Christoph Burgstedt

It’s not exactly “business as usual” yet for the healthcare sector, but procedure counts have continued to recover as the pandemic pressures ease, with recoveries in elective procedures particularly notable. Unfortunately, while this recovery has been well-anticipated by the market, there is still evidence that margin pressures may be weighing on the sector more than expected.

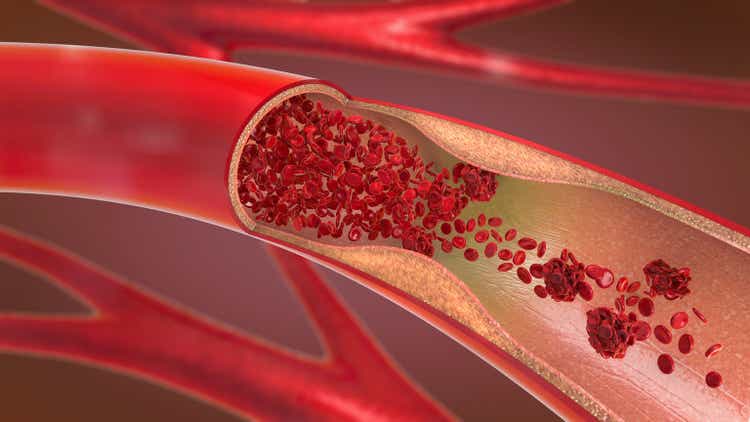

Specific to AngioDynamics (NASDAQ:ANGO), the company closed the fiscal year on a strong note with respect to revenue growth, but margins remain challenging and seem likely to remain pressured into FY’23. There’s a lot to like about the company’s growth potential in areas like thrombectomy, atherectomy, and oncology, but it will take time to develop and nurture that growth, and near-term margin pressures are likely to limit multiple expansion unless/until the company can exceed revenue growth expectations by a more meaningful extent.

Mixed Results To Close The Fiscal Year

AngioDynamics did not post a bad fiscal fourth quarter, but ongoing challenges on the cost side (margins) counterbalanced a lot of the upside from stronger revenue growth in the quarter. Likewise, management’s guidance for FY’23 called for better revenue than I’d expected, but also ongoing margin pressure.

Revenue rose 13% in the quarter, beating expectations by close to 5%, with the fast-growing Medical Technology business growing 40% and the legacy Medical Devices business growing 6%. All in all, I’d call that 6% figure a good growth number that is reflective of the overall ongoing recovery in surgical procedures.

Gross margin declined 170bp from the year-ago period, but improved 120bp from the prior quarter, missing Street expectations (mine were lower). Adjusted EBITDA rose 38% to 6.2M (a 7.1% margin), but I’d note that this number adds back share-based compensation. Ex-items operating income improved about $0.4M from the prior year to $0.7M. At the bottom line, the company matched adjusted EPS expectations, with the revenue beat offset by weaker margins.

Good Momentum In Core Business Drivers

AngioDynamics reported over 18% growth in its Endovascular Therapy business, with 10% growth in AngioVac/AlphaVac thrombectomy sales. I’d expect Penumbra (PEN) to do a fair bit better than this when the company reports second quarter results, but I’d also note that Penumbra has a larger set of offerings, approvals, and addressable markets, so it’s not exactly an apples-to-apples comparison. Continuing to generate healthy double-digit growth in this business is an important part of the bull thesis, though, so these numbers merit watching.

AngioDynamics also reported 110% year-over-year and over 31% quarter-over-quarter growth in the Auryon atherectomy business. That’s likely to be a strong result relative to Medtronic (MDT), Philips (PHG), and Cardiovascular Systems (CSII) as the company continues to gain share in peripheral atherectomy off of a low base (a little under $10M in sales this quarter).

Oncology sales were mixed, with 19% growth in Solero and 16% growth in NanoKnife probes (disposables), while Alatus/IsoLoc sales rose 7%, BioSentry declined 2%, and RF declined 18%. NanoKnife remains the key growth driver here, but one that is still very much gated by clinical trials – the most recent of which, PRESERVE for prostate, has begun enrolling patients.

Expanding Share And Addressable Opportunities

The bull thesis for AngioDynamics can be boiled down or simplified to this – the company’s ability to gain share with innovative products like AngioVac/AlphaVac, Auryon, and NanoKnife in growing, under-penetrated markets, while also using product development and clinical trials to expand labeling and addressable market opportunities.

In thrombectomy (AngioVac/AlphaVac), there are large future opportunities in areas like pulmonary embolism (roughly half of the total market opportunity at around $1.6B) that are gated by product development and clinical clearance. To that end, the company has an IDE study underway in pulmonary embolisms with its AlphaVac F18, as well as plans to expand in ilio-femoral deep vein thrombosis with the AlphaVac F14.

On top of new market/product opportunities, it’s worth noting that mechanical atherectomy remains a growth market, as facilities and physicians switch from pharmaceutical to device-based approaches given improving ease-of-use and efficacy with new devices and increased recognition of the costs/risks associated with complications from drug-based clot-busting therapies.

In atherectomy, AngioDynamics still has a lot of market share growth potential in its core peripheral market, as here too physicians are increasingly aware of the benefits of mechanical intervention and increasingly willing to do the procedures. Management also intends to follow in the footsteps of companies like Philips and Cardiovascular Systems and pursue expanded opportunities like chronic total occlusion, thrombectomy, coronary atherectomy, and lead removal (using laser energy to disintegrate unneeded pacemaker/ICD leads).

I’ve discussed the NanoKnife opportunities many times in the past and don’t want to spend too much time repeating myself here. Nevertheless, there are opportunities here to harness the core electroporation technology for patients with liver, pancreatic, or prostate cancer that either lack pharmaceutical treatment options or have not responded adequately to them.

The Outlook

Executing on the growth opportunities here is paramount for management, and I believe the company’s execution has been good recently. That said, labor and material cost inflation have clearly taken a significant toll on the business, and that looks like it will continue into FY’23. I expect this will be a more sector-wide phenomenon than the market currently expects, but even so I believe smaller companies like AngioDynamics likely have fewer options for offsetting the pressures than the larger med-techs do.

With management’s guidance, I’ve increased my FY’23 revenue estimate by about 2% (or $7M), and I see potential upside from the thrombectomy and atherectomy businesses. The lower end of management’s gross margin range fit within my expectations, though were below Street expectations, and I think it will be challenging for management to offset this with operating efficiencies while also trying to support the growth potential of its core growth driver businesses.

My longer-term assumptions haven’t changed that much, though, and I’m still looking for longer-term revenue growth of around 6%, with FCF margins in the low-to-mid-teens.

The Bottom Line

In light of ongoing margin pressures, I’ve trimmed back my EV/sales multiple to 3.25x (from 4x); this is arguably conservative, particularly with the potential for high single-digit growth over the next several years, but I think weak markets argue for a bit more conservatism. Even so, the shares look undervalued below the high $20s and these shares have enough potential to be worth consideration from more aggressive investors looking for an off-the-radar med-tech with possibly underrated top-line growth potential.

Be the first to comment