Takako Hatayama-Phillips

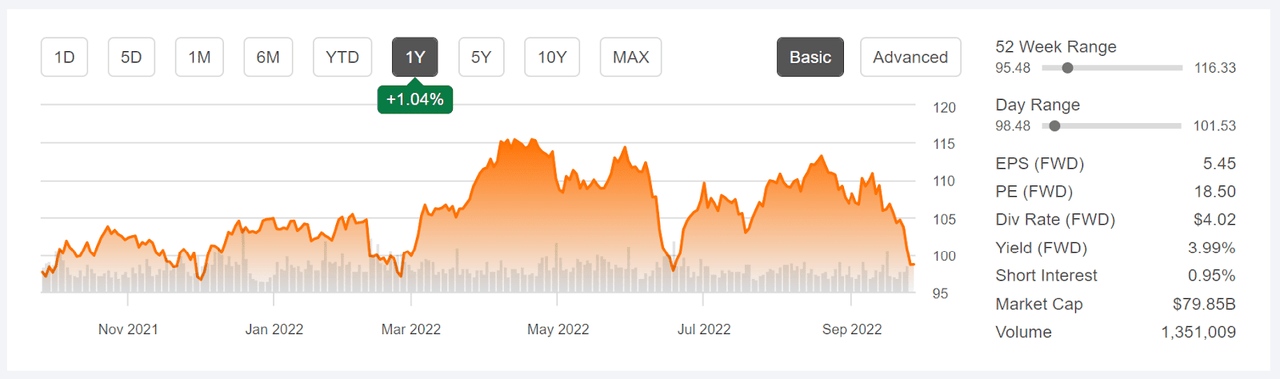

Duke Energy (NYSE:DUK) has fared quite well so far in 2022, winning by not losing. Duke’s YTD total return is -1%, as compared to -22.4% for the S&P 500 (SPY), although DUK has fallen about 13% since mid-August. DUK’s market-beating performance is likely due to the strength of the utility sector, rather than to anything specific to DUK, however. The Utilities Select SPDR ETF (XLU) has a YTD total return of -0.1% (DUK is the 3rd largest holding in this ETF). It is also worth noting that DUK is currently trading below the pre-COVID 2020 high close of $102.02 on February 18, 2020.

Seeking Alpha

12-Month price history and basic statistics for DUK (Source: Seeking Alpha)

Looking at a 3-factor Fama-French analysis of DUK and XLU helps in understanding the contributors to their outperformance during this market downturn. Over the past 5 years (through August), DUK and XLU have betas of 0.37 and 0.49, respectively. These results show that utilities in general, and DUK specifically, are not very sensitive to moves in the broader equity market. As expected, XLU and DUK have similar loadings on the size factor (SMB) and on the value factor (HML). The negative weighting on SMB means that DUK and XLU track more with large-cap than small-cap indices.

|

Name |

Ticker |

Beta |

SMB |

HML |

Annual Alpha |

|

Duke Energy Corporation |

DUK |

0.37 |

-0.45 |

0.18 |

5.52% |

|

Utilities Select Sector SPDR ETF |

XLU |

0.49 |

-0.44 |

0.09 |

4.13% |

Fama-French 3-factor weightings for DUK and XLU for the 5 years through August of 2022 (Source: Portfolio Visualizer)

DUK, and to a lesser extent XLU, have a value weighting (positive HML factor). This also helps to explain DUK’s substantial outperformance vs. the broader market. Value has substantially beaten growth so far in 2022. The iShares S&P 500 Value ETF (IVE) has returned -15.5% for the YTD, as compared to -28.7% for the iShares S&P 500 Growth ETF (IVW).

Even considering the factor exposures, DUK has performed well over the past year and beyond. A number of factors have contributed. First, rising fuel prices serve to encourage electrification, shifting from fossil fuel appliances to electric stoves, heat pumps, water heaters and transportation. Perhaps as significant as rising fuel prices is the growth in investor enthusiasm for non-fossil energy. One need only look at the 28.3 forward P/E for NextEra (NEE), the largest producer of wind and solar in the world, to see that the market is assigning a substantial premium to clean energy producers. DUK is focusing considerable resources on an ‘energy transition’ to non-fossil sources (see slide 21).

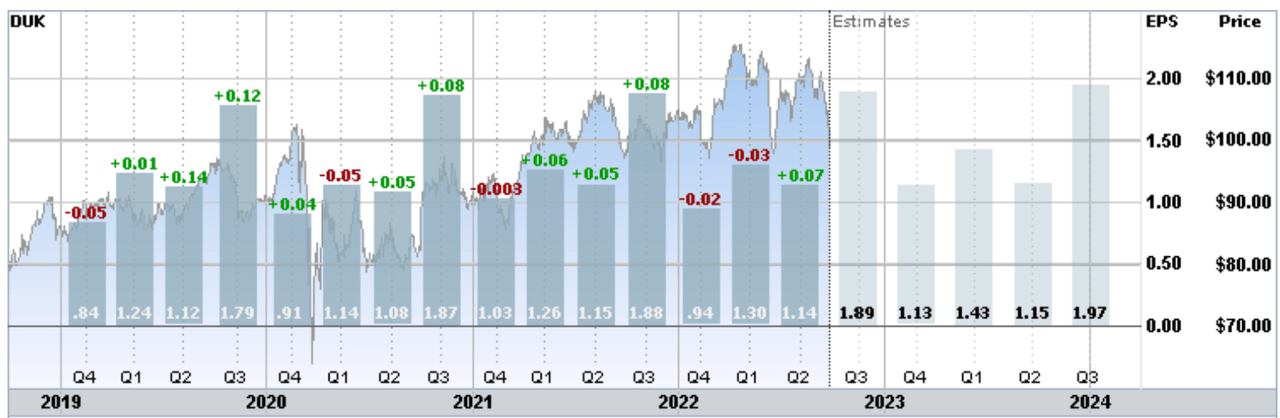

Along with the forward-looking strategy, DUK would not have done well without producing consistent solid earnings. The earnings in recent years have been stable, with a small amount of growth. The consensus expectation for Q3 is for EPS that is almost identical to Q3 of 2021and Q3 of 2020. The consensus expectation for EPS growth over the next 3 to 5 years is 5.6% per year.

ETrade

Historical (4 years) and estimated future quarterly EPS for DUK. Green (red) values are amounts by which reported EPS beat (missed) the consensus expected value (Source: ETrade)

DUK has a 3.99% forward dividend yield and trailing 3-, 5-, and 10-year annualized dividend growth rates of 2.0%, 2.8%, and 2.85 per year, respectively. The Gordon Growth Model indicates that expected total returns in the range 6%-7% per year are reasonable. This is very close to the trailing total returns over the past 15 years and various sub-periods therein.

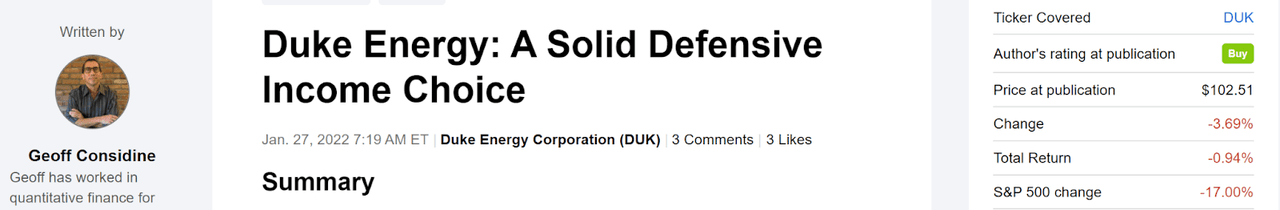

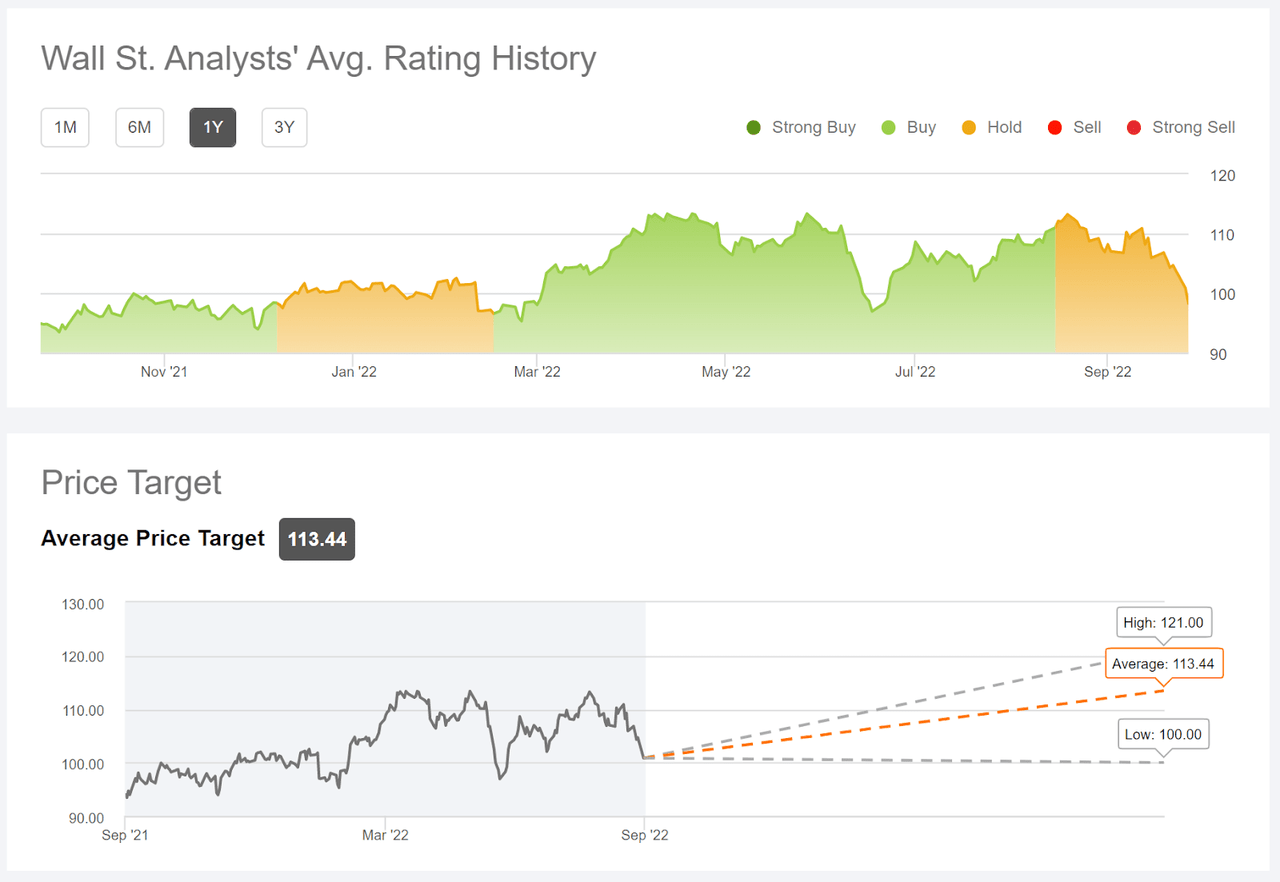

I last wrote about DUK on January 27, 2022, 8 months ago, at which time I maintained a buy rating. While the valuation was a bit high as compared to recent years, the overall narrative for DUK was solid, with reliable modest growth expectations. The Wall Street analyst consensus rating was predominantly neutral, and the 12-month consensus price target corresponded to a total return of 7.6% over the next year. In analyzing a stock, I also rely on the consensus outlook among buyers and sellers of options, as reflected by options prices, the market-implied outlook. The market-implied outlook to January of 2023 was slightly bullish, with expected volatility of 22.8% (annualized). Considering the neutral to bullish Wall Street consensus, the slightly bullish market-implied outlook, and the low expected volatility, as well as the very low beta, maintaining the overall buy rating was a natural choice. I also noted that selling covered calls on DUK was worth considering and that I had done this myself.

Seeking Alpha

Previous analysis for DUK and subsequent performance vs. the S&P 500 (Source: Seeking Alpha)

In the 8 months since my analysis, DUK has dramatically outperformed the broader equity market, almost entirely due to the stock’s defensive character and the rotation to value in the face of a substantial drop in the overall equity market. As I noted in the introduction, DUK has won by not losing.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

I have calculated updated market-implied outlooks for DUK and compared these with the current Wall Street consensus outlook in revisiting my rating.

Wall Street Consensus Outlook for DUK

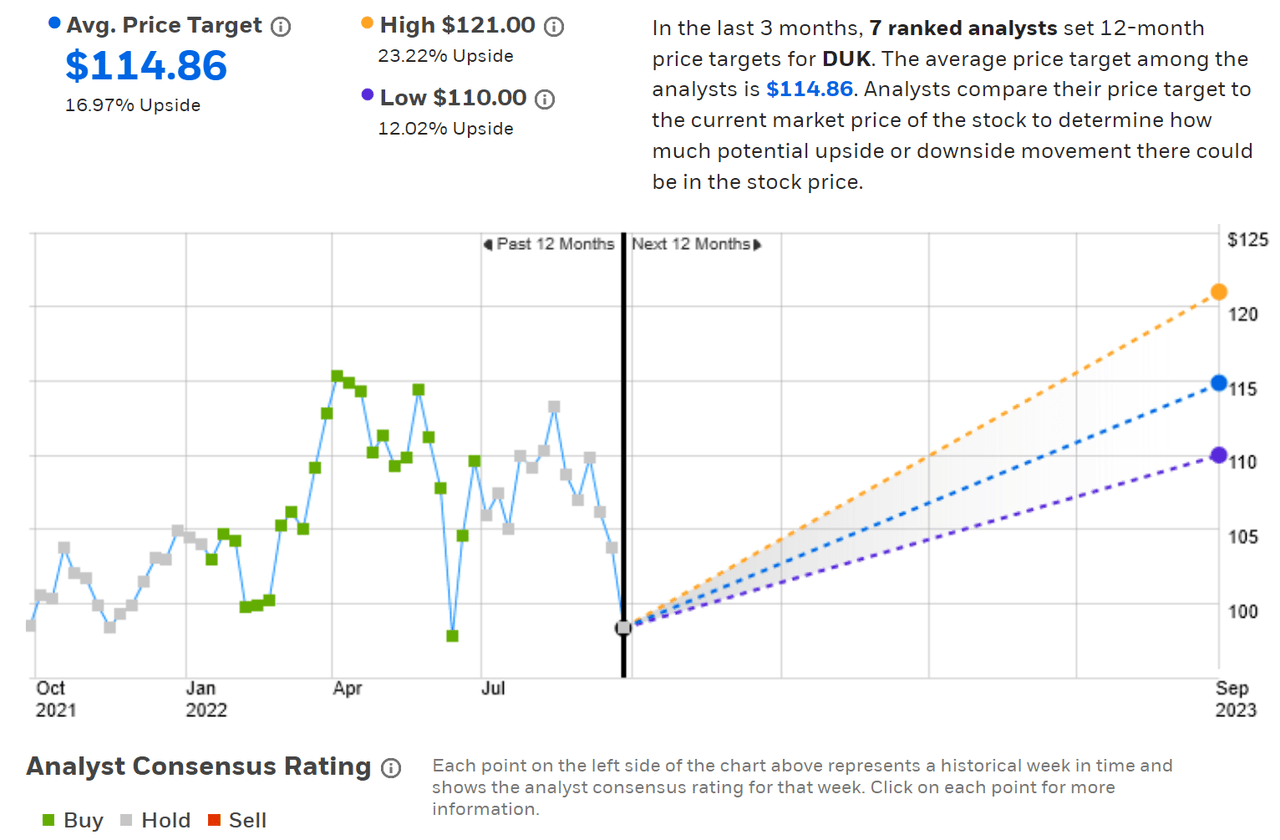

ETrade calculates the Wall Street consensus outlook using ratings and price targets from 7 ranked analysts who have published their views within the past 3 months. The consensus rating is neutral and the consensus 12-month price target is 17% above the current share price. The consensus price target is considerably higher than it was back in January, which accounts for the much higher expected 12-month return for the next year. The spread in the individual price targets is low, increasing confidence in the predictive value of the consensus price target.

ETrade

Wall Street analyst consensus rating and 12-month price target for DUK (Source: ETrade)

Seeking Alpha’s version of the Wall Street consensus outlook is calculated by combining the views of 21 analysts who have published ratings and price targets over the past 90 days. The consensus rating is neutral and the consensus 12-month price target is 15.5% above the current share price.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for DUK (Source: Seeking Alpha)

Back in January, the Wall Street consensus rating was mixed (buy from ETrade and hold from Seeking Alpha) and the average of the two consensus price targets corresponded to an expected total return of 7.6% for the next year. Today, both ETrade and Seeking Alpha have hold ratings on DUK, but the average of the two consensus price targets equates to 20.2% expected total return. The higher expected upside is primarily due to a rising price target, which is somewhat odd given that the ratings are neutral. To expect 20% in return on a low-beta, low-volatility stock like DUK would seem to suggest a robust buy rating. The apparent disconnect is probably due to the significant drop in DUK’s share price since mid-August, which raises the expected 12-month return.

Market-Implied Outlook for DUK

I have calculated the market-implied outlook for DUK for the 3.8-month period from now until January 20, 2023 and for the 8.6-month period from now until June 16, 2023, using the prices of call and put options that expire on these dates. I selected these two dates to provide a view to the start and middle of 2023, as well as because the options expiring in January and June tend to be among the most liquid.

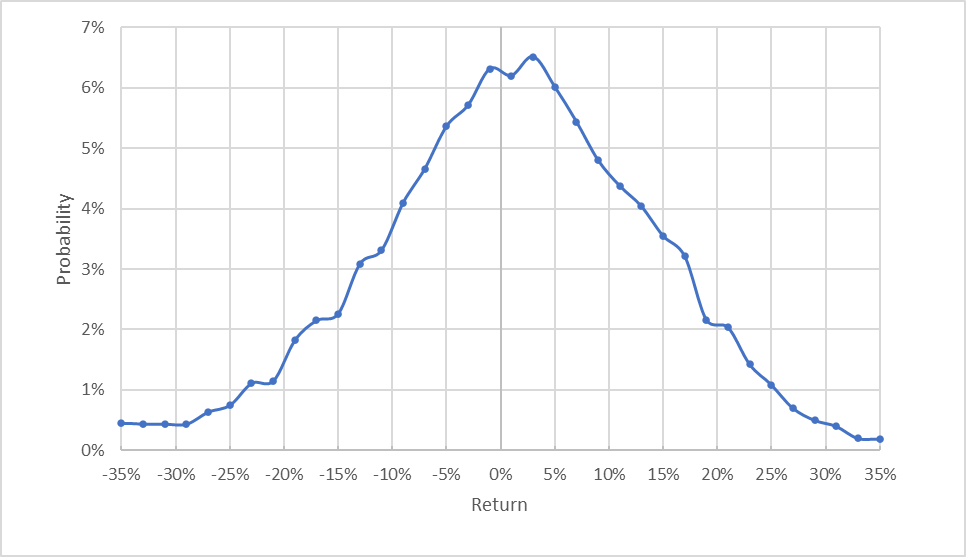

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for DUK for the 3.8-month period from now until January 20, 2023 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook from now until mid-January of 2023 is tilted to favor positive returns. Compare, for example, the probabilities of having a +5% or +10% return to those for a -5% or -10% return. The expected volatility calculated from this distribution is 26.7% (annualized), somewhat higher than the expected volatility from my January analysis, 22.8%. This is probably mainly due to the higher current higher market volatility relative to January, rather than to something specific to DUK.

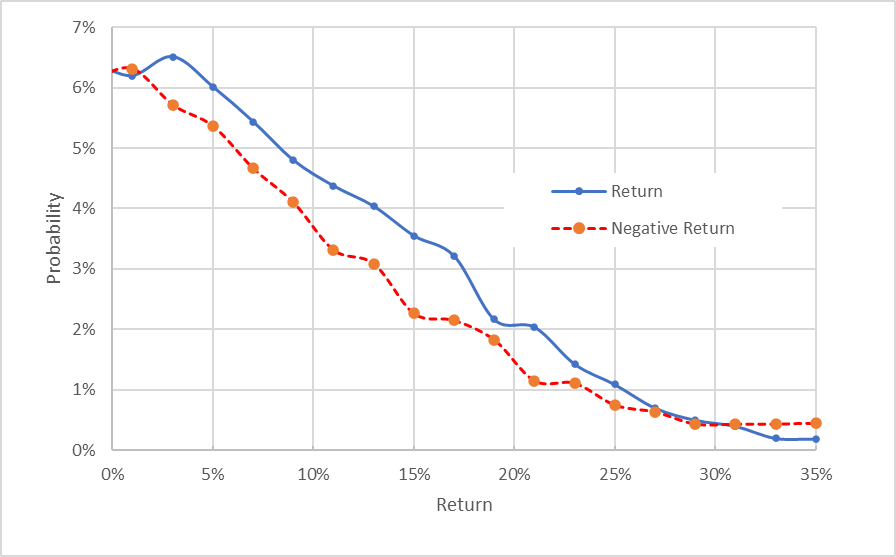

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for DUK for the 3.8-month period from now until January 20, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view highlights the consistent shift in probabilities to favor gains vs. losses, across a wide range of outcomes (the solid blue line is consistently above the dashed red line over the left ⅔ of the chart above). This is a bullish outlook.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the bullish interpretation of this outlook.

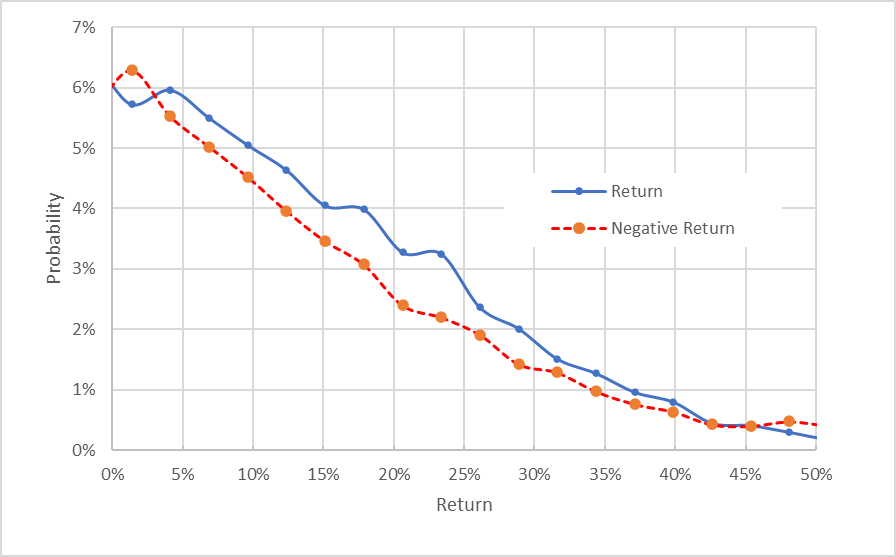

The market-implied outlook for the 8.6 months from now until June 16, 2023 is very similar to the shorter-term outlook, although the bullish tilt is less pronounced (the spread between the solid blue line and the dashed red line is smaller). Even so, this is a solidly bullish outlook. The expected volatility calculated from this distribution is 25.9% (annualized).

Geoff Considine

Market-implied price return probabilities for DUK for the 8.6-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlooks for DUK to January and to June of 2023 are consistent in that they are more bullish than they were back in January and the expected volatility is somewhat higher.

Summary

DUK has provided the type of portfolio stabilization that one would expect during a market downturn, although DUK has performed even better than the beta and value tilts would predict. I believe that much of this extra benefit is due to the broad shift towards increased electrification and growing investor enthusiasm for clean energy. DUK has also provided consistent, albeit modest, earnings growth in the past several years. The Wall Street analyst consensus rating for DUK is neutral, but recent declines leave considerable expected upside to reach the consensus 12-month price target. Taking the Wall Street consensus outlook at face value, DUK has an expected total return of 20.2% over the next year. As a rule of thumb for a buy rating, I want to see an expected 12-month total return that is at least ½ the expected volatility (26%-27% from the market-implied outlook). Taking the Wall Street consensus at face value, DUK is well above this threshold. The market-implied outlooks for DUK to January and to June of 2023 are also bullish. I am maintaining my buy rating on DUK. Given the recent declines, this is a good time to buy the dip.

Be the first to comment