RomoloTavani

Investment Thesis

Palantir Technologies Inc (NYSE:PLTR) continues to report cash burn and lack of profitability by FQ2’22. The stock’s fate was also sealed when management reduced its FY2022 guidance, raising investors’ concerns about its previously bullish 30% annual growth rate through 2025. Therefore, we were not surprised by the stock’s continued plunge of -26.4% post FQ2’22 earnings call, from $11.45 on 05 August 2022 to $8.42 at the time of writing on 25 August 2022.

In addition, PLTR may likely miss consensus estimates of FY2022 net income profitability, triggering further weakness in its stock prices by February 2023. Barring a miraculous growth in sales over the next two quarters, we may see a bloodbath ahead, worse than the one witnessed in May 2022. Bullish investors, please fasten your seat belts and brace for impact.

PLTR Unfortunately Remained Unprofitable By H1’22

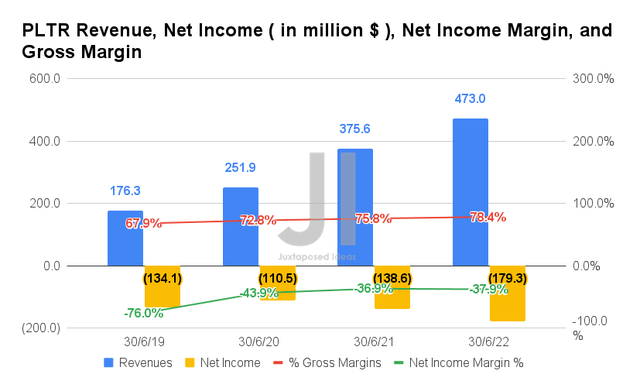

In FQ2’22, PLTR reported revenues of $473M and gross margins of 78.4%, representing stellar YoY growth of 25.9% and 2.6 percentage points, respectively, despite the rising inflationary issues. In contrast, the company reported widening net losses of -$179.3M and worsening net income margins of -37.9% in FQ2’22, representing a decline of 29.3% and a percentage point YoY, respectively.

It is evident that the worsening macroeconomics had adversely affected PLTR’s commercial growth, as expected in our previous analysis. Thereby triggering a meaningful deceleration of growth in its commercial consumers QoQ, from 25.1% in FQ1’22 to 10.3% in FQ2’22. Even its commercial revenues experienced a minimal growth of 2.4% QoQ, from $205M in FQ1’22 to $210M in FQ2’22. Assuming continued weakness ahead, we may see a further fall over the next few quarters, since most companies are tightening their belts with staff layoffs and cost cuts through 2023. This downturn is a natural effect post reopening cadence and not an actual reflection of PLTR’s fundamental performance.

Even fellow SaaS companies, such as Microsoft (MSFT), had experienced a notable decline in their growth in the Productivity segment at 13.6% YoY in Q2’22, compared to 24.7% in Q2’21. Similarly, Oracle (ORCL) experienced a minimal growth of 2.5% YoY in its Services segment in Q2’22, compared to 10.4% in Q2’21. Therefore, the situation is obviously not unique to PLTR.

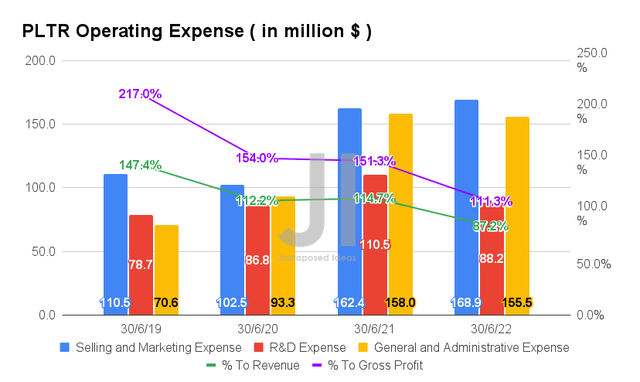

In FQ2’22, PLTR still reported massive operating expenses of $412.6M, representing an increase of 5.4% QoQ though a notable decline of 4.2% YoY. However, these cost-cutting efforts still fail to produce profitability despite the significant reduction in the ratio of operating expenses to sales. By the latest quarter, the company still reported an elevated ratio of 87.2% to its growing revenues and 111.3% to its gross profits. Therefore, explaining the main reason why PLTR is still unprofitable.

Though we would love to use the term, growth at all costs, it is evident that this term is no longer suitable for describing a 25-year-old company. Thereby pointing to PLTR’s less effective client acquisition strategy of usage-based pricing and the unsustainable headcount growth in FY2021. Nonetheless, all hope is not lost, since we expect these investments to be eventually top and bottom lines accretive, once the macroeconomics improve by mid-2023. We shall see.

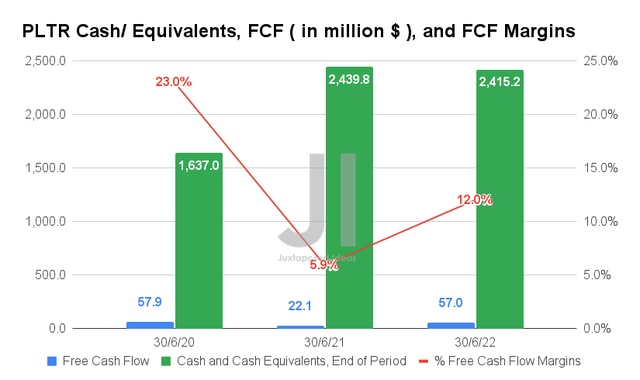

Nonetheless, after certain adjustments, it is also encouraging to see that PLTR still manages to report positive Free Cash Flow (FCF) in FQ2’22, with an FCF of $57M and an FCF margin of 12%. It represents a satisfactory increase of 257.9% and 6.1 percentage points YoY, respectively. PLTR’s cash and equivalents on its balance sheet also remain more than sufficient at $2.41B in the latest quarter, without the promising need to rely on debts at the moment, as seen with many other companies during the pandemic.

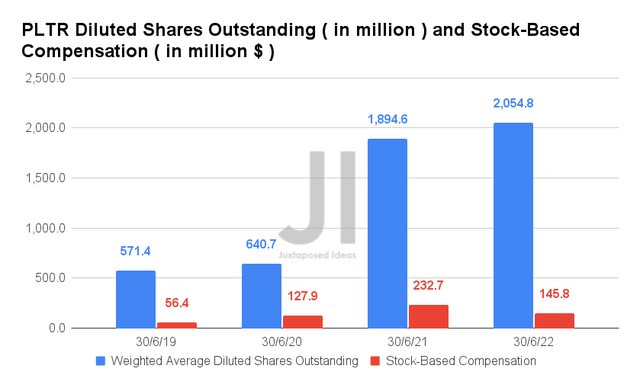

In the meantime, it is notable that PLTR has delivered on its promises on the moderation in its diluted shares outstanding and Stock-Based Compensation (SBC) thus far. By FQ2’22, the company reported a total share count of 2.05B, representing a minimal increase of 0.9% QoQ and 8.4% YoY. In addition, its SBC expenses of $145.8M in the latest quarter also represent a notable decrease of -2.3% QoQ and -37.3% YoY.

These numbers indicate a massive deceleration of PLTR’s reliance on SBC expenses, compared to 82% YoY in FQ2’21. This has meaningfully put an end to all the noise surrounding its previous share dilutions. However, I suppose no one is interested in PLTR’s SBC stories anymore, given its underperformance thus far.

Chasms Are Finally Showing In PLTR’s Forward Guidance Of 30% In Annual Growth

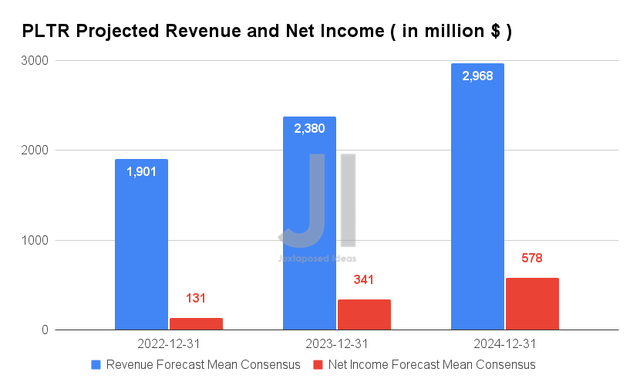

Over the next three years, PLTR is expected to report revenue growth at a CAGR of 24.33%, while finally achieving net income profitability in FY2022. However, these numbers represent a notable decline of -6.6% since previous estimates in February 2022, on top of failing to achieve its annual growth guidance of over 30% through 2025.

For FY2022, consensus estimates remain optimistic that PLTR will be able to report revenues of $1.9B, though these also represent a decline of -4.5% from previous consensus estimates of $1.99B. However, we may potentially see an upsized rerating if the company receives new significant contracts from the US government over the next two quarters. In the meantime, we are skeptical that the company will be able to deliver a net income of $131M by the end of the year, since it remains unprofitable in H1’22 with total net losses of -$280.71M.

Therefore, it is evident that the time of maximum pain is not here yet, with a potential further fall in PLTR’s stock performance over the next two quarters. We may, unfortunately, see a $5 stock in the intermediate term, with some projecting an even more drastic price target of $2.50. That is disappointing, since we were rather bullish many moons ago.

In the meantime, we encourage you to read our previous article on PLTR, which would help you better understand its position and market opportunities.

- Palantir’s Hype Train Crashed – The Bears Could Have Been Right After All

So, Is PLTR Stock A Buy, Sell, or Hold?

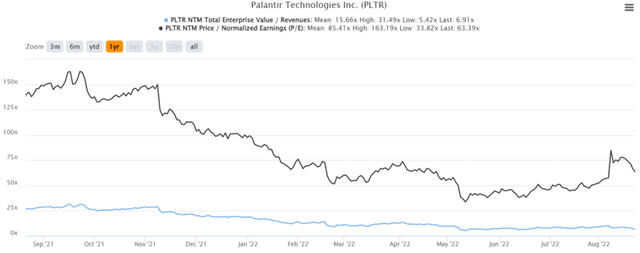

PLTR 1Y EV/Revenue and P/E Valuations

PLTR is currently trading at an EV/NTM Revenue of 7.24x and NTM P/E of 66.04x, lower than its 1Y mean of 15.47x and 84.74x, respectively. The stock is also trading at $8.42, down 71.2% from its 52 weeks high of $29.29, though it is still a premium of 30.7% from its 52 weeks low of $6.44. Judging by its recent price movement, it is likely that the stock will further retrace over the next few weeks.

PLTR 1Y Stock Price

Therefore, despite the consensus estimates price target of $11.25, we are not convinced of its eventual 33.61% upside. PLTR will continue to underperform in the near and intermediate term, given the worsening macroeconomics. Commercial sales may likely pick up by mid-2023, though its stock valuations would already be decimated then.

Investors who remain bullish about its fundamental business may continue holding on for that speculative event, since PLTR still reports excellent Net Dollar Retention of 119% and a remaining deal value of $3.5B in FQ2’22. Combined with its 9.1% QoQ growth in the US government segment and 12.5% QoQ growth in total deals closed by FQ2’22, there is no reason to turn our backs on this unique company with a robust moat and zero competitors. Missing guidance does not necessarily spell the end of the world, after all.

Therefore, PLTR bulls with a higher tolerance for risk may continue to add once the stock retraces meaningfully by the end of 2022. In the meantime, we rate PLTR stock as a Hold for now.

Be the first to comment