Olemedia/E+ via Getty Images

Intro

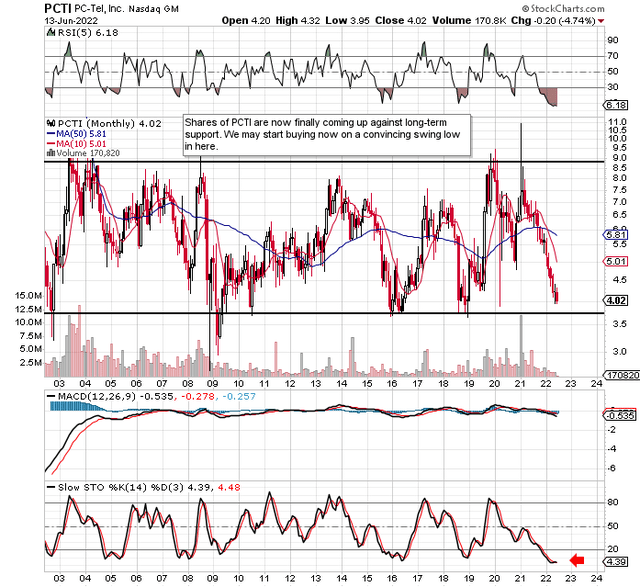

We wrote about PCTEL, Inc. (NASDAQ:PCTI) in March of this year when we stated that investors needed to be patient before putting capital to work in this play. The reason being is that the market (by means of sustained lower lows on the technical chart) remained unconvinced at the time despite the impressive fourth quarter earnings print as well as sustained growth in PCTEL’s order book. Shares are now down over 11% since we penned that piece but now are finally coming up against long-term support which essentially means a firm bottom should be on the cards for PCTEL in due course.

Technical Chart Of PCTI (Stockcharts.com)

Although shares of PC-TEL pierced below the support line depicted above in the great recession of 2009, shares have managed to remain above the $3.70 to $3.80 level since then which is encouraging. Remember, the purpose of studying long-term charts is to compress share-price behavior so a much longer period of time can be taken into account. Therefore, those successful “support tests” in 2010, 2015 & 2018 carry plenty of weight and lead us to believe that support is most likely to be successfully held once more. Suffice it to say, our job is to decipher whether PCTI is once more a worthwhile investment at these levels. We do this by monitoring the company’s trends concerning its profitability and valuation to see if downside risk is limited at this juncture.

Profitability

Although PCTI reported GAAP earnings of -$0.09 per share in its most recent first quarter, we were encouraged by some of the trends taking place within the company. Revenues for a start of $22.5 million came in 27% higher over the same period of 12 months prior. The Smarteq deal obviously aided the top-line here but there was plenty of organic growth also which is encouraging from a demand perspective. Furthermore, clear reasons existed for the negative earnings print in the quarter. For one, the non-GAAP gross profit margin in Q1 was down roughly 5.7% due to the higher mix of antennas and the fact that many antennas shipped in the quarter came from the previous backlog which meant they evaded the price increase enacted by the company in the fourth quarter last year. Antenna-related income will grow from present levels with the rail, utility & electric vehicle spaces all expected to see demand growth in upcoming quarters. Then when one couples the expanded reach that Smarteq’s portfolio brings to this space, it becomes evident that the fundamentals remain very strong in this area.

Furthermore, further down the income statement, we see that operating costs grew due to Smarteq’s operating costs entering the mix. Then, from a cash-flow perspective, negative free cash flow was reported due to the restructuring costs concerning the Chinese manufacturing initiative. However, this transition has now ended which means demands on the company’s working capital should soften significantly in upcoming quarters. Moreover, this means PCTI should be profitable on a GAAP basis by year-end, and it is encouraging to see expected sequential sales growth for the remainder of fiscal 2022, as well as the Q2 consensus earnings, estimate increasing in recent weeks.

Valuation

Shares trade with a book multiple of 1.13x and a sales multiple of 0.78x which look really attractive, especially on the sales side. Although PCTI was not profitable from a net income standpoint in the first quarter this year or over the past four quarters for that matter, the company still generated approximately $3 million of operating cash flow over the past 12 months. This remains key in our eyes. Why? Because as shares have lost more than half of their value over the past 30 months or so, PCTEL for the most part has managed to generate cash. This means the amount of share outstanding (18+ million) has been protected and the balance sheet has remained free of interest-bearing debt. The dividend also remains sustainable because its associated pay-out ratio has to be viewed over a forward-looking basis instead of what has taken place over the past 12 months. Suffice it to say, given the fundamentals we are seeing in the antenna space as well as the multiple growth catalysts in the 5G space and beyond for the test and measurement segment, we believe shares are very close to a long-term bottom here.

Conclusion

Therefore, based on PCTEL’s profitability trends as well as its valuation, we remain bullish long-term but will wait for a convincing weekly swing or monthly swing low before we put capital to work here. There has been too much investment (on the back of clear demand) for the market not to price shares higher in upcoming quarters. the company continues to generate cash, has no debt, is trading on the cheap, and growth is on the way. We look forward to continued coverage.

Be the first to comment