Dilok Klaisataporn/iStock via Getty Images

Investment Thesis

Payoneer Global Inc. (NASDAQ:PAYO) offers a payment platform to regulate the payment and commerce of the business. The industry of payment platform companies is currently experiencing secular growth trends. To get the maximum benefits of these trends, the company is expanding its cross-border payment services in various countries by partnering with strategic partners.

Payoneer is expected to report earnings on August 11 after the market close. I believe these collaborations and secular growth trends might be a primary catalyst for Payoneer Global’s growth in the coming period.

About Payoneer Global Inc.

The company operates a platform that regulates the payment and commerce of marketplaces, platforms, and online merchants. Its cross-border payment service assists a network of marketplaces and marketplace merchants in paying their sellers in around 190 countries and territories by linking to Payoneer APIs and for sellers to receive payment. The company’s platform offers security, stability, and redundancy of a bank’s caliber together with digital capabilities that connect the entire world marketplace network on a single platform. As compared to the all-other similar platforms, which offer only limited services, the company provides two side commerce networks to offer a variety of services such as cross-border payments, B2B accounts payable/accounts receivable, a multi-currency account, physical and virtual Mastercard cards, working capital, merchant, tax, compliance, and risk, etc.

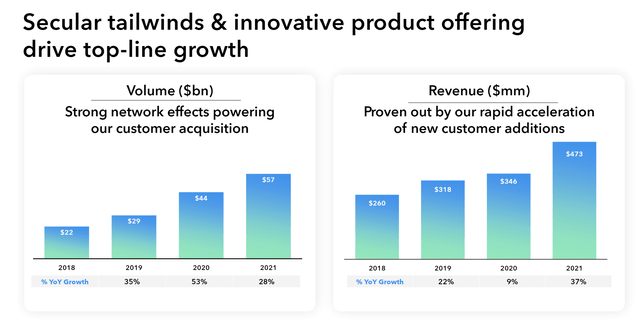

Currently, the company’s primary revenue source is China, contributing 34% of the total revenue. Compared to China, the U.S. is the second largest contributor as the company generates 12% of the total sales, and all other countries combined generate 54% of the total revenue. The payment platform companies are experiencing secular growth trends from the accelerated digitalization and growing cross-border commerce. The company has acquired many new customers in the last four years, resulting in a growth of 26.9% CAGR in the volume of transactions on the platform. The company has managed to grow its revenue at a 16.14% CAGR in the last four years.

Volume and Revenue Growth (Investor Presentation)

Payoneer Global is now planning to extend the market leadership with a marketplace ecosystem strategic and & channel partnership and development of new products & services. The company will also focus on inorganic growth through strategic mergers and acquisitions. From now on, the company is targeting 20%+ YoY revenue growth and EBITDA margin. The company has partnered with strategic partners in different countries to strengthen its cross-border payments.

Secular Growth and Strategic Partnerships

The increased digitalization and expanding cross-border trade are currently driving secular development trends in payment platform companies. After the covid-19, a greater number of the population started engaging in online activities, accelerating the growth of digital commerce for businesses and customers. Business-to-business (B2B) digital e-commerce has shown more significant development than retail e-commerce, and by 2026 it is expected to be $42.7 trillion. The ability of people and organizations in various parts of the world to engage, converse, and transact has also risen due to the rapid growth of digitalization. Because of this, the company has seen a sharp increase in cross-border activity of many kinds, including communication, trade, and content consumption.

In addition to creating new opportunities and demands for new payment and commerce-enabling technologies to support cross-border trading firms, the growth of cross-border trade is altering how consumers buy and how businesses sell. The company believes all these factors will be a growth catalyst in the coming years, as it expects cross-border eCommerce to grow by 14.7% CAGR from 2020 to 2027. I believe the company will be a crucial beneficiary of the emergence of eCommerce and cross-border payments in B2B business. To grow at a faster pace, the company has to expand its business in various geographies with new products and services. It has already initiated the expansion by partnering with strategic partners.

Recently, the company announced a partnership with Linnworks, a UK-based eCommerce technology company, to enhance cross-border and B2B transactions. The collaboration will give online sellers more chances to diversify their marketplace offerings while giving shops integrated options for receiving money and making payments with competitive currency conversions. The company has also partnered with EC21, a Korean-based global B2B marketplace, to strengthen its position in the Korean market and improve Korean SMBs’ cross-border business.

As a result of this collaboration, Payoneer’s ERP API solution will be integrated into EC21’s payment system. With this service, Korean SMBs may manage their Payoneer accounts, examine their earnings, and transmit and receive funds from more than 190 countries and territories inside the EC21 portal. The company has also partnered with SEAGM, a Malaysian-based international digital goods e-commerce platform, to regulate the payments from India, the Netherlands, China, Turkey, South Africa, and other locations customers who actively trade on SEAGM’s marketplace ecosystem. I believe this secular growth in the industry driven by solid & sustainable growth factors and strategic partnerships of the companies might act as the primary catalyst for the company’s robust growth in coming years.

What is the main risk faced by Payoneer?

Inflation

The company is dependent on consumer purchases through eCommerce platforms. The inflation has resulted in a decline in consumer spending on non-essential items. The non-essential products form a big chunk of the eCommerce platforms, and if consumer spending decreases, it will negatively impact the company’s revenue. The indication of a possible recession is becoming more prevalent by the day, and could drastically impact the company’s earnings. The company has managed this risk by expanding its presence in the market and not being restricted to a small buyer’s group.

Technical Analysis and Fundamental Valuation

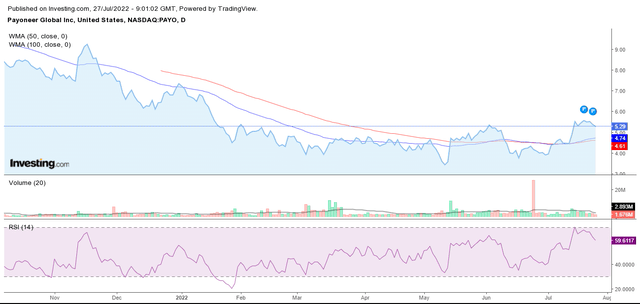

Technical Analysis Chart of PAYO (Investing.com)

The technical indicators are very positive for PAYO. It is trading above its 50-day, and 100-day weighted moving average (WMA). The stock has recently witnessed a crossover of 100-day by the 50-day WMA, which is a very bullish indicator for the stock. The stock price is consistently sustaining over its 100-day and 50-day WMA, reflecting the strength in the momentum.

As per the WMA indicator, the stock is an attractive buy opportunity. The RSI indicator suggests that the stock price is in the buying zone, but there is no significant bullish divergence in the stock at the moment. The stock is testing the 70-band and taking resistance from that level. The stock clearly has momentum on its side and can again test the 70-band and possibly cross it. Overall, the technical indicators are bullish on the stock and reflect a buying opportunity.

The company has witnessed a 47% decline in the share price in the past year and is trading at a share price of $5.30. This decline in the share price has made the stock undervalued at current price levels with strong growth prospects in the future. PAYO is expected to be profitable in FY23, and with robust growth prospects, it could outperform its competitors in the industry. I believe the stock might have significant upside potential from current price levels.

Conclusion

The secular growth of Payoneer Global and its partnerships with all strategic partners are expected to drive tremendous growth. The technical analysis suggests a bullish trend in the stock, with solid growth opportunities in the future stock price. PAYO is undervalued at current price levels given the huge decline in share price over the past year. I recommend a buy rating for the company after analyzing all these factors.

Be the first to comment