hapabapa

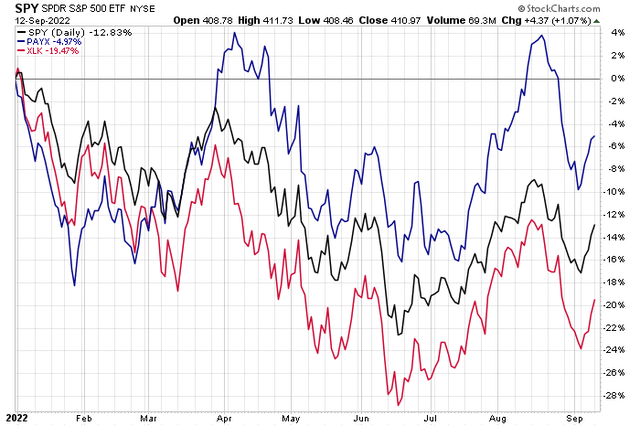

Some payroll and accounting-related IT services stocks have weathered the tumultuous year of 2022 well. Paychex, Inc (NASDAQ:NASDAQ:PAYX) has beaten not only the S&P 500 Trust ETF (SPY) but also its sector fund – the Select Sector SPDR Technology ETF (XLK) – handily year-to-date. The company has an earnings date in about two weeks, and the options market is not expecting a big reaction. I outline a trading idea and go through the longer-term valuation situation with this household name.

PAYX Beating SPY & XLK YTD

According to Bank of America Global Research, Paychex is the second-largest provider of payroll, human resources, and benefits outsourcing solutions in the U.S. Clients are primarily small- to medium-sized businesses. The company offers comprehensive payroll services, including payroll processing, payroll tax administration, and employee pay services. It also provides HR solutions, such as 401(k) and retirement services.

The $46 billion market cap Rochester, NY-based IT Services industry company in the Information Technology sectors trades at a high 33.2 trailing 12-month GAAP price-to-earnings ratio and pays a 2.5% dividend yield, according to The Wall Street Journal. Competitors like Automatic Data Processing (ADP) and Intuit Inc (INTU) also trade at lofty P/E ratios.

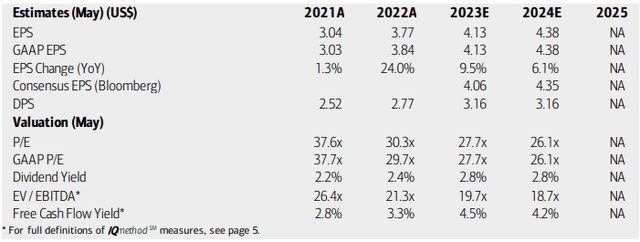

The company reported a strong quarter back in late June and has an upcoming earnings report later this month. Paychex’s current valuation should turn somewhat cheaper if BofA’s earnings outlook verifies. EPS is seen as improving by a solid 24% this year, but then moderating to the 6% to 10% range through 2024. Its dividend is expected to go up by more than 10% from 2022 through next year.

The stock trades at a high EV/EBITDA multiple while its free cash flow yield is steady, but not too impressive. Overall, the stock looks expensive here, but is there a play ahead of earnings?

PAYX Earnings, Valuation, and Dividend Forecasts

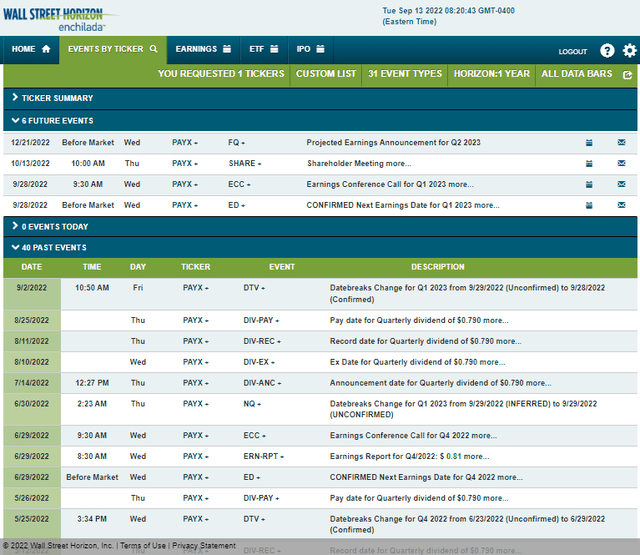

According to Wall Street Horizon, PAYX has a confirmed Q1 2023 earnings date of Wednesday, September 28 BMO with an earnings call to follow. You can listen live here. Key corporate events continue with a shareholder meeting a month from now on Thursday, October 13 followed by a projected Q2 reporting date of Wednesday, December 21 BMO.

Corporate Event Calendar

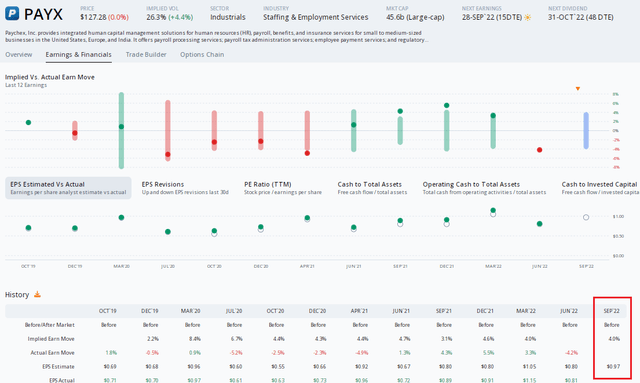

The Options Angle

Digging into the earnings report later this month, data from Option Research & Technology Services (ORATS) show an implied stock price move of just 4.0% post-earnings using the nearest-expiring at-the-money options. That’s about in line with expected swings in previous reports given muted recent reactions. I think that being long options into earnings makes sense as traders may have become too comfortable with low volatility of late in PAYX.

Analysts expect $0.97 of per-share earnings, which would be a solid increase as was reported in the same quarter last year. ORATS also notes that there have been five analyst upgrades of the stock since the previous report – a big number.

Finally, the company has brought home the bacon as seen in its earnings surprise history. ORATS and Seeking Alpha data show the firm has beaten bottom-line estimates in each of the past 12 quarters.

Paychex: A Low Implied Volatility & Positive Beat Rate History

The Technical Take

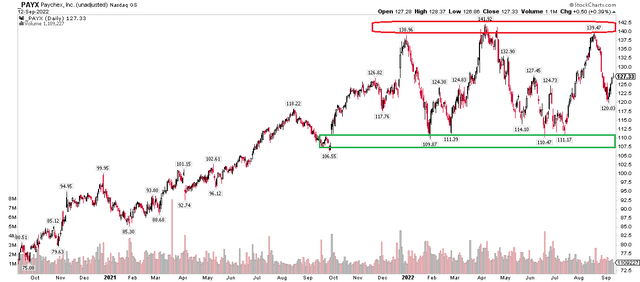

Paychex has been a relative winner this year. With the stock simply trading sideways since October 2021, holders of shares have done much better than the downtrending broad market and IT sector. Technicians would say to buy the stock on a breakout above the current $106 to $142 trading range or to ‘buy the dips’ in the $106 to $114 area. I think owning shares here ahead of earnings makes sense, but profits should be taken on an approach of $140. Given cheap options, a long vertical call spread could make sense.

PAYX: A Defined Trading Range Ahead Of Earnings

The Bottom Line

Long-term investors might want to steer away from PAYX given its high valuation and unimpressive earnings growth. But there is an opportunity for short-term traders ahead of and through earnings using call options given low implied volatility and a defined trading range on the chart.

Be the first to comment