Pijitra Phomkham/iStock via Getty Images

Investment Summary

Following our last 2 publications on Outset Medical, Inc. (NASDAQ:OM), where we rated the stock a firm hold, the clouds of investment return have since swelled and started to rain. OM caught a strong bid following its latest set of numbers, where management revised FY22 revenue guidance to the upside, and ahead of consensus.

Previously, [see: here, and also here] we mentioned the overhang of its Tablo for home segment, where the company decided to place a shipment hold on bookings and revenue for Q2 FY22. That, and a slew of other factors, kept us patiently waiting on the sidelines.

Now, following its Q3 financial results, we noted substantial fundamental momentum brewing for the company and believe now is the time to make an entry. Hence, we’re back today to discuss our latest findings and reveal all the moving parts in the OM investment debate. Unlike previous publications, here we will dive deeper into home hemodialysis market and OM’s core offering to identify the investment opportunity at hand.

As a reminder, OM sells the Tablo hemodialysis system, and this is a key differentiator in our opinion, now with more interesting economics tied into the mix. It is a portable, automated dialysis machine designed to provide patients with the same quality of hemodialysis they would normally receive at a traditional dialysis center. It is designed to be used in a variety of settings, including the home, clinic, hospital, and nursing home. For OM, this broadens the patient scope immensely and offers a far greater growth curve of Tablo in our opinion.

Consequently, we are revising our rating on OM to a buy, seeking technically derived targets of $25 and then $35. These assumptions are backed by the company’s strong revenue growth in Q3, and its revised growth forecasts looking ahead.

Market opportunity: home hemodialysis market growing, differentiated

We feel it’s essential to discuss in detail what’s underpinning our revised investment thesis on OM. In order to do that, we first have to analyze what hemodialysis is, the conditions it’s indicated for, the market, etc., and link this to OM.

Hemodialysis is a form of renal replacement therapy that is commonly used to treat chronic and/or end–stage renal failure, a condition in which the kidneys are no longer able to adequately filter waste and excess fluid from the blood. Hemodialysis is also the gold standard to manage chronic kidney disease (“CKD”) as it can help to reduce complications and improve quality of life.

Epidemiological studies have shown that CKD affects approximately 10–15% of the world‘s population and is increasing in prevalence. It is most common in people over the age of 60 and is more prevalent among certain racial and ethnic groups, including African Americans, Hispanics, Native Americans, and Pacific Islanders. Men are more likely than women to suffer from CKD. Other factors that are associated with an increased risk of developing CKD include diabetes, hypertension, obesity, smoking, family history of kidney disease, and being of lower socioeconomic status.

The treatment of CKD involves the use of a dialysis machine to filter the blood and remove waste products, including urea and creatinine. The treatment can be performed in–center, at home, or at a dialysis center. In–center hemodialysis has traditionally been the preferred option for CKD patients as it can provide better control over the treatment.

However, home hemodialysis is also an option for some patients, though it is more complex and may require more frequent monitoring. OM’s offering lies within the home hemodialysis treatment market.

The efficacy and safety of hemodialysis in CKD has been demonstrated in several studies. A systematic review of 12 studies found that hemodialysis was associated with a significant improvement in cardiovascular risk factors, including blood pressure, lipid levels, and blood glucose control. Additionally, the treatment was found to be safe, with no significant adverse events reported. It is a cost–effective treatment option for CKD, as it can reduce costs associated with hospital admissions and other medical interventions.

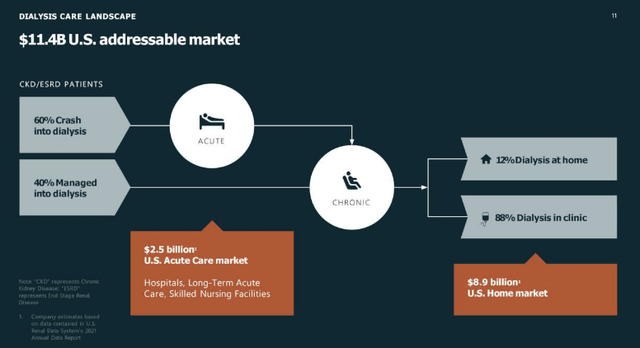

In addition to the efficacy and safety of hemodialysis, there has been a wealth of research examining various aspects of its clinical practice. For instance, several studies have looked at the effects of various dialysis modalities on patient outcomes. A meta–analysis by Chiu et al. (2018) concluded that hemodialysis was superior to peritoneal dialysis in terms of mortality, hospitalizations, and quality of life. Other research has focused on the cost–effectiveness of the treatment and its potential for reducing healthcare costs. In particular, a study by Lok and colleagues (2020) found that hemodialysis was associated with lower costs than peritoneal dialysis in terms of hospitalization and other healthcare utility. You can see further information on CKD and dialysis in the image below, taken from OM’s Q3 investor presentation.

Exhibit 1. CKD and dialysis, some of the numbers and how it relates to OM:

- $2.5Bn acute care market

- $8.9Bn at home market [U.S]

- $11.4Bn Total addressable U.S market

Data: Outset Medical Q3 investor presentation, pp. 11

Home dialysis system market opportunity

The global home dialysis systems (“HDS”) market is expected to witness a CAGR of 5.8% over the coming 5 years. Contrary evidence points to a CAGR of 10.3% into 2028. Either way, his growth can be attributed to the growing demand for home dialysis systems from the elderly population, increasing occurrence of CKD, rising awareness regarding home dialysis, and the availability of reimbursement coverage for home dialysis.

The market for HDS’ is segmented based on product type, end–user, and geography. By product type, the market is divided into hemodialysis systems and peritoneal dialysis systems. The former of the systems accounted for the largest share of the market in 2022, owing to the fact that they are more effective and efficient compared to peritoneal dialysis, and they require less frequent dialysis treatments.

By end–user, the HDS market is divided into hospitals & clinics, dialysis centers, and homecare settings. Of these, the hospitals & clinics segment is expected to account for the largest share of the market in the coming years, due to the rising demand for home dialysis systems from hospitals and clinics, which are increasingly investing in dialysis technology to improve patient outcomes.

Hence these settings represent the broad market OM has propensity to sell into. For FY22 it forecasts $113mm at the upper end of guidance [discussed later], calling for 10.78% YoY growth. Should it hit these numbers, then we estimate it would no doubt have gained additional market share above and beyond the market’s growth rate.

Q3 financial results

Turning now to the numbers, we’d note it was a strong quarter of growth percentages vertically down the P&L for OM.

We noted revenue increased in Q3 with approximately 11% sequential growth, and 6% YoY growth to reach $27.8 mm. Upsides were driven by higher service and other revenue, and higher consumables revenue from their expanded installed base.

Product revenue was up 11% from the prior quarter, and roughly flat YoY at $21.7 mm. Console revenue grew 13% from the second quarter, but decreased 3% YoY to $15 mm. This decrease was offset by increased Tablo demand and a steady growth in the installed base.

Switching to OM’s service and other revenue, we note it pulled in to $6 mm, also an 11% increase from the prior quarter and a 34% increase compared to the prior year. Growth stemmed from expansion of the installed base and the assigning of code X3 to its agreements with health and human services (“HHS”), adding ~$2mm in turnover for the quarter.

Sliding down the P&L, we saw that gross margins came in to 16.4%, up 50bps YoY. This was due to OM’s cost down program and higher revenue volumes in high-margin segments. OpEx totaled $38.1 mm in the third quarter, up $7.8 mm from the prior year period, driven by investments in commercial organization, increased headcount and R&D.

Guidance upgrade the key upside catalyst

We believe the key catalyst to move the needle was OM’s raised FY22 guidance. It now projects revenue in a range of $111mm–$113mm. Noteworthy is that consensus estimates $108mm at the top in FY22, calling for 8–10% YoY growth at the top. Thus, the revised forecast it ahead of consensus as well.

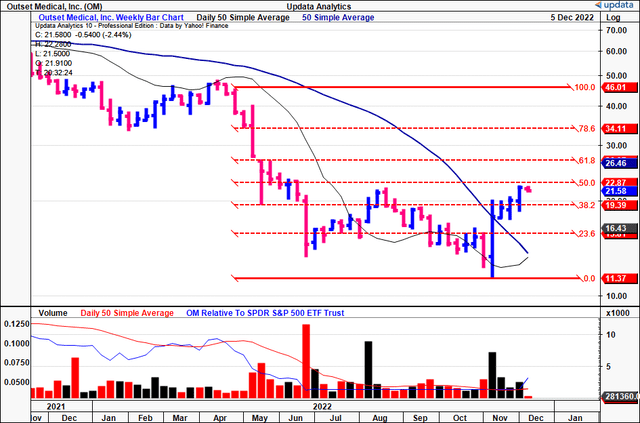

Following the revised guidance investors swiftly re-rated the stock and pushed it back above previous highs [Exhibit 2]. As such, it now trades above both the 50DMA and the 250DMA.

Tracing the fibs’ down from the April FY21′ high to the bottom in November FY22′, we see OM has already retraced 38% of the move and broken out above this key level. It now looks to clear ~$22, which has been identified by the sell-side as a level. Next target from there is $26, then $34.

Exhibit 2. OM 2-year price evolution [weekly bars, log scale]

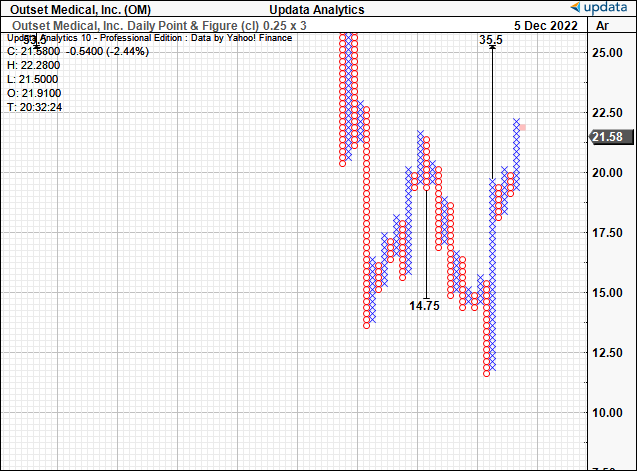

We now have upside targets to $35 based on point and figure charting analysis, as seen below.

Exhibit 3. Upside targets to $35.

Data: Updata

Conclusion

After Outset Medical, Inc. revised its FY22 guidance to the upside, we believe this serves as a meaningful springboard for the stock to re-rate up towards price objectives of $26 and then $35. We bullish on Outset Medical, Inc. stock up to these levels. Rate buy.

Be the first to comment