koya79/iStock via Getty Images

Introduction

We live in a complex global financial system with cross-border interconnections and interdependencies. It is an essential feature of our modern economy that extends naturally to the commodity segment, with its most-watched representatives – gold and oil.

Gold is the leading precious metal often considered a refuge in the face of recession. It has many applications and functions as a form of currency in times of duress. For instance, gold rose sharply throughout the COVID-19 crisis in 2020 and reached a record high of $2,065 per ounce.

Conversely, oil is the most traded raw material and is indispensable in shaping today’s economy. As the economy grows, so does the oil demand.

Moreover, the conflict in Ukraine and troubles in the Middle East are creating supply fears. Oil demand tumbled in 2020 during the pandemic when lockdowns led the price to plunge momentarily below zero due to a significant downturn in economic activity. Oil prices have since climbed sharply to as high as $140 per barrel, following a solid recovery post-lockdowns.

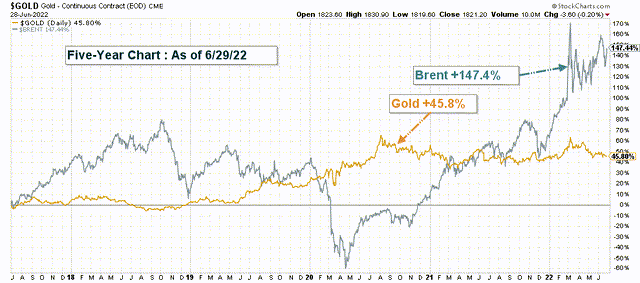

Hence, the volatility in one market often impacts the price of the other, even though this relationship is not entirely clear if we look at the 5-year chart below.

In short, when oil prices spike, it exhausts economic growth and fuel inflation, inevitably leading to a recession. This situation ultimately favors the gold price and potentially the gold miners.

Gold and Brent 5-year Chart comparison (Fun Trading StockCharts)

Thus, it is realistic to base a balanced portfolio on these two commodity pillars, and their relationship is often linked to inflation and instabilities.

The fundamental action at an investor’s level is to identify that type of connection, recognize it quickly, and determine its predictable outcome to adopt the most suitable investment strategy.

One potential trading strategy is to trade simultaneously one gold stock and one oil stock using a LIFO strategy. I suggest selecting Barrick Gold Corporation (NYSE:GOLD) and Occidental Petroleum Corporation (NYSE:OXY), which have a common denominator called Buffett that may amplify volatility.

Buffett’s syndrome and what can we learn from it

1 – Barrick Gold short investment

On August 17, 2020, Barrick Gold’s stock rocketed more than 10.5% after Buffett’s Berkshire revealed a stake in Barrick Gold.

Berkshire added a $562 million position in Barrick Gold in the second quarter, according to SEC filings Friday. While the position is small for Berkshire — which owns more than $89 billion in Apple stock — the conglomerate is the 11th largest shareholder of the gold mining company,

This was an unusual move considering Buffett, a long-time value investor, has long professed a dislike for gold, preferring assets that have cash flows or pay dividends.

We could also add that Warren Buffett did not invest in gold per se but a company with real net income and free cash flow.

However, as the old Greek philosopher, Heraclitus, said, everything constantly changes, “Panta rhei.” It was a short honeymoon, and Buffett’s Berkshire Hathaway exited Barrick Gold entirely in February 2021, triggering heavy stock selling.

2 – Occidental Petroleum’s ongoing investment

The relationship between Buffett and Occidental Petroleum started in April 2019 when billionaire Warren Buffett’s Berkshire Hathaway committed to investing $10 billion in OXY, subject to the company’s entering into and completing its proposed acquisition of rival Anadarko.

Note: The preferred stocks owned by Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) bear an 8% interest payable quarterly and can be paid in cash or shares. Also, they have warrants for 83.9 million at an exercise price of $59.624 per share.

Also, on June 26, 2020, OXY shareholders obtained 1/8th (125 shares for 1,000 shares) of a warrant for every stock they owned as of July 6, 2020. (The warrants can be exercised from August 3, 2020, to August 3, 2027, with an initial exercise price of $22 per share of common stock.)

It was a sweet deal for Buffett that entitled OXY to acquire Anadarko for an exorbitant price.

Occidental’s surprise $76-per-share bid is valued at $57 billion, including debt. That is well above Chevron’s $65-per-share offer, worth $50 billion including debt

I recommend reading one of my numerous articles on OXY related to the acquisition and the ensuing struggle. It was also the time that I pushed investors to buy OXY at or below $10, which I did.

Since then, Berkshire Hathaway kept buying OXY and now owns a massive 16.3% stake in Occidental Petroleum. OXY has strongly recovered and now trades above $61.

3 – Commentary

It is not my intent to judge what Warren Buffett’s Berkshire Hathaway did but to highlight the solid artificial inflationary pressure of such buying and selling power exerted on the stocks or commodity concerned.

We can even describe it as a legal manipulation of the market. It is essential to recognize it to adopt a trading strategy that could help us make profits out of this situation. It has been evident with Barrick Gold and Occidental Petroleum.

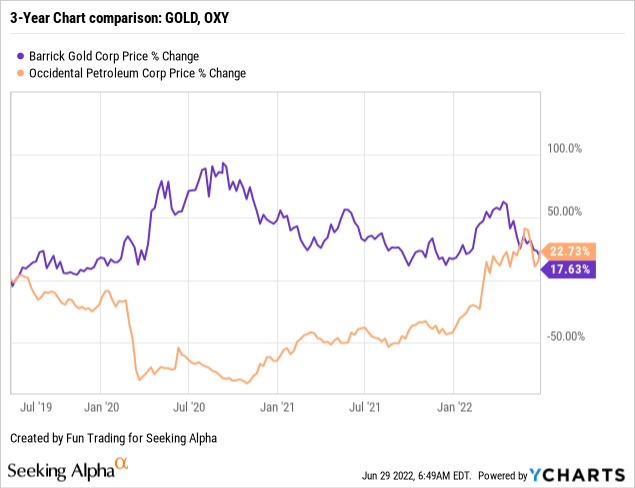

Surprisingly enough, we can see that the two stocks have delivered a similar return on a 3-year basis. From an investor’s point of view, both stocks did not do much in terms of appreciation.

GOLD can be considered slightly better due to a dividend yield of 2.16% compared to 0.84% for OXY.

What next?

The strategy that I recommend is to use what the market has to offer with an open mind.

I do not believe we should turn short on one side and bullish on the other. Instead, we should use the weakness in gold to accumulate slowly and take profits on oil on any upticks.

It is clear that the oil sector is overheating and will probably retrace significantly when the economy collapses into a recession, plunging market sentiment to negative territory. We have already seen how the market reacts to this situation, and the signs are starting to show an ominous trend.

The U.S. economy shrank an annualized 1.6% in the first quarter, reflecting a deeper contraction than the most recent estimate of a 1.5%, revised data released Wednesday showed.

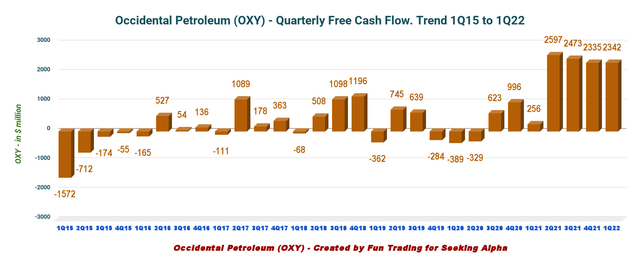

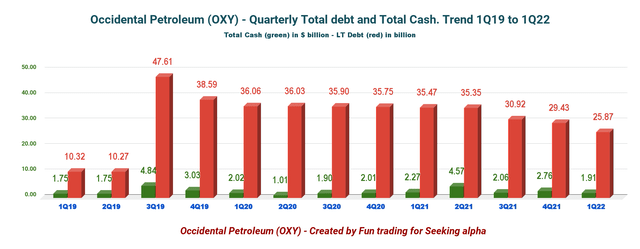

If we look at Occidental’s balance sheet, the company is doing well but is only a step away from correcting, depending on how low oil prices will drop later this year. The company is generating an impressive free cash flow, but the net debt is still too high and stands at $23.96 billion at the end of March 2022.

OXY Quarterly Free cash flow history (Fun Trading)

OXY Quarterly Cash versus Debt History (Fun Trading)

Hence, it is highly probable that Occidental Petroleum is now at an unsustainable valuation exacerbated by Berkshire Hathaway’s relentless buying. It is my honest opinion; of course, I could be wrong.

I recommend reading my article on Occidental Petroleum published on May 13, 2022.

On the other side, Barrick Gold has dropped significantly and is out of favor. It is so out of favor that gold miners are no longer correlated to gold prices and are drifting lower with the market sentiment.

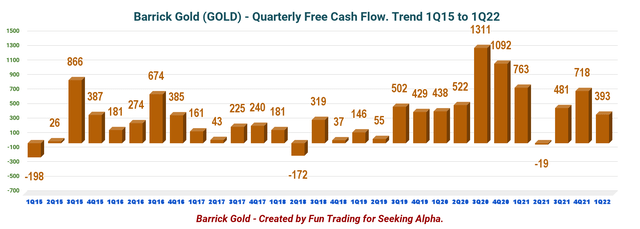

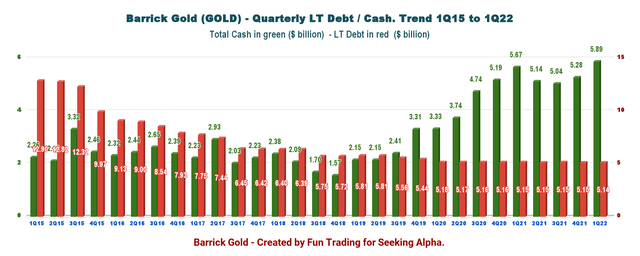

However, if we look at the fundamentals, the company is doing reasonably well with sound free cash flow generation and no net debt or net cash of $743 million.

GOLD Quarterly free cash flow history (Fun Trading)

GOLD Quarterly Cash versus Debt history (Fun Trading)

I recommend reading my recent article on Barrick Gold published on May 20, 2022 (1Q22).

The question is, how effectively will the FED be fighting rampant inflation after being too late to recognize it?

The FED has been quite clueless and did not recognize the threat of inflation when it could have made a noticeable impact. As always, the FED is too politicized to timely respond to such a threat and often ends up “behind the curve.” Therefore, they are forced to act more severely to compensate for lost time. However, it is often too late when the Ghoul (inflation) is out of the bottle.

Inflation is getting out of control and is fueled by too high commodity prices. If the FED can’t control it in 2022, which is possible, we will fall rapidly into a damaging recession that could boost the gold sector while hurting the oil sector significantly when demand starts to plummet.

Top economist Mohamed El-Erian said on June 24 that:

It is, unfortunately, uncomfortably possible that the Fed is going to slam on the brakes and push us into a recession,

A straightforward solution is to trade LIFO using a pair trade OXY versus GOLD.

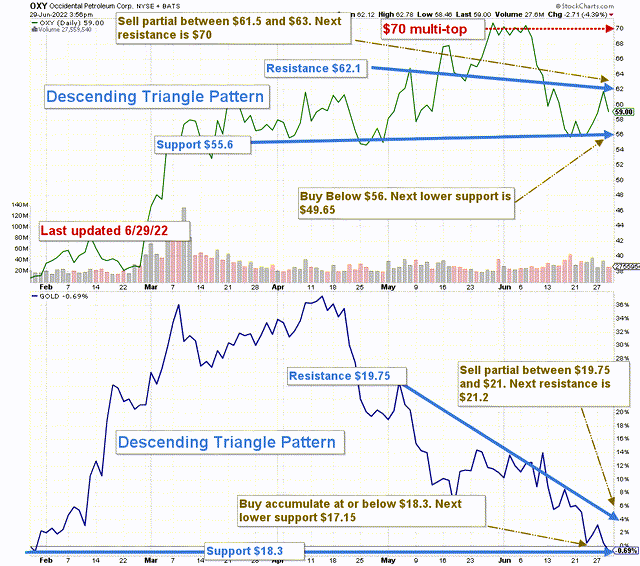

OXY and GOLD TA charts short-term (Fun Trading StockCharts)

The pair-trade strategy is simple. I recommend selling about 50%-60% of your OXY position between $62 and $64 with potential higher resistance at $70.

While it makes sense to add at below $56, I do not think it is the best winning strategy LIFO available.

I believe it is time to reduce your overall position in OXY by about 55% and wait patiently for an oil correction, pushing the stock price down at or even below $45. Patience is required.

Conversely, It is more reasonable to accumulate GOLD between $18.5 and $17.15 using the cash from OXY and eventually trade LIFO about 30%-35% of your position and use the gain to increase your core long-position, waiting for a potential rally in gold.

Trading LIFO is the most adapted strategy that lets you trade your most recent purchases and keep your core long-term position intact, waiting for a much higher target.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only U.S. traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote for support. Thanks.

Be the first to comment