Drew Angerer

Palantir Technologies Inc. (NYSE:PLTR) is a global software company that was originally backed by the CIA. The company’s products are used by large organizations, governments, and of course military customers. The business has specifically tilted its brand towards offering high reliability for military use cases.

This is a risky tactic during times of peace, but the Russia-Ukraine war could actually act as a tailwind for the company. The war has caused geopolitical uncertainty to be heightened and Putin has recently announced he will do “any means necessary” to win, which could include using a nuclear arsenal. Now, whether this is a bluff or not, nobody knows. But will Governments really want to take the risk? It seems not, as in the first quarter of 2022, Biden announced a $29 billion increase in the U.S. defense budget, bringing the total to $782 billion. This is up 5.6% year-over-year. In addition, a staggering $6.5 billion has been provided in assistance to Ukraine, in the form of weapons mainly. The 2023 fiscal budget will start on October 1st and this will include the Pentagon’s largest research and development budget ever, with $130 million set aside for developing new weaponry such as hypersonic missiles.

Palantir CEO Alex Karp recently stated in a September 2022 shareholder letter

“The most significant arms race of our time is to construct the next generation of artificial intelligence.”

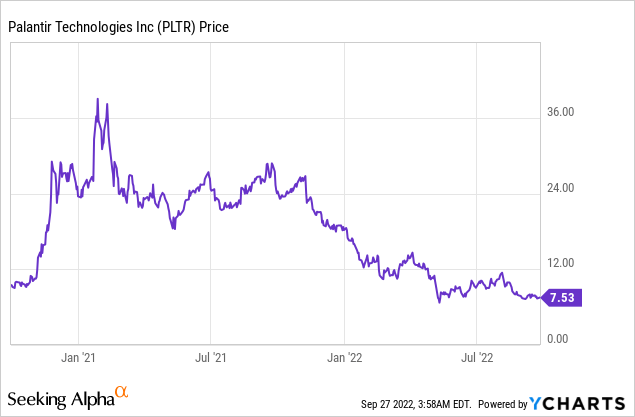

Future wars will be won and lost on the back of technological prowess. It won’t be about who’s the “toughest,” it will be about who’s the smartest, thus Palantir is poised to provide the smartest software for the world’s military. Despite the tailwinds, Palantir’s stock price has been butchered by over 78% from its all-time highs. Thus, in this post, I’m going to break down the business model, financials, and valuation, so let’s dive in.

Best in Class Software

In the words of Billionaire Investor Warren Buffett, “invest into what you can understand.” I have seen many posts on Palantir which don’t actually explain what the company does. I personally believe many investors don’t actually understand the business. Thus, to help you guys out, here is an overview of its products, which mainly consist of best-in-class software packages;

Gotham

Gotham is an “Operating System” that is used for “Global Decision Making.” The software basically “joins the dots” between various real-time data sources and displays insights on a “single pane of glass” or dashboard in plain English. Data sources include information from defense agencies, military organizations, disaster relief units, and more.

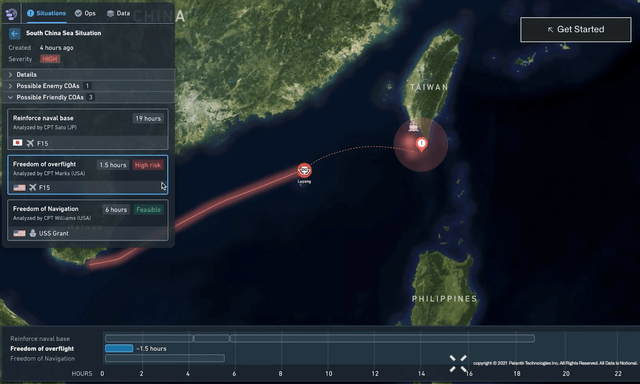

An example, the company highlights with a simulation video on its website is that of an escalating situation between the U.S. military, China, and Taiwan. In the example, Gotham is being used to track Chinese Battleships which are traveling around the coast of Taiwan in a potentially hostile manner. Palantir’s software automatically detects these battleships using AI and satellite imagery, before automating a reconnaissance drone to fly over the Pacific Ocean for a closer look.

China-Taiwan War Example, drone dispatched (Gotham Palantir)

During times of war, an Army general can view this dashboard in front of him to automate the executions of missiles and other responses after analyzing real-time data.

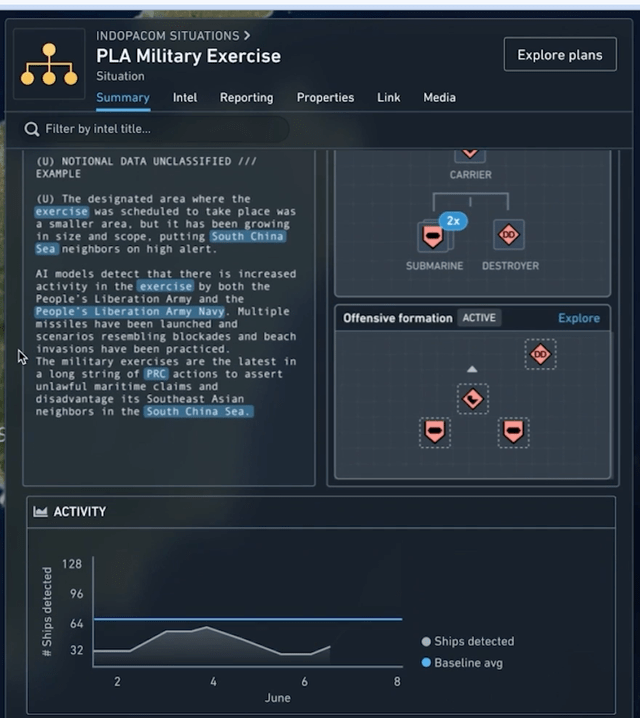

Military Exercise (Palantir Gotham example)

MetaConstellation

MetaConstellation uses the power of “Satellite constellations” and AI to improve life on earth and collect data. Palantir has a partnership with Satellogic, a leader in Satellite “Sub-Meter” resolution imaging. This basically means that each pixel on the photograph is less than a meter in width and thus this enables the granular monitoring of situations on the planet. There are many applications for this technology, from crop and wildfire monitoring to global warming effects and, of course, military exercise monitoring. For example, before the Russia-Ukraine war, the U.S. already knew that Russia was planning something major which wasn’t a “drill,” as previously promised by the Russian government. This is because the U.S. Army had satellite images of many troops at the border. Now, although it is not known whether Palantir was used specifically in that use case, the U.S. Army is a customer, and its research lab recently expanded its AI contract with Palantir for $99.9 million.

Russian Troops assemble at Kursk close to Ukraine Border pre war (Kursk region Satellite image )

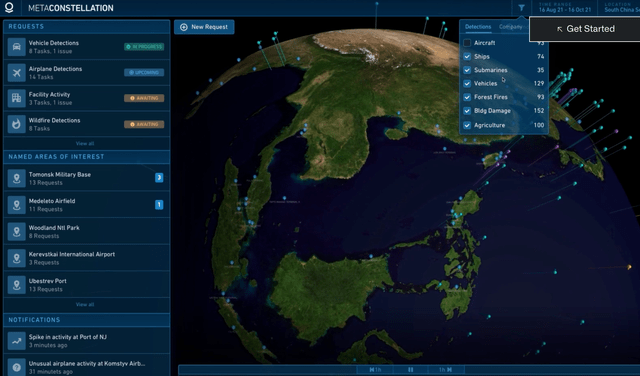

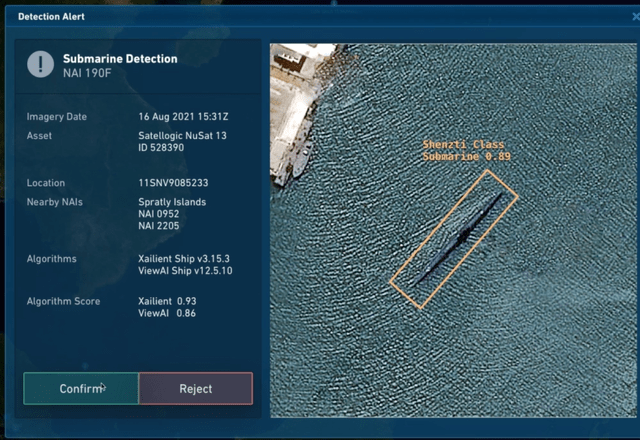

An example Palantir gives is the tracking of submarines all over the world. This is because they act as a strategic threat to the U.S. and its allies. Anti-submarine warfare officers use MetaConstellation to monitor ports across the pacific, as you can see on the image below.

Meta Constellation Submarine Monitoring (Palantir Website Video)

The Satellite AI models are used to detect submarine movements, which are then directly downlinked to allied forces. The forces can then issue a response, which could be a drone for reconnaissance, troop/ship deployment, or even military action.

Submarine Detected (Meta Constellation)

Satellite imagery can also be used in the world of trading and investing. For example, some images have been used to track oil container reserves, and thus use this as a data point to forecast the price of oil and profit.

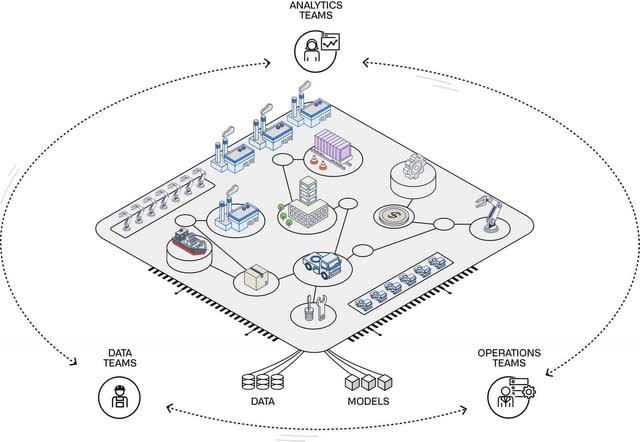

Foundry

Foundry is the “Operating System” for the “Modern Enterprise.” An “Enterprise” is just a large organization, for the uninitiated. Many of these have data siloed across multiple departments, and thus it is underutilized. Foundry helps to bring this “big data” together in order to run AI models on it and derive insights. The Big Data industry is forecasted to be worth $273 billion by 2026, thus Palantir has plenty of growth potential ahead.

Foundry software creates a “closed loop” between analytics, data, and operations teams, which means data can be harnessed in real-time. The foundry can also be used to create “Digital Twins” of manufacturing setups.

Foundry software was used to handle the complex logistics and deployment of CV19 vaccines by the National Health Service [NHS] in the UK. Pacific Gas and Electric (PG&E) in California uses Gotham to get an entire operating picture of the grid, to help protect against wildfires by switching routes for electricity.

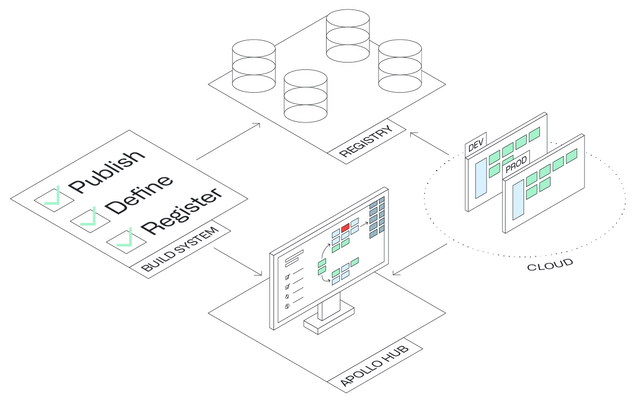

Apollo

Apollo is used to rapidly manage production software and new releases. The platform unifies development, security, and operations teams to enable rapid software changes in production environments. This platform enables software teams to be more efficient and focused.

Apollo’s customers include major organizations such as Airbus (OTCPK:EADSF, OTCPK:EADSY), Hyundai (OTCPK:HYMTF), and even Rio Tinto (RIO, RTNTF, RTPPF), one of the world’s biggest mining companies. The range of customer industries and use cases means the company has a huge total addressable market and plenty of runway for growth.

Mixed Financials

Palantir announced mixed financial results for the second quarter of 2022. Revenue popped by 26% year over year to $473 million, which was slower than the 30% growth rate produced last quarter, but this did beat analyst consensus estimates by $1.29 million.

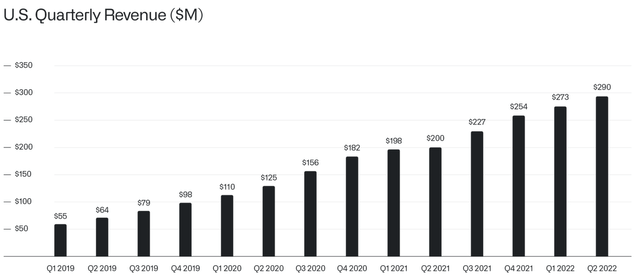

US Quarterly Revenue (Palantir)

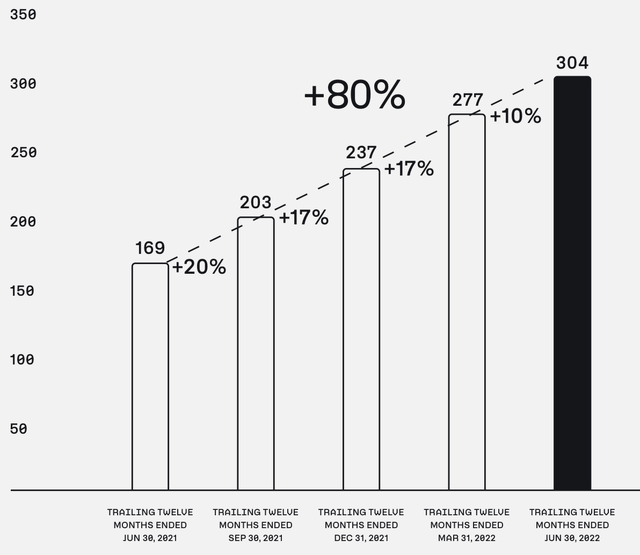

U.S.-only quarterly revenue was a strong growth driver, which popped by 45% year over year to $290 million. U.S. Commercial revenue increased by a rapid 120% year over year, driven by U.S. commercial customers increased by a blistering 250% year over year. To put things into perspective, Palantir had 34 U.S. commercial customers in the second quarter of 2021, which increased to 119 customers by the second quarter of 2022. Total customers were up 80% in the trailing 12 months to 304.

Palantir Customers (Q2 Earnings Report)

The Healthcare segment for Palantir is a strong growth driver and increased revenue by 267% year over year, from $42 million to $153 million. This was driver by various CV19 vaccine rollout programs such as that with the NHS in the UK.

Palantir has recently been announced as number one in the world, by Artificial Intelligence derived revenue, beating tech giants such as Microsoft (MSFT) and even Google (GOOG, GOOGL).

Palantir AI (Alex Karp Shareholder Letter September 2022)

The great thing about software companies is they tend to have high margins, due to the low capex requirements. In this case, Palantir has a super high gross margin of 81%, which only dipped by 1% year over year.

Earnings per share was negative $0.01 which did miss analyst estimates by $0.04. Profitability is a big issue for many fast-growing technology companies as they aim to invest for growth until they reach a certain scale. In this case, the majority of this loss was driven by a decline in the price of marketable securities. This was mainly driven by the rising interest rate environment, which has compressed the valuation multiples of all growth stocks.

A positive data point was Adjusted free cash flow, which was $61 million in Q2,22 and represented the seventh consecutive quarter of positive free cash flow.

Palantir has a robust balance sheet with $2.4 billion in cash and cash equivalents and virtually no debt.

Lower Guidance

The financial results for the second quarter of 2022 were mixed, but investors got spooked by the revised guidance issued by Palantir’s management. The company forecasted $1.9 billion in revenue for the full year of 2022. This would mean a 23% growth rate year over year, which is substantially lower than the 41% growth rate generated in the full year 2021.

CEO Alex Karp believes this is because of the “uncertainty toward the end of the year” which will likely mean a “slowdown in the rate of spending and lengthening of sales cycles.” The good news is Karp remains optimistic about the growth rate over the next three years.

Advanced Valuation of Palantir

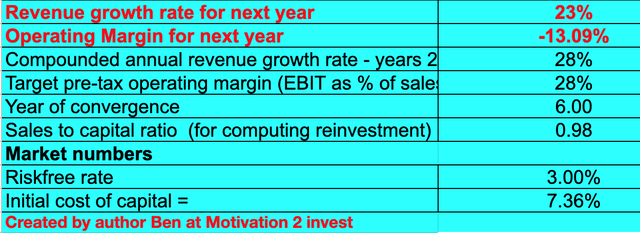

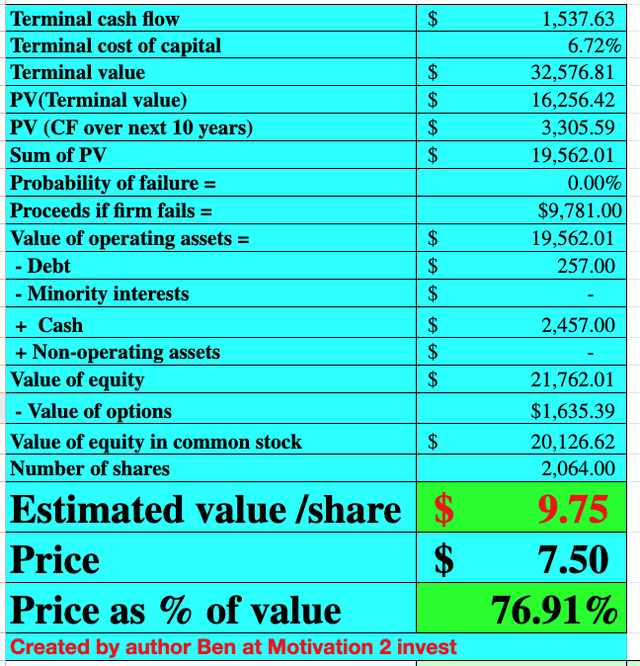

The value of a company is the value of its future cash flows, discounted back to today. In this case, there is much uncertainty about Palantir’s future growth. Therefore, to be conservative, I have revised down my previous revenue growth estimates of >30% for next year, to a lower 23%. After which, I forecast revenue to continue to grow at a 28% growth rate over the next two to five years, as economic uncertainty starts to lessen and the company benefits from defense spending tailwinds.

Palantir stock valuation (created by author Ben at Motivation 2 Invest)

I have forecasted Palantir to increase its operating margin over the next 6 to 28%, as it benefits from increasing scale and high software margins. In addition, I expect the business to continue with account expansion as it upsells multiple software packages to customers.

Palantir stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $9.75 per share. Palantir stock is trading at ~$7.50, and thus is ~23% undervalued.

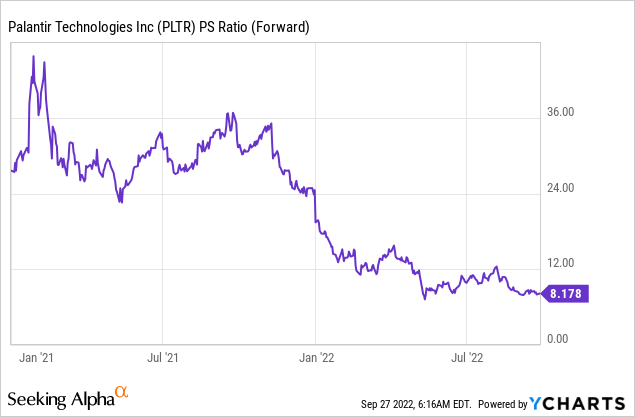

As an extra data point, Palantir is trading at a Price to Sales Ratio = 8 which is significantly cheaper than historic price-to-sales ratios of over 30 achieved in 2021.

Risks

Stock-Based Compensation

Palantir uses a lot of “adjustments” when presenting its financial results. These adjustments tend to exclude stock-based compensation which was an eye-watering $146 million or 30% of revenue in the second quarter of 2022. This is a substantial expense and thus, over time, this will need to decrease as a portion of revenue in order for the business to generate significant profits. Now, as someone who has worked for many large technology companies, I understand the importance of stock-based compensation, as it is necessary to attract and retain the best talent. However, when a company’s stock price is lower, its cost of capital is higher, and thus this type of compensation puts a squeeze on margins.

Recession forecast

The stimulus pump of 2020 is now correcting and we are in a high inflation and rising interest rate environment. This is increasing the input costs and putting margin pressure on businesses across the board. The energy crisis in Europe and threats that Russia may “turn off the gas tap” to countries such as Germany in the winter are also a concern for nations. Thus, this uncertainty may lead to delayed spending and longer sales cycles, at least in the short term.

Final Thoughts

Palantir creates gold standard software for enterprises and government agencies. The company is poised to benefit from growth trends across big data, and even from the conflict in Russia-Ukraine which has been a catalyst for increased defense spending. Palantir stock is currently undervalued intrinsically and relative to historic multiples, and thus this could be a great long-term investment. However, I do expect some short-term volatility in Palantir at least for the next couple of quarters.

Be the first to comment