shaunl/E+ via Getty Images

Emera (EMA.TO) (OTCPK:EMRAF) is a geographically diverse regulated electric and natural gas utility with a substantial percentage of its current and future business in Florida, one of the best regulatory environments in the US. With higher allowed ROE and larger percentage of allowed equity, Florida is a preferred location for utility investments. The industry is under siege from rising inflationary costs, higher cost alternative power, and escalating consumer electricity and natural gas bills, making both investors and credit agencies jittery. Unlike another SA author, I consider Emera Inc as a Hold, with a nibble price about 10% to 12% below current prices.

I have several SA articles describing Emera’s utility enterprise and won’t offer much overlapping information concerning EMRAF regulated businesses spanning Florida, New Mexico, Caribbean, and the eastern Canadian province of Nova Scotia. In addition, EMRAF owns energy infrastructure assets in New Brunswick and Labrador. Of the 8 previous articles, the most recent are linked here: Emera: ‘Constructive Florida Regulation Offers Significant Growth’ (May 2022) and Emera: It’s ‘Inflation’ O’clock. Do You Know Where Your Utility Regulators Are? (Jan 2022).

Industry-wide, credit agencies are nervous with rising inflationary costs and the sector’s ability to recover higher pass-through energy expenses, called “fuel recovery” charges. After several years of relatively average rate hike requests for the sector, there is a growing fear that regulators will be under an avalanche of rate hikes requests and countervailing mounting political pressure to “do something” about rising utility bills. Brokerage analysts are beginning to prefer utilities that are due for regulatory rate reviews post-2023, and to group companies by rate request timing.

The recent untimely decision by the Nova Scotia provincial government to preempt traditional utility regulatory oversight creates both business and profit uncertainty, which is the cause of the current decline in EMRAF share prices. In November 2022, the Nova Scotia government enacted legislation that overrides a pending rate case currently being reviewed by the NS regulators, UARB. The legislation limits non-fuel rate increases, excluding increases relating to demand-side management costs, to a total of 1.8% per cent between the effective date of the UARB’s decision and the end of 2024. EMRAF has requested a rate increase of 7% each year for the next 2 years.

In response, Emera management announced it will cut its capital investment in Nova Scotia by up to $500 million, which had been earmarked for renewable power generation in the province. Currently, Nova Scotia Power NSP uses coal/pet coke for 47% of its power generation. 30% is from renewables, mainly from the recently completed Maritime Link, a $1.8 billion project which can carry 500MW of hydro capacity from northern provinces to Nova Scotia. It should be intriguing to watch how the politics of Canadian federal government mandated 80% renewable requirements by 2030 interplays with the legislative-induced reduction of Emera’s profitability and investment in renewables.

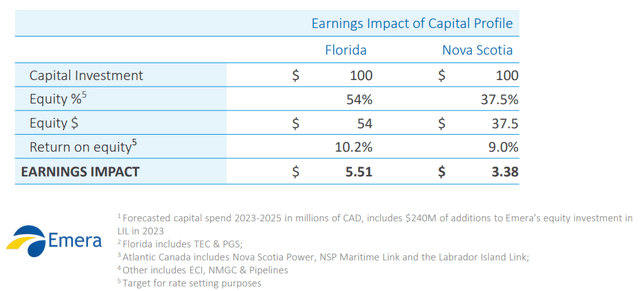

The table below from the 3rd quarter investor presentation outlining the vast difference between the economic of utility investments in Nova Scotia vs Florida. Not only is allowed ROE higher, but the layer of equity is also higher. This translates into higher profit returns for each dollar invested and a lower level of debt required to finance the investment.

Emera 3rd Qtr 2022 Earnings Presentation

Every dollar invested in EMRAF’s Tampa Electric earns 63% more profit and operating cash flow than the same dollar invested in NSP. As a by-product of the unprecedented political interference, moving capital budgets to higher return jurisdictions makes economic sense.

During the recent conference call, Scott Balfour, President and Chief Executive Officer, addressed the negative actions of Moody’s to change EMRAF’s outlook to “Negative”. Rating agency S&P Global dropped Nova Scotia Power credit rating to just above junk bond status and downgraded another NSP credit category, known as Canadian commercial paper, which provides short-term financing to businesses and government agencies. S&P commented:

The unprecedented political intervention is significantly detrimental to NSPI’s credit quality because it impairs the regulator’s ability to act independently to protect the utility’s credit quality, undermining the regulatory construct and the utility’s cash flow predictability.

The vast majority of questions in the conference call were concerning the NSP rate cap/freeze. Balfour commented:

S&P is mostly a reaction, not to expected financial metrics, but really is a reaction as we all expected to the government intervention and the challenge that that will put on the regulatory construct in Nova Scotia. Moody’s came out with an industry-wide report. Talking about fuel under recoveries, they put the entire sector back on negative outlook from stable outlook. I think we’re getting caught up in that a little bit. Fortunately, for us, the majority, if not all our fuel under recoveries to date are largely in Florida, and we’ve been working very constructively with the various customer representatives down there and see a viable path forward over the next coming months.

Not to be outdone, Fitch also issued a warning for utility credit ratings. In a Dec 6 press release, Fitch commented:

U.S. public power entities face a more challenging environment next year with rising inflation, high natural gas costs and slower economic growth eating into operating margins. As a result, Fitch’s sector outlook is ‘deteriorating’. Sustained cost pressures and slower economic growth through 2023 will result in one of the most challenging operating environments the public power sector has faced in many years. Disciplined cost recovery and rate-setting are both sector hallmarks that will be put to a very stiff test marked by prolonged high inflation and lower demand.

There is an option for management to find a buyer for Nova Scotia Power. From their 2021 Annual Report, NSP is the second-largest utility in Emera’s stable, generating Cnd$141 million in adjusted net income. Based on a companywide total of Cnd$723 million in 2021 net income, NSP represents ~20% of net income. With a rate base of Cnd$4.4 billion and total debt of Cnd$3.04 billion, NSP could fetch upwards of $8 per EMRAF share, based on a “back of the napkin” approximation of 9x EV/EBITDA valuation. Utility mergers are usually completed at a range of 12x to 15x. I don’t expect management to take this route as a buyer could be difficult to find, but it is an option.

I don’t foresee a dividend cut in Emera’s future. A potential sale of non-core assets coupled with a dividend freeze for 2 years are more likely outcomes of the political intervention in Nova Scotia. Without a dividend cut and the potential to buy on further stock price dips, “chasing EMRAF yield” in my outlook is an acceptable action.

I am in agreement with the credit agencies’ caution for utility common stock investments. I have moved to the sidelines for the sector, except if EMRAF drops to the $34-$35 range, at which level I would be a buyer of Emera’s common stock for a long-term income investment. At $34, the current $2.03 annualized payout generates a 5.97% yield, vs 2.84% yield for the broad-based S&P Utility ETF (XLU). In addition, as the dividend is actually paid in Canadian dollars, any weakness in the USD$ to Cnd$ exchange rate improves the cash payout and yield. It is important to note that in non-IRA US accounts, there is a 15% Dividend Withholding Tax levied, which is recouped as a credit of US IRS taxes paid.

Utility investors should watch closely the regulatory actions in those states with the lowest Regulatory Environment Assessment ratings from S&P’s Regulatory Research Associates. These include Alaska, Arizona, Connecticut, Kansas, Maryland, Montana, New Jersey, New Mexico, Washington DC, and West Virginia. In addition, investors should watch closely states with historically activist legislatures, such as California, Washington, and New York, for Nova Scotia-similar restrictive legislation as an answer to the public outcry “to do something”.

In my previous research of Canadian utility regulators, S&P, Morningstar, and others considered Canada as a financially supportive utility regulatory environment. I guess the old saying applies here as well – “Regulators are supportive – until they are not”. These are treacherous times for utility investors.

Be the first to comment