AlexSecret

A fourth straight day of losses for the S&P 500 should come as no surprise with the index bumping its head on the ceiling of the overhead resistance we have been talking about for several weeks. That said, the cumulative decline has been less than 1%, which is remarkable given the repeated calls by Wall Street pundits for new bear-market lows. Lower guidance from chip companies and retailers soured sentiment for the technology and consumer discretionary sectors yesterday, but there have not been a lot of negatives to upend this rally.

Finviz

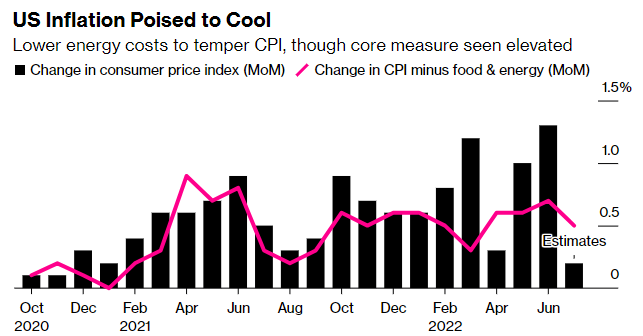

This morning’s inflation report could be the excuse for a sharp pullback if the Consumer Price Index does not decline from 9.1% to 8.7%, as expected, but the die has been cast for a much lower rate this fall. Therefore, I am not concerned about the number, but I will be watching to see how the Fed funds futures market rerates the probabilities of rate increases later this year as a result. I think the writing is on the wall for as rapid a decline in the rate of inflation as we saw in its ascent.

Bloomberg

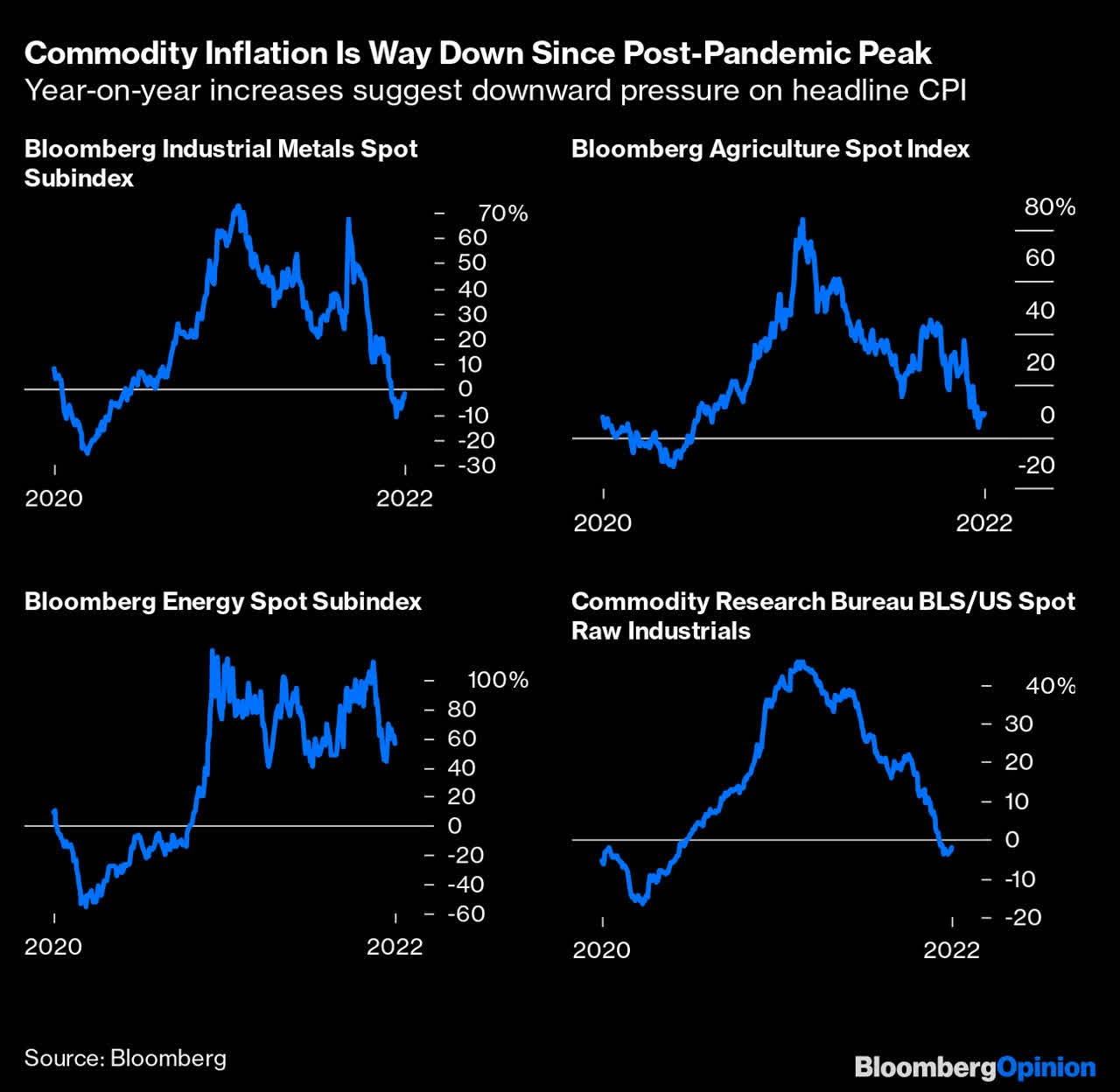

Leading the decline in prices to date are hard and soft commodities, which should start to be reflected in the July CPI report. The most important of these is crude oil, which is facing more difficult year-over-year comparisons with each passing month as we approach the $85 level reached last October, but the prices for industrial metals and agricultural products have fallen even more sharply. These input cost declines should start to feed into the finished products that consumers buy off the shelves in the months to come, while the ones they see on their computer screens are already falling.

Bloomberg

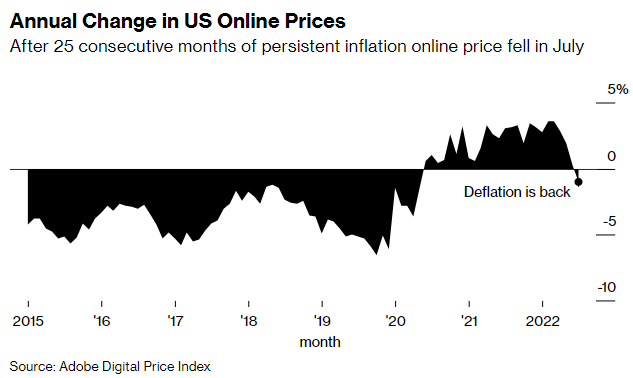

The price of online goods fell for the first time in 25 months on an annualized basis during July, according to the Adobe Digital Price Index. Electronics and apparel are leading in the price drops. Food is one category where prices are continuing to increase, but lower energy and transportation costs should feed into lower food prices in the months ahead.

Bloomberg

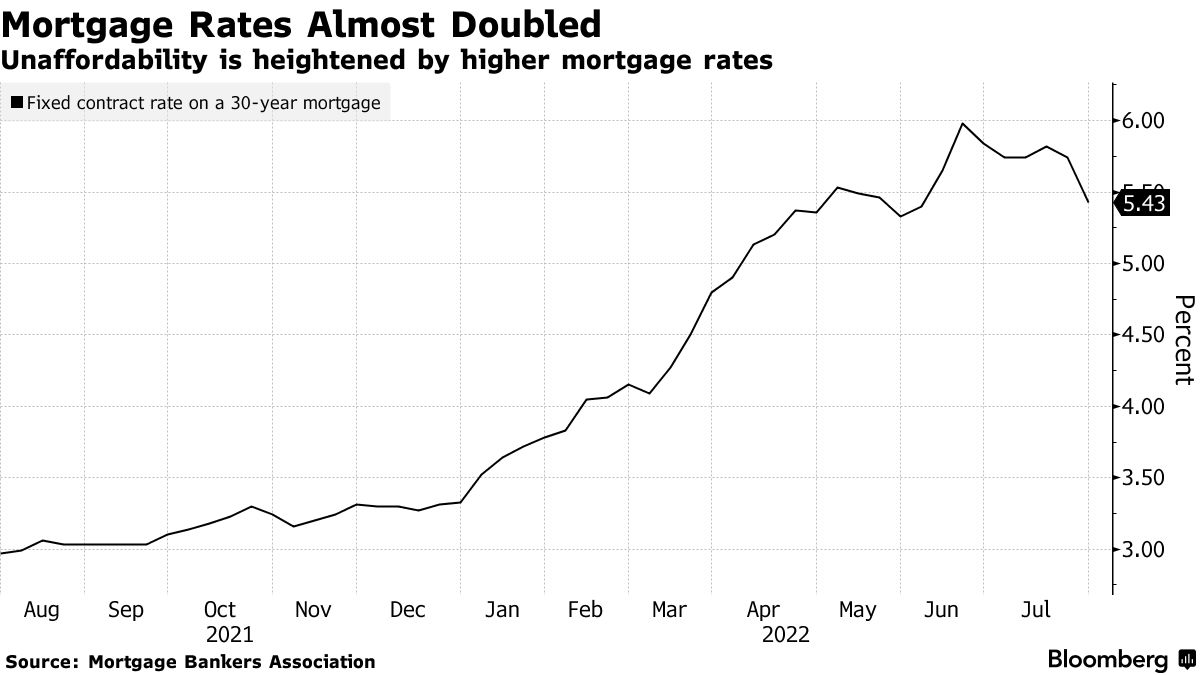

Home price appreciation is coming to a screeching halt with the doubling of mortgage rates this year. We may not see outright price declines, due to limited inventory, but the lack of further appreciation should start to cap rent inflation in the coming 12 months, which is the driver of the core rate today.

Bloomberg

The bottom line is that the rate of change in price for the majority of the components of the Consumer Price Index and Personal Consumption Expenditures price index are moving in the right direction now, as in lower. This should result in a lower Fed funds rate than the consensus is now expecting, smooth the runway for a soft economic landing, and help to fuel the ongoing recovery in the stock market.

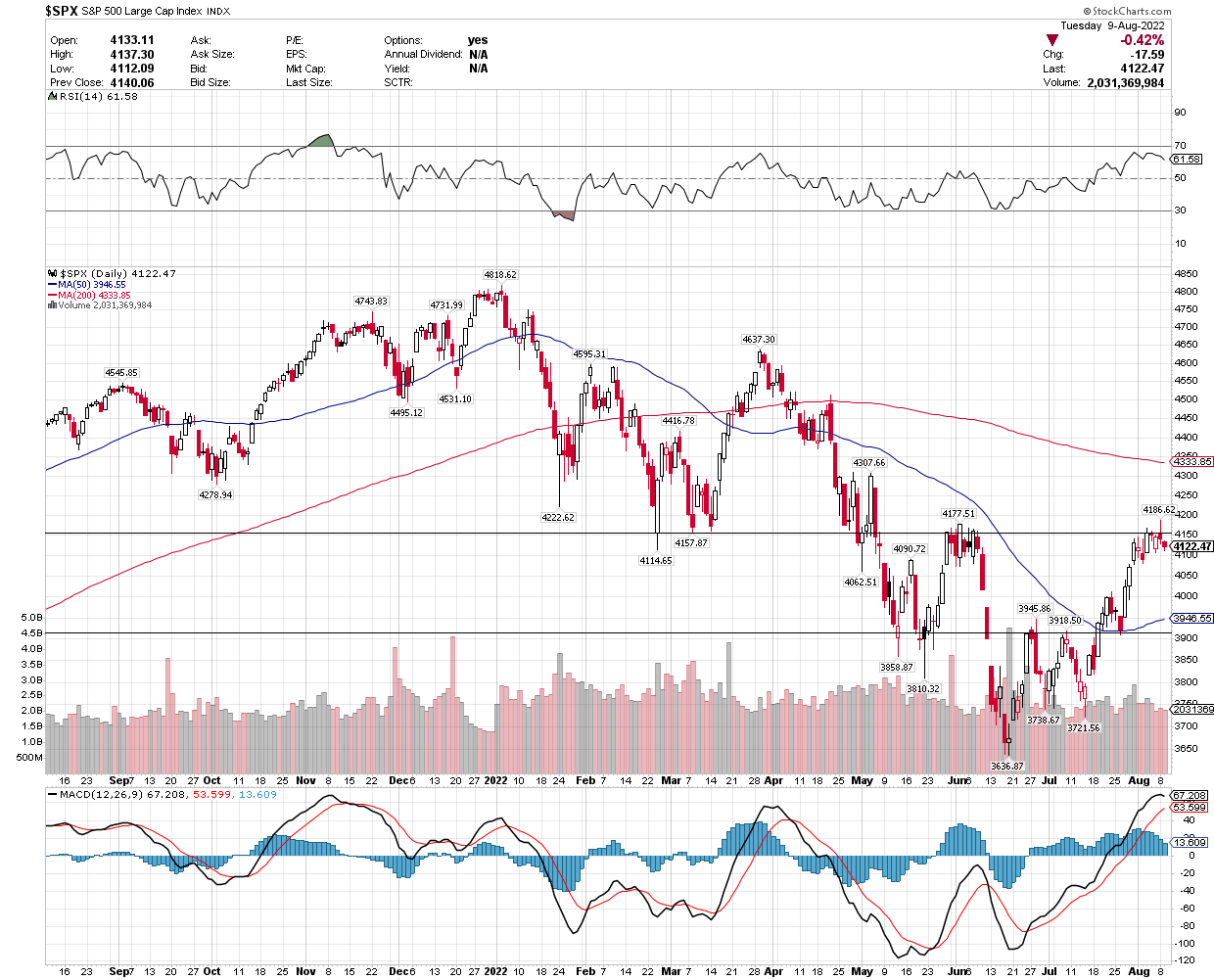

The Technical Picture

We met my 4,150-4,200 initial price target for the S&P 500, which is why I think we are pausing to digest the tremendous gains off the June low. We can do that by either pulling back in price or hold these levels over a period of time. It is usually a combination of the two. I think support comes into play at the rising 50-day moving average.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment