Aslan Alphan

Introduction

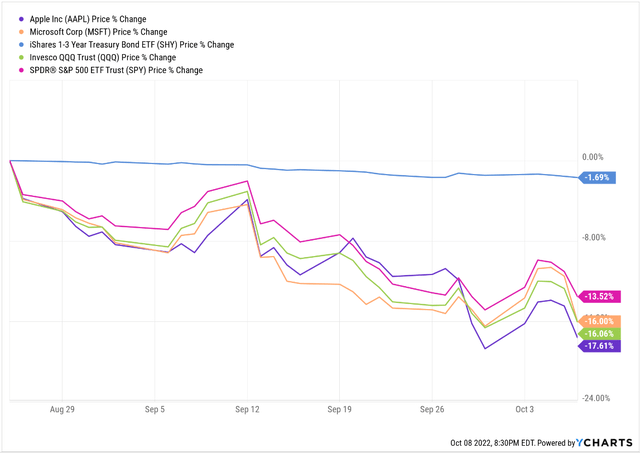

Since my last update on the “Battle of Safe Havens” on 25th August 2022, Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Treasury bonds have experienced a swift decline in price due to rapidly rising interest rates and a worsening macroeconomic environment.

Here’s our past coverage of this intriguing battle:

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-2

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens

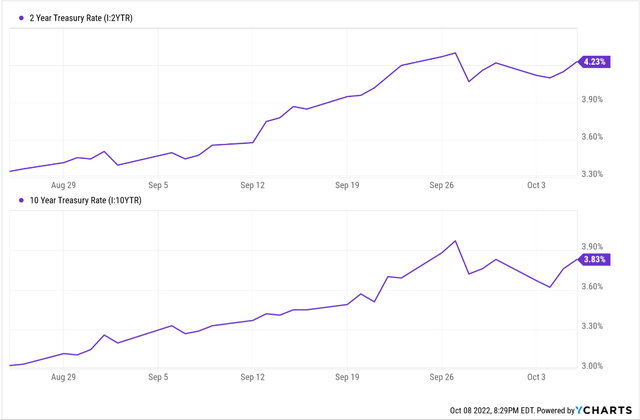

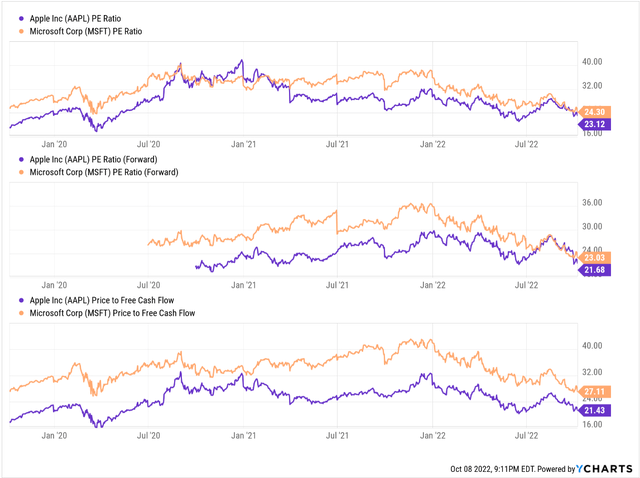

In my previous note, I highlighted how slowing revenue growth and contracting margins at BigTech companies were making their valuations untenable in a rising interest rate environment. With the risk-free treasury rate (of 3.5-4%) higher than the free cash flow yield offered by so-called safe haven stocks like Apple and Microsoft, there is a lack of equity risk premium. This is a breach of the immutable laws of money.

With the 10-yr treasury at 4%, one could argue that high-quality businesses like Apple and Microsoft deserve a Price-to-Earnings multiple of ~20-25x (equity risk premium of 0-1%). And by this logic, Apple and Microsoft seem fairly valued right now.

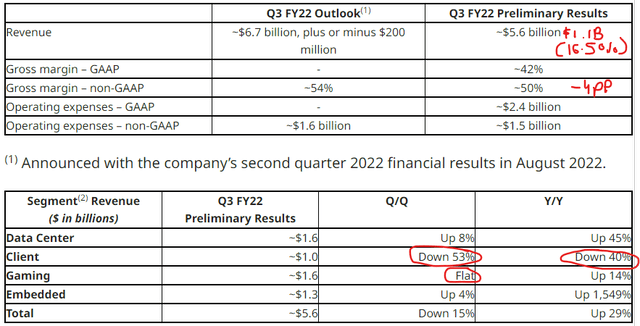

However, evidence suggests that the ‘E’ (earning) could be about to contract in upcoming quarters. Last Friday, Advanced Micro Devices (AMD) pre-announced its Q3 results, and it was an absolute shocker for investors. AMD is gaining share in the PC market, and still, its PC revenues (distributed across Client and Gaming business lines) are down significantly in Q3. Now, some customers might be waiting for AMD’s upcoming Zen4 devices, but the slowdown in PC markets is pronounced.

As you may know, Apple and Microsoft have significant exposure to PC markets, and the pull forward from COVID could result in a sizeable hit to their topline in upcoming quarters. Before AMD, Micron (MU) and Nike (NKE) announced decent quarterly numbers, but an inventory problem is set to hurt margins in Q4 for both companies. With the Fed hellbent on fighting inflation, the threat of recession looms large. An earnings recession is coming, and even the likes of Apple and Microsoft are not immune to the broader economy. If (more like when) earnings estimates for Q4 and 2023 are revised lower, we will see another leg down in BigTech stocks (and, by extension, broader equity markets).

Despite significant valuation moderation, the near to medium-term risk/reward for Apple and Microsoft is still unfavorable for investors. Here are TQI’s fair value estimates and projected returns for Apple and Microsoft:

| Stock Price | TQI Fair Value Estimate | Next 5-yr CAGR Return (%) | |

| Apple | $140 | $105.98 | 13.26% |

| Microsoft | $234 | $156.27 | 10.34% |

Now, many DGI investors would happily accept double-digit CAGR returns, and if you are such an investor, buying Apple and Microsoft here is fine. At TQI, our investment hurdle rate is 15%, and since we are not getting that (just yet), I am still ‘Neutral’ on Apple and Microsoft.

What Do The Charts Tell Us?

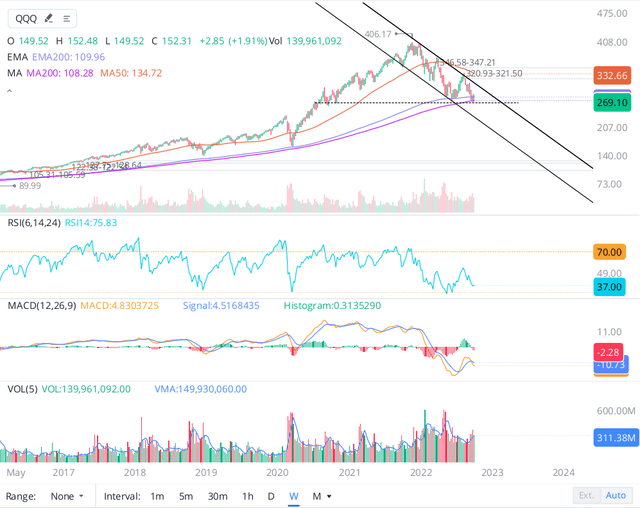

Since Fed’s hawkish pivot in Nov-21, broad market indices have entered a correction. In a rising interest rate environment, high-flying tech stocks have come under immense selling pressure. The Nasdaq-100 index [tracked by QQQ ETF (QQQ)] is re-testing June lows, and a breakdown of these lows could result in a decline to the pre-COVID range of $215-235 (for QQQ).

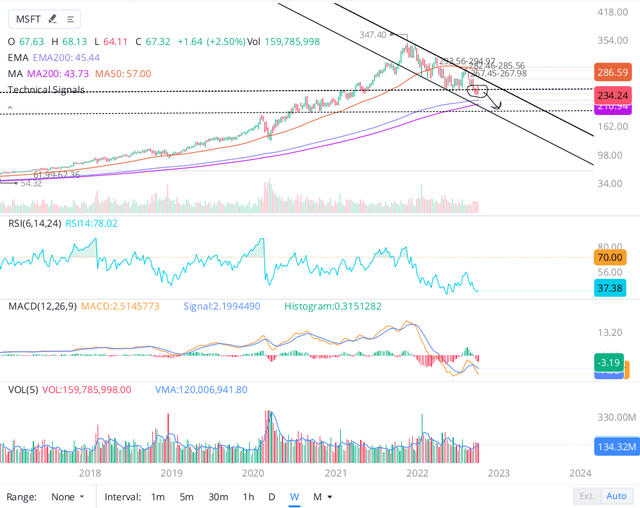

Microsoft is a significant component of broad market indices like the QQQ and SPY, which means its price action tends to be similar to what we see in the broad market. Unfortunately, Microsoft has already broken below its June lows and is now looking nailed on to test the pre-COVID level of $210. My fair value estimate for Microsoft is only $156, and so, I am unlikely to turn into a buyer at $210, either. For now, Microsoft’s stock is firmly entrenched in a downward falling wedge pattern, and I won’t rule out a decline to the mid-100s. And that’s where I would like to buy more MSFT shares.

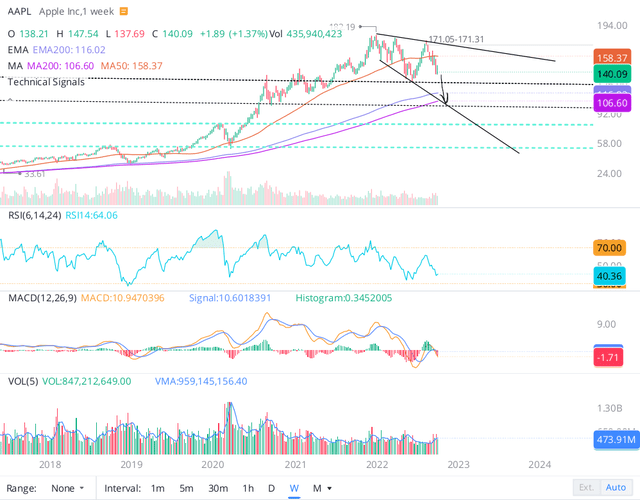

Apple is a bellwether stock, and while most tech stocks are falling in downward wedge patterns, Apple’s stock chart is looking like a descending broadening wedge, which is a bullish continuation pattern.

Technically, Apple is experiencing a correction, and it will likely move higher in the long term. However, in the near term, Apple looks set to re-test its June lows of $130, and if it breaks this key level, Apple could be headed down to its fair value of ~$105 (which is also the 200DMA level).

Considering the medium-term risk/reward [25-40% downside risk vs. 10-13% CAGR returns] for Apple and Microsoft, I rate both of them ‘Neutral or Avoid or Hold’ at current levels.

Bonds Are Now Looking Attractive

In order to fight persistently-high inflation, central banks across the globe have adopted quantitative tightening programs, which include interest rate hikes and liquidity withdrawal through balance sheet roll-off. The risk-free treasury rates in the US are now in the 3.5-4% range, and if the Fed sticks to its rate hike path, we could be headed even higher in 2023. After more than a decade, bonds are a real alternative to equities.

In the past, treasury yields have risen beyond the CPI inflation rate during periods of high inflation; however, this ongoing rate hike cycle may be close to peaking out as concerns around financial stability are growing and assets are deflating across the board.

Holding cash is not ideal if you plan to deploy this cash at a certain time in the future. And so parking it in highly-liquid, risk-free assets is a smart move. For those looking to invest in bonds, I want to share a Cash or Treasury management strategy.

A bond ladder is a collection of bonds with different maturities. Such an investment strategy is devised to get assured periodic cash flows. For example, we can invest in ten US treasury notes/bonds with a term length of 1, 2, 3, … 10 years. Every year one bond matures, and that cash flow can be used as per need. For our investing operations at TQI, we are using T-bills such that one matures each month. In the case of our GARP portfolio, we had $45K (~43% of AUM) in cash that we planned to deploy over the next nine months. Here, we bought T-bills of $5K each with maturity/term lengths of 1 to 9 months. So, instead of $5K, we will have a somewhat greater amount to invest at the time of our planned bi-weekly capital deployments.

Building a bond ladder is simple, but if you have any questions, please share them in the comments section below.

Final Thoughts

We concluded our last update on “The Battle of Safe Havens” in the following manner:

According to the definition, a bear market ends with a 20% bounce off of lows, and we got this in recent weeks. Hence, by definition, the bear market is over, and a new bull market has started. However, I think it is still too early to call a bottom. A tighter monetary policy could lead to a growth slowdown and cause a recession. Despite the growing clamor for a Fed pivot, I still think inflation is too high, and the Fed will need to keep going for some time to come. The markets may go up with rates (as this has happened in the past), but these tightening cycles often lead to something breaking in the economy and eventually a crash in the stock market. Will this time be any different? I don’t know.

I don’t know where the market is headed next; nobody else knows either. The macro-environment remains challenging, and the Fed’s QT [quantitative tightening] program is just getting started. With Apple and Microsoft trading at lofty valuations despite an evident slowdown in revenue growth and significant moderation in operating margins, I think the near to medium-term risk/reward from current levels is unfavorable for bulls. Yes, there are tons of opportunities in beaten-down growth stocks, but if the large caps get hit (in an earnings recession), the smaller cap stocks will likely continue to remain under pressure. Hence, I plan to stick with The Quantamental Investor’s playbook for a bear market environment –

“Build long positions slowly using DCA plans, and manage risk proactively.”

Source: Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-2

How Are We Investing In These Uncertain Markets At The Quantamental Investor?

As we have seen in the “Battle of Safe Havens” series, traditional safe-haven stocks like Apple and Microsoft are not so safe for the near to medium term.

As of today, the entire June-August rally has been reversed, and it is fair to say this move was just another bear market rally. I have no idea where the market is headed next. So far, in this bear market, the selling has been very much measured. We haven’t seen capitulation. Will the market (SPX) crash to $3,000 by year-end? I don’t know. What I learned from Micron and Nike’s results is that corporate earnings will come under severe pressure in upcoming quarters. Honestly, I think earnings will drive markets going forward because the multiple contraction is more or less complete (except for a few large-cap tech names like Apple, Microsoft, and Tesla (TSLA)). The top 10 S&P 500 companies are trading at 21-22x+ PE, whereas the remaining 490 are already at 13-14x PE.

The Quantamental Investor

This is a very tricky market, but there are tons of incredible opportunities for individual stock investing. In all three of TQI’s core portfolios [GARP, Buyback-Dividend, and Moonshot Growth], we are ready with cash (roughly 50% of AUM) if the opportunities improve. Our playbook for this bear market is simple – “Build long positions slowly using DCA plans, and manage risk proactively.”

In the “Battle of Safe Havens”, cash has been the winner so far; however, surging treasury rates are making treasury bonds a viable alternative to equities. If I had to choose between Apple, Microsoft, and the 2-yr treasury bond, I would go with the 2-yr treasury bond for the medium term.

Key Takeaway: I rate both Apple and Microsoft ‘Neutral/Avoid/Hold’ at current levels.

Thanks for reading, and happy investing. Please share your thoughts, questions, and/or concerns in the comments section below.

Be the first to comment