Edwin Tan/E+ via Getty Images

Owlet Inc. (NYSE:OWLT) offers digital parenting technology with products aimed at providing insights on baby wellness. The “Owlet Cam” is a WIFI-connected baby monitor that incorporates a mobile app with night vision viewing and real-time notifications. The company also offers a wearable device that attaches to a baby’s ankle to monitor indicators like heart rate and movements in support of sleep training.

The company faced some controversy in 2021 when the U.S. FDA pulled its previous “Smart Sock” product, warning the marketing as a medical device required approval. At the time, shares crashed lower with a major impact on quarterly sales. Fast forward, the company has since relaunched the product as the “Dream Sock” by removing some features to regain compliance.

Indeed, getting past the setback from last year, Owlet maintains a positive long-term outlook with several developments this year. We are bullish on OWLT following what has been an extreme selloff amid the ongoing market volatility. The attraction here is a company that has already established itself as a category leader and is well-positioned to benefit from the increasing demand for high-tech parenting products. The company’s solid balance sheet position highlights overall solid fundamentals that are expected to improve with firming financials going forward.

OWLT Financials Recap

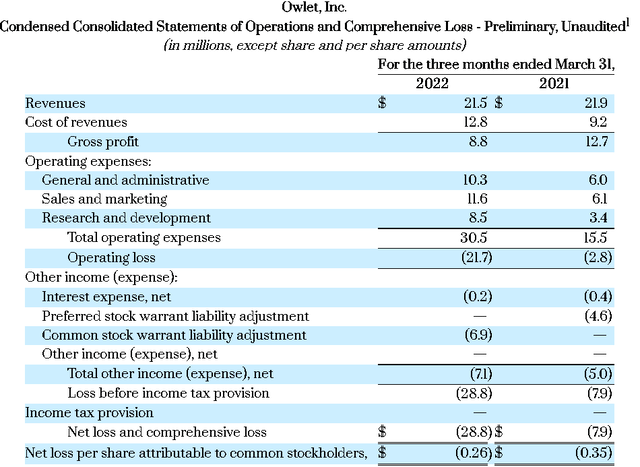

The company last reported its Q1 results back on May 11th with a net loss of -$0.26 per share, which missed expectations by $0.11. Revenue of $21.5 million was about flat compared to the period last year. The context here is the significant disruption from pulling the Smart Sock product at the end of 2021. The new Dream Sock device technically launched in January, but only became widely available at major retailers towards the end of the quarter.

The timing impact of product availability at retail explains some of the earnings miss, while sales are expected to accelerate into Q2. Total expenses in the quarter at $30.5 million nearly doubled from the period last year in support of the growth opportunities and ongoing expansion. Higher expenses this quarter included costs related to retrieving the recalled devices and repacking them with the updated marketing.

The result is that the operating loss widened to -$21.7 million from -$2.8 million in Q1 2021. It’s worth noting that the company ended the quarter with $68.7 million in cash and equivalents against around $20 million in debt.

Overall, the takeaway is that Q1 for Owlet was a transitional period as the company repositions its product lineup and marketing. While the company is not providing financial targets, comments during the conference call projected a sense of optimism toward current operating trends. The following points highlight what are several growth trends this year:

- Owlet plans on submitting a formal application to the FDA for a prescription version of the Dream Sock as representing a new market opportunity.

- Development of a new “pregnancy band” for expecting mothers as a medical device is also in the works.

- Launch of new sleepwear accessories later this year as part of a “connected nursery ecosystem”.

- The company is also moving forward with an international expansion.

OWLT Stock Price Forecast

We’re looking at OWLT as the classic turnaround pick with a sense that the stock selloff has gone too far, too fast. Shares are down by an incredible 70% in just the last six trading days, essentially giving up their rally from recent months that was building on the improved outlook with the product pipeline. In other words, from the trend lower since Q3 of last year when the stock was hit by the FDA warning letter, the news flow had been improving this year as the company relaunched “Dream Sock”.

The latest crash likely includes market-wide panic selling amid headlines of record inflation hitting consumer spending and retailers looking to discount products amid a glut of inventory. Target Corp (TGT) where Owlet products are sold, for example, reported it intends significant pricing actions to move items off its shelves. Owlet simply got caught up in the narrative based on a fear that global consumer spending is collapsing and its product sales face significant demand headwinds. We are more optimistic about this point.

The silver lining here is that the crash in shares of OWLT have worked to reset valuations at what we believe may be a deeply discounted level. From the current market cap of around $250 million, shares are trading at essentially 3x sales from the annualized Q1 result of $22 million. Keep in mind that all indications are that Q1 sales only incorporated a few weeks of the Dream Sock sales that were rolled out through the quarter. The sales multiple is even lower considering the balance sheet net cash.

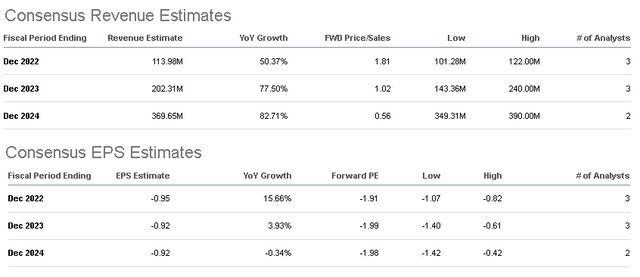

According to consensus estimates, revenues are expected to reach $114 million for the full year 2022, $202 million by next year, and climb towards $370 million by 2024. All this compares to $75 million in total sales for 2021. Again, this outlook is based on the product pipeline that has been announced along with the ongoing international expansion. While the company is not expected to be profitable over the forecast horizon, we believe there is an upside to these estimates that may prove to be conservative with the potential that the company outperforms as part of the bullish case for the stock.

As it relates to the potential FDA approval of the more advanced medical features of the Dream Sock, our take is that there is every indication the application process should go through. Our understanding is that the issue is not in regards to safety concerns, but more in terms of how parents are expected to use the data. The prescription version opens the door for medical professionals to recommend the device for special needs children which can further boost growth beyond the retail version.

Final Thoughts

OWLT as a high-growth, yet unprofitable, consumer-tech name is exactly the type of stock the market has punished this year. Our message is that the company benefits from several positive developments beyond the macro outlook that keep it interesting.

We rate the stock as a buy and see a significant upside as market conditions stabilize. We won’t say OWLT is going back to $6.00 in the immediate future, but our thinking here is that the company as a tech stock with a layer of healthcare deserves a higher growth premium. A string of better-than-expected results over the next few quarters along with headlines related to the FDA approval process and new product launches can work as catalysts to send shares higher. OWLT is high risk and remains speculative, but we see a good chance shares can be trading higher over the next year.

Be the first to comment