Kristen Prahl/iStock via Getty Images

Investment Thesis

Overstock (NASDAQ:OSTK) is facing major headwinds as pandemic trends reverse. Revenues, active customers, and orders are declining at a double digit rate. The business is financially healthy, and its operating model should avoid large losses. But I don’t think the valuation is cheap enough for me to consider buying or holding shares.

Overstock’s Transformation And Reversing Growth

This year, Overstock finally completed its transformation into a home goods retailer. The business started out as a product liquidation company. It then shifted to general online merchandise sales. Now, it only sells home furnishings. This shift is a bold strategy to focus on one of the company’s most successful markets. It was also probably the worst time to make this move.

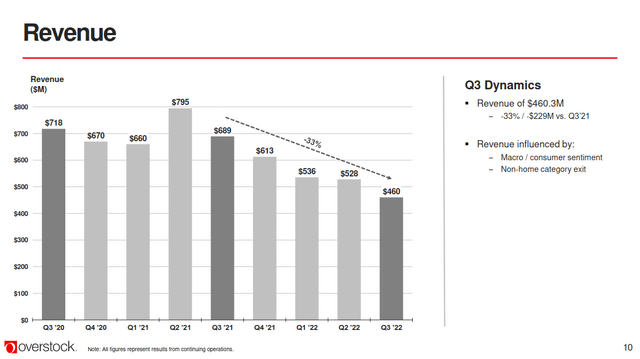

The broader environment for home furnishings is rapidly deteriorating. I can point to several unfavorable macro trends. Inflation is causing consumers to shift spending away from durable goods. A lot of sales were likely driven by the hot housing market. Home sales have dropped in recent months, removing a major sales driver. Additionally, the reopening economy has caused a return to in person sales. Overstock has no retail presence. These headwinds caused revenue to drop for five straight quarters.

Overstock Q3 2022 Earnings Presentation

The company reported revenues down 33% from last year. Active customers fell by 41% since the 2021 peak. Order frequency has also slightly decreased. The company was able to offset this with a 13% increase in average order value. But these results paint a picture of a business facing major headwinds.

Management believes that they’re spending heavily on marketing and growth. But results are still declining. Overstock thinks this is because of its competitors. Other companies are liquidating products and ignoring profitability. This has hurt Overstock’s sales volumes.

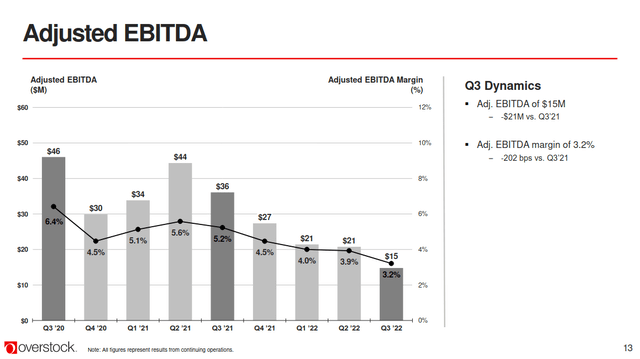

Overstock’s profitability has suffered as well. The company’s adjusted EBITDA cratered by 59% since last year. On a GAAP basis, the company reported its first loss since the beginning of the pandemic.

Overstock Q3 2022 Earnings Presentation

Overstock’s management pointed out that these results aren’t too bad compared to 2019. The company’s top line is still up 33% from those levels. But I don’t think that this is a great comparison. 2019 was an especially rough year for the company. Overstock’s revenues are essentially flat compared to its average from 2016 to 2018. Since 2016, the company’s top line CAGR was just 0.7%.

Overall, Overstock’s results are declining fast. It isn’t clear when the business will hit the bottom. The headwinds that have caused demand to drop off are still ongoing. I also don’t have enough information to say if the company’s pandemic performance was a fluke. Did the company improve on a fundamental level or was it just a favorable environment? I’d want these questions answered before betting on Overstock’s ongoing performance.

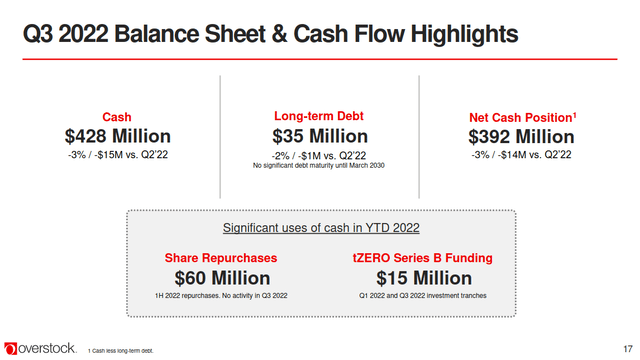

Solid Financial Health

Overstock has healthy liquidity and limited cash burn. This helps offset its declining fundamentals. The company has a defensive balance sheet, with $427 million in cash on hand. This is offset by only $35 million in debt due in 2030.

Overstock Q3 2022 Earnings Presentation

Overstock’s operating model also reduces the risk of large losses. The company doesn’t carry inventory on its balance sheet. Instead, it acts as a distribution channel for other companies. The company can keep its margins steady regardless of where the market is. On their earnings call, management discussed how this helps maintain consistent gross margins.

Gross margin came in at 23.3%, a 60 basis point improvement versus the same period last year. The year-over-year increase was driven by operational efficiencies, partially offset by higher promotions and discounting. We expect this highly promotional competitive backdrop to continue through the fourth quarter.

Our gross margin performance is a proof point of our asset-light model. We are able to improve our margins during this challenging cycle while continuing to offer our customers smart value. In the quarter we navigated product cost inflation and significant liquidation from retailers with excess owned inventory. It’s important to remember that our business model does not have an expensive logistics operation with a high fixed cost base or significant owned inventory.

Overstock is leveraging these assets to sustain itself through these headwinds. The business is essentially cash flow neutral, generating just $1.8 million in LTM free cash flow. This is down from $68 million last year. It’s still good performance compared to many of Overstock’s competitors. Wayfair (W) has been solidly unprofitable since late last year. Even if Overstock has to burn cash for some time, it’s unlikely it will have to increase its debt or dilute investors.

Shares Aren’t Cheap Enough

I’m going to use enterprise value multiples to value Overstock. This adjusts the company’s value for the large amount of cash on its balance sheet. Overstock has a net cash position of $392 million. This is equal to about a third of its market cap.

The business also has some blockchain assets related to its Medici Ventures fund. This is its way of offloading some cryptocurrency projects started by the prior CEO. These assets may be worth something in the future, but I don’t think it’s concrete enough to factor into my analysis.

The company is trading at an adjusted LTM EV/EBITDA of around 14 times. On a LTM basis, the company is trading at an EV to operating cash flow of 73 times. This is above what I’d be willing to pay for a company with this profile. Overstock is experiencing a drastic contraction in its revenue and profit. The valuation isn’t cheap enough to be a deep value play. As a normal investment, I want to get a better idea of where revenues could end up in a recession.

Overstock has paused its remaining share buyback authorization of $40 million. The company has already spent $60 million on its own shares this year. I think that there is potential for solid returns, but only if the company can stop losing customers.

The company is financially healthy, but I don’t think that bankruptcy is the primary risk here. I think the main risk is that Overstock will return to its previous underperformance. Revenues are already trending towards 2018 levels.

Final Verdict

I think that Overstock has some potential. The company has a resilient operating model and good liquidity. It also has the ability to operate without burning a lot of cash.

But revenue declines are continuing at a worrying rate. The company is also losing users on its platform. Those who stay are ordering less often. For these reasons, I recommend avoiding the stock right now. I think that the risk to reward is unfavorable until the company’s fundamentals find a floor.

Be the first to comment