curraheeshutter/iStock via Getty Images

Introduction

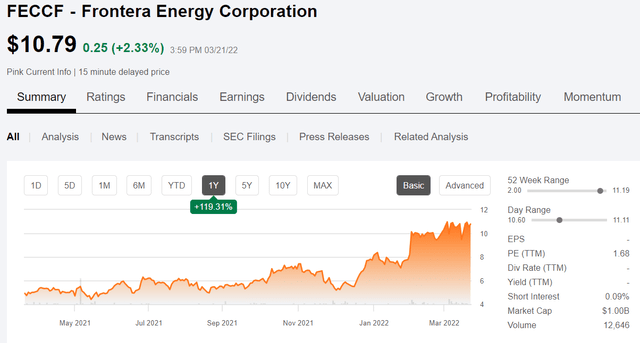

In this article, we’re going to take a close look at South American explorer and producer, Frontera Energy Corp. (OTCPK:FECCF), a Toronto Stock Exchange, TSX registered company. I wish I’d paid some attention a few months back. It has doubled since early Feb, and we missed the easy money bus. You can’t be everywhere at once, we’ve been busy! The question remains is there more to go?

Share price graph for Frontera (Seeking Alpha)

The company first came to my attention in the review of CGX Energy, (OTCPK:CGXEF) that was posted the other day. The company exceeded my initial expectations for financial metrics. Cash flow is positive after capex, they’ve bought back stock, and they have a nice chunk of cash on the books. When you add manageable debt levels to the previous points, you have a story that makes my ears prick up.

I think FECCF makes a solid investment case at or near present levels, subject to a bit of domestic political risk that I will highlight.

The investment case for Frontera

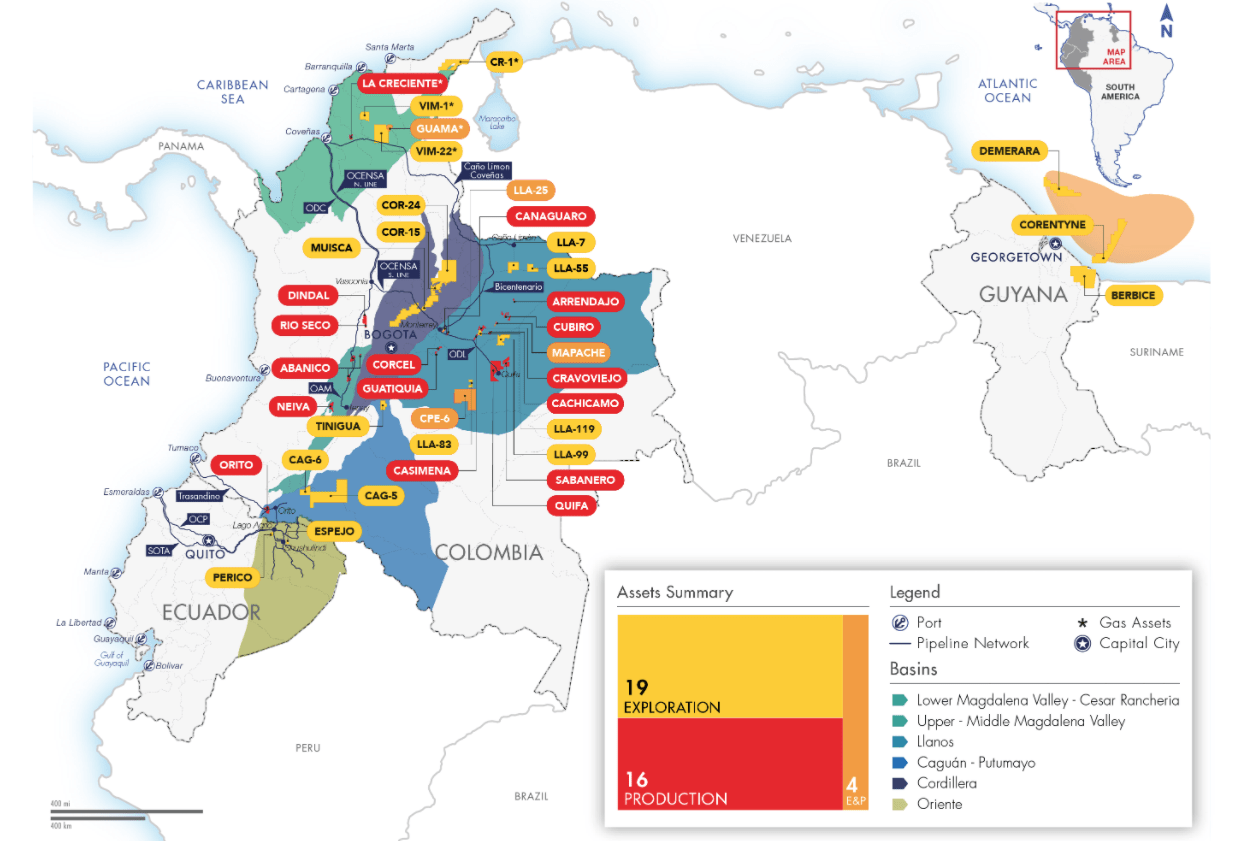

With its three-country footprint as shown below, the company has distributed its geopolitical risk in Colombia and Ecuador, and advantaged itself with respect to the North American market. The third country, Guyana gives them exposure to a world class deepwater opportunity that targets light oil in several reservoir packages. With an ~80% stake in CGX Energy, the company has a large exposure to an emerging market that is unparalleled in the world today. As noted in the CGX article, it’s early days in spite of promising initial results, and they could still drill a water well.

FECCF Footprint in Lat America (FECCF.com)

They have a capex budget that is self-funded at $70 Brent, and designed to deliver about 15% production growth to ~43,000 BOPD in 2022.

In 2021, the company drilled 42 producer wells, three injector wells, and completed 148 workovers and well services. The company replaced 157% of net 1P reserves, 105% of net 2P reserves and extended their net 1P reserves life index to 8.7 years and net 2P reserves life index to 13.3 years.

Frontera also increased net 2P natural gas and associated natural gas liquids reserves by 105% to 90 million BOE, further diversifying Frontera’s future production mix.

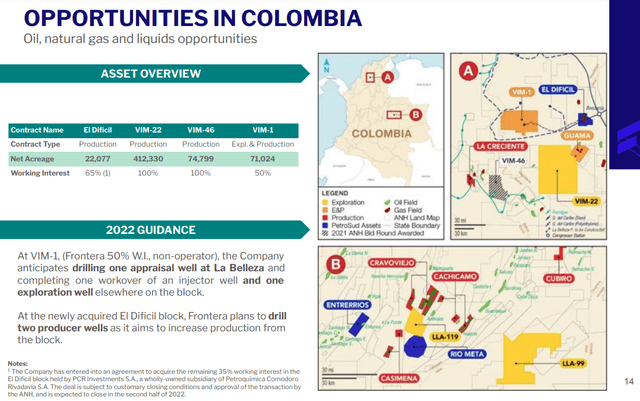

FECCF Footprint in Colombia (FECCF.com)

In Columbia, the source of most of the Frontera’s production to this point, the company produces significant quantities of heavy crude that is demand by U.S. refiners. From its Quifa water flood field alone it produces 16.2K BOPD of heavy Magdalena crude with an API gravity of ~20. CPE-6, another heavy oil field produces ~5K BOPD of Castilla grade crude. That’s over half the company’s daily output of 38K BOPD. Guatiquia field produces another 9.4K BOPD of light to medium gravity crudes.

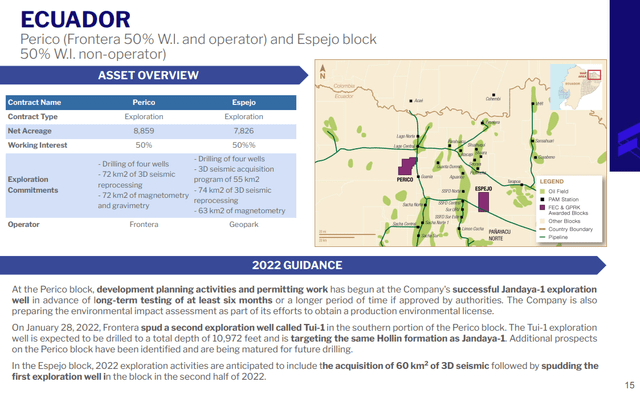

FECCF Footprint in Ecuador (FECCF.com)

Frontera’s position in Ecuador is more exploratory at this stage, but they have good tests on the wells noted in the slide above. Development plans are underway as noted by Orlando Cabrales, CEO of Frontera in the call:

Development planning activities and permitting work is underway in advance of long-term testing of at least six months or a longer period of time if approved by authorities.

Some possible catalysts for Frontera

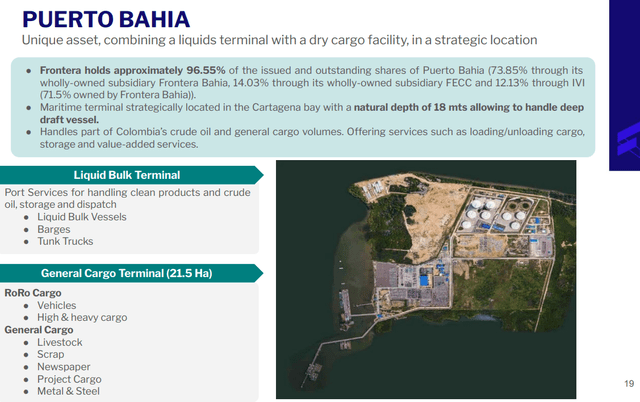

Having a deep water port is not something you see typically in a company Frontera’s size. This is a facilitator for the company. It’s a short run up to Panama for a transit of the canal and the crude hungry refiners of the GoM. Or a straight shot up to California and refineries of Long Beach and San Francisco.

Puerto Bahia Terminal (FECCF.com)

The CGX stake is potentially a catalyst in the success case for the Corentyne Block. It also a risk given the money Frontera has advanced in the form of WI payments for their share of drilling costs, and carrying those costs for CGX in the form of loans. That money could be down the drain.

Frontera called this “transformational” in their filings and likened the potential to the results seen by APA Corp (APA) and Exxon Mobil (XOM) offshore Guyana and Suriname.

These intervals are similar in age and can be correlated using regional seismic data to recent successes in Block 58 in Suriname and Stabroek Block in Guyana.

As I noted in the CGX article while the costs of drilling the Corentyne block are being borne by Frontera, and they have the resources do so…up to a point. This is an exploratory well! What that means is there may be surprises, expensive surprises, if things turn pear-shaped on the upcoming well…it could be bad. Fortunately as I also noted, they have some top-notch drilling talent that’s seen it all.

The larger point here is they definitely need a “rich uncle” to underwrite this operation. My expectation is a deal is being shopped and we should hear something in the near future. But this is still a risk.

Q-4, and 2021

OCF was $113.5 million in the fourth quarter of 2021, a 43% increase compared to the prior quarter. The company’s total cash position as at December 31, 2021, was $320.8 million compared to $419.5 million at September 30, 2021.

As of December 31, 2021, the company had increased its uncollateralized credit line to $89.6 million an increase of $69.6 million compared to December 31, 2020. Subsequent to the quarter, the company has continued to increase its credit line by approximately $16 million. Frontera currently has uncollateralized credit line in excess of $100 million.

The company repurchased for cancellation 989,300 common shares during the fourth quarter at a cost of approximately $6.2 million. As of March 1, 2022, the company has repurchased approximately 4.1 million common shares for cancellation for approximately $23 million. The company intends to renew its NCIB when it expires on March 16, 2022, to permit purchases for up to 10% of its outstanding float over the next year.

Capital expenditures were $135.5 million in the fourth quarter of 2021 compared to $103.2 million in the prior quarter. The company executed approximately $314.3 million in total capital expenditures in 2021 compared to $108.1 million in 2020. The increase in capital expenditures in the fourth quarter compared to the prior quarter was primarily due to increased development drilling and increased exploration activity in Guyana, Colombia and Ecuador.

Mainly as the result of an impairment reversal the company reported net income of $629.4 million or $6.6 per share in the fourth quarter of 2021 compared with net income of $38 million or $0.40 per share in the prior quarter. Net income for the year was $628.1 million or $6.50 per share in 2021 compared with a net loss of $497.4 million or $5.30 per share in 2020.

The company’s operating netback was $47.8 per BOE up 26% compared to the prior quarter, primarily due to higher net sales realized price and reduction in transportation costs, mainly due to the recognition of prepaid services of the Bicentenario business, partially offset by the increase in production costs mainly due to higher well services, maintenance activities, and the increase in power generation and communities costs.

The company’s net sales realized price was $69.53 per BOE in the fourth quarter, up 17% compared to the prior quarter. The increase was primarily driven by higher Brent oil prices, higher volumes sold, lower cost of risk management contracts, and lower royalties per BOE during the fourth quarter of 2021.

Production costs averaged $12.71 per BOE in the fourth quarter, up 11% compared to the prior quarter. The increase in production costs was mainly due to additional activities, maintenance activities and increase in power supply and community costs. Frontera production costs averaged $11.46 in 2021 at the high-end of our 2021 guidance rate of $10.50 to $11.50 per BOE.

Transportation costs averaged $9.02 per BOE down 12% compared to the prior quarter. Frontera’s transportation costs averaged $10.43 per BOE within a 2021 guidance range of $10 to $11 per BOE.

The company recorded a realized loss on risk management contracts of $6.7 million in the fourth quarter of 2021 virtually flat compared to the prior quarter. The realized loss on risk management contracts was primarily due to the cash settlement on three-way collars, puts and put spreads contracts paid during the quarter at an average price of $79.66 per barrel. Subsequent to December 31 2021, the company entered into new put hedges. So the current hedge portfolio will take approximately 40% of 2022 estimated production up until September 2020 at a $70 per barrel price, with no ceilings allowing the company to fully benefit from higher oil prices. In other words, the company’s first quarter 2022 hedges do not cap any upside potential and not any of the subsequent quarters as well.

A bit of political risk for Frontera

Periodically the two countries in which the company operates have significant political upheaval, that can have an impact on how the oil industry is perceived. There is also constant litigation and infrastructure risk from indigenous groups in Ecuador, and insurrectionist groups in Columbia-FARC, who have found in the past that oil facilities in remote areas are hard to defend. Investors in this company must assume some of this risk as well. Of course, oil pipelines are hard to defend everywhere, so it’s not hard to imagine this risk could someday filter northward.

Your takeaway

I was impressed with the overall picture here. The company is generating ~$460 mm in OCF with hedges and stands to do better as the year goes on. Let’s be generous and say in 2022 they will hit $500 mm in OCF. On that basis Frontera is trading at ~2X. Pretty cheap. On a P/FB basis the multiple is $30K per barrel, allowing their YE 2022 exit production target. Again, pretty cheap when you consider Brent is at $115 or so.

As noted above, the company replaced its 1P reserves by 157% through its E&P program, and currently has reserve life of 8.7 years. With its balance sheet, share count reduction, and the potential for a big move with a good confirmation test on the CGX Wei-1 well, the total picture looks very compelling for risk tolerant investors at current levels.

Be the first to comment