We Are

One of the biggest problems facing most people in America today is the incredibly high rate of inflation. This has pushed up the prices of many of the necessities of daily life such as food, energy, and shelter. As these are things that everyone needs to buy, it has strained the budgets of many households and has even forced some people to take on second jobs or enter the gig economy in an effort to obtain the extra money that is needed to support themselves and their families.

Fortunately, investors like us have other ways that we can obtain the money that is needed to maintain our lifestyles. One of the best of these ways is to purchase shares of a closed-end fund that specializes in the generation of income. These funds benefit from professional management and have the ability to utilize various strategies that can boost yields beyond that of any of the assets in the fund. In this article, we will discuss one of these funds.

This fund, the PIMCO Access Income Fund (NYSE:PAXS), boasts an 11.45% yield as of the time of writing so it is certainly capable of providing a very high level of income. PIMCO funds are also fairly renowned for being very high-quality ones, especially the company’s bond funds. Therefore, let us investigate this fund and determine if it could be a good addition to a portfolio today.

About The Fund

According to the fund’s webpage, the PIMCO Access Income Fund has the stated objective of providing investors with a high level of current income. As this fund is a bond fund, this is not exactly surprising. After all, bonds are primarily an income vehicle because their capital gains potential tends to be fairly limited. This is because bonds do not have any link with the growth and prosperity of the issuing company. After all, a company will not increase the amount that it pays to its bondholders just because its profits increase. These assets are instead priced based on interest rates. When a bond is issued, its yield is set by a spread over the federal funds rate at the time of issuance. Thus, bonds issued during periods of low interest rates have lower yields than bonds issued during periods of high interest rates.

When interest rates are rising, this creates a problem for the holders of existing bonds because nobody will buy an existing bond with a lower rate when a newly issued one will have a much higher yield. As a result, the price of the existing bonds declines so that they will deliver the same yield-to-maturity as a newly issued bond with the same characteristics. The reverse process happens during times of falling interest rates.

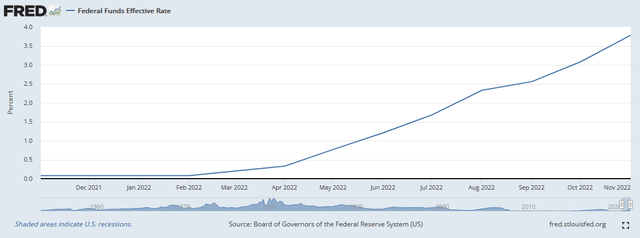

As everyone reading this is likely well aware, the Federal Reserve switched from a loose monetary policy to a tight monetary policy earlier this year. This has been exemplified by the fact that interest rates have been climbing this year. Back in February, the federal funds rate was at 0.08% but it rose to 3.78% by November 2022:

Federal Reserve Bank of St. Louis

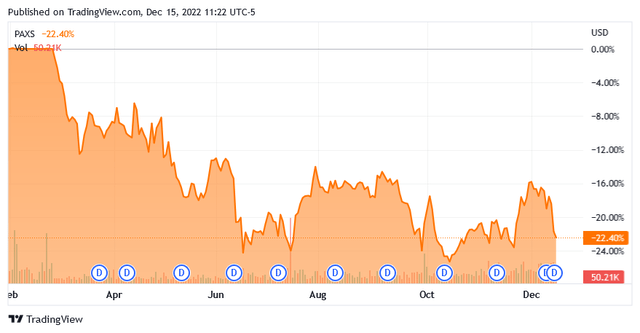

The Federal Reserve hiked the federal funds rate by 0.5% yesterday, so we can expect that the observed effective rate will likely be higher in the near future. Due to the way that bonds are priced, this has had a devastating effect on bond prices. We can see this quite clearly by looking at the iShares Core U.S. Aggregate Bond ETF (AGG), which is down 12.17% year-to-date. The PIMCO Access Income Fund has certainly not been spared by this bond bloodbath, either, as it has fallen 22.40% year-to-date:

The PIMCO fund’s higher yield helps to offset this underperformance somewhat, but the fund has still underperformed the index year-to-date. One of the reasons for this is that the PIMCO fund uses leverage, which we will discuss later in this article.

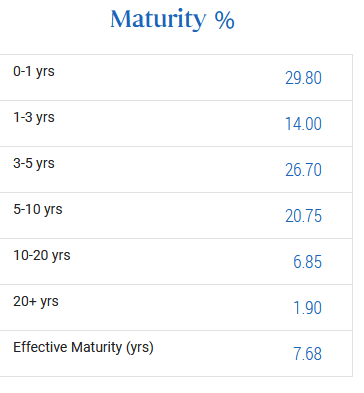

One of the characteristics of bonds is that they always pay out their face value at maturity. Thus, an investor that intends to hold a bond over its entire life will end up getting their money back. Any fluctuations in the bond price do not actually matter to an investor like this. The same applies to the fund as all it needs to do is hold the bonds to maturity in order to receive its money back (assuming that the fund bought the bond when it was first issued). Thus, we want to have a look at the maturity dates in the portfolio to determine how long it needs to hold the bonds in order to achieve this outcome. Here is a basic overview:

PIMCO Funds

As we can see, many of the bonds in this fund are fairly short-term bonds as they mature in less than five years. This is nice for a lot of reasons, not just the fact that the shorter the bond’s term, the less time that we have to wait for the fund to get its money back. Overall, short-term bonds are less risky than long-term bonds because a lot more can happen over a long time period than a short time period. This is one of the reasons why the yields on bonds tend to increase the further away it is from maturity. In addition to this, the further into the future the maturity date is, the more the bond’s price is affected by interest rate changes. Thus, we can expect the price of this fund to be more stable than the price of a fund that consists primarily of long-term bonds. This is something that likely appeals to more risk-averse investors.

Another major risk with bonds is default risk. After all, a bond issuer might go bankrupt or run into other financial trouble that makes it difficult or impossible for it to honor its obligations to the bondholders. One of the best ways to protect against this risk is to be invested in a very large number of bond issuers. This should ensure that the percentage of the portfolio that each issuer represents is fairly small so any default will have a negligible impact on the overall portfolio. The PIMCO Access Income Fund does this to a degree as it has 272 unique positions. This is a reasonable number that should limit the percentage of the portfolio that any individual issuer represents, although it is nowhere near as many holdings as the BlackRock bond funds possess. It should be okay though.

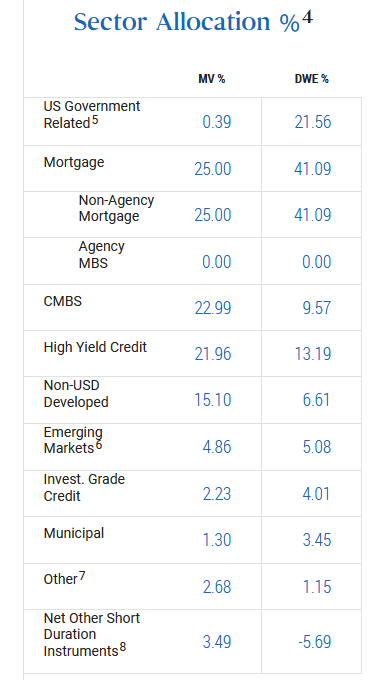

Another thing that should provide a certain degree of comfort to risk-averse investors, such as most fixed-income investors, is the fact that the majority of the bonds held by the PIMCO Access Income Fund are mortgage-backed securities:

PIMCO Funds

As a general rule, mortgage-backed securities and commercial mortgage-backed securities are somewhat safer than many other bonds. This is because these securities are backed by physical property that can be seized by the creditor in the event of a default. Thus, assuming that the properties backing these mortgages hold their values, these bonds should prove to have a reasonably low risk of loss. Admittedly though, the rising interest rate environment has had something of an adverse impact on property values. This is mostly because potential buyers tend to purchase properties based on the affordability of the monthly mortgage payment. As interest rates have risen, the monthly payment on a mortgage is going to be much higher than the payment on the same-sized mortgage was last year.

Over the long-term, though, properties do tend to hold their value. Regardless, the fact that physical property can be seized in the event of a default still reduces risk compared to having nothing securing the bond.

Leverage

As mentioned earlier, the PIMCO Access Income Fund uses leverage as a way to boost its yield beyond that of any of the underlying bonds. Basically, the fund is borrowing money and using those borrowings to purchase bonds. As long as the yield that it receives from the bonds is higher than the interest rate that it has to pay on the borrowed money, the strategy works pretty well to boost the overall yield of the portfolio. As the fund is able to borrow at institutional rates, which are lower than retail rates, this will usually be the case.

Unfortunately, the use of leverage is a double-edged sword. This is because leverage boosts both gains and losses. This is one of the reasons why this fund has fallen more than the index in response to rising interest rates. As such, we want to ensure that the fund is not using too much leverage since this would expose us to too much risk. I do not usually like to see a fund’s leverage above a third as a percentage of its assets for this reason. The PIMCO Access Income Fund is unfortunately a bit above this as its leveraged assets account for 37.56% of the portfolio. With that said though, the fact that the fund is invested in fairly safe bonds as opposed to riskier assets like common stocks means that it is probably okay at the current level. Overall, the risk-reward tradeoff seems reasonable here, but we will want to keep watching to ensure that it does not get too much higher.

Distribution Analysis

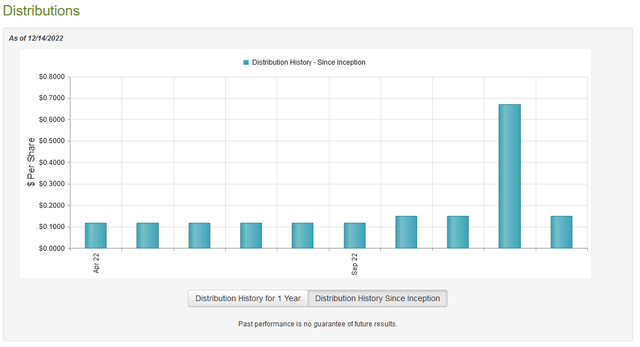

As mentioned earlier in the article, the primary objective of the PIMCO Access Income Fund is to provide its investors with a very high level of current income. In order to accomplish that, it is investing in a levered portfolio of bonds that provide the majority of their investment return through direct payments made to investors. As such, we can assume that the fund likely boasts a reasonably high yield itself. This is certainly true, as the fund currently pays a monthly distribution of $0.1494 per share ($1.7928 per share annually), which gives it an 11.45% yield at the current price. The fund is a fairly new fund, so it does not have much of a history to look at, but it has been consistent and even increased its distribution a few months ago:

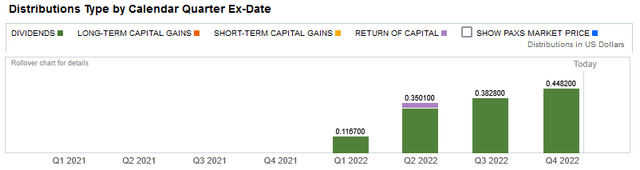

This certainly may appeal to those investors that are seeking a reasonably safe and secure source of income to help them afford the higher cost of living in today’s world. These same investors will also likely appreciate the fact that the fund’s distributions consist almost entirely of dividend income:

This is nice to see because dividend income is generally the most sustainable form of distribution. This is because this implies that the fund is simply paying out the money that it receives from the fixed-income securities in its portfolio. This is better than depending on capital gains, which may not always be repeatable, or return of capital to fund its distributions. However, as I have pointed out in the past, it is possible for these distributions to be misclassified. As such, we still want to investigate the fund’s finances in order to determine how sustainable the distributions are likely to be.

Fortunately, we have a fairly recent report that we can consult for this purpose. The fund’s most recent financial report corresponds to the full-year period ending June 30, 2022. This is nice as it gives us an idea of how well the fund performed during the initial stages of the monetary tightening regime. Unfortunately, the fund has not actually been in existence for the full-year period so it will not give us a very large amount of data to use to project the fund’s future performance. During the period, the PIMCO Access Income Fund received a total of $25.408 million in interest and another $509,000 in dividends net of foreign taxes. This gives it a total income of $25.917 million during the period. The fund paid its expenses out of this amount, leaving it with $19.821 million available for shareholders. This was not enough to cover the $20.531 million that the fund actually paid out to its investors, although it did get very close. However, we still want to find out where the rest of the money to cover the distribution came from.

As is the case with most funds, the PIMCO Access Income Fund can also get money through capital gains to cover the distribution. As might be expected, it failed at this task during the period. The fund did achieve net realized gains of $1.003 million but this was offset by the $123.302 million of net unrealized losses that it had during the period. While this is somewhat disappointing, it actually did have sufficient realized capital gains to make up the difference between net investment income and the distribution. Thus, the fund did only pay out its investment profits during the period. As noted earlier though, the fund is very new so time will tell how well it actually performs. We should have a better idea of its long-term performance once the fund releases its results for the six-month period ending December 31, 2022.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the PIMCO Access Income Fund, the usual way to value it is by looking at a metric known as the net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund’s assets for less than they are actually worth. That is indeed the case with this fund today, which is actually quite unusual for a PIMCO fund. As of December 14, 2022 (the most recent date for which data is currently available), the PIMCO Access Income Fund had a net asset value of $16.43 per share but the shares only trade for $15.50 per share. This gives the shares a 5.66% discount to net asset value at the current price. This is a much better price than the 2.19% premium that the shares have possessed on average over the past month. Thus, the price certainly appears to be right here.

Conclusion

In conclusion, the PIMCO Access Income Fund looks like a reasonably safe fixed-income play that provides its investors with a very high yield. The PIMCO Access Income Fund portfolio is reasonably well diversified and consists primarily of safe securities, such as those backed by real estate. The PAXS price is also very attractive today, as this is one of the rare occasions that we see a PIMCO fund trading at a discount. Thus, it may make sense to purchase shares of PIMCO Access Income Fund today, particularly if the fund can continue to cover nearly all of its distribution out of net investment income.

Be the first to comment