sefa ozel/iStock via Getty Images

2022 has proven to be an incredibly difficult year for smaller companies. Wild swings in both consumer and enterprise demand have left many previously high-flying growth names in limbo status, least of all EverQuote (NASDAQ:EVER).

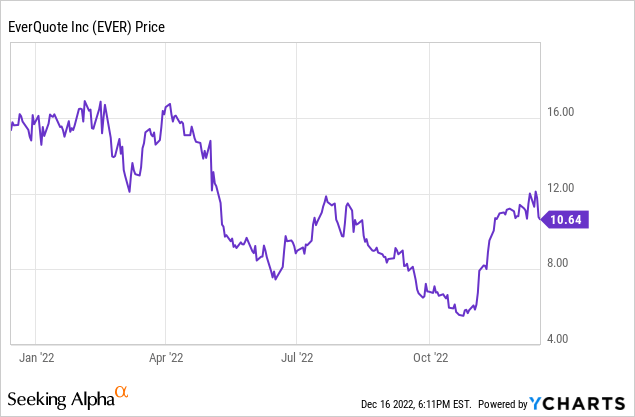

EverQuote, an insurance marketplace that primarily markets auto insurance products to online shoppers, saw last year’s double-digit growth rates grind to a halt and reverse into a decline this year. As insurance companies deal with higher claims and lower end-consumer demand, they have focused more on profitability and less on customer acquisition – hurting marketplaces like EverQuote. Year to date, EverQuote has lost ~35% of its value (which is milder than most growth stocks, though EverQuote also spent much of 2021 in the dumpster while other growth peers were rallying):

I’ll cut to the chase here: I am now neutral on EverQuote after previously being bearish. Several factors are driving that upgrade:

- Trends seem to have bottomed out. EverQuote’s most recent quarterly results, which we’ll discuss in the next section, show growth rates in the key auto vertical flattening and not declining further; on top of that, management has also sounded off positive notes on underlying trends in the auto insurance industry.

- Traffic continues to grow. Even though EverQuote has reined in marketing spend, the company continues to grow traffic and quote requests in the double-digits. Even if revenue is in a slight y/y decline, the fact that EverQuote still retains healthy traction among online web shoppers is a good sign that its marketplace will be well-positioned once auto insurers start chasing customer adds again.

- EverQuote remains profitable on an adjusted EBITDA basis, which may make it a sleeper acquisition target. Though its revenue crunch has squeezed profitability, the company has maintained adjusted EBITDA profitability since 2019. That, plus the company’s relatively tiny enterprise value, may make it an attractive target for a smaller PE firm.

This all being said, there is still a lot of uncertainty on the horizon for EverQuote. It is heavily dependent on how aggressive auto insurance carriers are in marketing, and we have not yet seen evidence for a full rebound. In addition, the company’s ambitions to expand into other non-auto categories seems to be flailing, as these categories experience double-digit y/y declines – diminished by the rising star of more popular brands like Lemonade (LMND), which directly offers its own home/renters insurance policies instead of operating a marketplace.

Overall, I don’t see much of a future for EverQuote standalone, and am neutral primarily on the possibility of its adjusted EBITDA being seen as an acquisition asset. Don’t rush in to buy this stock: it’s at best a wait-and-see.

Q3 download

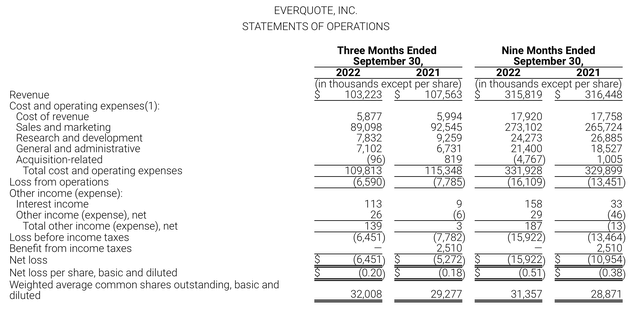

Let’s now go through EverQuote’s latest Q3 results in greater detail. The Q3 earnings summary is shown below:

EverQuote Q3 results (EverQuote Q3 earnings release)

EverQuote’s revenue declined -4% y/y to $103.2 million. While this sounds like bad news, note that the company came in well ahead of Wall Street’s consensus of $93.1 million (-13% y/y) by a huge nine-point margin. Note as well that the company had expected in Q3 for auto insurance industry dynamics to worsen in Q3.

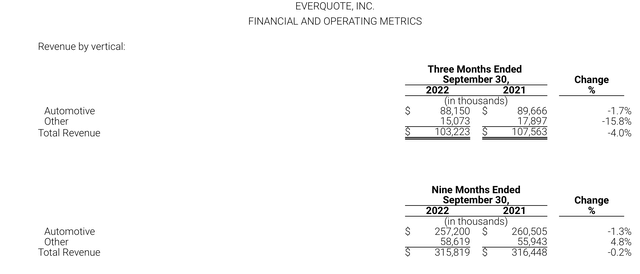

This, evidently, did not happen. Automotive revenue declined -2% y/y in Q3: versus a -3% y/y decline in Q2:

EverQuote revenue by vertical (EverQuote Q3 earnings release)

Jaymes Mendal, the company’s CEO, noted on the Q3 earnings call that EverQuote is starting to see signs of normalization in auto insurance as carriers succeeded in having rates set higher (key points highlighted):

The state of the auto insurance market remains unsettled. In August, we began to see the first major carrier return to more normalized historical spending patterns as they started to restore rates and profitability to their desired levels. While this positive dynamic drove better than expected Q3 performance, Hurricane Ian expected to be among the largest loss events in history, has put significant incremental downward pressure on the market and on carriers marketing spend through year end. As a result, we continue to expect the bulk of the auto recovery to materialize in 2023.

Despite a challenging backdrop, we executed well in Q3 and continued to make progress on several fronts across our business. On the consumer side of the marketplace, we grew consumer volume by 27% year-on-year through strong execution from our customer acquisition teams. On the provider side of our marketplace, agent-oriented distribution channels continue to demonstrate relative strength and resilience. Feedback from multiple carrier partners indicates that EverQuote is the largest and highest performing referral partner to their local agents. In addition, data suggests EverQuote has gained market share since the start of the downturn and we also continue to mix strides on longer term strategic initiatives.”

It’s worth noting that in spite of a revenue decline, traffic growth of 27% y/y suggests that the EverQuote brand is continuing to gain visibility with consumers, positioning the company well for when auto insurance carriers’ budgets are more fully recovered.

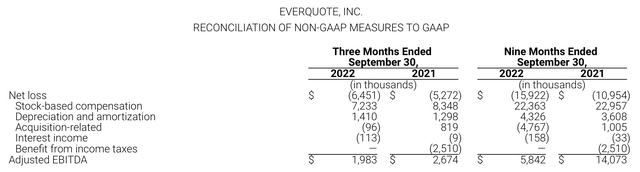

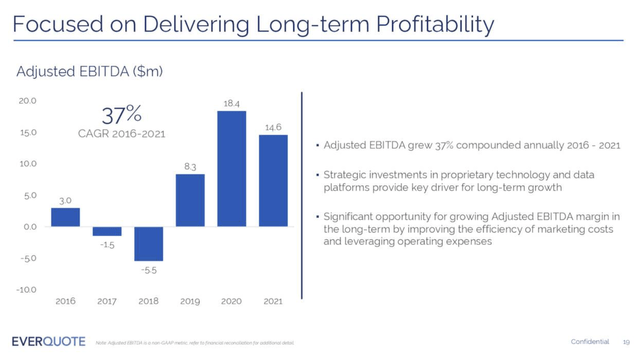

From a profitability perspective, EverQuote’s adjusted EBITDA declined -2% y/y to $2.0 million, but remained positive – margins declined slightly to 1.9%, 60bps lower than 2.5% in the year-ago quarter.

EverQuote adjusted EBITDA (EverQuote Q3 earnings release)

It’s worth noting that EverQuote has maintained profitability on an adjusted EBITDA standpoint since 2019. The ability to maintain this profitability – especially through tough years like this one – may be attractive to a potential acquirer.

EverQuote adjusted EBITDA (EverQuote earnings deck)

Key takeaways

With better-than-expected results in Q3 and a potential recovery in the auto insurance space underway, EverQuote’s runway is looking healthier than I had originally expected. That being said, it’s unclear how EverQuote plans to return to growth or expand its bottom line beyond its current low single-digit margins. Unlike other smaller companies that have faced significant revenue shortfalls this year, EverQuote has not announced any major layoffs or cost savings plans. Stay cautious here.

Be the first to comment