Michael Vi/iStock Editorial via Getty Images

Palantir (NYSE:PLTR) seems to be once again surrounded by bearish speculation. Its key executives have sold almost $2.3 billion worth of Class A shares since its direct listing in September 2020 and investors are now questioning the loyalties of these company insiders. While many are fearing that Palantir’s executives are bailing before the ship sinks, others feel that they’re profiting at the expense of shareholders. In this article, I’ll attempt to cover Palantir’s insider sales in detail, discuss why they were elevated in 2021 and why investors shouldn’t be concerned about them in 2022. Let’s take a closer look.

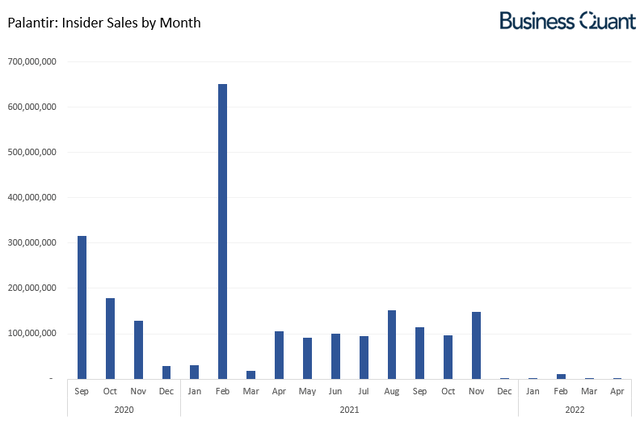

Aggressive Insider Sales

Let me start by saying that the SEC mandates company insiders, which includes officers, 10%-plus stockholders and top-level employees, to disclose their trading activity pertaining to their company, through form 4 filings. These personnel tend to have real-time information about their company’s financial and/or operating performance, so the Street monitors their trades to get insights about the concerned company’s upcoming results.

The general perception is that if a company’s prospects are deteriorating, then its insiders would look to exit their positions ahead of a market-wide selloff. Conversely, if a company’s prospects are improving, then these insiders would be privy to such information beforehand and they’d look to increase their holdings in the company instead. The problem here is that this is just an indicator of what the insiders are doing, and isn’t a full-fledged trading strategy on its own.

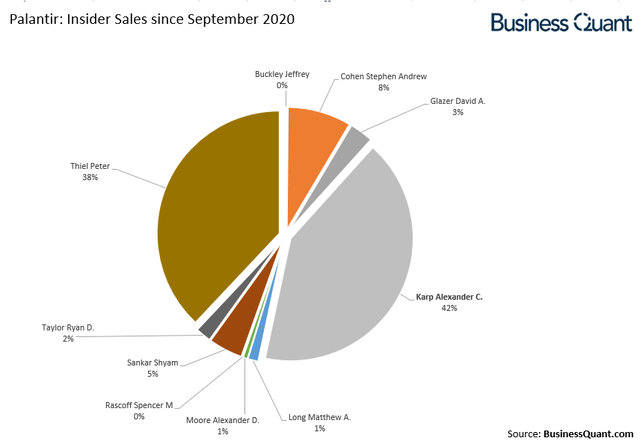

As far as Palantir is concerned, its insiders have sold 127.1 million shares since September 2020. To put things in perspective, the dollar-value of these share sales amounts to roughly about $2.3 billion, or almost 9% of the company’s entire market capitalization at the time of this writing. Interestingly, the company’s CEO, Alexander Karp, was responsible for the bulk of these share sales (~42%).

Given the sheer size of this insider selloff, readers and investors are understandably concerned about investing in Palantir. There’s the obvious concern that, perhaps, Palantir’s key executives aren’t confident in their company’s future prospects which is why they’re actively selling their shares. Then, there’s the secondary concern that continued dumping of shares into the open market will increase the supply of shares and weigh on the stock price.

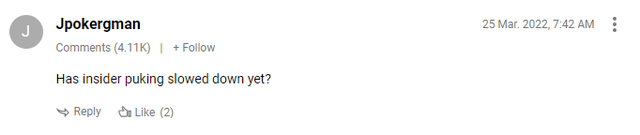

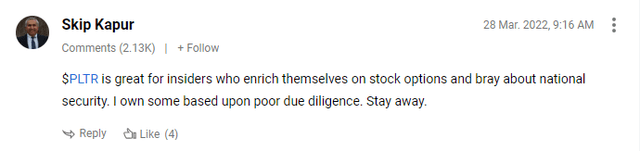

Here are a few recent comments from readers expressing their concern regarding Palantir’s ramping insider sales.

But as we’ll see in the next section of this article, the worst is behind us and investors need not be concerned about Palantir’s insider sales anymore.

No Need to Panic

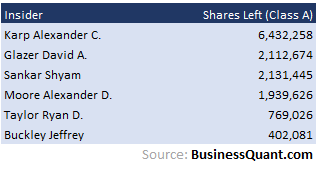

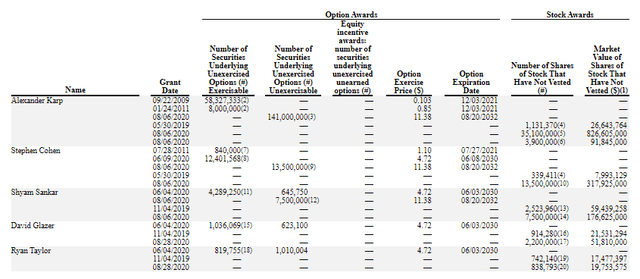

As I previously stated, the general fear associated with these sales is that Palantir’s insiders are, perhaps, bailing before the ship sinks. But fact of the matter is that its key personnel are still holding on to a significant number of their shares and still have ample skin in the game. The table below highlights that Palantir’s insiders collectively still own about 13.78 million Class A shares in the company. This is in addition to their Class B share holdings and the options that are due for expiration in subsequent years. So, in my opinion, this is one of the many reasons why investors shouldn’t panic.

BusinessQuant.com

Secondly, the pace of this insider selloff has massively slowed down in recent months. Per our database at Business Quant, Palantir’s insider share sales in Q1 CY22 are down 95% sequentially and down 98% year over year. In fact, Palantir CEO hasn’t sold a single share in the open market in the last 5 months. These data points lead us to conclude that Palantir’s insider sales have waned off considerably of late and aren’t a cause of concern anymore.

Another thing worth noting here is that Palantir’s shares have risen 40% from their February-lows. If its key executives did not believe in their company’s growth story, they would’ve opportunistically reduced their holdings on the rally. But as we see in the chart above, insider selling did not pick up in March 2022. This should reassure Palantir’s long-side shareholders that the company’s top brass isn’t looking to jump ship.

Before we move on to the third point, let’s understand why this insider selloff occurred in the first place and why it virtually disappeared post November 2021. See, these company executives had over 66 million stock options expiring in the second half of 2021. They had two options here:

- Let their options expire worthless, and forego financial gains, which wouldn’t have made financial sense, or;

- Convert these options into Class B shares by paying under-$2 per share and selling them in the open market at the market price (above $18 per share at the time).

These insiders took the second option. The option conversion and the subsequent sale of shares into the open market created a tax liability for them and they sold off more of their holdings in order to foot the tax bill. The table above highlights that there aren’t any option expiration dates in the near future which is why I believe that Palantir’s insider sales are likely to remain muted in 2022 and 2023 at least.

Besides, I want to mention that insider selling isn’t always bad. Palantir’s key personnel have been with the company for several years, some for almost a decade. So, the company’s direct listing was a liquidity event for these insiders to unlock their paper wealth, diversify it and, perhaps, also to fulfill personal financial obligations — there’s nothing nefarious about it. So, unless Palantir’s insiders accelerated their pace of share sales, investors should rest easy.

Final Thoughts

So, overall, I contend that Palantir’s insider sales was a problem of the past and investors need not be concerned about it anymore.

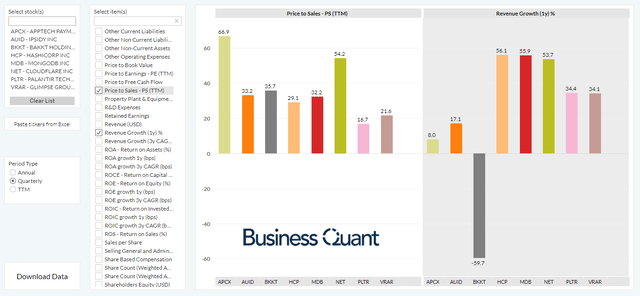

Palantir’s shares, on the other hand, have corrected by 45% in the last 6 months on virtually no company-specific negative news and largely due to the market-wide selloff in growth stocks. This has made Palantir’s shares attractively valued at current levels, especially when we compare its Price-to-Sales multiple with some of the other rapidly growing software infrastructure stocks.

In light of Palantir’s growth prospects (as detailed here) and its attractive valuation, I reiterate my bullish stance on the company. Investors with a long-term time horizon may want to accumulate Palantir’s shares on potential price corrections. Good Luck!

Be the first to comment