Clear Channel’s current management has made many good moves, but the most important will be getting the sale of the company’s European assets completed at a good price so they can pay down debt and move forward with the U.S. assets. belterz/E+ via Getty Images

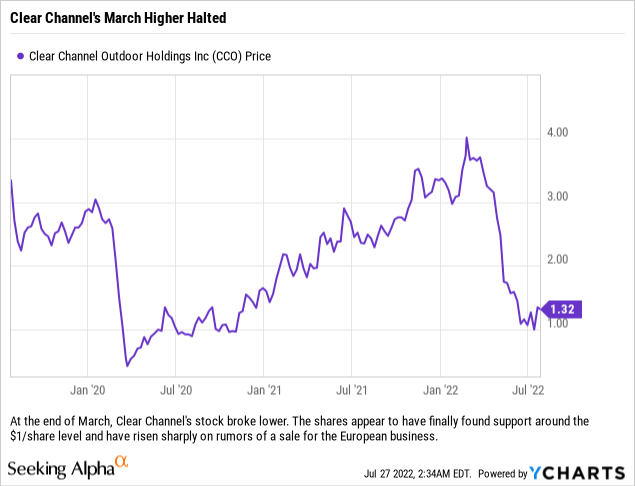

Clear Channel Outdoor (NYSE:CCO) has been a big loser recently in our portfolios which have an aggressive investing style. Impressively, some of those portfolios’ cost basis (even with purchases in 2022 before the sharp pullback) is so low that the overall positions are still showing solid overall gains. While we recognize that it may appear that we are a Clear Channel permabull, we would argue that rather than trade in and out of this name it is better to stay long to let this story play out in its entirety.

As our readers know, we have liked Clear Channel Outdoor for a while and have continued to add to positions as we believe that the company has positioned itself to potentially be a huge winner. Management was able to refinance debt just before COVID hit; accomplishing two goals: to lower interest costs and extend maturities. COVID’s impact upon the economy was a major setback, especially for Clear Channel which has a lot of exposure to the largest urban areas (which were most affected by COVID), but management was able to stabilize the business while also divesting assets in China which then left the company with two main geographic areas; the Americas and Europe.

With the debt under control, many focused on what the company would do with the European segment as its results were lagging (not only was the segment reporting negative EBITDA but revenues were sharply lower) and one could argue that Clear Channel’s valuation is dragged down by those lower margin assets. When the company announced that it was reviewing strategic alternatives for the European business, we thought that the company might be turning the corner and finally entering the phase of our thesis whereby Clear Channel would essentially become a U.S. pureplay billboard company.

Why is this important? Because Clear Channel would then be valued similarly to peers Lamar (LAMR) and Outfront Media (OUT) while also being able to take the proceeds from the sale of the European assets to pay down debt and deleverage the balance sheet.

So Where Are We Now?

To be clear, we are still buyers of shares and will accumulate before the company is set to release earnings on the morning of August 9th. We suspect that the company will have good things to say about the Americas but again will be forced to discuss how tough the European business is, especially now that they are facing the headwinds caused by the Russian invasion of Ukraine. So while the bad news is that the company still has to deal with the European assets, the good news is that there are now reports that Clear Channel is working on a sale with a private equity firm which could be announced soon.

We think that in order to make the numbers work, Clear Channel needs to get at least $2.5 billion for their European business which would allow them to repay a significant portion of their debt after taxes. Anything less than that amount and the company is better off just holding on to the assets and structuring a spin-off for a later date.

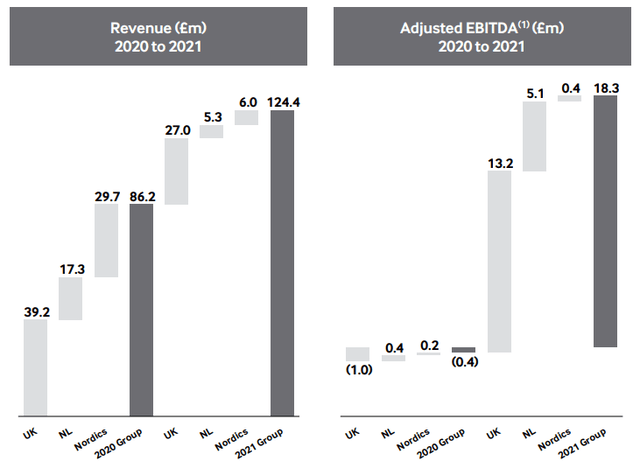

The good news for Clear Channel is that there has been interest recently in European out of home advertising assets, with the latest deal being the UK’s Ocean Outdoor being acquired by Atairos for $580 million (or £463 million). While the assets are not perfect comps, the deal is being done at roughly 3.72x 2021 revenues (we used revenues because the company’s EBITDA was only £18.3 million for 2021 coming out of COVID). Anything close to that valuation and Clear Channel shareholders would have to be pretty happy as the company could pay down a considerable amount of debt and increase free cash flow and EPS dramatically, thus enabling the company to ramp up M&A and continue to clean up the balance sheet.

Ocean Outdoor is a much smaller player in the U.K. with about 1/10th the revenue of Clear Channel’s European business. However, the deal could shed some light on what investors could expect in a deal for Clear Channel’s assets. (Ocean Outdoor Investor Presentation for FY2021 Results)

Management did not want to discuss their process for the strategic review or give any ideas about valuations during recent conference calls, which leads us to suspect that investors will just have to wait for management to announce the completion of a deal before they will go into any details right now. In short, do not expect any discussion on this topic during the upcoming earnings conference call even though reports are circulating about a deal potentially being announced in a matter of weeks.

Moving Forward

If Clear Channel can get top dollar for their European business, structure the deal to minimize their tax bill and then use the net proceeds to pay down debt, then we think that the company could look similar to Outfront Media. However, Clear Channel will need to look at a REIT conversion moving forward to put it on a more level playing field with peers Lamar Advertising and Outfront Media. The REIT conversion would help with a few issues, from valuation to accounting and would also begin rewarding shareholders with dividends. That is a long way down the road and depends on a lot of other items having to happen first; the most important of which is the sale of the European business.

What We Are Doing

We are once again purchasing Clear Channel shares, and are comfortable doing so ahead of earnings. So long as the economy does not crash, the company should turn cash flow positive this year and build upon that in FY2023. We think that management has a clear path to creating significant shareholder value through a sale, but also think that management could keep grinding it out if the current private equity buyer were to walk away from buying the European assets. We are still bullish on this name because we see many ways for the company to dig itself out from its debt issues, including selling some US markets if the economy were to turn sharply lower.

We believe purchasing shares below the $1.40/share level once again gives us a cheap option on a potential deleveraging play with multiple “kickers” (such as increased valuation based on being a pureplay US billboard/display stock, ability to do M&A, credit upgrade cycle and long-term a potential REIT conversion and/or transformation into a dividend player).

Be the first to comment