Joe Raedle

An above-average company at an above-average price

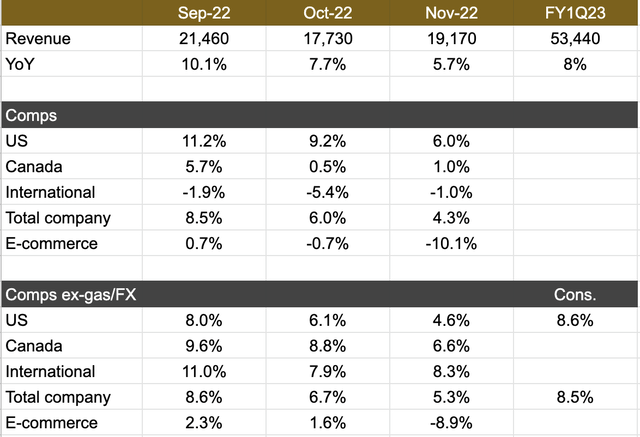

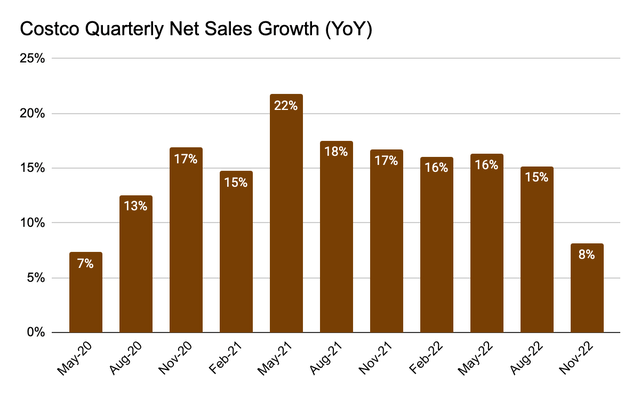

Costco Wholesale Corporation (NASDAQ:COST) is by all means a great business with a differentiated model and a top-notch management team. In FY22 (ended in August), the company delivered revenue of $227 billion (+16% YoY vs. +17% in FY21), while comps (ex-gas/FX) increased by double-digits across all regions (U.S., Canada, Other International) and e-commerce. Both operating income of $7.8 billion (3.4% EBIT margin) and net income of $5.8 billion (2.6% net margin) increased by 16% YoY, leading to diluted EPS of $13.14 (+17% YoY).

Unlike companies that have a habit of growing revenues with minimal operating leverage, Costco has consistently demonstrated textbook financial discipline where OPEX rarely outgrows revenue. At the end of FY22, the company had ~$11 billion of cash and short-term investments on the balance sheet against ~$6.6 billion of total debt. While Costco is evidently a high-quality business that deserves to be in any high-quality portfolio, the problem is that the stock comes with a premium multiple of 32x forward earnings and is being priced with a lower required rate of return than what the current environment would otherwise suggest.

Recent performance

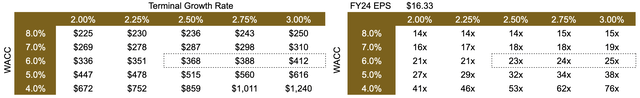

Costco reports revenue and comparable sales on a monthly basis. Following the company’s results for the August quarter where revenue of $72 billion (+15% YoY) and EPS of $4.20 (+12% YoY) both met consensus estimates, Costco reported September/October/November comps and net sales growth of 8.5%/6.0%/4.3% and 10.1%/7.7%/5.7%.

In November, total company comps (ex-gas/FX) of 5.3% came in below 8.5% consensus, while U.S. comps of 4.6% were also below 8.6% consensus. Comps were likely supported by Food & Sundries that increased low-double-digits (vs. +LDD% in Oct) and Fresh Foods that increased mid-single-digits (vs. +MSD% in Oct) due to persistent inflation.

On the other hand, Non-Foods declined low-single digits during the month (vs. +LSD in Oct), driven by weakness in consumer electronics (“CE”), jewelry and hardware. This was the first decline since April 2020 (lapping CE demand pull-forward in Oct/Nov last year) and again confirmed the broader trend that discretionary spending is slowing in an inflationary environment.

Given e-commerce has higher exposure to general merchandise, the negative 10% e-commerce comp (-8.9% ex-gas/FX) in November was likely a result of underwhelming non-food sales. Costco noted that many non-food categories (automotive, tires, toys, sporting goods) were up YoY, which indicates that CE likely accounted for a meaningful percentage of overall non-food sales which saw low-single-digital YoY decline.

On traffic and average ticket, worldwide ticket (ex-gas/FX) decelerated to +1% in November (vs. +2.5%/3.7%/4.3% in Oct/Sept/Aug), while traffic was slightly down to +3.4% (vs. +3.5%/4.7%/5.6% in Oct/Sept/Aug). In the U.S., traffic increased 2.4% in November (vs. +1.7%/2.6%/2.9% in Oct/Sept/Aug), and ticket decelerated to +2.2% (vs. +4.4%/5.4%/4.7% in Oct/Sept/Aug).

Overall, Costco’s below-expectation results in November show that overall comps are decelerating, with food inflation likely providing the majority of the upside. Going forward, my instinct is that: (1) the eventual step-down in food inflation will likely put further pressure on comps; and (2) non-food sales (with CE likely being a key component) are unlikely to pick up the slack. For this reason, I continue to see Costco’s shares as expensive at 32x forward earnings, as markets have been flocking to this high-quality, defensive name throughout 2022.

Valuation

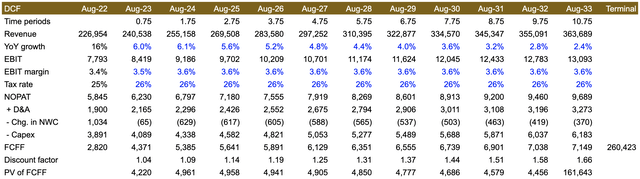

Doing some reverse-engineering of Costco’s current share price of ~$480, we can find that markets are pricing the stock using a discount rate that is significantly lower than what the current environment would theoretically suggest. The model assumes:

- Revenue growth in line with consensus estimates through FY26, then decelerates to +2.4% by FY33 with a terminal growth rate of 2%.

- EBIT margin of 3.5% in FY23 and 3.6% in FY24 and thereafter.

- An effective tax rate of 26% per management’s guidance for FY23.

- Net working capital as % of revenue in line with historical average.

- Depreciation & amortization and Capex at 0.9%/1.7% of revenue.

Company data, consensus estimates, Albert Lin Company data, consensus estimates, Albert Lin

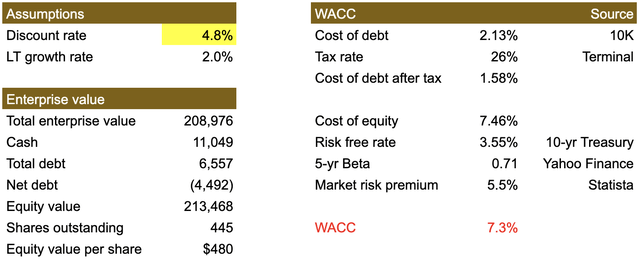

Using a 2% terminal growth assumption and a manually entered discount rate of 4.8%, we can arrive at a total enterprise value of ~$209 billion, which ultimately boils down to today’s share price of ~$480. This is significantly lower than the calculated WACC of 7.3% for Costco, which includes a ~7.5% cost of equity, driven mostly by a higher risk-free rate in today’s environment (using the current 10-yr treasury yield of 3.55% as a proxy) and a long-term equity risk premium of 5.5% per Statista.

With investors pricing Costco’s stock using a rather easy hurdle rate, I believe future returns will be mediocre at best. Of course, Costco is understood as a best-of-breed retailer and the expansion opportunities in China (only 3 warehouses by the end of 2022 vs. 14 already in Taiwan) could help justify a premium valuation for the stock. However, I see many of the positives being adequately captured in the share price given the discount rate of 4.8% itself already implies a 1% risk-free rate. This suggests shares are unlikely to benefit much from lower interest rates in the event of a Fed pivot, while forward comps could be underwhelming due to normalizing food inflation.

When to buy the stock?

In my view, Costco is priced for perfection, so any sources of profits will likely come from multiple expansion vs. above-expectation growth or margins. During the pandemic, Costco benefited from accelerating spending in both discretionary and non-discretionary goods due to widespread lockdowns and government stimulus checks, which were both transitory factors that biased revenue growth to the upside and drove the stock’s multiples to as high as 44x NTM earnings in December 2021 vs. the March 2020 low of 30x.

Given revenue growth is likely to moderate going forward on normalizing spending patterns and fading food inflation, I do not see a strong case of the current forward multiple of 32x re-rating to the upside. Instead, I believe a multiple contraction is long overdue given markets will likely view any multiple above 35x as very demanding for a diversified retailer expected to deliver slightly above mid-single-digit revenue growth.

As a result, I’d ideally like to see the FY24 earnings multiple correct to near 5-year low of 23x or $368 a share. Of course, the market doesn’t necessarily have to agree with that given the May 2022 low of ~$410 (25x FY24 P/E) could be easily viewed as a technical bottom for investors. Taking the midpoint between these two prices, however, I see $390 (~24x FY24 P/E) as an attractive entry point that should serve investors well in the long-term.

Consensus estimates, Albert Lin

Conclusion

Costco Wholesale Corporation is a high-quality business but an expensive stock that is potentially being priced by the market using a required rate of return that’s lower than the company’s weighted average cost of capital. Given sales growth is expected to normalize, I see a higher probability for a multiple contraction vs. expansion and would remain on the sidelines before valuation gravitates towards its 5-year low. Recognizing that there are no rules suggesting which price is THE price to buy, I’d probably nibble Costco Wholesale Corporation at the May low of $410 and get more aggressive should COST stock revisit $390.

Be the first to comment