Brett_Hondow/iStock Editorial via Getty Images

Introduction

We think Party City Holdco Inc. (NYSE:PRTY) is the perfect 2022 reopening play. We believe the business is now comping up 3-5% versus 2019 and beating Q1 consensus expectations by 5-10%, and yet the stock is still down 75% today from its pre-Covid levels. Party’s stock traded as high as $11.00 in mid-2021 when the business was comping up 3-5% relative to 2019, and yet today the stock is at $3.60. Our 98% correlated credit card panel is showing a meaningful inflection in Party City’s business since the subsiding of Omicron in early February. We have corroborated this with hundreds of store calls and conversations with several industry veterans. Here are some of the quotes we heard from industry veterans:

“Everything I hear – since Valentine’s Day they are running up about 5% in their stores (relative to 2019)”

“Don’t think this momentum they have should stop, if anything it should be better.”

“The next few years should be the best they’ve ever had”

“If I was running Party City I’d be licking my chops given the industry environment. Next few years could be an incredibly dynamic time for the business.”

We heard this from several store calls:

“Sales trends are still on the rise. With more regulations being lifted we are starting to see daily increases.”

Based on industry calls, we believe the party industry is projected to grow 10% this year given pent-up demand for various events. We also think improving business fundamentals will wake investors up to the earnings potential and value of Party City. Trading at a trough multiple with significant financial and operating leverage, we think Party City could potentially have over 700% upside over the next 5 years with the potential for much of those gains to occur within the next 12 months.

We think PRTY should trade where it normally has since it has been public – between 9-10x EBITDA. Party City is a high quality business with dominance in party wholesale and retail – no one has the breadth of SKUs (40,000) or the depth of distribution (over 800 retail stores). Party City is also recession resistant; it grew EBITDA every single year from 2000 to 2018.

We view 2022 as the year the world fully reopens and the pent-up demand from the last 2 years should make Party City’s business explode. Wedding demand is huge this year, the graduation season is already tracking significantly ahead of 2019, all Party City demand drivers are up significantly. We believe recent weakness in the stock is temporary – due to a weak Q1 guide from a bad January due to Omicron. We think on the Q1 call, PRTY will raise guidance as they are seeing very strong trends in the business since early February. We model around $0.70-$0.80 in FCF/share for this year and over $1.00 in FCF next year. Today, Party is trading at 4-5x earnings and we think earnings will double in the next year or two as Party benefits disproportionately from the world reopening. If we put 8x EBITDA on 2023 consensus numbers, we get 200% upside or just over an $11/stock. In 3 years, we think Party can get back to 400m in EBITDA, will have paid off in excess of 200m in net debt and at 9x would be a $23.00 stock vs $3.75 today. Party City is the perfect investment for investors looking for upside to the world reopening this year.

Valuation Information

| Current | 2022 | 2023 | ||

| Price | $3.60 | EPS | $0.76 | $1.00 |

| Shares Outstanding (M) | 115.5 | P/E | 4.8 | 3.8 |

| Market Cap ($M) | 417.0 | EBITDA ($M) | 291.3 | 323.5 |

| Net Debt ($M) | 1283.9 | EV/EBITDA | 5.9 | 5.3 |

| Enterprise Value ($M) | 1700.9 | Price Target | $8.83 | $16.27 |

Thesis Summary

-

Dominant wholesale, manufacturing, and retail player in the party space with an unmatched position within Party retailing leading to a high quality business

-

Owned by 3 top Private Equity firms and one top hedge fund who focus on business quality – Goldman Sachs Credit Partners, Berkshire Partners, TH Lee, and CAS Investment Partners

-

10% industry growth in 2022 and multi-year industry tailwind from pent-up demand

-

If Party City ran a process to sell, we believe bids would be 200% higher than today’s price

-

We prefer Party City to stay public as we see a clear path to a mid $20.00s stock, 700%+ upside from today’s levels

-

Secular trends are in its favor as the world reopens and pent-up demand for social gatherings leads to a huge increase in the weddings business, graduation ceremonies, Halloween and birthday parties

-

Wildly misunderstood business – viewed as an overlevered retailer who is facing increasing competition from Amazon (AMZN) when in fact it is resistant to Amazon due to an incredibly unique retail experience

-

Next-gen stores have had huge success, which is leading to a 1% annual comp tailwind over the next 5 years as Party revamps its stores

-

Stock trading at a 75% discount to its pre-pandemic levels despite emerging today as a stronger retailer – average revenue per store is up 20% vs. pre-pandemic

-

Amazon can’t undercut Party City on price because of their low price points

Business Background

Party City’s wholesale business is named Amscan, which is the largest manufacturer and distributor of party goods in the world, and it was acquired by Berkshire Partners and Weston Presidio from Goldman Sachs Credit Partners in 2004. In 2005, Amscan acquired Party City. Party City (the retailer) was considering entering the wholesale business which would compete with Amscan. Rather than risk having a competing company being built, Amscan bought Party City. This first acquisition was the building block for how Party City was put together – acquiring any potential competitors on both the retail and manufacturing/distribution front to create a dominant player in the party goods industry. Organically, Amscan was increasing its share of shelf space within Party City; it started at 25% share of shelf when it acquired Party City and grew to 80% today.

Amscan acquired Party America in 2006 and Factory Card & Party Outlet (FCPO) in 2007 which were the second and third largest Party retailers after Party City. It transitioned the FCPO and Party America format into Party City’s store format. It also started to increase the share of shelf of Amscan within the Party America and FCPO stores.

Amscan was able to switch off most of the other wholesalers that Party City was buying their products from – thereby increasing margin and sales. So Amscan bought the number two and number three party supplies company, and it kept consolidating the party supply retail industry, and it became by far the largest party supply retailer and wholesaler in the country.

That model has worked well for it, with revenue growing at an 18% CAGR since 2000 before being acquired in 2012. Based on historical margins, we believe the retail stores are lower margin than the wholesale business which leads Party City to derive half its margin from retail and half from wholesale. We did this by looking at the historical gross and EBITDA margins from when Amscan acquired Party City and also looking at the segment breakdown in 2011 between Amscan and Party City (at the time it was roughly equal contribution from each segment). Amscan’s wholesale business was around a 16-18% EBITDA margin business. At roughly 1 billion in gross sales in 2022 for the wholesale segment, that would be around 160-180m in adjusted EBITDA. We conservatively assume that the wholesale segment contributes closer to 150m in adjusted EBITDA, which puts it at half of the high end of management’s guide for 2022. Growing wholesale businesses trade at over 20x EBITDA as evidenced by companies like POOL or SITE.

There are not many competitors in the manufacturing and distribution side. It is the largest manufacturer of metallic balloons and makes an estimated ~50% gross margins on those balloons. The balloon business on both the manufacturing and retail side is considered to be the gem of the business. It is important to understand how the various entities within Party City work together to create a higher margin business. Party City talks about singles, doubles and triples. Singles are retail products sold in Party City stores, doubles are distributed by Amscan and sold in Party City and triples are manufactured, distributed, and sold by Party City and Amscan. Triples are the highest margin and thus are a big focus for the company.

Over time, Party City transitioned its business more and more towards triples. Amscan was able to acquire competitors and then shut off the manufacturer or distributor that Party City was previously buying from, thus often converting products from a single to a triple and thus capturing a much higher margin. As an example, Amscan went and bought Christy’s, a costume designer and manufacturer in the UK. That costume manufacturer was making two million in EBITDA from making a small piece of costumes for Amscan’s international division. Amscan realized that Christy’s was really good at costume design and making costumes in a very cost-effective fashion, and very high quality costumes for the entire company.

So, Amscan acquired that company and in three years it took the two million EBITDA of the costumes business it bought, which is called Christy’s Costumes, and it shut off the manufacturer (Rubie’s) it was buying costumes from for Party City. It transferred all the volume from Rubie’s into Christy’s and Christy’s, according to one of our calls, became an estimated 20 million EBITDA business without growing the top line at all, it was just shifting the vendor from an external vendor to internal vendor.

Amscan and Party City started doing that on the manufacturing and the distribution side as well, where they would acquire other manufacturers, like a plastic cup manufacturer, they were buying the plastic cups from somebody else, they bought one of the manufacturers that was a high quality manufacturer, and then they shifted the volume away from those vendors to internal operations.

That was a very successful strategy – where they buy the retailers and switch off competitors, or buy manufacturers and they switch off competitors, and they’re able to keep most of the margin internally. So, that’s the strategy and how Party City as it stands today was built.

In 2012, TH Lee bought Party City and then IPOed the company in 2015. Previously, the company was public under the name Amscan and marketed as a distributor. In 2015, however, retail multiples were higher, and so they decided to IPO Party City and pitch the company to investors as a retailer. Fast forward to today, distributors trade at much higher multiples – so this was obviously a mistake. The intercompany eliminations and cost accounting make most of the profits appear at the retailer today, but the reality from 2000-2012 was that Amscan was a higher margin business and if the margins are similar today, the distributor would contribute more than half the profits.

Recent History

Brad Weston was appointed CEO in 2019, he came in to give retail experience to a business that had traditionally been heavily focused on the wholesale side. We have done a lot of calls with former employees of Party City, and one thing that has consistently come up is there is so much room for improvement. As an example, not having clear inventory management where all the stores across the country might get the same items despite there being huge regional biases is one thing we heard. There is clearly some low-hanging fruit at Party City – and we believe Brad Weston is going out and capturing a lot of the easy things that can be done to improve the retail experience. It is incredible that the management team has made so many mistakes and yet the business has performed so well over the past 20 years. We think it speaks to just how strong a business was built with Party City that it could make a lot of mistakes and still have strong business growth.

In 2019, Party City had its blow-up year. There was a helium shortage and so they were unable to get helium for their most important, high margin, and differentiated product – balloons. Balloons are the biggest draw that bring people in the store, because they are the product that customers can’t get anywhere else in the same way. So when Party City was out of helium, it had a big impact on traffic that was detrimental to the business. Then obviously COVID was one of the worst possible things that could have happened to the business and 2020 was a difficult year for the Party industry. Party had a solid 2021, but still was hampered by people not getting together as much due to Covid. 2022 will be the first year since 2018 without any huge negative impacts to the business, although freight costs are having an impact on them as they are with all other retailers, we believe that is more than factored into their conservative guidance.

Party City Is a Beneficiary of the Recent Environment

Quotes from a competitor who is a former employee and industry veteran:

“Everything I hear – since Valentine’s Day they are running up about 5% in their stores”

“Net net a later Easter is better because the weather is better”

“Anecdotally – seems like it will be a good graduation. My graduation business is off to a good start and the last few years have been good for graduation. That bodes well for Party City – extremely good wedding year (big bridal shower). Women are having a bridal shower so that should be good for them. They should have a good spring for sure.”

“Don’t think this momentum they have should stop, if anything it should be better.”

Quotes from another former employee:

“The next few years should be the best they’ve ever had”

“If I was running Party City I’d be licking my chops given the industry environment. Next few years could be an incredibly dynamic time for the business.”

In order to corroborate the data and color from industry consultants, we also conducted store calls. Here are a few of the things we heard:

Store calls:

“Sales trends are still on the rise. With more regulations being lifted we are starting to see daily increases.”

“I am proud to say our sales trends are increasing especially with regulation guidelines being lifted in various places.”

“Balloons are really kind of having their moment in the trend world right now. They’re kind of the star of the show when you think about a big party.”

Party City Is Internet Resistant

As a first point, I think I should mention my high level hypothesis about retailers. Our thesis is that the combination of significant store closures in the past 5 years and the rapid growth of omnichannel retailing (e-commerce + brick-and-mortar) will lead to a new paradigm for retail where these businesses should not be trading at 5-8x earnings. This has already occurred with plenty of retailers. Restoration Hardware, as an example, has a great online presence and is up 10x+ in value from its lows in 2016. Amazon is interested in getting into department stores and Wayfair (W) is opening up brick-and-mortar stores. We think brick-and-mortar retail has a permanent place in our economy; it will just have to be combined with an online presence.

With every retailer, it is important to address the impact of the internet. There is no question that Party City’s business has been impacted by the competition that was brought on by the internet. However, Party City has been competing with internet players for a long time, and it grew EBITDA every year from 2000-2018 despite the internet becoming a huge deal over that 18-year time frame. There are several reasons for this – part of the reason is because Amazon cannot compete with Party City due to the lower prices and lower average basket size. Another reason why Party City does so well is because mothers and their kids love coming to Party City.

Most mothers who go into Party City stores to shop bring their children along because it’s a fun experience for their children. Children have a lot of things to play around with in the store. What happens to the mothers who shop at Party City, if you talk to them, you’ll find out that they plan for a 45-minute visit to the store, but most mothers come out of the store spending an hour and a half in that store. Most importantly, everybody’s happy when they leave, the mother is happy and the children are happy because they have fun in the store. The retail experience that everybody talks about, what is the holy grail for retail to survive is the retail experience that Party City has figured out for their consumer. I have not come across many retail concepts where people spend twice the time that they think they’re going to and actually leave the store happier or feel good about it, and not complain that they spent so much more time in the store.

When people are designing and planning for parties, they have a certain idea in their head, they have a certain color scheme in their mind, a certain design. When they go into the store, they get inspired by all the different inventory and different ideas that they have.

In the store itself, they’re coming up with different designs for the party and they basically start putting in more things in their basket than they were thinking about or different things completely. The consumer spends a whole lot of time thinking and talking to the store associates to design the party. That is one of the biggest differences between Party City versus other stores.

There is also a demographic trend towards people throwing more lavish parties because now they have the earnings to do so, they’re buying more expensive costumes and so on. The young adults are becoming a bigger category within Party City.

Where Party City has lost share to Amazon was in adult Halloween costumes. They decided to not go risque and stay family friendly, and that cost them market share to Spirit as well, their main Halloween competitor. The general ease and convenience of buying a costume online has also led to some share shifting to Amazon in that space as well. So from an Amazon risk perspective, it is much more on the costumes where people can buy package costumes, one-off products directly from Amazon, rather than walk into a store and then buy. For the rest of the SKUs, Party City stores carry 25,000-40,000 SKUs in the store – they are generally safe from Amazon in large part due to their low price points.

Additionally, it’s much harder to shop on Amazon for a party because parties are an ensemble shopping experience. People are not buying one product at a time. Costumes are a one product at a time experience, and Amazon and other online shopping is more for one product at a time at a higher average price. However, if you’re buying an ensemble of products, buying online becomes much harder. If you go into a store – you can see everything in one store, you can buy the ensemble in one place.

Party City is a high quality business and is the Dominant Player in its Space

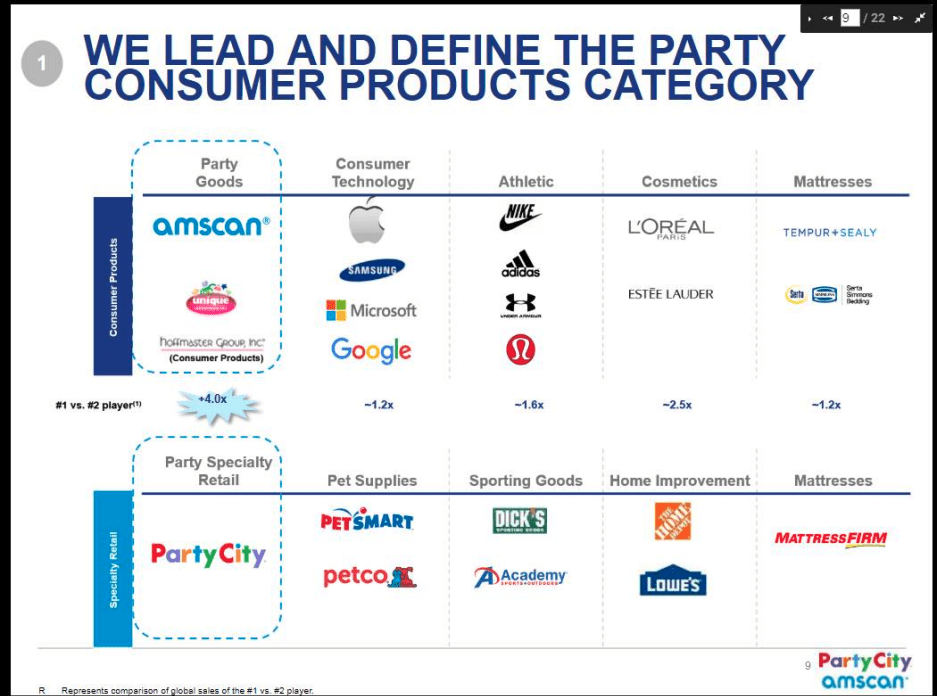

In the history section, I explained how and why Party City was built; I will touch briefly on its dominance here. This is a slide from an old 2018 Party City presentation, but I think it illustrates my point quite well.

Party City

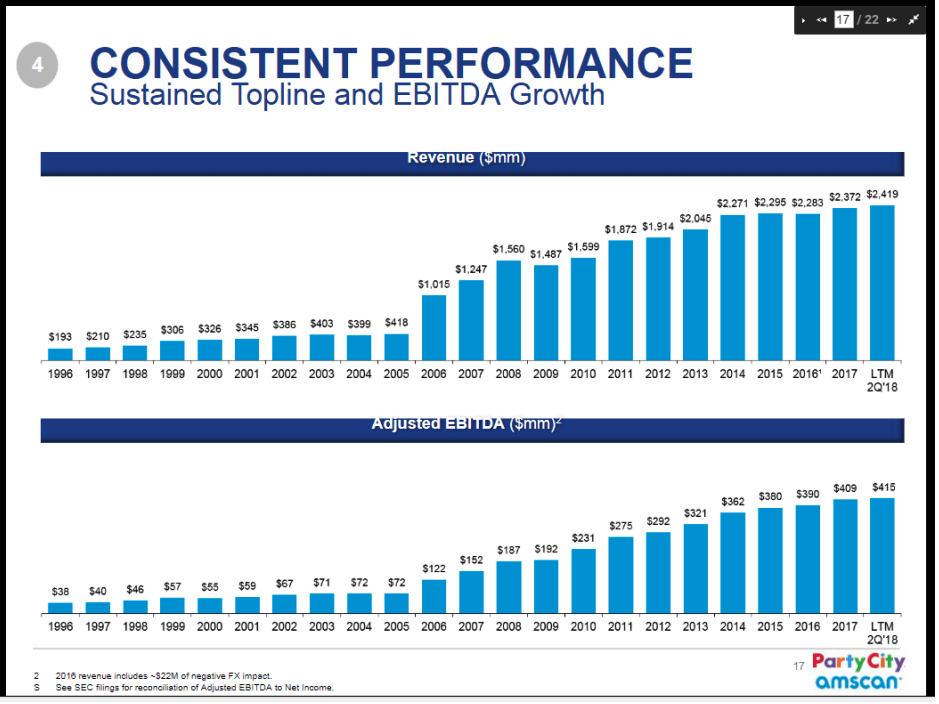

The previous private equity owners built a party business whose dominance is unrivaled and unmatched in almost any other consumer product category. Do they have competition? Of course, every company does, but they bought up so many of the competitors within the space that their only competition exists from Spirit, Amazon, and other retailers like Walmart (WMT) and Target (TGT). There is no one else in the Party category that even comes close to them on either the retailing or manufacturing side of things. Take a look at Party City’s performance from 2000-2018; keep in mind this was achieved as Amazon and online competition grew significantly:

Party City

Party City Margins and Net Debt/EBITDA Should Improve over the Next Few Years

Party City averaged a 17% adjusted EBITDA margin in 2015-2018, and has only guided to a 12.5% EBITDA margin at their midpoint for 2022. We think they have more than factored in any headwinds they may experience from supply chain issues or inflation. In the 2000-2018 time frame, Party City averaged EBITDA margins north of 16%, so we think this year is overly conservative. Nothing has structurally changed in the business today vs. pre-Covid, so we believe there is significant margin expansion baked in over the next few years. The incremental EBITDA flows directly to free cash flow. If we take 300m in EBITDA this year, 90m of normalized capex, 100m of interest expense that is 110m in pretax and 80m in after-tax earnings. Consensus estimates have EBITDA increasing 34m next year, which we think is reasonable. So at 335M in adjusted EBITDA in 2023, the entire 35m incremental EBITDA flows to Free cash flow, so 80m in 2022 goes to 110m in 2023.

Net debt to EBITDA should move from the 4.1x it is at today to roughly 1-1.5x net debt/EBITDA in 5 years. The P/E multiple should expand significantly over that time frame as the net debt declines.

Growth Expectations

The next generation Party City store has a much cleaner look and feel, and is generating better gross margins and higher sales with lower inventory. Party is seeing a 24-month payback on the store remodels and is rolling them out to 10-15% of the store base on an annual basis. We think this will drive an extra 100 bps of comp for Party on top of the 2-3% we expect the business to generate over the next 5 years. Additionally, Party’s guidance for this year is only for an adjusted EBITDA margin of 12.5%, therefore we see significant upside in margins over the next few years as the business improves coming out of the pandemic and supply chain and inflation pressures ease. We do not need those effects to occur to hit the upside we foresee, but they would be additional wins to the upside. Party should grow sales at ~2x GDP. GDP is the governor for the party business. Number of parties is growing higher than GDP and spending per party is growing on top of that, which is how we get to 2x GDP. So top line in the 4-6% range with some margin expansion gets you to EBITDA growth in the high single-digits or low double-digits. Debt paydown and incremental EBITDA margin flowing directly to net income margins should get you to EPS growth at 20%+ from here.

Valuation

Since it was public, Party City has usually traded at around 9-10x EBITDA, which we think is a fair multiple given the recurring revenue nature and dominance of the distribution business. Today, however, investors have turned particularly negative on Party City, and it trades at 6x EBITDA and 5-6x earnings. We think this will prove temporary, and that the business will grow its EBITDA and FCF/share rapidly over the next 5 years. We use a hybrid of wholesalers and retailers to value Party City; below are the two main ways we look at it:

-

We believe Party City will generate 450m of EBITDA in 5 years and pay down its debt level to 500-700m in net debt. At 9x EBITDA Party City would be a $30 stock, 700% upside from today’s levels.

-

Put another way, we get to around $2.10 in EPS in 5 years; at 15x earnings, that is a $31.50 stock.

Be the first to comment