chonticha wat

Economic Outlook and its Implications for Gold as a Hedge Against Expected Exceptional Uncertainty

The immediate future will be very uncertain, as the monetary policy that central banks will continue to adopt to curb runaway inflation is very daring. Since this inflation is not driven by strong demand for goods and services but caused by an energy crisis, massive spending on armaments and geopolitical tensions, the policy of rate hikes will almost certainly lead to a recession. During a phase of economic contraction, we’ve already seen it during the COVID-19 crisis, the financial markets are getting hysterical because with stocks collapsing and real returns uninspiring due to entrenched inflation, it’s not clear where to go. Gold will prove itself as an efficient safe haven against the extreme uncertainty that usually leads to increased volatility. Gold futures – which expire in December 2022 – have a current price of $1,770.55 an ounce at the time of writing and a future one expected to be higher for the reasons given.

If gold trades higher going forward, investors can take advantage of that growth by investing in gold mining stocks, which tend to outperform the metal when their managers have good growth plans.

In the mining industry, I have identified a good investment proposition in K92 Mining Inc. (OTCQX:KNTNF) (KNT.CA).

About K92 Mining Inc. in the Gold & Silver Mining Sector

Based in Vancouver, British Columbia (Canada), K92 Mining Inc. is a precious metals and copper producer and explorer with mineral assets in the Eastern Highlands province of Papua New Guinea.

Second Quarter 2022 Operating Results: A Record Throughput at the Mill as well as Mined, as Daily Throughput Tonnage Gains Momentum

Operations performed well during the second-quarter of 2022 as the plant facilities saw a record volume of material delivered. Nearly 109,000 tons of ore were processed or an average volume of 1,196 tons handled per day.

The operational result was significantly better than what the company expected from Phase 2 of the expansion project, with which it continues to strive for an increase in throughput in the future. As of Q2 2022, K92 Mining Inc. managed to surpass by an impressive 44% quarterly level in 2021.

The second quarter operating results show a pretty good trend that is sure to be welcomed by shareholders or spark the interest of those who might be attracted by the K92 Mining stock.

The throughput expansion project was expected to meet its operating target of approximately 1,100 tons of mineral per day.

June was particularly positive in terms of average daily tonnage, as the operation delivered 1,251 tons of ore per day, meaning production had grown at a rate well above expectations.

In addition, the months of May and June surpassed the project target by 18.2% almost every two days, bringing the daily tonnage of ore to 1,300 tons of mineral.

There were no impediments during hauling, so the mining facility also had a record volume of nearly 114,500 tons of mineral mined during the quarter or a daily annual tonnage of 1,258, representing a whopping 60% increase compared to the same quarter in 2021.

Interesting Uptrend on Track to Hit Higher Metal Prices

After the second quarter was mastered with flying colors, the next phase of the expansion project, called Stage 2A, has to cope with a daily target of 1,370 tons tonnage.

Another fact that will draw the market’s attention to this miner is that July was already a record in terms of daily throughput volume with peaks of 1,638 tons, 1,609 tons and 1,642 tons of ore processed on July 6, July 12, and July 14, for positive margins of respectively 19.6%, 17.4% and 19.9% from the Phase 2A run-rate target.

This data may indicate an upcoming period that is operationally encouraging for K92 Mining Inc. as it appears to predict a very significant increase in the company’s metals production.

With the metallurgical recoveries for gold and copper being around 91%, this means that large quantities of metal are being mined and then brought to market where the price, which is certainly not low today, could potentially skyrocket in a few weeks.

And all of this is about to happen as the company plans to increase its ability to recover metal from the ore through the installation of additional grout flotation tanks.

As the metal is mined underground, additional technology is already on site to set up operations there as well to improve the ability to achieve higher throughput. This is critical as the exploration of the ore underground is progressing rapidly as the entire deposit (~1,826 meters) has been 75% developed in just one year. This is possible because its operations are supported by the particularity of K92 Mining’s mineral resources which, like any other source of porphyry ore in Papua New Guinea, tend to cluster.

The benefits come from the ability to significantly reduce exploration and mining costs, resulting in a competitive advantage over other operators, even among those with the best resources and equipment.

If, as planned, the company succeeds in doubling the amount to be subjected to the metal recovery process each time, K92 Mining’s throughput expansion project will be optimized with an expected reduction in extraction costs.

If all this materializes, it can be concluded that K92 Mining has its own growth strategy to take advantage of the expected rise in precious metal prices, and so it makes sense to maintain a bullish stance on this stock today.

The Balance Sheet to Sustain Growth Plans is Well Equipped

Total cash was nearly $82 million as of June 30, 2022, while total debt was almost zero.

Financial leverage ratios are also good with interest coverage of 25.42 and debt-to-EBITDA of 0.29.

Ideally, the first ratio should be no less than 1.5 to judge the company solvent when paying the interest charges on the entire outstanding debt.

The second ratio is better positioned than the sector median of 1.48. This comparison offers a significant advantage over other operators, assuming the company has to resort to debt capital to fund growth, especially with rising borrowing costs.

Q2 2022 Metal Production and Costs

On the wave of a three-month period with record throughputs and well above the expansion project targets, production and costs improved remarkably.

Thanks to the following gains, gold 22,934 ounces [up 3.53% yoy], copper 1.23 million pounds [up 12% yoy] and silver 25,224 ounces [up 69.1% yoy], K92 Mining mined 26,085 ounces of gold equivalent [GEO] in Q2 2022, up 4.3% year over year.

Costs dropped significantly from $736 per ounce in Q2 2021 to $617 per ounce in Q2 2022 for cash costs, while from $1,057 per ounce to $893 per ounce for all-in-sustaining costs.

The addition of mining technology to a rich asset showing 10 g/t gold equivalent from intercepts or even higher ranges of 26.34 g/t to 61.2 g/t from certain parts of the deposit bodes well for stopes of higher quality.

It is therefore plausible that the company will increase production in the second half of the year, which should have a very positive effect on the share price if the precious metal rises sharply.

K92 Mining could also reach the higher limit of its production guidelines for 2022, ranging between 115,000 and 140,000 ounces of gold equivalent.

From Q2 2022 Financial Results: With a high EBITDA margin, the Stock has its Privilege amid Rising Gold

K92 Mining posted a 17% year-over-year increase in net earnings to $5.1 million in the second quarter of 2022 or $0.02 per share, on higher revenues of $37.4 million (up 5 .2% year-on-year higher).

Thanks to higher production and higher metal prices, along with lower operating costs, the miner increased EBITDA to $13.3 million in Q2 2022 from $11.8 million in Q2 2021.

The EBITDA margin came in at 35.56%, well above the sector median of 20.84%, suggesting that K92 Mining will be able to generate more profit for every $1 increase in the yellow metal’s price than most other competitors.

Stock Valuation and Wall Street Ratings

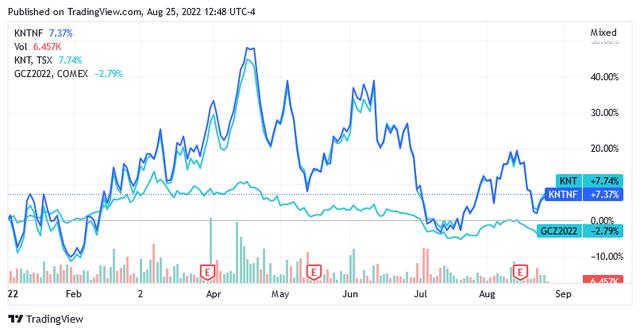

While gold futures maturing in December 2022 have fallen 2.8% so far this year, shares of K92 Mining Inc. rose with the KNTNF symbol on the US over-the-counter market and with the KNT.TO symbol on the Toronto stock exchange, by 7.37% and 7.74%, respectively.

As of this writing, KNTNF has a share price of $5.91 for a market cap of $1.35 billion and a price-earnings ratio of 34.47, while KNT.TO has a share price of CA$7.69 for a market cap of CA$1.79 billion and a price-earnings ratio of 34.33.

KNTNF has a 52-week range of $4.42 to $8.33 while KNT.TO has a 52-week range of CA$5.75 to CA$10.52.

Stock prices are currently below the middle of these two ranges, which can technically give an indication of affordable prices. Also, the comparison with the respective 200-day moving average of $6.29 and 200-day moving average of CA$8.03 gives an impression of affordability.

If we then take into account the growth potential given by strong expectations about production and prices of precious metals, then this price could also be a bargain price.

6 Wall Street analysts seem to share the same view, who have assigned a buy valuation to KNTNF stock and a target price of $8.91 which represents a return of nearly 50% compared to its current price.

KNT.TO has seven buy ratings at a target price of $11.32, implying an upside potential of over 45%.

Valuation Risk:

The stock has a 5-year monthly beta of 1.02, which means it has been slightly more volatile than the market, meaning that if the market falls, K92 Mining should decline slightly more on average.

However, since K92 Mining’s stock price should be much more tied to the metal’s price than the stock market, the beta market could turn negative in a stock market crash.

This is the scenario in which the stock market pays for the impact of a recession caused by US Federal Reserve monetary policy, while K92 Mining tracks a rising price of gold, which is expected to be in high demand as investors try to resist increased volatility.

Country Risk:

K92 Mining has assets in Papua New Guinea, a country included in a medium-high risk geographic area, but not for political reasons and neither for social tensions or issues of political instability in the country. It seems that there haven’t been any recently, as no positions have even been taken against the mining activities of foreign operators. The only problem is of a geological type as Papua New Guinea tends to undergo seismic phenomena like all other countries in the Southeast Asian area. The last earthquake occurred last May about 200 km offshore in the Bismarck Sea with even considerable intensity (about 6.3 degrees on the Richter scale), but fortunately without causing damage or casualties. However, investors should also consider this factor.

Conclusion – Higher Bullion Triggers Looking to Increase in Well Positioned Miners

K92 Mining Inc. is expanding its gold mining business in a remarkable way, as evidenced by positive operational trends.

So this operator represents an interesting opportunity to take advantage of gold’s next upleg as the stock has the potential to grow much faster than the metal.

Be the first to comment