subman

Thesis

JPMorgan Chase & Co. (NYSE:JPM) is expected to announce Q3 2022 results on the 14th of October (pre-market), and I believe the bank is in a good position to beat market expectations. Although investment banking fees for the quarter are likely down more than 50% versus the same period in 2021, the bank’s global market division is poised to deliver blow-out results, given the volatile market environment. Moreover, given depressed confidence in the global banking system – following the Credit Suisse (CS) insolvency speculations – the expectations needed to meet are arguably very low.

Being down about 35% YTD, versus a loss of approximately 23% for the S&P 500 (SPX), JPMorgan stock is also trading cheap. Personally, I like the risk/reward going into the Q3 earnings results, and I argue buying time sensitive 105/125-% moneyness call spreads could be an attractive short-term trade.

Earnings Preview

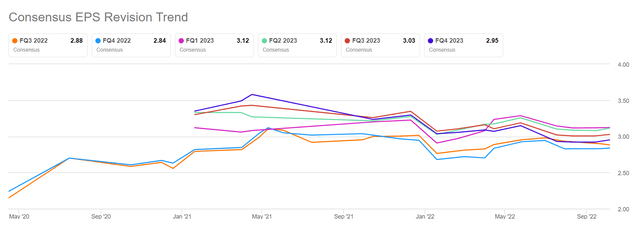

According to the Bloomberg Terminal, as of October 11th, 15 analysts have submitted their estimates for JPM’s Q3 results. Total sales are estimated between $30.45 billion and $33.31 billion, with the average estimate being $31.99 billion. If an investor would assume the average as the anchor, JPM’s Q3 sales are estimated to grow almost 8% as compared to the same quarter in 2021. EPS estimates are between $2.41 and $3.20. The average is $2.88, which would imply a year over year growth of -18.86%

Notably, there has been no major revisions in earnings for JPM’s Q3 EPS estimates since early 2021.

In my opinion, analysts’ expectations are reasonable. But given the negativity surrounding the Credit Suisse bankruptcy discussions, investors should consider that the stock might be priced for an earnings miss. Moreover, the publicly known weakness in global investment banking activity might support such positioning.

Investment Banking Likely To Remain Weak

Daniel Pinto, a leading executive of the world’s largest investment bank JPMorgan, has warned that investment banking fees for Q3 are expected to be down approximately 50% year-over-year.

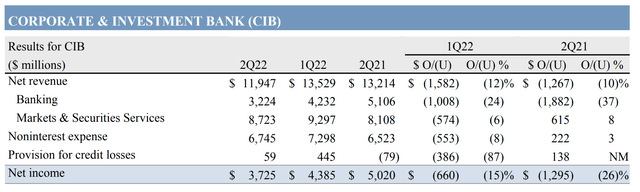

But the weakness in investment banking is well known and has materialized already in the bank’s Q2 results, when JPMorgan reported a 61% fall in investment banking fees.

But warning of lower investment banking fees is actually much less important than what the media discussion might imply. In fact, investors should consider that the investment banking segment is only a part of the bank’s larger Corporate & Investment Banking (CIB) group, and accounts for only about 25% of said group.

The lion share of JPM’s CIB segment is driven by markets & securities services (73.3% of revenues)

Trading/Markets Division Poised For Strong Results

Q3 2022 has been an enormously volatile quarter, not only for equities, but also for global fixed income markets (reference British government bonds). And in an environment of considerable market volatility, JPM’s markets & securities services is poised to deliver a strong quarter. This is due to the strong relationship of market volatility and trading activity, as investors are working to rebalance and/or reposition fixed income and equities portfolios, as well as trade derivatives to hedge exposure and speculate on price action.

For reference, in Q2, JPM’s markets & securities services segment revenues increased by 8% versus the same period in 2021.

Markets revenue was $7.8 billion, up 15%. Fixed Income Markets revenue was $4.7 billion, up 15%, driven by strong results in macro businesses, partially offset by lower revenue in Credit and Securitized Products. Equity Markets revenue was $3.1 billion, up 15%, driven by a strong performance in derivatives.

Securities Services revenue was $1.2 billion, up 6%, predominantly driven by growth in fees and to a lesser extent higher rates

Solid Commercial Banking & Asset Management

With regards to JPM’s other segments, I do not see any major reason for a surprise, either on the downside or on the upside. Given prudent asset allocation decisions, the asset management arm is likely to defend stable asset under management (JPM has been net-short treasuries, and underweight growth equities). For commercial banking I expect +/- 2% deposit growth, as well as loan growth.

Cheap Valuation

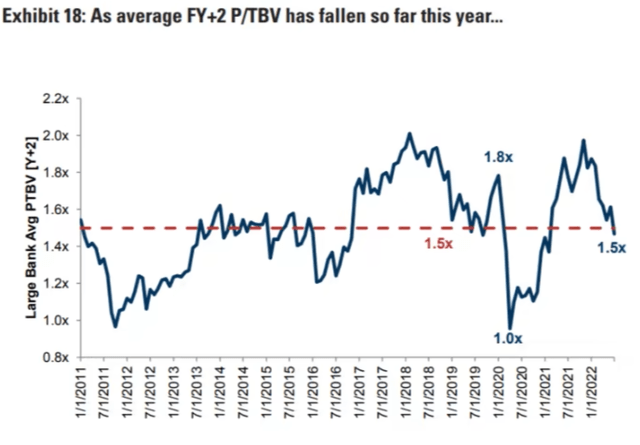

Reflecting on JPM’s Q3 results, investors should also consider the bank’s results in relation to valuation. And given that JP Morgan is the industry leader in the financial services industry, a one-year forward valuation of x1.2 P/B and x9.8 P/E is very cheap.

In fact, investors could argue that JPM is trading already at a distressed valuation based on P/B. According to research by Goldman Sachs, the cyclical low for bank stocks is usually around the x1 P/B multiple, and the historical average is somewhere around x1.5.

I have previously valued JPM stock at $194.48/share, and I continue to believe that such a pricing should reflect the bank’s fair implied value.

Risks To Q3 Earnings

The major risk that I see going into Q3 2022 is a substantial one-time loss or asset write-down, that could be related to derivatives exposure. Investors should consider, that as valuations are falling across asset classes, it could be that some of JPM’s counterparties have been having trouble meeting margin calls. This could expose the JPM to losses similarly to what happened following the Archegos blowup to Credit Suisse, Nomura (NMR) and Morgan Stanley (MS).

How I Trade The Earnings

In the context of a weak investment banking environment and depressed confidence in the financial services industry (as a consequence of the Credit Suisse bankruptcy discussions), I argue the market is very cautious and nervous going into Q3 for JPM–too pessimistic in my opinion. As a consequence, JPM’s share price could be vulnerable to upside surprise.

Personally, going into earnings, I am increasing my exposure to JPM stock with time-sensitive call spread options as a short-term play. I argue the buying 105/125-% moneyness call spreads with October 21 expiration provide an attractive risk/reward set-up (ca. 4:1 pay-out).

Be the first to comment