US DOLLAR OUTLOOK: NZD/USD PRICE ACTION UNDER PRESSURE AMID RISK-OFF MARKET SENTIMENT

The US Dollar strengthened steadily across major currency pairs during Tuesday’s trading session. US Dollar buying pressure was most pronounced relative to sentiment-linked NZD/USD and AUD/USD, which fell -2.3% and -1.6% respectively. The risk-off tone expressed by market price action exacerbated underlying Kiwi weakness as New Zealand outlined new measures to reign in its rampant housing market and lifted pressure off the RBNZ to turn more hawkish. EUR/USD and GBP/USD were dragged lower in similar fashion as US Dollar bulls flexed their muscles. Even USD/CAD ended up advancing 65-pips despite news that the BoC is moving toward tapering policy.

| Change in | Longs | Shorts | OI |

| Daily | 44% | -7% | 13% |

| Weekly | 42% | -20% | 2% |

DXY – US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (21 OCT 2020 TO 23 MAR 2021)

Chart by @RichDvorakFX created using TradingView

On balance, the broader DXY Index gained 0.64% for the session. This seemed largely fueled by resurfacing risk aversion and demand for safe-haven currencies like the US Dollar. With US Dollar bulls seemingly back in control of direction after a short-lived pullback from month-to-date highs, it looks like the DXY Index could be eyeing technical resistance posed by its 200-day simple moving average. Eclipsing this barrier might bring to focus the 94.00-handle underpinning early November highs. On the other hand, if US Dollar bears attempt to make a push, the DXY Index might find technical support provided by its 20-day simple moving average.

Recommended by Rich Dvorak

Forex for Beginners

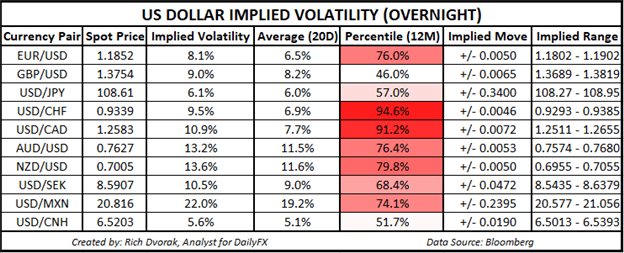

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

US Dollar implied volatility readings are heating up across the board of key FX pairs. EUR/USD overnight implied volatility of 8.1%, for example, is above its 20-day average reading of 6.5% and ranks in the top 76th percentile of readings taken over the last 12-months. Upcoming event risk detailed on the DailyFX Economic Calendar highlights the release of monthly PMI data. Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen will be back in the spotlight for day two of their congressional testimonies as well.

Keep Reading – EUR/USD Price Outlook: Euro to Struggle as US Economy Outperforms

— Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

Be the first to comment