, the President and CEO (Dr. Frank Bedu-Addo) enthused,

We made tremendous progress this quarter with our lead candidate, PDS0101, across all four ongoing Phase 2 clinical trials, and also with our advancing oncology pipeline candidates PDS0102 and PDS0103. Our clinical data at this year’s ASCO meeting not only solidified our confidence in our Versamune platform, but also in the potential of PDS0101 to make a meaningful difference in the treatment of advanced HPV16-positive cancer patients with significant unmet needs. With these data, we are hopeful that our upcoming meetings with the FDA will clarify our regulatory path forward for PDS0101.

Financial Assessment

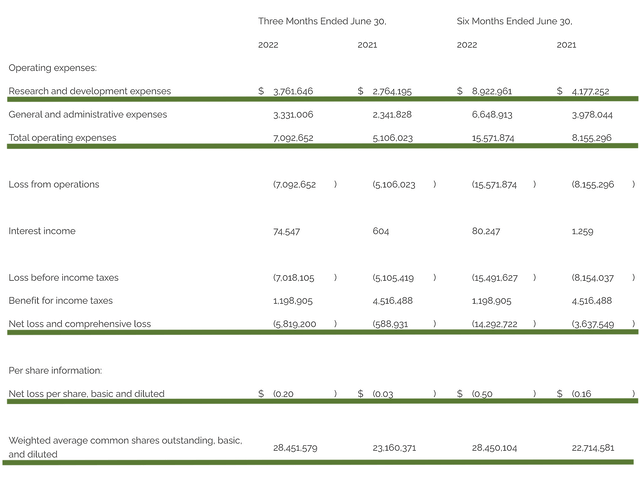

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, you should assess the 2Q2022 earnings report for the period that ended on June 30.

Like most developmental-stage biotech companies, PDS does not have any revenue. As such, you should check up on other more meaningful metrics. Accordingly, the research & development (i.e., R&D) registered at $3.7M compared to $2.7M for the same period a year prior. I viewed the 37.0% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $5.8M ($0.20 per share) net losses compared to $588K ($0.03 per share) declines for the same comparison. As you can see, the higher R&D spending cut into the bottom line.

Figure 8: Key financial metrics

About the balance sheet, there were $53.0M in cash. On top of the $35.0M in recent financing, the cash position is increased to $88.0M. Against the $7.0M quarterly OpEx, there should be adequate capital to fund operations into 2Q2025. Simply put, the cash position is robust relative to the low burn rate.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for PDS is whether the Versamune drug (i.e., PDS0101) would continue to generate positive clinical data. The other risk is that Merck didn’t want to fund the VERSATILE-002 trial. As such, it doesn’t give much validation to Versamune technology. At least, not at this point.

Conclusion

After it rebranded from Edge Therapeutics, PDS Biotech is now in a completely different biotech niche. As a premier treatment vehicle for deadly cancers, there are tremendous promises from the Versamune platform. Both early data and Phase 2 outcomes are extremely robust. If more positive data are reported in November, PDS shares are likely to rally. Moreover, other developments like a better partnership would ensue.

Be the first to comment