hapabapa/iStock Editorial via Getty Images

Apple (NASDAQ:AAPL) recently announced many new offerings to its Wallet app and is becoming a large player in the fintech industry. One of its most major announcements is the company’s expansion into Buy Now, Pay Later services to rival many of the top fintech companies in the market. However, many investors are questioning the launch of this service as an upcoming recession appears to be imminent and could cause severe harm to the company. With this in mind, it is important to determine how Apple Pay Later would perform during an economic downturn and against its competitors.

Apple Pay Later Overview

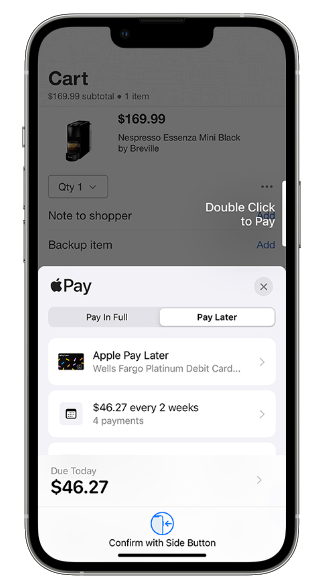

Apple Pay Later was recently announced and is a new effort for the company to further break into the fintech industry. The service allows consumers who use Apple Pay to split a total purchase into four equal payments over six weeks. Furthermore, the service charges no interest, no convenience fees, and no late fees. Apple instead generates revenue from this service by making Apple Pay more attractive to consumers. Since Apple takes a small percentage of each transaction completed with Apple Pay, more consumers who use Apple Pay means more revenue for the company. Therefore, Apple Pay Later is simply an effort for the company to attract more consumers to complete more transactions with Apple Pay.

Apple Pay Later (Company Presentation)

The company is also handling its lending and credit checks for the service itself instead of partnering with an external firm. Previously, Apple partnered with Goldman Sachs (GS) when working on its credit card. Since the company is now handling its own financial services, it will further strengthen itself as a strong player in the fintech industry. However, this also likely means mistakes are likely to come. A major problem with Buy Now, Pay Later, or BNPL, we will talk about later is delinquencies. If Apple is unable to properly understand the risk of consumer credit, Apple Pay Later could cause serious financial harm to the company.

Apple Pay Later vs. Competitors

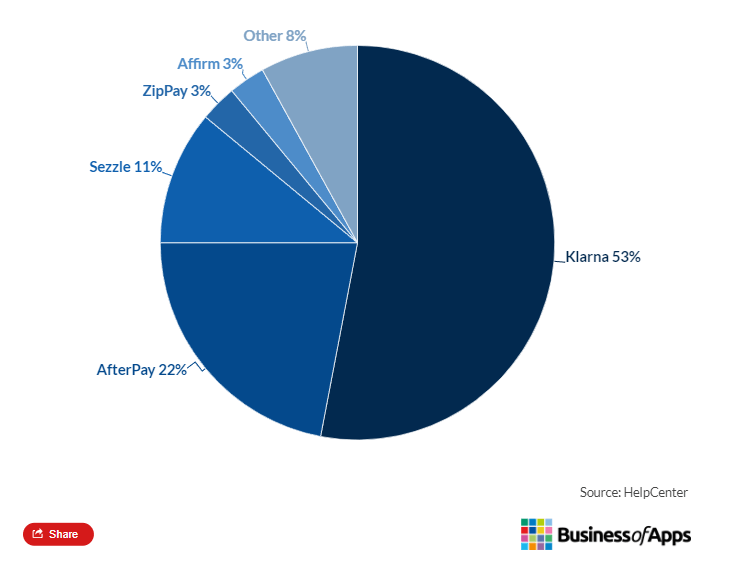

With Apple breaking into the BNPL industry, it is going to face strong competitors that have established themselves in the industry. The first is industry leader Klarna. Currently, the company has over 147 million users worldwide, with 20 million users being in the United States. This means the company still has lots of room to grow in the U.S. despite already being the industry leader with a market share of about 53%.

BNPL Market Share Breakdown (Business of Apps)

The next largest competitor is Afterpay, which was acquired by Block (SQ) earlier this year. Afterpay is partnered with over 100,000 merchants and has been integrated into many of Block’s other payment systems like Square and Cash App. Block is becoming one of Apple’s most similar competitors in the fintech industry. Both companies now offer Tap to Pay and BNPL solutions, as well as allowing consumers to transfer money to each other. The next major competitor is Affirm (AFRM), which is partnered with about 12,000 merchants. Previously, Affirm dominated the BNPL industry by holding roughly 78% of market share in 2018. With the rise of other competitors in the industry, Affirm began to lose its ground and is no longer one of the leading BNPL companies in the market.

The final and largest competitor of Apple Pay Later is PayPal Pay in 4 (PYPL). Pay in 4 is PayPal’s attempt at the BNPL market and it is seeing lots of success. On Black Friday in 2021, PayPal Pay in 4 saw a 400% Y/Y increase in volume and is now seeing millions of consumers use the service. Recently, PayPal expanded its BNPL services by offering PayPal Pay Monthly. This allows consumers to take longer and more expensive loans than previously. Now, users of PayPal’s BNPL services can make payments over 6-12 months for purchases ranging between $199-$10,000. Overall, Apple Pay Later is going to face extreme competition from very strong players in the BNPL industry. The company may want to attempt partnering with popular merchants to gain users quickly, as well as offer more diverse loans similar to PayPal after the service begins to gain steam.

An Upcoming Recession Could Be Extremely Harmful

With more and more investors and analysts projecting a recession in the upcoming future, many are wondering if this is a good time for Apple to launch its BNPL service. Many of the previously mentioned competitors are beginning to face problems and are preparing for a grim future. Klarna even cut its workforce by 10% in anticipation for a slower future, meaning the upcoming future of Apple Pay Later could not be bright.

The first major issue many BNPL firms are facing is rising interest rates. Many BNPL companies open credit lines to support the financials of the company. With borrowing costs increasing, Apple Pay Later and other services could see much higher expenses which could lead to steep losses. With the Fed expected to continue raising rates through the upcoming years, BNPL companies will continue to experience higher costs and this could severely hurt Apple Pay Later.

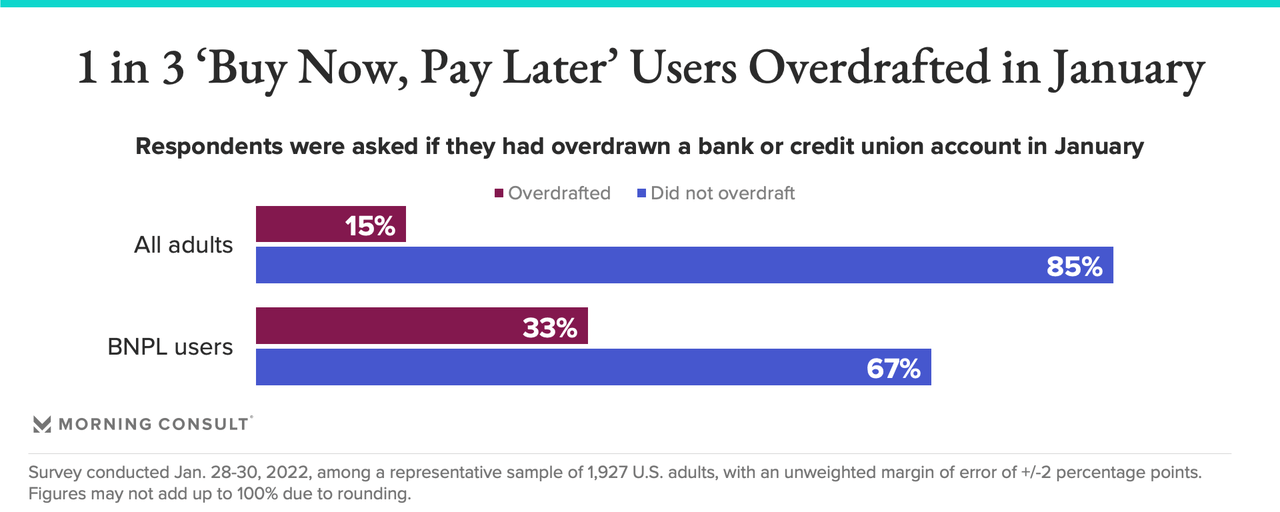

Many BNPL companies are also experiencing much higher delinquency and loss rates than previously. In March, 3.7% of Affirm’s outstanding loan dollars were at least 30 days late. This is up from 1.4% in March of 2021. Afterpay is also experiencing similar issues with its losses from total payment dollars rising from 0.9% to 1.17%. Zip also stated its bad debts increased by over 403% in the past six months. With these delinquency and loss rates on the rise, investors are demanding higher yields on the debt they purchase from BNPL companies. This has caused Affirm to raise its weighted average yield to 4.61% in April, up 3.3 points since last year. Another issue with the BNPL industry is the credit standing of a large portion of the users. Roughly 43% of shoppers who applied for payment plans or loans at checkout have subprime credit scores, despite only making up 15% of U.S. adults. Furthermore, many BNPL users are much more likely to overdraft than the average consumer, with 33% of users overdrafting in January. This will likely lead to even higher delinquency and loss rates in the upcoming future. Since Apple Pay Later is not monetized through late fees or interest rates, the service could see huge losses after its launch.

Overdraft Data of BNPL Users (Morning Consult)

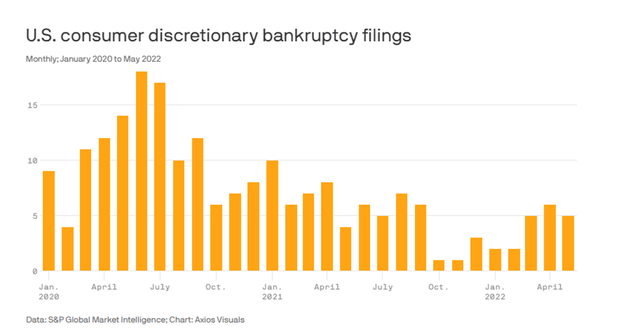

Since Apple Pay Later does not charge late fees or interest, the service must maintain high transaction volumes to generate enough revenue. However, this will likely be a problem for the company in the future. Many BNPL companies performed exceptionally well while consumers had lots of cash from stimulus checks. Now that consumers no longer receive stimulus checks and money is tightening for the average consumer, transaction volumes for Apple Pay will likely decline. Many of the transactions through BNPL services are for discretionary purposes. When money gets tight during a recession, consumers cut out discretionary items first and this can already be seen affecting companies currently. The consumer discretionary sector of the S&P 500 is down roughly 33% YTD and is continuing to fall as consumers spend less money. This trend could cause many merchants to file for bankruptcy and lead to consumers spending less at stores with BNPL services. Charles McManus, CEO of ClearBank, said it best by describing how consumers will decide: “Do I pay my gas bill or do I pay off the armchair I bought three years ago on interest-free credit that is coming due?” With the likelihood that Apple Pay Later will not be able to maintain high transaction volumes during a recession, the company could see major losses.

Consumer Discretionary Bankruptcy Filings from 2020-2022 (Axios)

Valuation

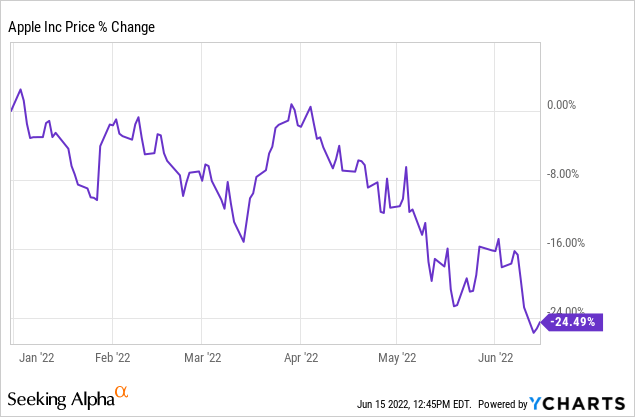

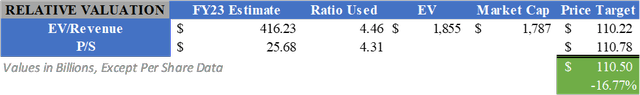

Apple’s share price is down nearly 25% since the beginning of this year and this is causing many investors to consider jumping into the stock. The expansion of Apple Wallet is giving investors the conviction they need to buy, however the stock still appears to be overvalued.

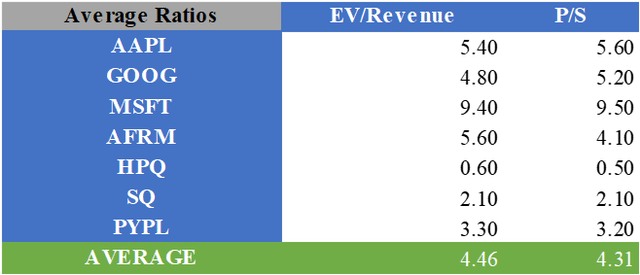

When multiplying consensus analyst estimates for FY23 by the average valuation multiples for EV/Revenue and P/S of Apple and its competitors, a fair value of $110.50 can be calculated after adjusting for cash and debt. This means the stock could continue to fall by roughly 16.77%.

What Does This Mean for Investors?

Apple Pay Later seems to be a popular expansion to the company’s fintech effort. However, many investors are questioning if this is a good time to launch the service since a recession appears to be imminent. The BNPL industry has incredibly strong competitors with lots of experience and since Apple is not using an external firm to handle lending or credit checks, the company will likely see hardships in the short term as it adjusts to the industry. In the long-run, a recession could cause severe harm. Rising delinquency and loss rates from subprime consumers are already causing many strong players to cut their workforces and projections and this will likely continue to rise. Furthermore, a decrease in discretionary spending could lead to Apple Pay Later not reaching the required payment volume to achieve a profit as the service does not charge interest or fees. Since the service appears to face hardships in both the short term and long term, as well as the stock still appearing to be slightly overvalued, I will apply a Hold rating at this time.

Be the first to comment