shaunl/iStock Unreleased via Getty Images

Paccar Inc. (NASDAQ:PCAR) is one of the largest commercial vehicle manufacturers in the world. This legacy business was founded in 1905 and went public in 1980. For a company that has low margins and fairly high capital intensity, the long-term returns have been very good.

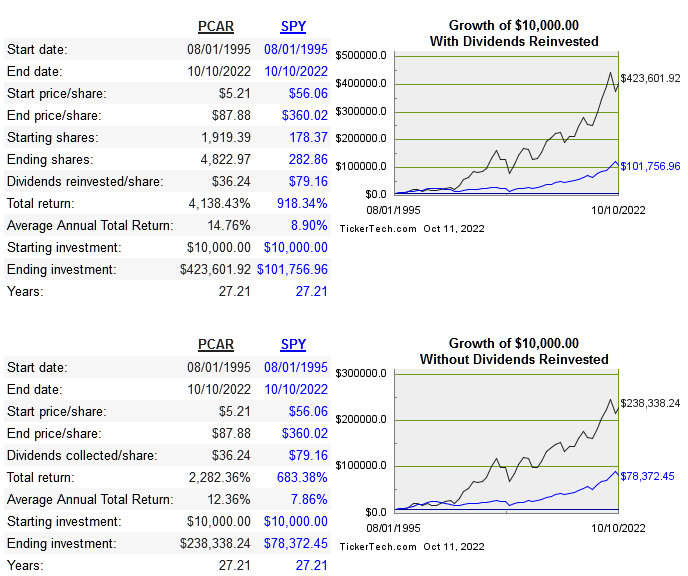

dividend channel

There are three segments: trucks, parts, and financing. The trucks segment makes up around 75% of revenue. Peterbilt, Kenworth, and DAF are the brand names of their trucks. Below is PCAR‘s market share for each class of vehicle in the US and Canada:

|

Heavy Duty |

29.2% |

|

Medium Duty |

9.7% |

The market for heavy and medium-duty trucks is estimated to grow at 8% CAGR worldwide till 2027. PCAR first began hitting important milestones for its electric trucks in 2020 and continues to innovate.

Below are the return on capital metrics versus peers:

|

Company |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF 10-Year CAGR |

Revenue 10-Year CAGR |

|

PCAR |

20.1% |

8.8% |

6.4% |

6.9% |

3.7% |

|

14.2% |

10% |

-5.9% |

-7.9% |

-3.5% |

|

|

20.6% |

15.5% |

4.3% |

0.6% |

2.9% |

|

|

15.5%% |

8.2% |

13.3% |

n/a |

0.8% |

|

|

15.7% |

6.6% |

3.3% |

3.3% |

-1% |

Source: QuickFS

Capital Allocation

Like many industrials, PCAR has paid a dividend for a very long time, and typically spends much smaller amounts on repurchases over time. This is very common for such a company, and the shareholder returns shown earlier illustrate much higher returns when dividends were reinvested.

I’m a big fan of “cannibal” companies, when done right it boosts EPS and common stock returns. My preference is that companies use a higher percentage of free cash flow to repurchase shares on a regular basis than to pay out dividends. That being said, the fact that PCAR prefers dividends doesn’t take away from the quality of the business or the future opportunity. The main issue is that dividends are taxed as income, which brings the returns down.

The company made some key acquisitions in the past, but this is not a regular use of capital for them these days and I don’t anticipate any sizable buyouts in the future.

Long term debt is at relatively high levels, currently $7.2 billion, but not enough to cause serious worry. Debt/equity is 1.2 and the quick ratio is 2.2. These debt levels do drive up the ROE, which is why there is such a difference between ROE and ROIC.

Risk

PCAR already has electric versions of their most popular models on the road and continues to expand, so the risk of being truly disrupted is low. The biggest risk is in these models not selling well relative to all the R&D and production cost. Overall the risk is low, even if the electric models don’t sell very well, the legacy models have significant market share, and the parts and financing segment help balance out revenue.

Valuation

Below is a comparison of multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

PCAR |

1.3 |

9.4 |

23.6 |

2.4 |

1.6% |

|

OSK |

0.6 |

15.5 |

119.1 |

1.7 |

1.9% |

|

CMI |

1.3 |

10.6 |

25.4 |

3.2 |

2.8% |

|

DMLRY |

0.6 |

3.8 |

4.7 |

0.7 |

n/a |

|

VOLVF |

0.9 |

5.9 |

49.8 |

2 |

4.6% |

There is no apparent discount from a pricing standpoint. Shares held up fairly well since the peak last year, down only about 8% compared to many others that have been dragged far lower.

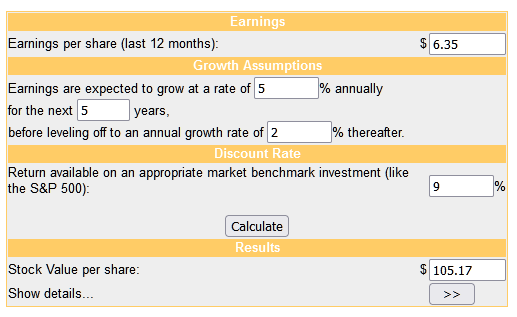

The DCF model is below:

money chimp

PCAR is undoubtedly a mature company, but the addition of electric trucks should provide a boost over the intermediate term. For any mature company that pays a dividend, I do prefer a higher yield than what is currently offered. The company is slightly undervalued using the DCF model, but I would wait for a higher yield at this point.

Conclusion

PCAR is a very good quality company that is well prepared for an electric future, no matter what the exact time frame is. The market share and brand power provide strength and protection from other disruptive EV companies.

Shares are slightly undervalued at current prices considering the growth that will likely be coming. They should be able to retain strong pricing power and all three segments do work together synergistically. I like the fundamentals at this price, but I would wait for price drop to bring about a higher dividend yield for this mature company.

Be the first to comment