Velishchuk/iStock via Getty Images

Thesis Summary

Grayscale Bitcoin Trust (OTC:GBTC) has been under scrutiny following the FTX (FTT-USD) demise and has, in fact, been sued by a hedge fund that is alleging that GBTC is not acting in the best interest of its investors.

Ultimately, I don’t see GBTC in danger of going out of business, but it’s essential for readers to know that GBTC is an inferior product to Bitcoin (BTC-USD).

GBTC: A Quick Overview

Grayscale Bitcoin Trust has been making headlines in recent weeks, as the demise of FTX has shone the spotlight on all forms of crypto companies and investment vehicles.

But before we get into what’s going on now, let’s quickly dive into how GBTC originated and works.

GBTC was created in 2013 as an investment vehicle for accredited private investors. Sometime later, it received FINRA approval, making its shares eligible for public trade. GBTC is part of the large conglomerate Digital Currency Group.

GBTC buys Bitcoin using its investors’ funds and then stores them in “cold storage” through Coinbase, Inc. (COIN). Each share represents a given amount of Bitcoin, but this does not mean shares can be redeemed into Bitcoin.

This is, in part, why Grayscale, currently trades at a discount to Bitcoin and why the fund has been working so hard to gain approval to become an ETF.

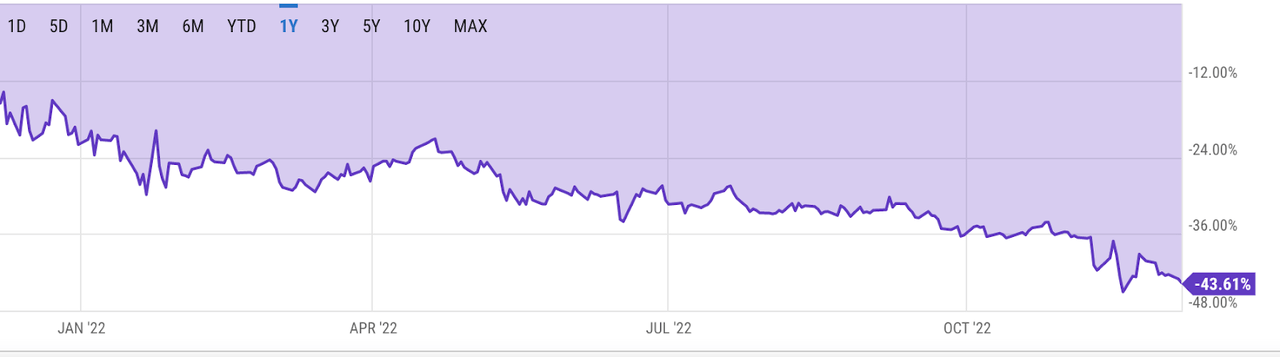

GBTC discount to NAV (Ycharts)

GBTC currently trades at a 43% discount to Bitcoin due to uncertainty over its holdings, safety and the fact that investors have been selling. More importantly, though, the fact that GBTC is not an ETF means it can’t arbitrage this discount in the open market.

This steep discount represents a possible opportunity for those who want to gain exposure to Bitcoin, but investors must understand that GBTC is not Bitcoin.

GBTC is Facing Trust Issues

GBTC may be a way to gain exposure to the movements in the Bitcoin price, but it is a far cry from owning Bitcoin. The fund does not offer redemption in Bitcoin or fiat, and its interests are not necessarily aligned with those of its users. Ultimately, GBTC is a part of Digital Currency Group, which makes money from the 2% fees levied on GBTC investors.

The issues above are at the heart of a recent lawsuit by Fir Tree Capital Management.

Fir Tree filed a lawsuit against Grayscale on 6 December at the Delaware Court of Chancery in a bid to force Grayscale to lower its fees, begin stock redemptions and hand over documents relating to its relationship with the Digital Currency Group.

Source: Hedgeweek.com

Fir Tree argues, quite rightly in my opinion, that there is no legitimate reason for GBTC not to allow redemptions or even let investors convert their holdings to fiat. GBTC also charges a 2% fee on its holdings’ value, not its fund’s value, which can also be seen as unfair.

If GBTC did indeed take these measures, then the discount to NAV would be reduced, and might even disappear. However, reducing fees or allowing redemptions is clearly not in the interest of the fund managers.

GBTC is Not Bitcoin

Grayscale offers a very convenient way to own Bitcoin, which is why investors put up with the fees. Furthermore, there are not many alternatives out there. However, it’s important to understand that GBTC is not Bitcoin, and that it in fact stands against the principles of Bitcoin, and one of the main reasons why Bitcoin is considered by many as a superior form of money.

Anything that isn’t money itself is but a proxy, which in moments of distress will be a lot less valuable than the money itself. This has been the case since the day of gold, and it is the case today.

This idea is better understood using concepts from the book Layered Money by Nik Bhatia. In the book, Bhatia describes money as a pyramid, with the top of the purest forms of money (gold) taking the top of the pyramid and then subsequent layers being added below of less “real” money.

Under the gold standard, Central banks held gold, and then banks issued notes that were redeemable in gold. However, these notes were not gold itself, in fact, they only promised to deliver gold. The US made good on this promise for centuries but eventually reneged on its gold obligations.

The gold-backed US dollar, a promise to give gold, was only as good as the word of its issuer. Further down the ladder, debt issued by banks is a form of money too, but it is much less valuable, especially when there is a crisis of confidence. In this scenario, people seek security in the higher forms of money i.e. gold, and in the case of cryptocurrencies, Bitcoin.

The same comparison can be drawn between GBTC and Bitcoin. Bitcoin sits atop the pyramid as “digital gold”, and GBTC is but an intermediary further down the pyramid that is issuing Bitcoin promises, which are a lower form of money.

The demise of FTX has highlighted these issues. What would happen to GBTC if its parent company faced liquidity issues? Or what could happen if Coinbase, which allegedly holds GBTC’s Bitcoin, ran into problems?

One of the main draws of Bitcoin is that it allows anyone unrestrained access to the highest form of money, Bitcoin itself.

Final Thoughts

GBTC is a lower form of Bitcoin, but that doesn’t mean it is in danger, in my opinion. I have no reason to believe that funds are being mismanaged at GBTC or Coinbase, and these are two large public-facing institutions that would face repercussions if something were to happen. I hold a small position in GBTC myself, and ultimately, I believe we will see GBTC close down its discount and even trade at a premium as it once did before. Still, this doesn’t change the fact that GBTC is an inferior way of owning Bitcoin.

Be the first to comment