PayPal shares have risen sharply today, which gives shareholders and investors alike an opportunity to collect attractive premiums on options. Sean Gallup

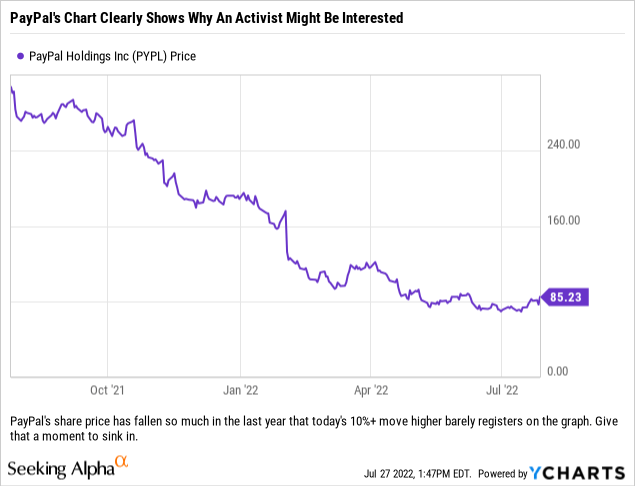

Back in April, we wrote about PayPal Holdings, Inc. (NASDAQ:PYPL) and why we thought that shares had reached a level where one could start accumulating a position. While we did not call a bottom that day, the shares have established a trading range between $70-$88/share. While we have been building our positions (across different portfolios), we have been able to trade around the price movements of the stock by selling covered calls and using cash secured puts to secure our entry points. Thus far, we have been pleased with where we are at and have been eagerly awaiting the company’s earnings announcement after the market closes on August 2, 2022.

However, late yesterday PayPal investors were thrown a bit of a curve ball after The Wall Street Journal reported that Elliott Management was accumulating a stake in PayPal – but there was no word on what Elliott planned to push the company to do. Bloomberg then came out with a report which said that Elliott Management was establishing a position in order to push for changes they believe the company needs to implement, while also urging the company to hasten their plans for previously announced changes.

Our Take On Elliott’s Entrance

Unlike many traders we know, activist investors do not bother us. They typically put their money where their mouth is, and are looking to increase shareholder value (sure, their goal is to make themselves money, but all boats rise with a rising tide). Bringing good ideas to a target company to enact is a value-add, and as long as the events do not stoop to circus-level exploits, we generally find ourselves appreciative of the activists’ efforts.

However, we are a bit perplexed by this latest move, if it does pan out to be true, because it seems that people think that the main issue Elliott has with PayPal is that they are not cutting expenses fast enough. Sure, cutting costs should be good for shareholders, but in reality, moving those cuts up by 6 months to a year would hardly justify taking a potential multi-billion dollar stake in a company to present that as your best idea. If someone has already identified the work that needs to be done and is currently implementing the changes, and the only thing you can add is that it would be nice to accomplish this move on a shorter timeline…well, that is not really a value-add in our book.

Is it logical that Elliott could have established a position? Yes, especially considering that PayPal was trading at a market cap below $100 billion at the time. The reports we have read indicate that Elliott’s position would put them in the Top 5 category of shareholders. That means that the company would have to have a holding of about 2% of PayPal – which Elliott could certainly do – but we come back to whether that move would make a whole lot of sense if your only idea was to hasten cost cuts.

So, if Elliott has amassed a stake to make them one of the five largest holders of PayPal stock, we suspect they are going to bring more to the table to discuss, meaning this is not really about cost cuts. Our guess is that Elliott may have their eyes on the company’s cash, which in recent months has represented about 10% of PayPal’s market cap (although the company has been spending that down). With the annual cost savings that PayPal will save from their restructuring, Elliott could be looking at ways for the company to allocate capital moving forward. Since the shares trade north of a 20 P/E on a forward basis, we think buybacks would be expensive. So, only a small dividend would make sense to us, as issuing debt to repurchase shares is expensive on both fronts (issuance costs/interest expenses have risen and the stock is not cheap). And we know that it does not make sense to break PayPal up, with Venmo going one way and PayPal going another. That would add costs and most likely be value-destructive.

How To Trade PayPal

With earnings due up in less than a week, we think that Elliott Management will now sit back and await the company’s quarterly results, since the news of their supposed stake has already made headlines. This move higher has complicated matters for investors, because you now have a major move higher on reports that an activist has surfaced, and another volatility-creating event in a few days with the company announcing their quarterly results. We think this leaves PayPal shareholders, and those who would want to be shareholders, with only two options at this point.

As shareholders, we want to continue to own the shares, as we think over time that the stock can move higher. Since we already own shares, we believe that the best way to play PayPal ahead of earnings, and on the back of the Elliott reports, is to write covered calls for August 5, 2022, at a strike of $92/share. This will generate roughly $2.95/share, or $295 per contract, in options premiums and will generate over $5/share in profit for our highest cost basis shares if we have our shares called away ($2 capital gain plus the $2.95 in option premium). Writing the covered calls allows us to generate some income just in case earnings are poor and the shares pull back, or if Elliott decides to cash out and do nothing because earnings turn out OK. Basically, we are locking in some upside which is only $5/share less than an area where we recently planned to lighten up. So, if we are called, we can still make money, and that is never a bad thing during a bear market – or when the economy is in a recession.

For those who do not currently own shares but are now interested in establishing a position, we think it would be wise to not chase during a bear market. That rule has generally served us well over the years and prevented some bad trades. So, instead of rushing in and buying shares, we think that utilizing the options market is a better proposition and pays you to establish your desired position at your target price. If it were us, we would utilize the August 5, 2022, Puts with a strike price of $80/share, which will generate about $3.05/share, or $305 per contract. We like this set-up because if the shares are assigned to you, your cost basis is just under $77/share and you accomplished the goal of owning shares but for roughly the price they were prior to the Elliott Management news. If the shares are not assigned to you, but the stock trades sideways, then it is easy enough to purchase shares and you still were able to collect $3.05/share. If shares do continue higher (say PayPal beats earnings solidly), then you miss out on that move but still get the $3.05/share.

We like these set-ups, especially as we believe that PayPal still has some work to do moving forward. Creating an exit strategy is nice for current holders, especially as we do not see any low-hanging fruit to significantly boost PayPal shares. By using options to create your ideal entry point, your trade generates a cash payment to you on day one while you wait to see if you get your position at your price. In the current environment, we think these are the best ways to manage risk and the recent volatility in PayPal shares.

Be the first to comment