tdub303

The energy industry, particularly when it comes to fossil fuels, is incredibly large and incredibly complex. It’s not as simple as extracting oil or gas from the ground and utilizing it for various end purposes. There’s also the process of refining the product and transporting it, both to the place it will be refined and its ultimate end destination. One of the companies that operates in the refining and supplying segment is a firm called PBF Energy (NYSE:PBF). And just like almost any type of player in almost any segment of this space, this firm has seen extremely volatile financial results in recent years. Fortunately for investors, the most recent data provided by management has been quite positive. And with that positivity, management has started focusing on rewarding shareholders directly. This, in turn, has been perceived favorably by the investment community, resulting in shares rising materially over a short window of time.

An overview of PBF Energy

The management team at PBF Energy describes the company as one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants, and other petroleum products in the US. While the company primarily focuses on major parts of the country like the Gulf Coast, West Coast, northeast, and even Midwest, it does also sell its products to customers in Canada and Mexico. It can also make its products available to international customers outside of North America. But that represents a very small portion of their business.

As of the end of the latest quarter, the company owned and operated six domestic oil refineries and the assets related to them. Combined, these facilities have a processing capacity of roughly one million barrels per day. To put this in perspective, consider that in the latest week for which data was available, the US reported 19.63 million boe (barrels of oil equivalent) of petroleum products supplied per day. In terms of core operations, the company has divided itself into two primary segments. The first of these is known as the Refining sacrament. And according to management, this unit handles operations over the six refineries in the company’s portfolio, as well as certain related logistics assets. Meanwhile, the Logistics segment of the firm is comprised of PBFX, which management completed the acquisition of November 30th of this year.

That particular purchase involved 52.3% ownership that the company did not already have. In exchange for the remaining shares that were outstanding, shareholders and PBFX received 0.27 shares of PBF Energy for each share of PBFX that happened to be owned. They also received $9.25 in cash per share of PBFX. All combined, this transaction cost PBF Energy roughly $655.9 million, with $303.5 million in the form of cash. Leading up to the deal being completed, management did not make available any pro forma financial results. But this is not a problem since PBFX was a consolidated entity that reported earnings that belonged to its other shareholders through non-controlling interests stated in the financial statements of PBF Energy. For the purpose of analyzing PBF Energy, I made certain adjustments to the most recent quarterly data that the company reported, namely reducing the cash component Of the purchase price from the consolidated entity’s balance sheet, factoring in the issuance of additional shares, and moving the non-controlling interests that would have gone to the common shareholders of PBFX up into the income statement of PBF Energy.

Recent developments are encouraging

On December 12th of this year, shares of PBF Energy spiked, closing up 9.9% for the day. This move higher was really attributable to only one primary development. That development involves management’s decision to initiate a $500 million share buyback program. According to the terms set forth by the company, the timing and number of shares repurchased could vary significantly. In fact, the firm could very well decide not to buy back any stock at all. However, with the tremendous amount of cash flow generation management has demonstrated so far this year, such a move would make sense and, if completed in full, would result in the company buying back roughly 10% of its outstanding shares at current prices. No matter how you stack it, that’s a sizable initiative.

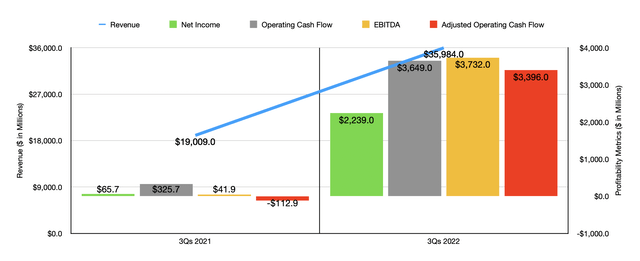

Already, I mentioned the company’s robust financial results so far this year. To put it in perspective what I mean by the word ‘robust’, consider that in the first nine months of 2022, revenue for the enterprise came in at $35.98 billion. This represents an 89.3% increase over the $19.01 billion in revenue reported the same time last year. There were multiple drivers behind this increase in sales. One of them, undoubtedly, was an increase in production. Total production increased from 839.7 thousand barrels per day in the first nine months of 2021 to 933.7 thousand barrels per day the same time this year. Crude oil and feedstocks throughput expanded from 823.2 thousand barrels per day to 920.4 thousand barrels per day. Another way to look at this is that total crude and feedstocks throughput expanded from 224.7 million barrels to 251.3 million barrels. There is no doubt that higher production figures were beneficial for the company. but the even bigger driver for the company was the surge in revenue per barrel the company experienced, a number that expanded from $76.95 last year to $127.56 this year.

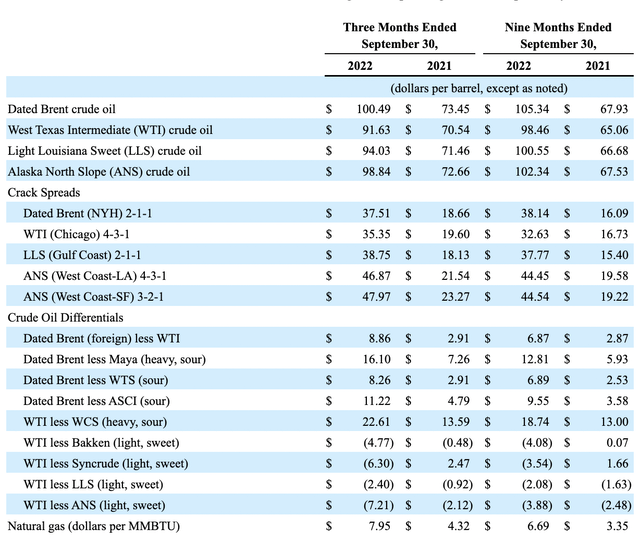

From my experience though, the actual revenue achieved by a company like this is not all that important. Instead, it’s the margin that the company can achieve from its activities. In particular, we are talking about the crack spreads and crude oil differentials that the company can capture as a result of various economic and industry factors. For instance, management stated that average industry margins were favorable during the most recent nine-month window compared to the same time last year, largely thanks to the timing and extent of impacts associated with the COVID-19 pandemic on regional demand and commodity prices. Increased refining margins also came about as a result of global supply disruptions when it comes to fossil fuels. As a rule of thumb, favorable movements in benchmark crude differentials typically result in lower crude costs for the company. As a result, they tend to positively impact the company’s financial results while the opposite is true with lower differentials impacting results negatively.

We could write an entire article dedicated just to crack spreads and crude oil differentials with regard to this particular player. In the image above though, you can see exactly how different these numbers were year over year. As a result of these factors, financial performance of the company was rather robust. Net income of $2.24 billion beat out the $65.7 million reported the same time last year. Operating cash flow surged from $325.7 million to $3.65 billion. If we adjust for changes in working capital, it would have gone from negative $112.9 million to positive $3.40 billion. And over that same window of time, EBITDA for the company jumped from $41.9 million to $3.73 billion.

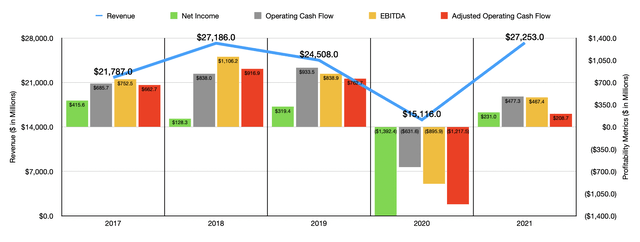

Although the 2022 fiscal year is proving to be exceptional for the company, extreme volatility is common. In the chart below, you can see financial data covering the past five years for the enterprise. Although revenue has largely remained in a fairly narrow range if you ignore the 2020 fiscal year, profits and cash flows have been very lumpy. In truth, this makes valuing the company an exercise in futility. What we do know though is that, after factoring in the aforementioned acquisition of the rest of PBFX the company did not own, overall net debt should only be $427.2 million.

With between $3.40 billion and $3.73 billion in cash flows (depending on which metric you prefer to use) reported in the first nine months of this year, it’s clear that the company is in healthy order and has the capacity to buy back stock if it so desires. the company has also been very active in buying back debt. In the first nine months of this year, the company made open market purchases of its 6% senior unsecured notes that are due in 2028 and its 7.25% senior unsecured notes due in 2025. the company also, in the most recent quarter alone, exercised its rights to redeem all of its 2025 senior secured notes that bear a 9.25% annual interest rate. this combination of no purchases alone cost the company in excess of $1.30 billion, but it will ultimately save on interest expense moving forward. In fact, from the end of last year through the third quarter this year, total gross debt has been reduced from $4.33 billion to $2.03 billion on a consolidated entity basis.

Taking a conservative approach, we could value the company based on results from 2021. With the exception of the 2020 fiscal year, which I have no doubt everyone would agree is an extreme outlier, the 2021 fiscal year was the worst for the company from a profitability perspective. On an operating cash flow basis, using data from that year, the firm would currently be trading at a multiple of 10.5. And the EV to EBITDA multiple for the company would come in only marginally higher at 11.6. But again, it’s easy to cherry-pick this data and end up with something far more attractive. Using data from 2019, for instance, these multiples would be considerably lower at 5.3 and 6.5, respectively.

Takeaway

While it might be frustrating to see a company that is as volatile fundamentally as PBF Energy has proven itself to be, the fact of the matter is that the enterprise looks very healthy at this moment. Clearly, investors are bullish when it comes to the company’s announcement regarding share buybacks. Already, management has demonstrated a willingness to buy back debt. So buying back stock is not a radical idea for this management team. Even when financial results weakened, it’s difficult to imagine a scenario where the company would make for a bad prospect for any extended window of time. So because of this favorable risk-to-reward situation, I do rate the enterprise a ‘buy’ at this time.

Be the first to comment