Justin Sullivan

By Brian Nelson, CFA

Everything seemed to be going fine at PayPal (NASDAQ:PYPL) in 2021. The stock continued on a very strong upward growth trajectory, earnings growth looked strong, and its outlook was solid. Then in October of 2021, Bloomberg ran a note saying that “PayPal Is Exploring a Purchase of Pinterest.”

We were taken aback. Though PayPal has put the Pinterest rumor to bed, we were left wondering what in the world was going on. However, when it issued its third-quarter 2021 results on November 8, we started to grow more and more concerned about its outlook for this year.

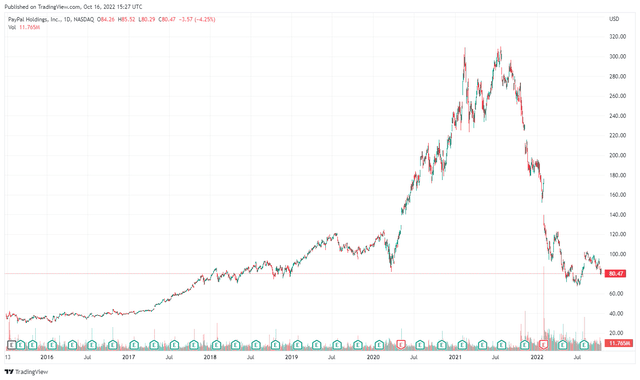

But nothing could have prepared investors for the decline in the company’s stock that would follow. Though there are many other companies doing far worse this year (see a list of the worst performers during the past 52 weeks here), PayPal is down nearly 60% so far in 2022.

Where we went wrong is that we grew way too optimistic on the stock with respect to our top-line growth and operating margin forecasts, as we may have underestimated the competition in the fintech space. PayPal is still a fine company, however, and while it may not be worth as much as it was last year, shares still look cheap.

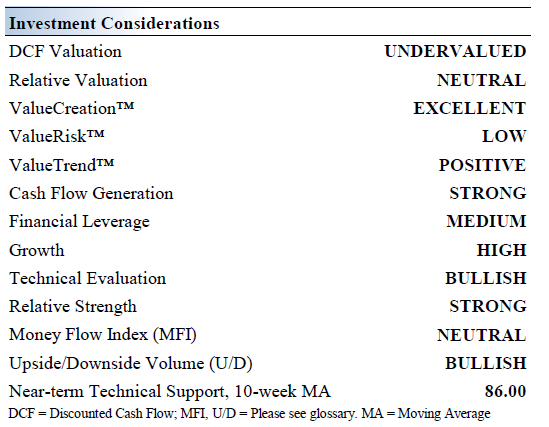

PayPal’s Key Investment Considerations

Image Source: Valuentum

PayPal operates as a technology platform company that enables digital and mobile payments on behalf of consumers and merchants worldwide. Its platform allows customers to pay and get paid, transfer and withdraw funds to their bank accounts, and hold balances in their PayPal accounts in various currencies. PayPal was spun off from eBay (EBAY) in July 2015.

PayPal’s stock is still up from it was spun off from eBay, but shares have fallen considerably in 2022. (Image Source: TradingView)

PayPal is constantly innovating and updating its products and platform to remain competitive. Venmo, its peer-to-peer platform, offers additional growth potential, and management is optimistic regarding its ability to further monetize the platform.

PayPal’s business is subject to extensive government regulation and oversight, as well as complex, overlapping and frequently changing rules, regulations and legal interpretations. Any factors that increase the costs of cross-border trade or restrict, delay, or make cross-border trade more difficult could harm its business, providing additional geopolitical risk.

PayPal continues to set itself up for long-term success. The firm has announced partnerships with Visa (V), Mastercard (MA), and Discover (DFS) that enhance customer service features, particularly in the area of digital payments. PayPal announced a partnership between Venmo and Amazon in November 2021.

Competition is growing for PayPal, including the likes of Square, now Block (SQ), Stripe, and digital initiatives from credit card companies. PayPal is a tremendous free cash flow generator with a strong balance sheet, providing it with ample financial firepower.

PayPal’s Economic Profit Analysis

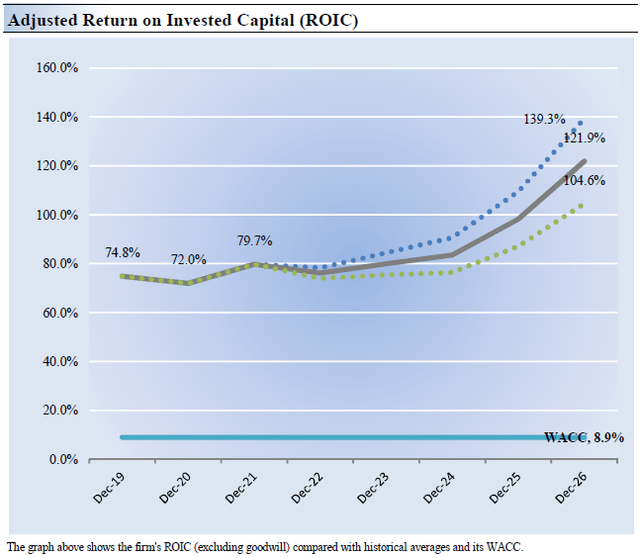

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. PayPal’s 3-year historical return on invested capital (without goodwill) is 75.5%, which is above the estimate of its cost of capital of 8.9%.

As such, we assign the firm a ValueCreation™ rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

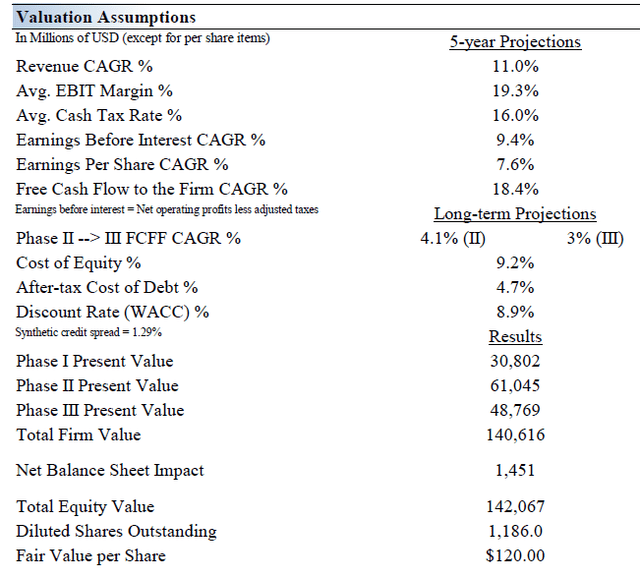

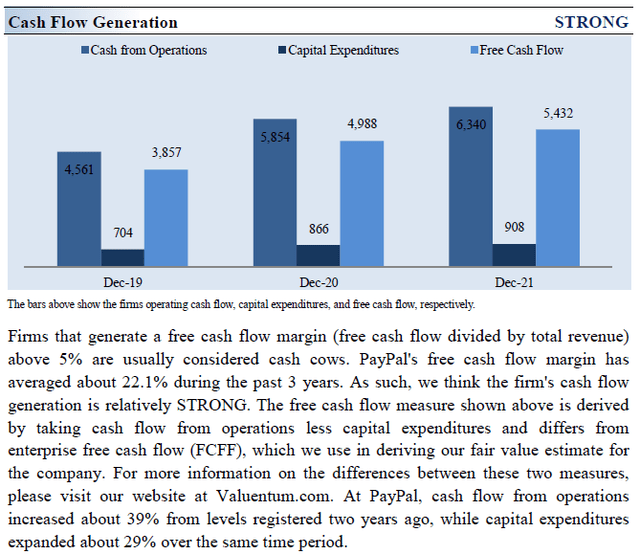

PayPal’s Cash Flow Valuation Analysis

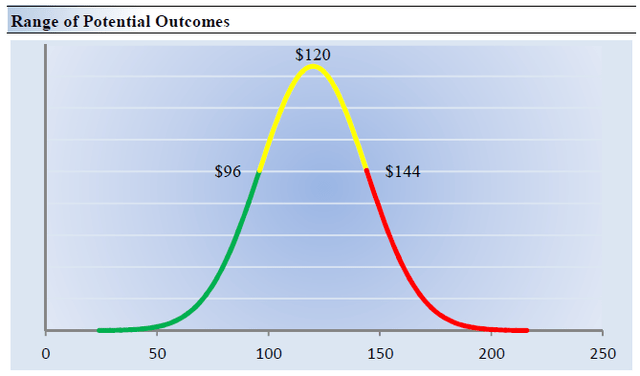

We think PayPal is worth $120 per share with a fair value range of $96.00 – $144.00. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk™ rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 11% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 18%.

Our model reflects a 5-year projected average operating margin of 19.3%, which is above PayPal’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 4.1% for the next 15 years and 3% in perpetuity. For PayPal, we use an 8.9% weighted average cost of capital to discount future free cash flows.

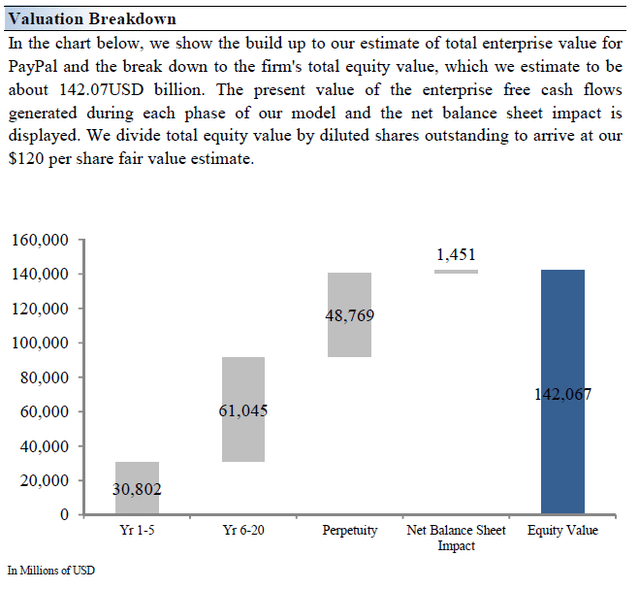

Image Source: Valuentum Image Source: Valuentum

PayPal’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate PayPal’s fair value at about $120 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk™ rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for PayPal. We think the firm is attractive below $96 per share (the green line), but quite expensive above $144 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Valuentum’s process. (Image Source: Valuentum)

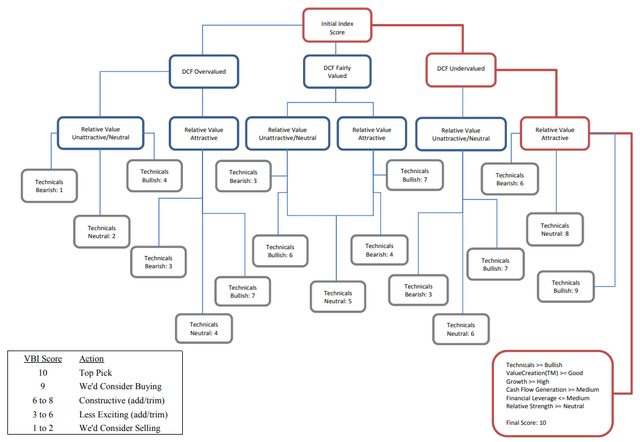

At Valuentum, we use discounted cash-flow analysis as the bedrock of our process. However, we also use relative valuation and technical and momentum indicators and blend that into an output called the Valuentum Buying Index rating. The image below shows how PayPal registers a 7 on the index. PayPal’s shares are undervalued, have a neutral relative valuation assessment, and are somewhat bullish technically, as the selling wave that has punished the stock seems to have subsided a bit of late.

The flow chart on how we rank stocks in our coverage universe. (Image Source: Valuentum)

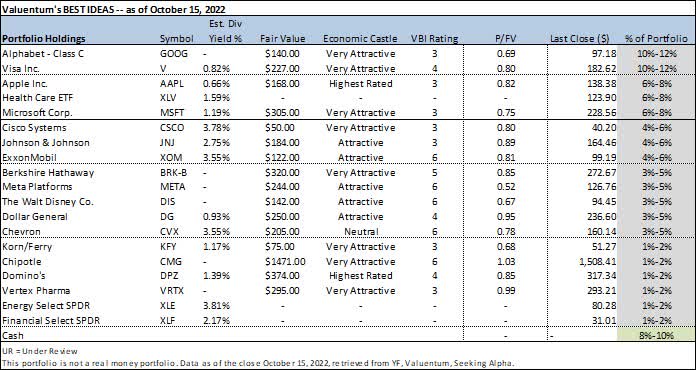

PayPal currently registers a 7 on the Valuentum Buying Index, which means we’re constructive on shares (as shown in the box in the image above), but we’re not as excited as other highly-rated stocks. We use the Valuentum Buying Index to source ideas for the simulated Best Ideas Newsletter portfolio, as shown below.

Portfolio information as of published date in top, left corner of table above. The Best Ideas Newsletter portfolio is not a real money portfolio. Past results are not a guarantee of future performance, and actual results may differ from simulated information provided. There is substantial risk associated with investing in financial instruments. (Image Source: Valuentum)

When it comes to PayPal, shares are cheap on the basis of our discounted cash-flow process, but we prefer other ideas in the simulated Best Ideas Newsletter portfolio at the moment.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment