grinvalds

A Quick Take On Paylocity

Paylocity (NASDAQ:PCTY) reported its FQ1 2023 financial results on November 3, 2022, beating revenue and EPS estimates.

The company operates a cloud-based payroll, tax, and related HR services platform for companies of all sizes.

PCTY may be facing a ‘soft patch’ as technology companies make workforce reductions into a softening economy.

I’m on Hold for PCTY in the near term.

Paylocity Overview

Schaumburg, Illinois-based Paylocity was founded in 1997 to provide organizations with payroll, tax and HR services via a software platform.

The firm is headed by Chief Executive Officer Steve Beauchamp, who was previously Vice President of Product Management at Paychex and VP of Payroll Operations at Advantage Payroll Services.

The company’s primary offerings include:

-

Workforce Management

-

Recruiting

-

Human Resources

-

Benefits

-

Employee Experience

The firm acquires customers through a direct sales team, broker referrals and through its website.

Paylocity’s Market & Competition

According to a 2022 market research report by IMARC Group, the global market for payroll outsourcing was an estimated $8.6 billion in 2021 and is forecast to reach $11.5 billion by 2027.

This represents a forecast CAGR of 5.11% from 2022 to 2027.

The main drivers for this expected growth are the continued digitization of services into cloud-based environments and a growing remote workforce.

Also, continued integration of payroll with other HR-facing service bundles is a trend that clients are seeking in order to reduce vendor bloat.

Major competitive or other industry participants include:

Paylocity’s Recent Financial Performance

-

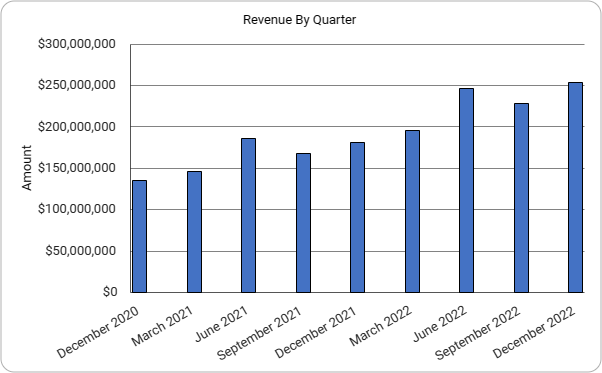

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

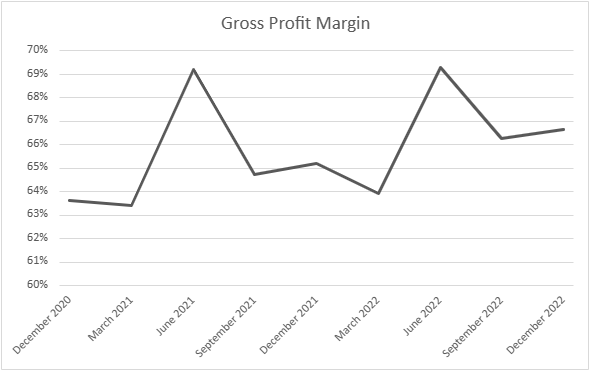

Gross profit margin by quarter has trended slightly higher in recent quarters, though unevenly:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

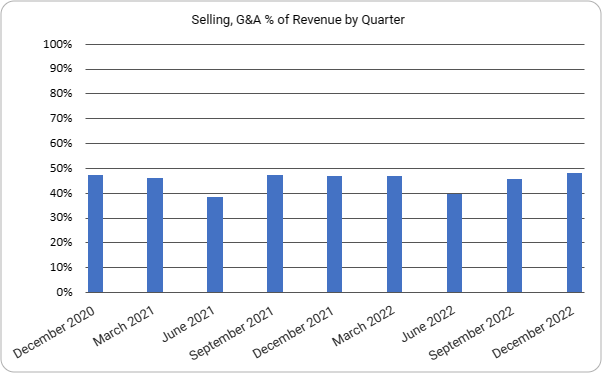

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a narrow range, as the chart shows here:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

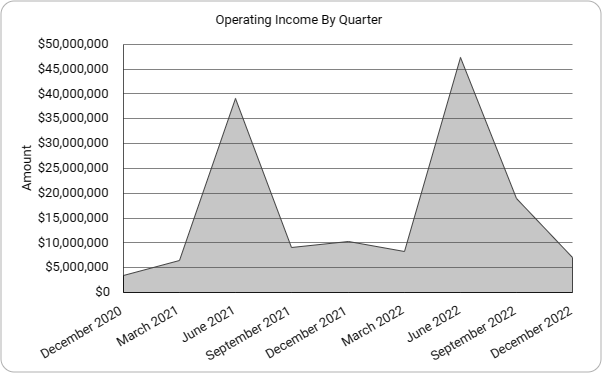

Operating income by quarter has varied substantially, as shown below:

9 Quarter Operating Income (Seeking Alpha)

-

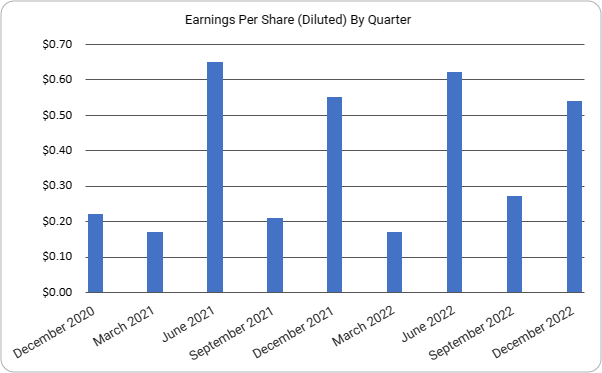

Earnings per share (Diluted) have also fluctuated sharply, as shown here:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

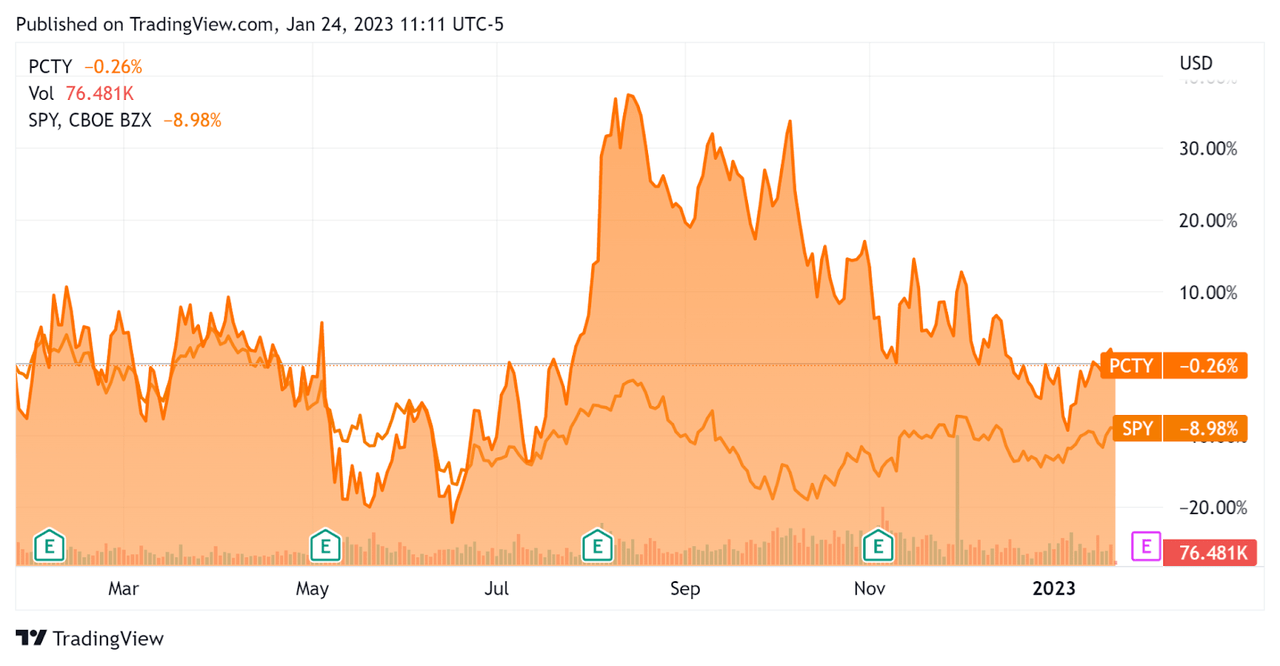

In the past 12 months, PCTY’s stock price has fallen 0.3% vs. the U.S. S&P 500 index’s drop of around 9%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Paylocity

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

11.9 |

|

Enterprise Value / EBITDA |

82.7 |

|

Revenue Growth Rate |

35.6% |

|

Net Income Margin |

9.8% |

|

GAAP EBITDA % |

14.4% |

|

Market Capitalization |

$11,075,208,192 |

|

Enterprise Value |

$11,041,186,290 |

|

Operating Cash Flow |

$175,572,000 |

|

Earnings Per Share (Fully Diluted) |

$1.60 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Paycor; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Paycor |

Paylocity Holding Corporation |

Variance |

|

Enterprise Value / Sales |

9.3 |

11.9 |

28.4% |

|

Revenue Growth Rate |

24.2% |

35.6% |

47.5% |

|

Net Income Margin |

-20.9% |

9.8% |

— |

|

Operating Cash Flow |

$17,500,000 |

$175,572,000 |

903.3% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PCTY’s most recent GAAP Rule of 40 calculation was 50.1% as of FQ1 2023, so the firm has performed well in this regard, per the table below:

|

Rule of 40 – GAAP [TTM] |

Calculation |

|

Recent Rev. Growth % |

35.6% |

|

GAAP EBITDA % |

14.4% |

|

Total |

50.1% |

(Source – Seeking Alpha)

Commentary On Paylocity

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted the growth of client usage of its Premium Video and Survey products as it seeks to expand its engagement-related offerings.

Leadership noted the leveling off of increases in workforce levels through October, which since then have likely turned into negative territory as technology and other companies have begun laying off employees in large numbers more recently.

As to its financial results, total revenue rose 39.4% year-over-year, exceeding the top end of previous guidance by $12 million.

Management did not disclose any retention rate metrics other than to say they ‘feel really good about where we are from a retention standpoint.’

The firm’s Rule of 40 results has been excellent, with a strong revenue growth result combined with a positive operating result contributing to a strong figure for this metric.

PCTY continues to invest in R&D, which increased 44.9% year-over-year and management expects to continue to make further investments through fiscal 2023.

For the balance sheet, the firm finished the quarter with $65.6 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash flow was a strong $157.3 million, of which capital expenditures accounted for only $18.3 million. The company paid a high $116.5 million in stock-based compensation.

Looking ahead, for the full fiscal year 2023, the firm expects to produce revenue growth of 32% and $338 million of adjusted EBITDA.

Note that adjusted EBITDA excludes stock-based compensation, which was the aforementioned $116.5 million in the trailing twelve-month period.

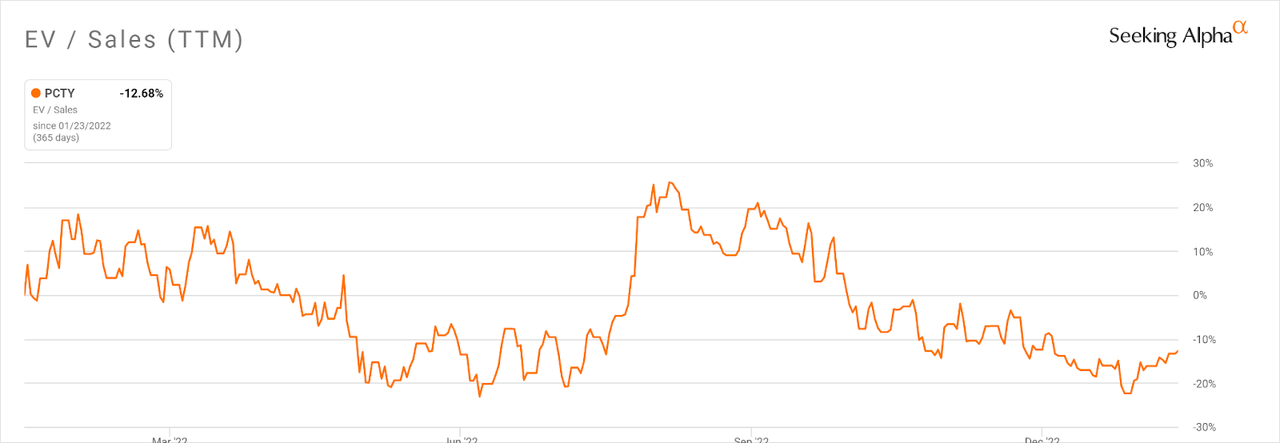

Regarding valuation, the market is valuing PCTY at an EV/Sales multiple of around 11.9x.

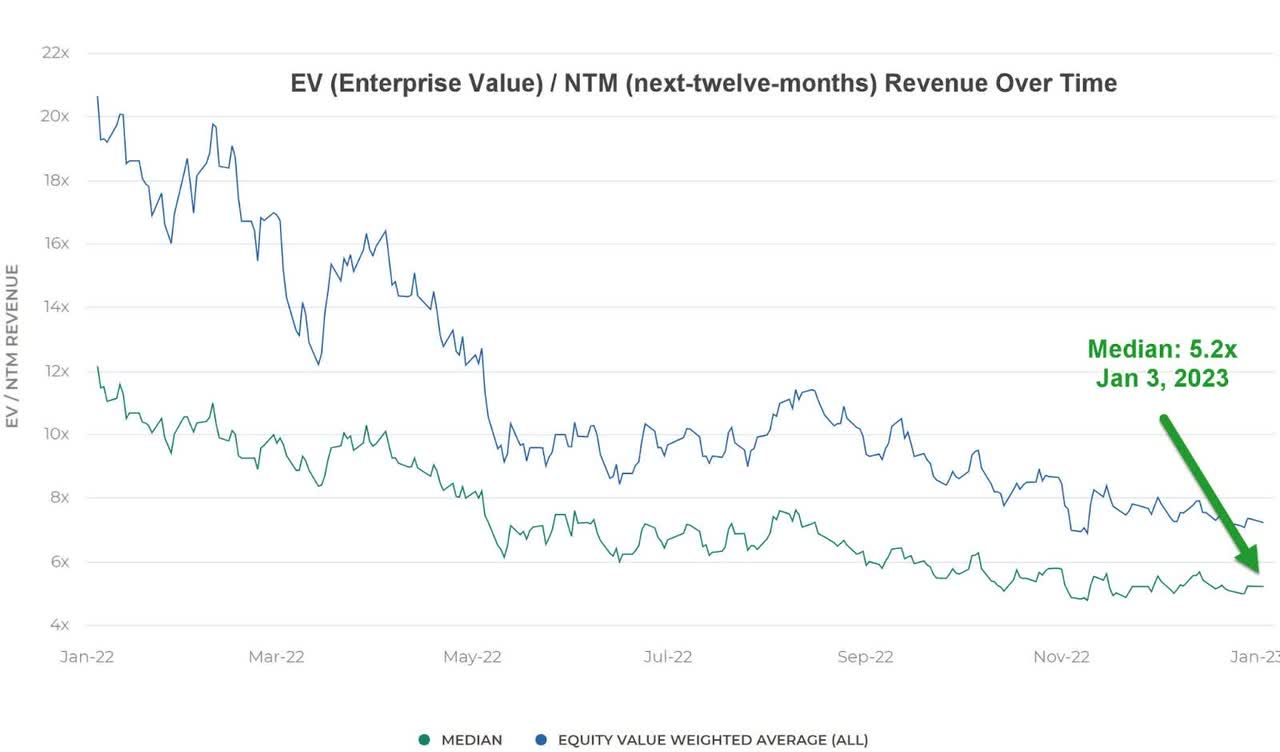

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 5.2x on January 3, 2023, as the chart shows here:

Enterprise Value / Revenue Forward Valuation Index (Meritech Capital)

So, by comparison, PCTY is currently valued by the market at more than double the broader Meritech Capital Index, at least as of January 3, 2023.

The primary risk to the company’s outlook is a likely macroeconomic slowdown, which may produce slower sales cycles and reduce its revenue growth trajectory.

Notably, PCTY’s EV/Sales multiple [TTM] has compressed by only 12.7% in the past twelve months, much less than many other technology stocks:

Enterprise Value / Sales Multiple (Seeking Alpha)

A potential upside catalyst to the stock could include a ‘short and shallow’ macroeconomic downturn with muted layoffs from non-technology companies.

However, I believe PCTY is facing a ‘soft patch’ in the next few quarters as it feels the brunt of tech layoffs already announced or in progress.

Therefore, I’m on Hold for PCTY for the near term.

Be the first to comment