janza

In 1876, Alexander Graham Bell patented his telephone in Canada and started Bell Canada.

Alexander Graham Bell receives a Canadian patent (#7789) for the Bell telephone on March 7. In the summer of 1877, he transfers 75% of these rights to his father Melville, who proceeds to start up a telephone company in Canada. Source: BCE

Over 100 years later, the company changes its name to BCE (BCE) and is the largest telecommunications company in Canada.

Here in the US, one of the largest (by revenue) of the remaining Bell companies is known as Verizon (NYSE:VZ).

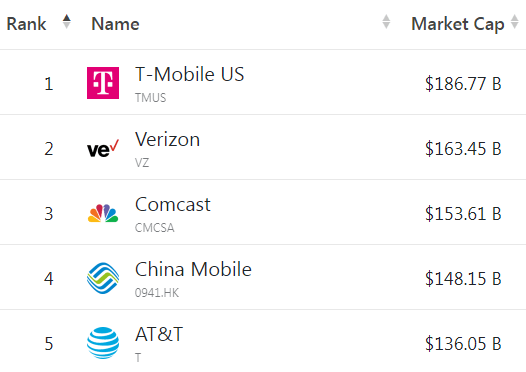

Verizon is the 2nd largest telecommunications company by market value, following only fellow competitor T-Mobile (TMUS).

companiesmarketcap.com

By the way, BCE comes in at 17th by MV (see here).

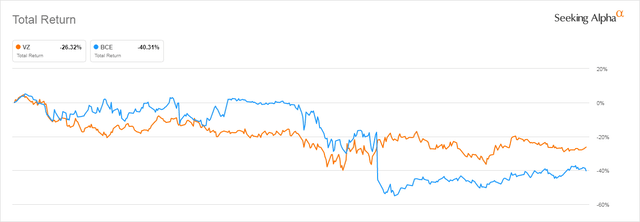

Their price performance over the last year has been negative for both companies, BCE down 7% while VZ has tumbled by 25%.

Both companies have been paying dividends for decades, but the question is will they have the cash flow to continue indefinitely in the future? If so, which one would be the best dividend choice right now?

And as with any dividend stock investment, one must not ignore the possibility of capital gains or losses.

In this article, I will analyze these two communication companies to determine which one is the best buy for dividend-seeking investors.

Financial metrics

A major part of the decision-making process in selecting dividend stocks is the company’s viability going forward. How likely are they to have the financial ability to at least keep the current dividend intact and better yet increase it each year going forward?

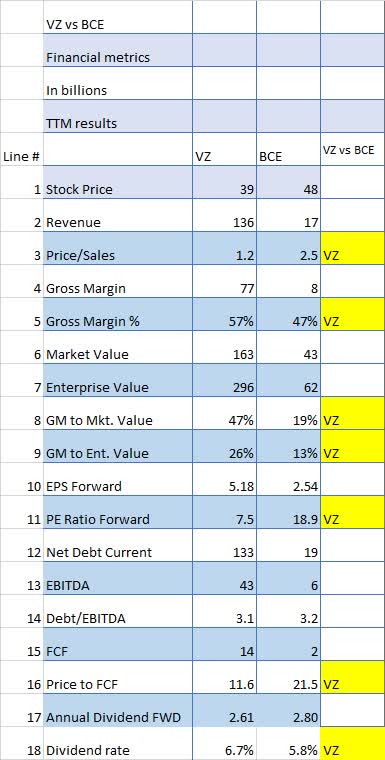

When we look at the financial metrics comparing the two companies on a TTM (Trailing Twelve Month) basis, several metrics should be noted. The first one is the Price/Sales ratio (Line 3) which shows VZ with a ratio more than 50% lower than BCE’s ratio. This could imply that VZ is a better value than BCE.

The Gross Margin % (Line 5) for both companies is large, with VZ winning by 57% to 47%. Large margins such as these indicate both companies have the potential to generate huge cash flows and subsequently dividends. Based on GM to Market Value Percentage (Line 8), VZ’s margin is also much higher than BCE’s 47% to 19%. Again, this may indicate that VZ is a better value based on market value.

The same thing occurs with the P/E Ratio (Line 11), VZ looks much better with a PE Ratio of 7.5 compared to BCE’s much higher ratio of 18.9.

The price to free cash flow ratio (Line 16) shows VZ much lower at 11.6 versus BCE’s much higher 21.5.

Seeking Alpha and author

And finally, the dividend rate (Line 18) is higher for VZ at 6.7% compared to BCE’s 5.8%.

When looking at the Financial Metrics in total, VZ looks like a much better bargain price-wise and VZ has a higher dividend too.

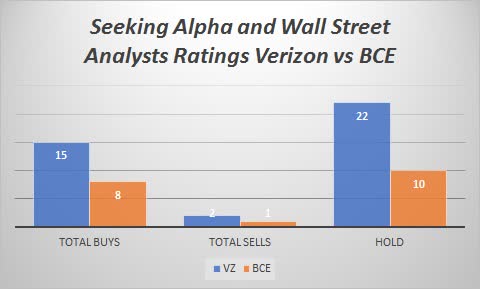

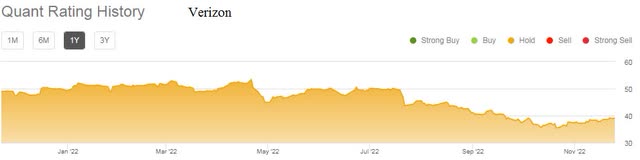

Wall Street analyst ratings show both VZ and BCE are well-liked, but the quant community does not seem to be enamored with either company

Wall Street analysts appear to have relatively strong feelings for VZ, with Wall Street plus Seeking Alpha analysts combined showing 15 Buys and only 2 Sells. BCE is about the same, with 8 Buy recommendations and only 1 Sell.

But for both companies, the neutral “Hold” ratings are high, with a total of 32.

Seeking Alpha

Quant ratings over the last year show considerably less enthusiasm, showing nothing but Hold ratings for both VZ and BCE over the entire time period.

So quants seem to be neutral on both VZ and BCE.

Keep in mind that quant ratings have little to do with whether a company is a good dividend stock, especially over the long term.

Dividends and net debt

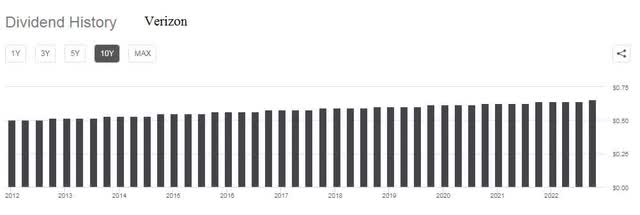

VZ has raised its dividend for 18 years in a row, a commendable record. Looking at the 10-year dividend chart below we can see that VZ has raised its dividend from $.58 to $.65 per quarter, an increase of 12%.

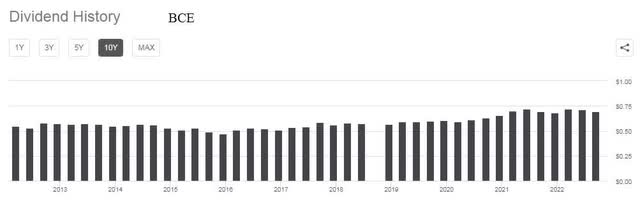

On the other hand, BCE has done even better, raising its dividend by 32% over the same 10-year period.

An important factor for investors to consider in BCE’s dividend is that it is subject to adjustment to account for the difference between the value of the Canadian dollar and the US dollar. In recent years that adjustment has generally been negative to US owners of BCE stock as can be seen by the ups and down in the dividend over time. In Canadian dollars, though, BCE has raised its dividend 22 years in a row.

Even though the unpredictable nature of the exchange rate makes BCE’s dividend variable on a quarter-to-quarter basis, it has increased at a faster rate than VZ’s dividend over the last 10 years. And, of course, in future years the exchange rate may turn in Canada’s favor, in which case, BCE’s dividend would rise faster.

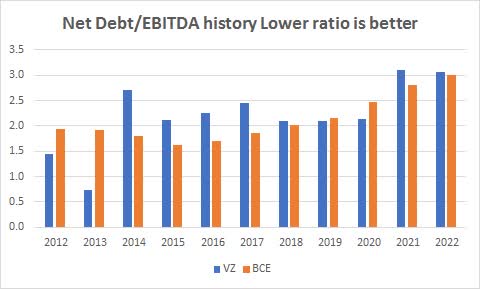

Another key factor to look at for dividend-paying stocks is the Net Debt to EBITDA ratio. The lower this ratio, the more likely the company will be able to keep paying the dividend.

In this particular case, both stocks have shown a steady increase in the ratio over the last 5 years, not a good sign for either one. To maintain their good dividend history, both companies need to lower their debt, in my opinion.

Seeking Alpha and author

The dividend and net debt advantage go slightly to BCE.

Risks

Large, capital-intensive companies, like telecommunications companies, tend to have problems with debt piling up as they expand their business to cover such costs as the 5G rollout. This often affects both the price of the stock and the dividend payments as they attempt to pay down the capital expended as the new services come on board but sometimes there is a lag between the two.

In Verizon’s case, the expenditures included a mind-boggling $45 billion in spectrum purchases to expand their networks, especially 5G. The risk for VZ, in this case, is if the markets do not expand as fast as anticipated or if competitors beat them, namely AT&T and T-Mobile to the punch. This could affect both EPS and FCF, negatively.

In a volatile environment like we’re facing now, cash is also a viable alternative. CD rates are now in excess of 4% a number we haven’t seen literally in years.

In addition, there could be a recession coming or even a depression, according to several economists. That may make profits elusive at best and provide losses at worst.

So please, do your own due diligence on every investment option.

Conclusion

When making decisions about dividend stocks, one of the main considerations has to be how long you plan on holding the stock. Obviously, we know from the dividend paragraph above that VZ has increased its dividend for 18 years in a row and BCE for 22 years in Canadian dollars.

The main problem that I see is the exchange rate, as shown in the following chart.

Ten years ago the Canadian dollar was extremely strong sitting at parity with the US dollar but it has gone as negative as $1.45 and currently stands at about $1.20.

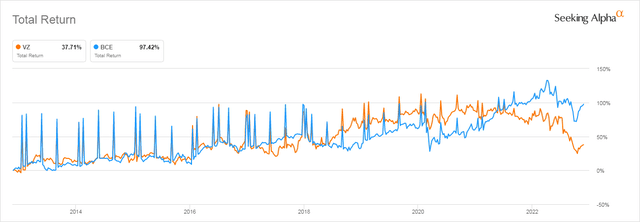

This can be dangerous for US owners of BCE, as shown by the following 10-year total return chart.

Those blue spikes may sometimes represent the extreme volatility of the exchange rate on the price of BCE’s stock. If you had to sell at a low point in the exchange rate, you could be punished severely.

Looking at these two companies, I see VZ as being better on the financial metrics, mainly because of a lower P/E ratio, lower Debt/EBITDA ratio, higher margins, lower-Price/FCF, and higher dividend rate.

If we look at the historical numbers for Price/Sales ratios over the last 5 years, we see that VZ has gapped downward vis-a-vis BCE. The investment argument for VZ is that the gap will eventually return to its historical norm or close to it, resulting in a substantial capital gain.

Based upon the above analysis, for American buyers, VZ is a Buy, and BCE is a Sell due to large potential volatility related to the exchange rate.

For Canadian buyers, I rate BCE as a Buy because of 22 years of substantial dividend increases and no exchange rate risk.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment