Frazer Harrison/Getty Images Entertainment

Paramount Global (NASDAQ:PARA) continues to be a conundrum for investors, as the share price has fallen by 43% over the past 12 months. Notably, this time period doesn’t even include the Archegos debacle in early 2021, when PARA’s stock became exorbitantly high, before crashing back down to earth.

This share price weakness isn’t necessarily a bad thing for value investors, especially considering that PARA is a dividend payer that currently yields a respectable 5.3% yield. In this article, I highlight why patient value investors seeking meaningful income may want to take a hard look at PARA, especially after its recent drop from the $20 level since earlier this month.

Why PARA?

PARA is primarily a media holding company that invests in and operates a diversified group of branded entertainment businesses. The Company’s segments include filmed entertainment, television stations, live events and consumer products.

It owns the highly valuable Paramount Pictures brand including a library of 2,500 films as well as a number of broadcast and cable television networks including CBS, Comedy Central, MTV, Nickelodeon, VH1, and BET. In addition, PARA is home to the number one movie this year, Top Gun: Maverick, and one of the highest rated shows on TV, Yellowstone, which currently streams on Peacock (CMCSA).

Starting with the negatives, PARA is facing a difficult advertising environment, as total ad revenue fell by 2% YoY due to declines in the traditional linear TV business. It’s no secret that this segment of the business is seeing headwinds from cord-cutting, as consumers increasingly watch their TV shows through streaming services.

While this is disconcerting, it’s worth noting that the ad business is far from being dead, as evidenced by streaming giant Netflix (NFLX) now offering an ad-supported plan for $6.99 per month.

In a recent interview, Netflix’s CEO Reed Hastings admitted to being wrong about advertising and being slow to adopt the advertising model. In the interview, he credited rival streaming service Hulu’s CEO Jason Kilar for successfully adopting tiered plans with an ad-supported option. Hulu was able to capture a swath of the advertising pie that was missing from linear TV as the coveted 18-49 year old demographic by advertisers increasingly moved towards streaming.

Turning back to PARA, its own direct to consumer streaming service continues to ramp up, as revenue grew by 38% YoY to $1.2 billion in the third quarter. This was driven by 2.7 million net subscriber additions to PARA’s Paramount+ and Pluto streaming services. This, combined with stellar film revenue driven by the long and very successful theatrical run of Top Gun: Maverick, contributed to an overall 5% YoY increase in revenue.

Looking forward, I see potential for PARA to capitalize on advertising revenue through its own streaming service on Paramount+, which had an ad-supported tier from day one. As the CEO noted during a recent industry conference, the company is seeking a simple and streamlined ad network by creating a holding company that will serve as a single point of contact for advertisements, thereby reducing silos across lines of businesses.

PARA’s CBS broadcast network also serves as a key differentiator for its streaming ambitions, especially in the increasing complex and fragmented streaming market. The network reaches nearly every household in the U.S., thereby giving PARA a strong launching pad for its shows. Importantly, PARA is also capitalizing on its runaway success of Yellowstone with the prequel, 1923, starring Harrison Ford and Helen Mirren.

Meanwhile, PARA maintains a strong BBB rated balance sheet with a reasonable long-term debt to capital ratio of 42%. This lends support to its attractive 5.3% dividend yield at present, which is well-supported by a 51% payout ratio.

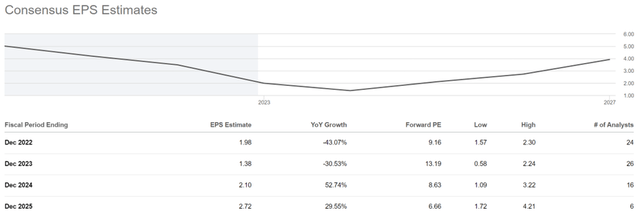

PARA also appears to be rather cheap at its current price of $18 with a blended PE of 8.7, sitting materially below its normal PE of 12.8. It’s worth mentioning that analysts expect an EPS decline of 31% next year, as PARA’s streaming service takes time to ramp up, before picking up the following year, as shown below. I would expect for PARA to trade at a minimum of 10x PE considering the quality of the enterprise, vast audience reach, and long-term potential.

PARA Earnings Estimates (Seeking Alpha)

Investor Takeaway

Overall, I believe that PARA is a good investment opportunity given its attractive dividend yield and cheap valuation. The combination of its traditional TV business, CBS network, and direct-to-consumer streaming service provides an interesting mix of revenues to drive future growth.

Moreover, PARA is well-positioned to capture a piece of the advertising pie, and its recent success with movies and TV shows seem to be underappreciated by the market. With all these factors considered, I think that PARA is an attractive investment opportunity at present.

Be the first to comment