D3signAllTheThings

Welcome to the August 2022 edition of the lithium miner news. The past month saw another stunning month for the lithium sector.

Not only did several producers announce record profits, we saw big auto (aka GM) agreeing to pay Livent US$198m for lithium supply ‘2 years in advance’ to be sure to secure lithium. Wow! We also saw more confirmation of strong demand and lithium prices with Pilbara Minerals achieving equivalent to US$7,012/t for spodumene SC6% at their BMX Spot auction.

Meanwhile ALB/MIN have commenced production at their Kemerton LiOH facility as has Tianqi Lithium from their Kwinana LiOH refinery, both in Western Australia.

Finally in the USA the Inflation Reduction Act passed. This has shone a huge spotlight on the EV metals supply chain mostly in North America, but also those countries that can meet the requirements (have a free trade agreement with the USA).

Lithium price news

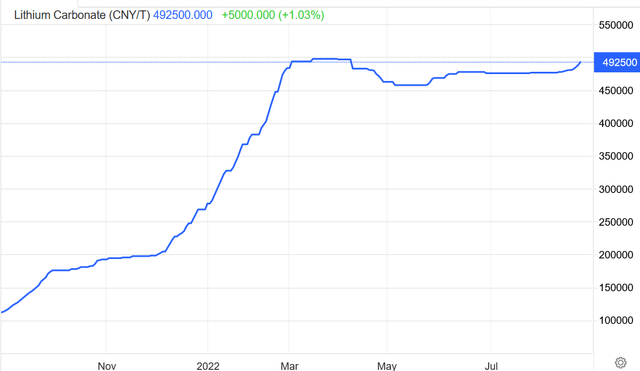

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were up 2.82% and China lithium hydroxide prices were up 0.33%. Lithium Iron Phosphate (Li 3.9% min) prices were up 1%. Spodumene (6% min) prices were up 2.42% over the past 30 days.

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 34,535 (~USD 5,039/mt), as of August 24, 2022.

China Lithium carbonate spot price – CNY 492,500 (~USD 71,873)

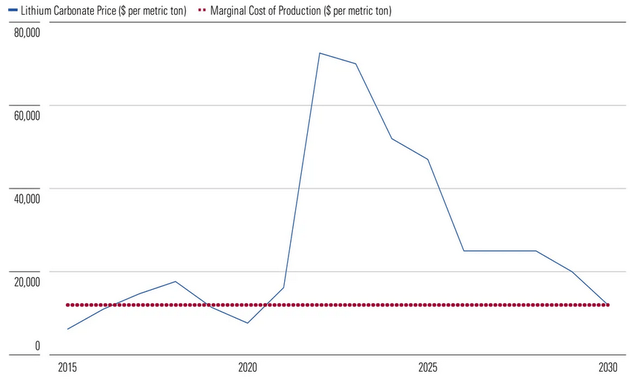

Morningstar’s lithium price forecast 2022 to 2030 (as of mid 2022)

Lithium demand versus supply outlook

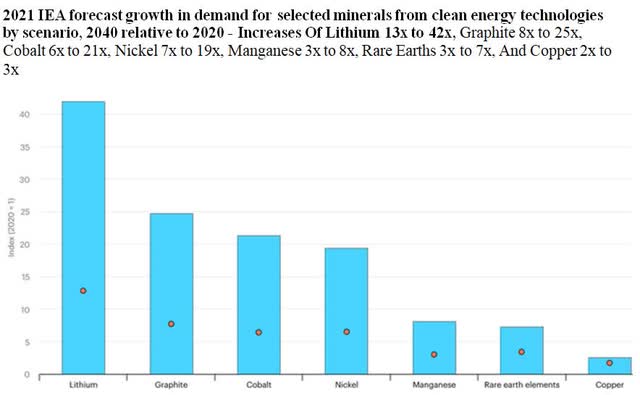

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x.

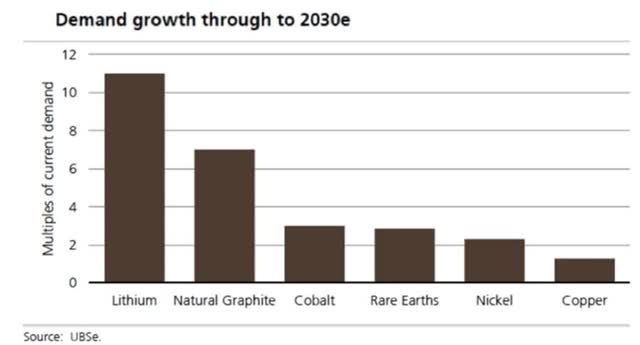

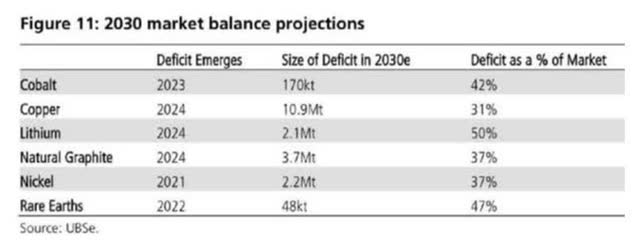

UBS’s EV metals demand forecast (from Nov. 2020)

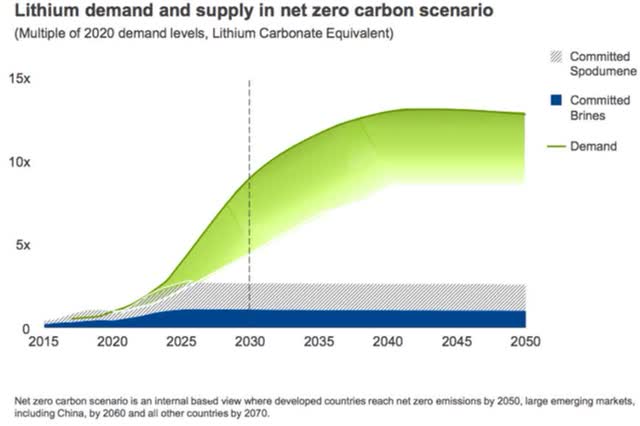

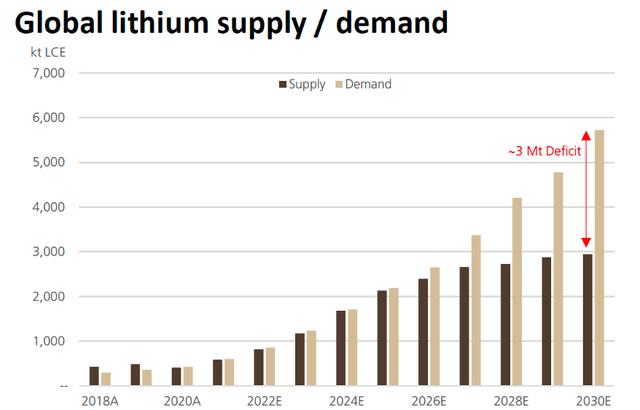

Rio Tinto’s lithium emerging supply gap chart (October 2021)

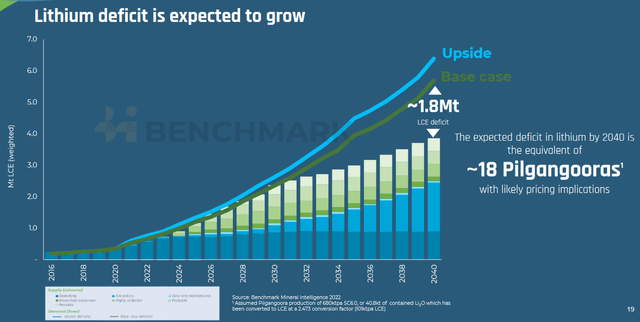

Lithium demand v supply forecast by Benchmark Mineral Intelligence (from mid 2022)

If supply can be rapidly ramped in future years it can come close to meeting surging demand

UBS forecasts Year battery metals go into deficit (chart from 2021)

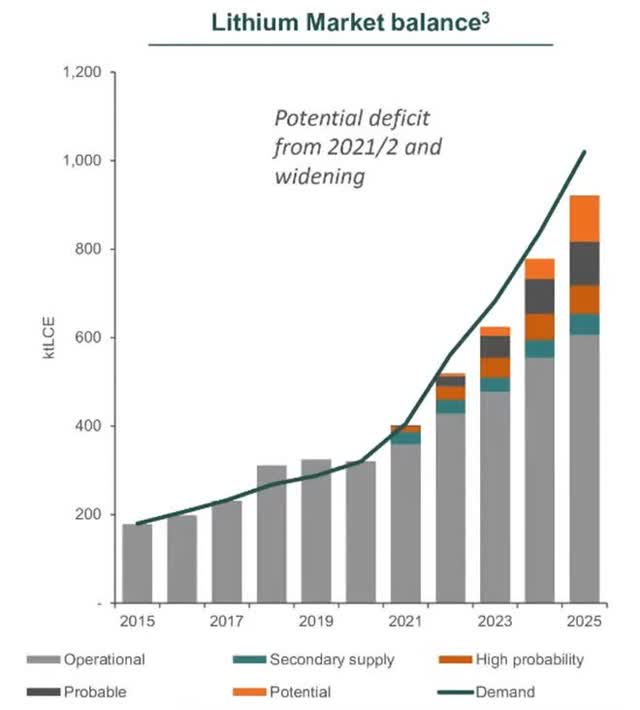

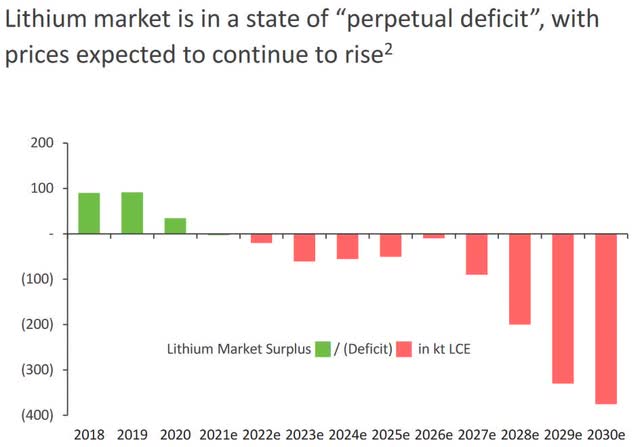

Macquarie’s lithium demand v supply forecast (July 2021) – Deficits from 2022 growing bigger from 2027

UBS lithium demand v supply forecast to 2030

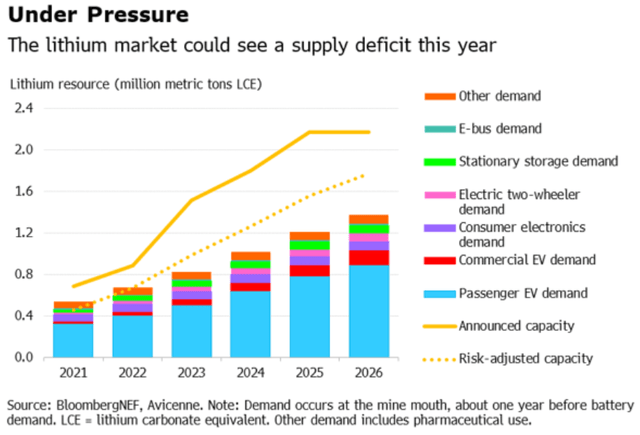

BloombergNEF lithium demand v supply forecast (as of mid 2022)

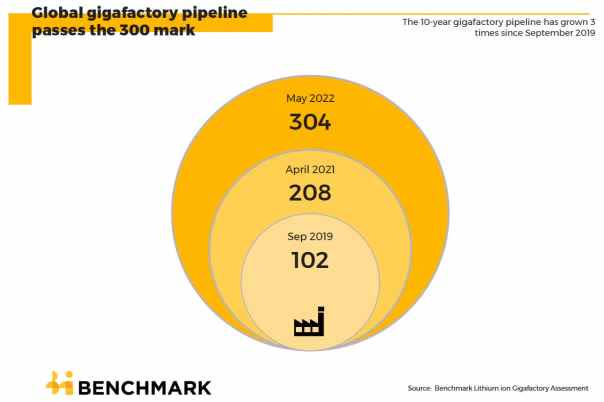

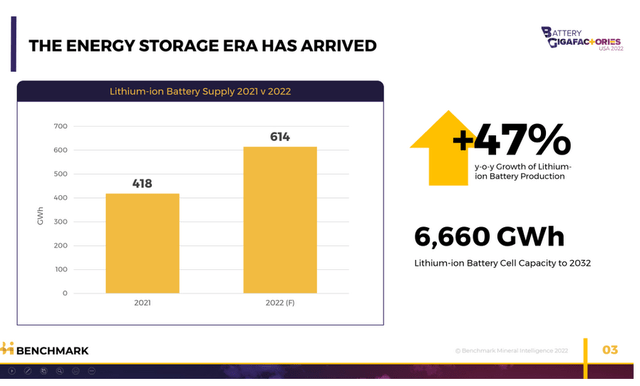

Global lithium-ion battery gigafactory pipeline – now at 304 and 6,387.6 GWh as of May 2022

BMI

BMI forecasts Li-ion battery cell capacity to grow at a CAGR of 47% from 2021 to 2032 (as of mid 2022)

Lithium market and battery news

On July 21 BloombergNEF released a great article: “Race to Net Zero: The Pressures of the Battery Boom in Five Charts.“

On July 22 Reuters reported: “Ford to buy cheaper CATL EV batteries to catch Tesla.”

On July 25 Bloomberg reported:

Tesla co-founder’s recycling startup is Building $3.5 billion battery-material plant… Redwood Materials Inc., run by Tesla Inc.’s former chief technology officer JB Straubel, is building a $3.5 billion factory in Nevada to produce battery components to power electric vehicles… It aims to produce enough anode and cathode components for more than one million EVs a year by 2025.

On July 26 The Korea Herald reported:

LG Energy Solution to set up 1st Korean battery recycling plant in China… LG Energy Solution, Korea’s largest lithium-ion battery manufacturer by production capacity, has signed a memorandum of understanding with Zhejiang Huayou Cobalt to launch a joint venture for the new recycling plant by the end of this year… Redwood is building the facility on a 175 acre (71 hectare) industrial center close to the Tesla-Panasonic gigafactory.

On July 27 Bloomberg reported:

Race to secure battery metals heats up as GM, Ford ink deals. Carmakers are scouring the world to diversify their supplies of raw materials needed to power EV fleets… General Motors Co. announced three deals Tuesday for supplies of raw materials needed to build a million EVs a year. Less than a week ago, Ford Motor Co. revealed a list of suppliers of inputs ranging from Argentine lithium to Indonesian nickel – enough to build 600,000 EVs a year. The world’s shift into electric vehicles means demand growth for lithium, nickel, cobalt and other key ingredients in EV batteries is outpacing supply that’s been hampered by Covid-related logistical woes and a general lack of investment, pushing up prices.

On July 29 Benchmark Mineral Intelligence reported:

$200 billion needed to meet battery cell demand by 2030… The demand for lithium ion batteries is expected to increase six-fold by the end of the decade compared to 2021. Given that a factory takes at least two to three years to build, the $200 billion equates to nearly $29 billion every year to 2028.

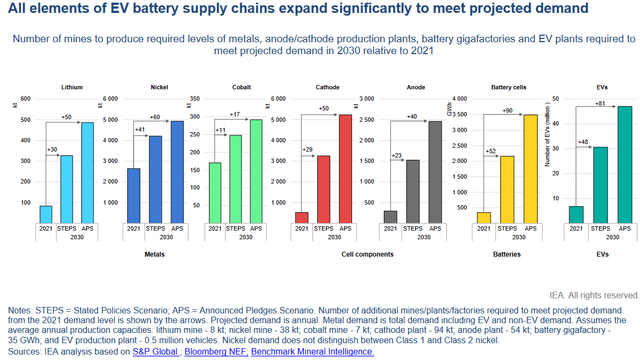

In August the IEA released:

Global supply chains of EV batteries… Battery and minerals supply chains will have to expand ten-fold to meet government EV ambition… Demand for EV batteries will increase from around 340 GWh today, to over 3500 GWh by 2030… For example, demand for lithium – the commodity with the largest projected demand-supply gap – is projected to increase sixfold to 500 kilotonnes by 2030 in the APS, requiring the equivalent of 50 new average-sized mines.

Note: Bold emphasis by the author.

Note: Nickel 60 new mines needed and cobalt 17.

IEA says we will need 50 new average-sized lithium mines by 2030

On August 2 Stockhead reported:

Eye on Lithium: Even if every lithium project comes online we could still have a 2 million tonne deficit by 2030, S&P says… S&P Global says that even if every lithium project around the world was to come online by 2030 there is still going to be a 220,000t gap minimum in demand in 2030. In fact, they said it could be as a high as a 2 million tonne gap.

On August 3 Investing News reported:

Greenfields exploration and the lithium supply shortage. North America is lagging behind in the electric vehicle race, and underexplored pegmatite greenfields are a reasonable solution and a compelling option to add more lithium projects to an investment portfolio. The lithium market is booming… The market simply cannot keep up. Estimates have historically varied as to precisely when demand will outstrip supply, but many experts believe that day will come sooner rather than later. Some have even gone so far as to suggest that, with the current strong outlook of electric vehicles, this could even happen in 2022.

On August 3 CNEVPOST reported:

CATL to supply M3P batteries to Tesla in Q4 for Model Y, report says. The lithium manganese iron phosphate (LMFP) material used in CATL’s M3P batteries will be supplied by Shenzhen Dynanonic Co, which plans to put 110,000 tons of LMFP material into production in the second half of this year, according to the report… LMFP cathode materials can be made by adding manganese to the LFP cathode materials currently used to make LMFP batteries… CATL‘s M3P batteries’ cathode materials are doped with lithium ternary materials and LMFP materials, a solution that solves the problem of short cycle life and high internal resistance of LMFP batteries… M3P batteries use the olivine structure of LFP as the base lattice structure by doping two of the metal elements such as magnesium, zinc and aluminum to replace iron at some points…

See also: CNEVPOST reported: “CATL says it’s developing M3P battery, different from LMFP battery.”

On August 5 Bloomberg reported:

Insatiable lithium demand fuels investment boom in Australia. Carmakers and miners inking deals amid $42 billion funding gap.

On August 9 GreenCarCongress reported:

Inflation Reduction Act mandates escalating battery critical mineral requirements to qualify for EV tax credit… There are 72 EV models currently available for purchase in the United States including battery, plug-in hybrid and fuel cell electric vehicles. Seventy percent of those EVs would immediately become ineligible when the bill passes and none would qualify for the full credit when additional sourcing requirements go into effect. Zero.

On August 10 Reuters reported: “U.S. automakers say 70% of EV models would not qualify for tax credit under Senate bill.”

On August 12 Bloomberg reported:

Mercedes, CATL partner on $7.6 billion Hungary battery plant. BMW, Stellantis, VW set to take cells from Hungary project. New facility will be CATL’s second in Europe following Germany… with an investment of as much as 7.3 billion euros ($7.6 billion)… The plant will have capacity of 100 gigawatt hours, enough to power more than 1 million cars… Mercedes said the batteries would go into its next generation of EVs, due to go on sale from around mid-decade.

On August 19 Wealth X reported: “S.Korean EV battery maker SK On raises $1.5 billion in expansion push.”

On August 22 Seeking Alpha reported:

FREYR Battery establishes Technology Center in Boston… FREYR is collaborating with its joint venture (“JV”) partners from Koch Strategic Platforms (“KSP”) to accelerate the development of Giga America, the company’s first U.S. Gigafactory… is intended to position the partners among the largest battery manufacturers in the U.S… FREYR intends to install 50 GWh of battery cell capacity by 2025 and 100 GWh annual capacity by 2028 and 200 GWh of annual capacity by 2030.

On August 23 Mining.com reported:

CATL profit surges as battery giant moves on from tough quarter… Earnings for the six months through June 30 jumped 82% year-on-year to 8.17 billion yuan ($1.2 billion)… CATL, a key supplier to Tesla Inc. and Volkswagen AG among others, had a global market share of 34.8% at the end of June, according to Seoul-based SNE Research, up slightly from 33.9% in May. LG Energy is No. 2 at 14.4% while Chinese electric car, chip and battery maker BYD Co. comes in third with an 11.8% share.

On August 23 Mining.com reported:

China lithium prices near record as power cuts squeeze market… Sichuan, home to more than a fifth of China’s lithium production, extended industrial power cuts this week amid the most intense heat wave in more than a half-century. The supply disruptions in the province are set to add fuel to the battery metal’s stunning rally in the past year… “We are estimating the lithium price momentum will last for a while, and the spot price for lithium carbonate will climb to 500,000 yuan per ton shortly,”

On August 24 Reuters reported:

Volkswagen, Mercedes-Benz team up with Canada in battery materials push. German carmakers Volkswagen and Mercedes-Benz struck battery materials cooperation agreements with mineral-rich Canada on Tuesday, intensifying efforts to secure access to lithium, nickel and cobalt.

Lithium miner news

Albemarle (NYSE:ALB)

On August 3 Seeking Alpha reported:

Albemarle reports strong second-quarter sales growth, raising guidance. Second Quarter 2022 and Recent Highlights (Unless otherwise stated, all percentage changes represent year-over-year comparisons)

- “Net sales of $1.48 billion, an increase of 91%

- Net income of $406.8 million, or $3.46 per diluted share; Adjusted diluted EPS of $3.45, an increase of 288%

- Adjusted EBITDA of $610 million, an increase of 214%

- Kemerton I lithium conversion plant in Western Australia achieved first product in July 2022

- Announced plans to build integrated lithium operations in the United States, including the Kings Mountain, North Carolina, spodumene mine and a lithium conversion plant in the southeast

- Guidance for 2022 further revised upward on successful Lithium contract renegotiations and increased prices in the Lithium and Bromine businesses

- Expect significant growth in full-year 2022 results including net sales of $7.1 – $7.5 billion (>2x 2021) and adjusted EBITDA of $3.2 – $3.5 billion (>3x 2021)

- With revised guidance, expect to be free cash flow positive in 2022.”

Note: Bold emphasis by the author.

Upcoming catalysts:

- Q3 2022 – Wodgina Lithium Mine (60% ALB: 40% MIN) Train 2 restart. Note the non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV.

NB: The Greenbushes Mine in WA is owned by Albemarle 49%, Tianqi Lithium Corporation ~25%, and IGO Limited ~25%. Wodgina Lithium Mine is a JV (50% ALB: 50% MIN). Kemerton Lithium Hydroxide Plant is a JV (60% ALB: 40% MIN).

Kemerton Lithium Hydroxide Plant (60% ALB: 40% MIN) in WA

Albemarle

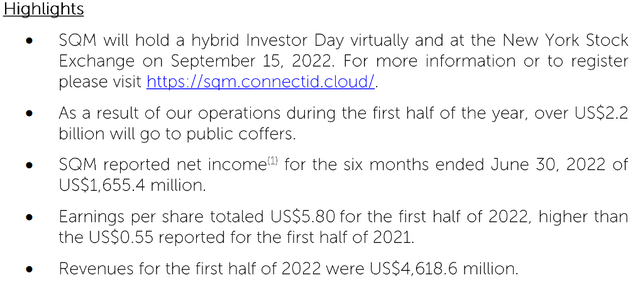

Sociedad Quimica y Minera S.A. (NYSE:SQM), Wesfarmers [ASX:WES] (OTCPK:WFAFY), Covalent Lithium (SQM/WES JV)

On August 17 SQM reported: “Earnings for the Second Quarter of 2022.”

Upcoming catalysts:

H2 2024 – Mt Holland production to begin (SQM/Wesfarmers JV) as well as their lithium hydroxide [LiOH] refinery.

Investors can read SQM’s latest presentation here or the latest Trend Investing article on SQM here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772] (OTC:GNENF) (OTCPK:GNENY)

On July 2 Ganfeng Lithium reported:

Ganfeng Mariana Salt Lake Project held groundbreaking ceremony… At the ceremony, Ganfeng announced that it will invest about US$600 million to build a lithium chloride production base with an annual output of 20,000 tons.

On July 31 CNEVPOST reported:

Ganfeng Lithium plans to build China’s largest solid-state battery production base… Ganfeng’s project in Chongqing’s Liangjiang New Area in southwestern China began construction on July 30 and will have 10 GWh of battery capacity and 10 GWh of pack capacity when completed, the company said Saturday… On December 10 last year, Ganfeng unveiled its first-generation solid-state battery, which is a hybrid solid-state and liquid lithium-ion battery. The battery has an oxide electrolyte and uses graphite for the negative electrode. It has a diaphragm, but unlike conventional diaphragms, it uses a solid electrolyte diaphragm…

Investors can read the latest Trend Investing article on Ganfeng Lithium here.

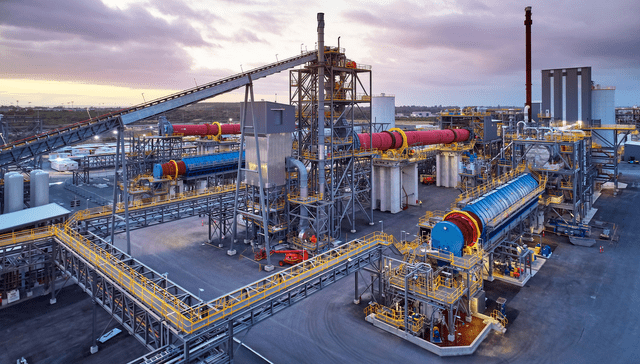

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466], Tianqi Lithium Energy Australia (TLEA) is a JV with Tianqi Lithium (51%) and IGO Limited (49%). TLEA owns the Kwinana lithium hydroxide facility in WA

On July 31 Mining News.net reported:

Tianqi’s $1B Kwinana lithium refinery a world first. AFTER five-and-a-half years and about A$1 billion in expenditure, the Kwinana lithium hydroxide refinery is finally in production. China’s Tianqi Lithium Corporation decided to build the plant in 2015 to convert spodumene from its 49%-owned Greenbushes lithium mine.

You can watch a good recent Tainqi lithium CEO video interview here, where he discusses lithium market demand and supply issues.

Kwinana lithium refinery JV (51% Tianqi: 49% IGO) in Western Australia

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On August 3 Pilbara Minerals announced:

Results of BMX Auction… A cargo of 5,000dmt at a target grade of ~5.5% lithia was presented for sale… Pilbara Minerals intends to accept the highest bid of US$6,350/dmt (SC5.5, FOB Port Hedland basis) which on a pro rata basis for lithia content (inclusive of freight costs) equates to a price of ~US$7,012/dmt (SC6.0, CIF China basis).

On August 23 Pilbara Minerals announced:

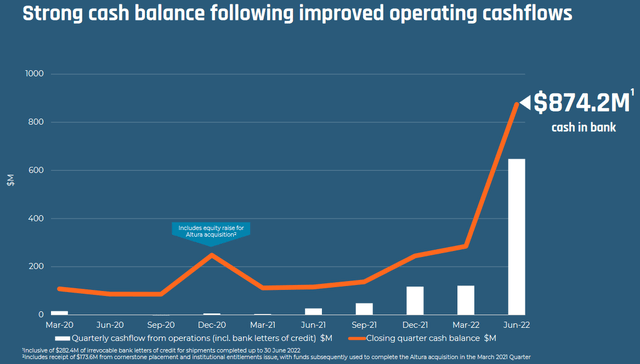

REVENUE OF ~$1.2 BILLION DRIVES INAUGURAL FULL YEAR PROFIT OF $561.8M ON THE BACK OF STRONG LITHIUM RAW MATERIALS DEMAND CONDITIONS… Year-end net cash position of $714.3M, inclusive of $282.4M of irrevocable bank letters of credit for shipments completed before 30 June 2022.

Pilbara Minerals Quarterly cash flow and cash in bank are surging higher

Upcoming catalysts:

Late 2023 – Plan to commission production of POSCO/Pilbara Minerals (18%, option to increase to 30%) JV LiOH facility in Korea.

Mineral Resources [ASX:MIN] (OTCPK:MALRF)

Mt Marion Mine (50% MIN: 50% Ganfeng). Wodgina Lithium Mine (60% ALB: 40% MIN) restarted in mid 2022. (Note the non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV). The 50ktpa Kemerton Lithium Hydroxide refinery (60% ALB: 40% MIN) is due for first sales in H2, 2022.

On August 25 Mineral Resources announced:

Mt Marion upgrades set to power new lithium opportunities… Earlier this year, in response to a strengthened global lithium market and positive metallurgical test results at Mt Marion, MinRes and Ganfeng announced a decision to increase spodumene production from 450,000 tonnes per year to 600,000 tonnes per year – with a further increase to 900,000 tonnes per year targeted for the end of 2022. To support expanded production capacity, significant enhancements are now underway across Mt Marion operations.

Investors can read the latest Trend Investing article on Mineral Resources here.

Livent Corp. (LTHM)[GR:8LV]

On July 26 Reuters reported:

GM signs agreements with suppliers, on course to reach 1 million EV capacity by 2025. General Motors Co said on Tuesday it had signed multi-year agreements with LG Chem Ltd and Livent Corp to secure key raw materials used in manufacturing batteries for electric vehicles. With the latest deals, GM said it had lined up supplies for all battery raw materials, including lithium, nickel, cobalt and cathode active material, and was on course to reach its goal of producing 1 million EVs annually in North America by end-2025…

On August 2 Seeking Alpha reported:

(Livent) Revenue was $218.7 million, up 52% and 114% from the first quarter of 2022 and the prior year, respectively. Reported GAAP net income was $60.0 million, 13% higher than the previous quarter, and 31 cents per diluted share. Adjusted EBITDA was $95.0 million, 78% higher than the previous quarter and roughly six times higher than the prior year, and adjusted earnings per share were 37 cents per diluted share… As announced in a joint press release last week, Livent entered into a long-term supply agreement with General Motors [GM]. This six-year agreement, which will deliver lithium hydroxide beginning in 2025, will also come with a $198 million advance payment from GM to be made in 2022. The upfront payment strengthens the binding commitments being made by both parties and establishes a foundation for expanding the relationship over time. This structure increases flexibility and certainty for Livent as it funds and executes its capacity expansion plans.

You can read the Trend Investing Livent article here when Livent was trading at US$7.26.

Allkem [ASX:AKE] [TSX:AKE] (OTCPK:OROCF)(formerly Orocobre)

On August 15 Allkem announced:

Allkem to acquire lithium tenement in exchange for Borax… Allkem will acquire 100% of the strategic lithium tenement of María Victoria located north of the Olaroz Lithium Facility (“María Victoria Tenement”) and in exchange transfer to MSR all of the shares in the Borax holding companies and US$14 million cash for employee and rehabilitation liabilities.

On August 25 Allkem announced:

“Allkem delivers record Full Year results. (full year ended June 30, 2022)

HIGHLIGHTS

• Mt Cattlin and Olaroz delivered record annual production volumes and operating profits despite the ongoing impacts of COVID-19.• Group revenue for the period increased over 800% to US$770 million, compared to the prior year

• Record revenue from Mt Cattlin was generated from sales of 200,715 dry metrics tonnes (dmt) of spodumene concentrate at an average price of US$2,221/tonne CIF for the period from 25 August 2021. Gross cash margin of 80%

• Record revenue from Olaroz increased 341% to US$293 million on sales of 12,512 tonnes of lithium carbonate with average pricing increasing by 370% to US$23,398/t FOB4. The gross profit margin was 82%

• Excellent operating performance and highly supportive market conditions generated group gross profit of US$605 million with group EBITDAIX of US$513 million and consolidated net profit after tax of US$337.2 million (2021: net loss of US$89.5 million) reflecting improved product prices, focussed operational management and comprehensive cost control mitigating inflationary pressures

• Strong cash generation and existing cash balance is expected to fully fund development projects

• H1 FY23 lithium carbonate prices will be approximately ~US$47,000/t FOB, excluding Naraha feedstock which is an intermediate input for the production of battery grade lithium hydroxide

• September quarter spodumene concentrate prices are expected to be over US$5,000/t CIF SC6.”

DEVELOPMENT PROJECTS

• Olaroz Stage 2 has now reached over 91% completion and first production is still anticipated late H2 CY22. The successful completion of this project will deliver material new production from H2 FY23 onwards

• Construction of the Naraha lithium hydroxide plant in Japan was completed during the year, with first production expected early Q4 CY22. Once product qualification is complete, this plant will provide Allkem with exposure to the high value lithium hydroxide market

• Construction at Sal de Vida commenced in January 2022, the first pond has been filled, and commissioning and first production continues to be expected by H2 CY23

• The Feasibility Study and Maiden Ore Reserve for James Bay was released in December 2021 and detailed engineering is advancing in parallel with stakeholder engagement and permitting.”

Upcoming catalysts include:

- Early Q4, 2022 – Naraha lithium hydroxide plant (10ktpa) commissioning (ORE share is 75%) has completed, first production expected in early Q4.

- Late 2022 – Olaroz Stage 2 expansion commissioning followed by a 2 year ramp to 25ktpa. When combined with Stage 1 total capacity will be 42.5ktpa.

- H2 2023 – Sal De Vida Stage 1 production targeted to begin and ramp to 15ktpa. SDV Stage 2&3 combined will begin about 2025 and ramp to an additional 30ktpa. Total combined when completed will be 45ktpa.

You can read the latest investor presentation here. You can read the latest Trend Investing Allkem article here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

On July 28 AMG announced: “AMG Advanced Metallurgical Group N.V. reports record earnings for Second Quarter 2022.

Financial Highlights

- Revenue increased by 42% to $424.1 million in the second quarter of 2022 from $298.4 million in the second quarter of 2021.

- EBITDA was $81.1 million in the second quarter of 2022, up 158% versus the second quarter 2021 EBITDA of $31.4 million, marking the highest six-month and quarterly EBITDA in AMG’s history and its eighth straight quarter of sequential improvement.

- Annualized return on capital employed was 25.5% for the first six months of 2022, more than double the 10.0% for the same period in 2021.

- Net income to shareholders for the second quarter of 2022 was $29.6 million, yielding 91 cents diluted earnings per share, compared to $3.6 million of net income to shareholders in the same period in the prior year and 11 cents diluted earnings per share.

- AMG’s liquidity as of June 30, 2022, was $476 million, with $301 million of unrestricted cash and $175 million of revolving credit availability.

- AMG declares an interim dividend of €0.30 per ordinary share, to be paid in the third quarter of 2022.”

You can view the latest company presentation here.

Upcoming catalysts:

2022 – Progress on a lithium project in Zeitz, Germany and a vanadium project in Zanesville, Ohio, both in the planning stage.

Q2 2023 – Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin, bringing its production capacity to 130ktpa.

Q3 2023 – Lithium hydroxide facility in Bitterfeld-Wolfen Germany with production set to begin.

Lithium Americas [TSX:LAC] (LAC)

On July 28 Lithium Americas announced: “Lithium Americas reports Second Quarter 2022 results…

Caucharí-Olaroz

- Construction continues to progress towards production with key areas of the processing plant preparing to commence commissioning shortly. With construction over 90% complete, focus has shifted to prioritize production over completion of all purification circuits. As a result, a portion of the purification process designed to achieve battery-quality is being deferred until early 2023…

Pastos Grandes

- In June 2022, the Company approved a development plan and a budget of approximately $30 million to advance Pastos Grandes towards a construction decision…

Thacker Pass

- On June 28, 2022, the State Environmental Commission unanimously rejected an appeal of the February 2022 issuance of a Water Pollution Control Permit for Thacker Pass by the Nevada Department of Environmental Protection… An appeal on the Record of Decision is moving forward with briefings scheduled to be complete August 11, 2022, and a final decision expected shortly thereafter. The Company has all permits to commence construction. Early-works construction is on track to commence in 2022… The Company continues to progress the U.S. Department of Energy Advanced Technology Vehicles Manufacturing loan program application, which is expected to fund the majority of Thacker Pass’ capital costs.

Corporate

- As at June 30, 2022, the Company had $441 million in cash and cash equivalents with an additional $75 million in available credit.”

Upcoming catalysts:

- H2 2022 – Thacker Pass FS and early construction works planned to commence.

- H2 2022 – Cauchari-Olaroz lithium production to commence and ramp to 40ktpa. From 2025 a Stage 2 20ktpa+ expansion is planned.

- 2023 – Possible lithium clay producer from Thacker Pass Nevada (full ramp by 2026).

NB: Ganfeng Lithium (51%) and Lithium Americas (49%) own the JV company Minera Exar S.A., which owns 91.5% interest and is entitled to 100% of the production from the Cauchari-Olaroz Project. The 8.5% interest is owned by Jujuy Energia y Mineria Sociedad del Estado (“JEMSE”) (a company owned by the Government of Jujuy province).

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Project in Argentina, targeting a fast-track development strategy. Argosy is now producing at a small scale and ramping to 2,000tpa lithium carbonate starting June 2022.

On August 1 Argosy Minerals announced:

Rincon 2,000tpa Li2CO3 Operations Update.

- 94% of total development works now complete – first production of battery quality Li2CO3 product targeted over coming months

- 2,000tpa lithium carbonate process plant development works progressing on schedule and budget

Investors can view the company’s latest investor presentation here, and the latest Trend Investing Argosy Minerals article here.

Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

Core 100% own the Finniss Lithium Project (Grants Resource) in Northern Territory Australia. Significantly they already have an off-take partner with China’s Yahua (large market cap, large lithium producer), who has signed a supply deal with Tesla (TSLA). The Company states they have a “high potential for additional resources from 500km2 covering 100s of pegmatites.” Fully funded and starting mining with a planned Q4 2022 production start.

On July 27 Core Lithium announced: “Quarterly Activities Report for Three Months Ended 30 June 2022.”

On August 15 Core Lithium announced: Core provides exploration activities update. +40,000m RC drilling program underway… first production on schedule for delivery by the end of 2022.”

Note: The above includes some gold related news. Also here some news on their new CEO change.

Investors can read a company presentation here, or the Trend Investing article when Core Lithium was back at A$0.055 here.

Catalysts include:

- Late 2022 – Lithium spodumene production at Finniss targeted to begin.

Sigma Lithium Resources [TSXV:SGML](SGMLF) (SGML)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo Project in Brazil.

On August 19 Sigma Lithium Resources announced:

SIGMA LITHIUM PROVIDES UPDATE FROM A TRANSFORMATIVE SECOND QUARTER, APPOINTS COO FOR OPERATIONAL READINESS ANDPREPARING PHASE 1 PIT FOR MINING.

- Doubled its planned near-term production to 531,000 tonnes per year of Battery Grade Sustainable Lithium

- Increased by ~50% the Project’s NI 43-101 total mineral resource estimate to 86 Mt with increased average resource grade of 1.43% of high purity spodumene lithium oxide…

- Received an extension of its environmental license to allow for increased production levels, with simultaneous mining from the north and south pit of the Project’s Phase 1 deposit licensing additional areas for dry stacked tailings

General progress of project construction is ~32%… Sigma Lithium appointed Brian Talbot to the leadership team as Chief Operating Officer… commissioning expected to begin in December.

Catalysts include:

- Late 2022 – Production targeted to begin at the Grota do Cirilo Project in Brazil and ramp to 531,000tpa spodumene (Stage 1 and 2 combined).

Investors can read the latest company presentation here or the Trend Investing article here back when Sigma was trading at C$5.00.

Lithium miner ETFs

The LIT fund was up strongly in August. The current PE is 22.53.

Our model forecast is for lithium demand to increase 5.3x between end 2020 and end 2025 to ~1.8m tpa, and 13x this decade to reach ~4.5 m tpa by end 2029 (assumes electric car market share of 32% by end 2025 and 70% by end 2029).

Note: A Nov. 2020 UBS forecast is for “lithium demand to lift 11-fold from ~400kt in 2021 through to 2030.”

Global X Lithium & Battery Tech ETF (LIT) 10 year price chart

- The Amplify Lithium & Battery Technology ETF (BATT) is currently on a PE of 17.83. It is a well diversified fund. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles. BATT seeks investment results that correspond generally to the EQM Lithium & Battery Technology Index (BATTIDX).

Conclusion

August saw higher lithium prices and analyst’s forecasting lithium deficits growing each year to 2030, when IEA says we will need 50 new average-sized lithium mines.

Highlights for the month were:

- Tesla co-founder’s recycling startup is building $3.5 billion battery-material plant.

- LG Energy Solution to set up 1st Korean battery recycling plant in China.

- Race to secure battery metals heats up as GM, Ford ink deals.

- BMI: $200b needed to meet battery cell demand by 2030, a six-fold increase in battery demand by the end of the decade compared to 2021.

- IEA: Lithium has the largest projected demand-supply gap, requiring the equivalent of 50 new average-sized lithium mines by 2030.

- S&P: Even if every lithium project comes online we could still have a 2 million tonne deficit by 2030.

- Investing News: “The lithium market is booming. The market simply cannot keep up.”

- Insatiable lithium demand fuels investment boom in Australia. Carmakers and miners inking deals amid $42 billion funding gap.

- Inflation Reduction Act mandates escalating battery critical mineral requirements to qualify for EV tax credit.

- CATL to supply M3P batteries to Tesla in Q4 for Model Y, report says. M3P is an enhanced LMFP cathode doped with ternary materials.

- Mercedes, CATL partner on $7.6 billion Hungary battery plant to produce 100GWh for EVs by mid decade.

- China lithium prices near record as power cuts squeeze market.

- Volkswagen, Mercedes-Benz team up with Canada in battery materials push.

- Albemarle reports strong second-quarter sales growth, raising guidance. Kemerton I lithium conversion plant in Western Australia achieved first product in July 2022.

- Ganfeng Mariana Salt Lake Project held groundbreaking ceremony. Ganfeng Lithium plans to build China’s largest solid-state battery production base.

- Tianqi Lithium’s the Kwinana lithium hydroxide refinery is finally in production.

- Pilbara Minerals announces record 2022 financial year earnings of $561.8m.

- Mineral Resources: Mt Marion upgrades set to power new lithium opportunities.

- Livent: GM signs lithium off-take deal with Livent to start in 2025, $198 million advance payment from GM to be made in 2022.

- Allkem delivers record production and net profit after tax of US$337.2 million in financial year 2022 (ended June 30, 2022).

- AMG Advanced Metallurgical Group N.V. reports record earnings for Second Quarter 2022.

- Lithium Americas: Caucharí-Olaroz 90% construction complete.

- Argosy Minerals: Rincon Lithium Project 94% of total development works now complete, on schedule and budget.

- Core Lithium first production on schedule for delivery by the end of 2022.

- Sigma Lithium project construction at ~32%, commissioning expected to begin in December 2022.

As usual, all comments are welcome.

Be the first to comment