NicoElNino

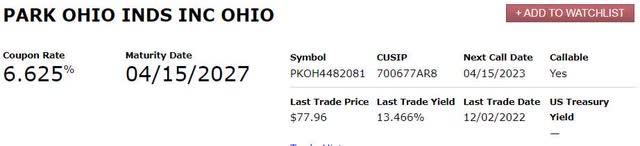

Park-Ohio (NASDAQ:PKOH) is a Cleveland, Ohio-based manufacturer of capital equipment with a supply chain management outsource division. The company has a CCC-rated bond due in 2027, yielding over 13% maturity. While the yield is slightly lower than the average CCC bond, the CCC+ rating and the company’s positioning in supply chain management piqued my curiosity as to a possible investment. What I found led me to believe the company is heading for a restructuring.

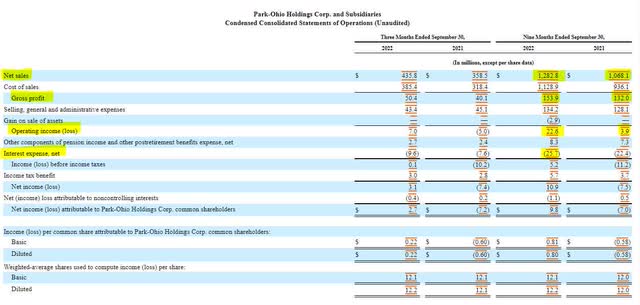

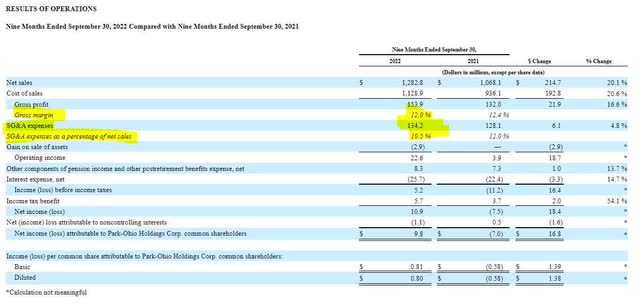

Park-Ohio has seen a boost in sales during 2022, but the company’s gross profit margin is not very strong. All operating income is consumed by interest expense on its growing debt load, leading to a net loss. Companies with a high cost of goods margin are not attractive areas for investors during periods of high inflation. Without improvements in its gross margin, the company has little chance of avoiding a restructuring.

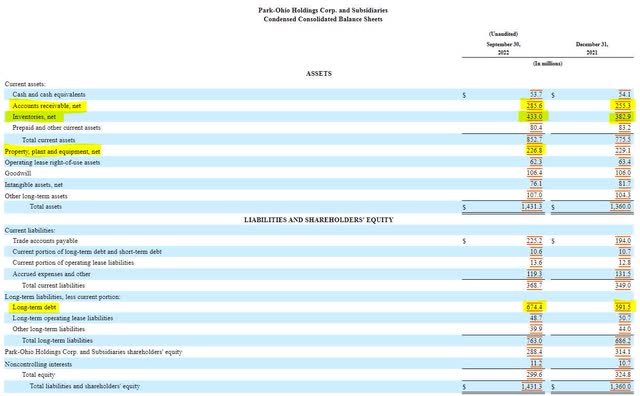

Park-Ohio has seen a buildup in receivables and inventory (working capital) during the calendar year 2022. There seems to be a one-to-one relationship between the increase in working capital and the increase in long-term debt. Throw in the increase in accounts payable and it’s clear Park-Ohio is having trouble managing its cash flow. The cumulative effect of these areas has led to an erosion of shareholder equity.

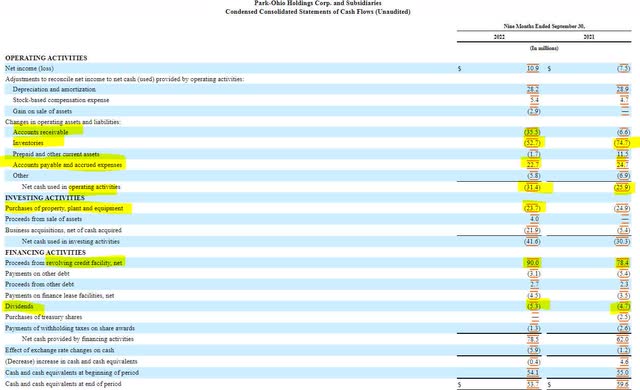

An examination of the cash flow statement shows just how substantial these problems are. Park-Ohio has burned cash on operating activities in the last two years. This is mainly due to the increase in inventories and the slow collections (increase in receivables). Consequently, the company’s accounts payable (amounts owed to vendors) have steadily risen. Despite a $22 million increase in credit from its vendors, the company still consumed $31 million in cash just to operate in the first nine months.

After capital expenditures, free cash flow was negative $55 million. Negative cash flow from operations and negative free cash flow are the single largest contributor to the company, drawing $90 million from its revolving credit facility in 2022. The cash flow drain is not helped by the payment of dividends, further increasing the organization’s need to borrow.

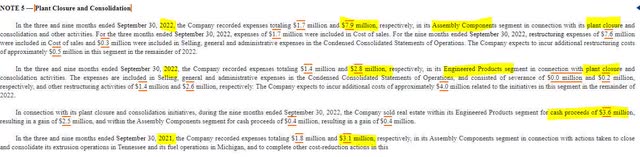

Park-Ohio is making efforts to consolidate operations by closing plants. In 2022, the company has recorded $11 million in expenses related to restructuring by closing of facilities, compared to $3 million in the same period a year ago. Theoretically, these expenses should not be a part of the 2023 financial statements and should buoy gross profit, but there are still more improvements needed to generate positive operating cash flow.

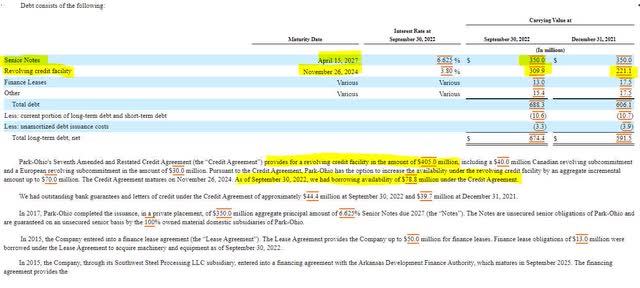

Park-Ohio’s revolving line of credit is 75% drawn at $310 million, with only $79 million remaining. This low level of liquidity gives the company approximately 12 to 15 months to turn its operations around or the combination of negative operating cash flow, capital expenditures, and dividends will exhaust the remaining balance on the company’s credit line. If you include the company’s cash balance, the total liquidity is $163 million, which would indicate roughly two years of funding remaining under current operating levels. Companies typically do not wait for liquidity to hit zero prior to filing bankruptcy, so Park-Ohio’s situation is getting quite tenuous.

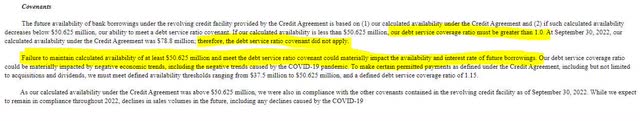

The liquidity buffer may also not be as large as it seems. The company did disclose in the covenants section that it has failed to meet the debt service ratio covenant, which will affect its ability to refinance its existing debt, but it is not in violation of its credit agreement or in default because it has greater than $50 million in credit line capacity remaining. Despite this reprieve, the fact that Park-Ohio is $30 million away from a possible debt covenant breach is deeply concerning.

While acquisition could be an investors’ saving grace, the company’s diversification of products and services limits the number of potential acquirers. A larger entity acquiring the company could create synergies in the areas of SG&A and possibly cost of goods sold by consolidating personnel structures and manufacturing, but it would need to be familiar with a broad range of product lines.

Investors should avoid the company’s debt and shares. I believe Park-Ohio’s debt should be priced lower to reflect the company’s negative cash flow, its inability to increase margins, and the lackluster results surrounding its consolidation efforts. In an increasing rate environment, Park-Ohio is likely to find itself on the outside of any new lending opportunities.

Be the first to comment