syahrir maulana/iStock via Getty Images

Advantage has been sought since the dawn of civilization.

- Traders would gain advantage by transporting goods from an area where they are low value to a market where they are high value

- A citadel achieves defensive advantage by being built atop a hill.

- A chess player gleans tactical advantage by controlling the middle of the board

Capturing advantage is not a novel concept yet so much of the investment world is satisfied with an average return. Over long periods of time the stock market goes up quite consistently so one can achieve an okay return by simply buying a broad market ETF and the masses do. Passive share has now eclipsed active share.

I’m not wired to accept average. It feels wrong to get a market return when there are advantaged investments from which to choose. In assembling this portfolio, I have layered in a series of advantages.

Major advantage #1: No corporate tax

For most of the S&P, investors are taxed twice. The company in which the investor owns stock has to pay corporate tax on its earnings and then the investor has to pay tax on dividends and/or capital gains.

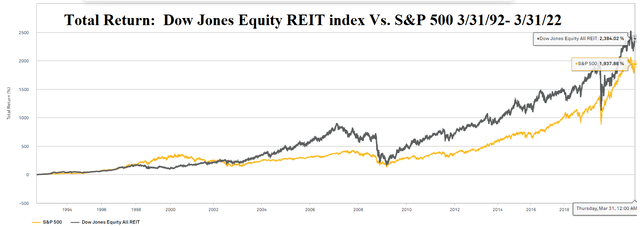

We have intentionally focused our efforts in the REIT space because REITs do not have to pay corporate tax. Thus, investors are only taxed once. This significant and clear advantage has led to REITs outperforming. Over the last 30 years, REITs have beaten the S&P by about 450 percentage points.

S&P Global Market Intelligence

The tax advantage remains in place so REITs should continue to outperform in the long run.

This advantage helps all REITs, so by swimming in the REIT pond, each of our stocks comes with a built-in advantage.

Major advantage #2: Investing in companies that buy well

Real estate purchases, like any other investments, fall in a spectrum. Some properties will generate a higher return than others and experienced real estate investors can achieve higher IRRs. Some REITs are run by great buyers while others are less skilled. We have intentionally selected REITs that buy properties well and avoid those who don’t.

Major advantage #3: Getting in at a good price

This is the bread and butter that compounds with the other advantages to really improve returns.

Consider a REIT that is a skilled buyer who can spot the gems and buy $105 worth of property for $100. If you as an investor buy the REIT at net asset value (NAV) you are getting a good investment because you are functionally getting that $105 property for $100.

However, if you can buy that same REIT at 80% of NAV, you are now getting $105 of property for $80.

This is the layering of advantage – fundamentally prosperous REITs at value prices. We have sought these advantages in every position resulting in a significantly advantaged portfolio.

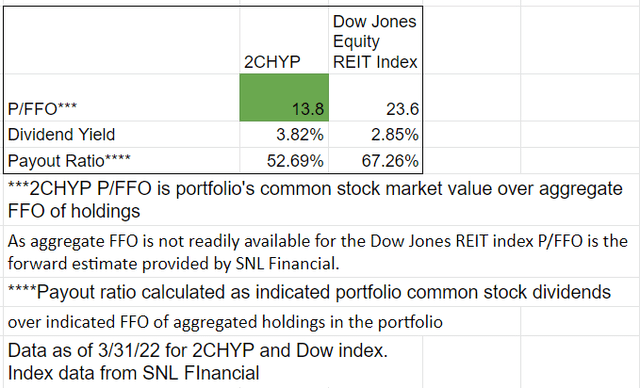

It shows up in the metrics. The REIT index trades at 23.6X funds from operations (FFO) while the 2MC High Yield Portfolio (2CHYP) has a P/FFO of 13.8X. The higher cashflows provide a dividend yield that is 34% higher with a lower FFO payout ratio which leaves more capital at the REITs for growth.

Author generated

Performance

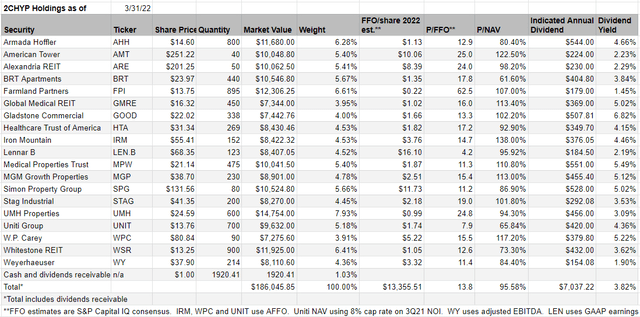

On 7/1/16 we commenced trading in 2CHYP with $100,000. That $100,000 grew into $186,045 as of 3/31/22 representing a total return of 86.05% – a simple annual return of about 15%.

Fundamentally strong stocks bought at a discount to intrinsic value tend to outperform and this too shows up in the numbers. Over that same 5 and ¾ year period, the REIT index returned 53.07%. This equates to outperformance of 3298 basis points.

|

Portfolio/index |

1-year total return 3/31/21-3/31/22 |

5-year total return 3/31/2017-3/31/22 |

Total return since inception 7/1/16-3/31/22 |

|

2CHYP |

29.38% |

63.85% |

86.05% |

|

MSCI U.S. REIT Index (RMS) |

26.20% |

58.49% |

53.07% |

|

Outperformance |

3.18% |

5.36% |

32.98% |

Data for 2CHYP from Interactive Brokers and RMS from SNL Financial. See accompanying disclosures about performance

Straightforward, fair, performance reporting

I feel inclined to note that this is real performance in a real portfolio verifiable by a legitimate third-party custodian (Interactive Brokers). Never trust performance data from a model portfolio or a backtest. It is remarkably easy to engineer good looking performance data for a model or to cherry pick time periods. We provide the entire time period (inception through most recent quarter’s close) so as to eliminate the ability to cherry pick.

I am very proud of this outperformance and will continue putting in the work to keep finding strong stocks in an effort to continue to outperform. To that goal, here is how we are positioned heading into the second quarter.

Portfolio Income Solutions

Our fair value estimate of each stock can be accessed in the Live Portfolio screen on Portfolio Income Solutions.

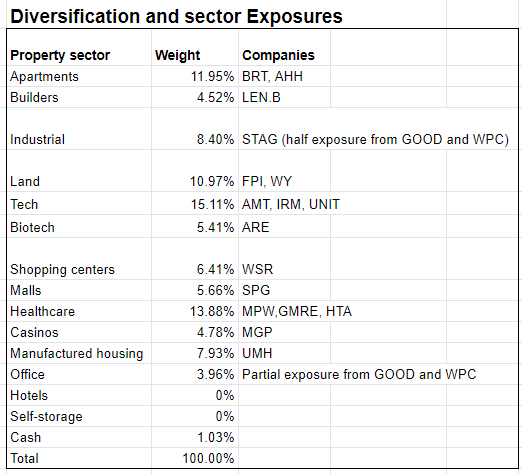

Below is our sector level exposure.

Portfolio Income Solutions portfolio analytics

Key Overweights and Underweights

Although tech REITs are the largest sector in the portfolio it is not a substantial overweight because the index also has substantial tech exposure. Quite simply, the tech REITs have big market caps. Land is our biggest overweight because it is virtually non-existent in the REIT index. Manufactured housing is also a big overweight as there are only three MH REITs and they make up a tiny fraction of the index.

In an inflationary environment, land and manufactured housing are extremely well positioned. I think index REIT investors are really missing out by not participating in these sectors.

Our big underweights are office, hotels and self-storage. This is very intentional. Each of these property types has wavering demand and significant oversupply of real estate. That is not a fundamental setup to which I want to be exposed.

While I think sector level exposure conveys some advantages this is a bottom-up portfolio. It all comes down to the individual stock picks.

Skilled Management Buying Intelligently

Much of the real estate world functions as spread buyers. They buy high quality yet generic real estate at a fair market price. This is the sort of real estate that is thoroughly shopped around and ends up going to the buyer that is willing to pay the highest price. They can make it work by having a low cost of capital such that there is a spread between purchase cap rates and cost of capital. The REIT then nets the difference between ROIC and WACC and can grow.

Most REITs are spread buyers, even some of the biggest and best known:

It works. It’s fine. But there is no advantage, and it usually leads to average results.

In deciding whether or not to invest in a given REIT, one of the biggest desiderata for me is their acquisition process. Much of our research goes into determining whether the REIT is a simple spread buyer or if they have an edge that gives them superior acquisitions.

In each monthly portfolio review I like to present a different angle of analysis and this edition will focus on the acquisition process of the companies in the portfolio.

Armada Hoffler (AHH)

AHH gets most of its value creation from its proprietary development capabilities. This can best be seen in Virginia Beach in which they created a series of high-end mixed use properties that became the prime area of the downtown.

Due to the in-house development team they can build a bit cheaper and they have an impressive track record of delivering on-time and under budget. The value creation in Virginia Beach is now being replicated in Baltimore as they are doing the same thing with their series of developments. Early leasing information indicates it will be a great IRR. This is one of the properties they are building in Harbor Point.

AHH

American Tower (AMT)

As there is nothing special about AMT’s towers compared to others, they are in some senses a spread buyer. However, most spread buyers are clipping something like 200 basis points over cost of capital. AMT is getting closer to 400-600 basis points.

Sometimes scale is its own value driver. American Tower owns such a large portion of telecommunications infrastructure in the countries in which they operate that the major TelCos either have to be their customer or have weak coverage maps relative to peers.

Given the low maintenance capex nature of macro towers this should be a low cap rate real estate sector, but the dominant market share keeps their ROIC higher than normal economic forces would dictate.

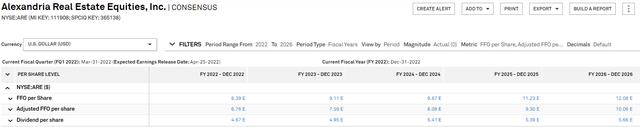

Alexandria (ARE)

Large life science campuses are a big investment with recent transactions for even single buildings coming in over $1 billion. The tenants need properties to be ready on time so they can keep their research on schedule, and they need the properties equipped with very specific infrastructure and equipment.

Given the scale and sensitivity of such projects the tenants strongly prefer to work with a trusted developer. Alexandria is by far the most trusted name in the space. As such, they are getting the lion’s share of the pipeline and on far more lucrative terms. ARE’s development cap rates dwarf those of stabilized properties which nets them immediate value creation as soon as the ribbon is cut.

ARE’s growth story is well established, and it shows up in consensus analyst numbers.

S&P Global Market Intelligence

The amazing thing here is that given the clear pathway to the growth shown above, ARE is trading at just 24X FFO. Its multiple is about the same as the market average, but its growth is both of higher quality and far greater speed. It is clear mispricing and a rare opportunity to participate in a company of this caliber at such a nice value.

Allow me to deviate a bit from the alphabetical order of the company specific analysis as BRT brings us to the residential sector which is rich with opportunity across the vertical.

The full housing vertical

We have spent a good portion of our time studying the housing industry recently because of the extent of the undersupply. Raw inventory has simply not kept up with population growth and the impact is measurable in each type of housing.

- Apartments have historically high occupancy rates because there simply aren’t enough units

- Single family home prices are at record levels because many people want to buy and few want to sell

- Manufactured housing is growing occupancy consistently

The result of this undersupply is rapidly rising rent in apartments, single family homes, and manufactured housing. It creates an advantage for the providers of housing and a disadvantage for the consumers of housing.

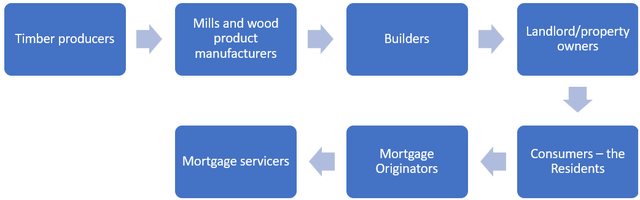

I chose the word “providers” carefully because it is actually quite a chain of companies that goes into actually providing housing. Here is a basic flowchart of the process. The arrows flow in chronological order of production, but money flows in the opposite direction.

Author Generated

Different sections of this chain benefit at different points in the cycle so by owning companies throughout the chain we can capture the aggregate advantage the providers have over the consumers from the undersupply while mitigating some of the risks.

Timber producers like CatchMark Timber (CTT) are presently disadvantaged by the bottleneck in mills and mill focused REITs like Potlatch Deltic (PCH) are reaping outsized profits. The market sees this imbalance and is trading mills at high multiples. Additionally, the number of mills under construction has ramped up considerably which will eventually tilt the balance in favor of timber producers. I like Weyerhaeuser (WY) for this section of the vertical because it is undervalued and has a balanced vertical integration of owning both mills and timberlands. Its mills and manufacturing facilities are producing extraordinary profits now and as the balance tips toward timber its land will experience substantial value accretion.

These wood products are being sold to the builders at very high prices, yet the builders are still getting unusually high profit margins because the price of homes has risen so dramatically. The same statement holds true whether we are talking about single family homes for rent, apartments, modular homes, manufactured homes, or owner-occupied single family homes.

Similar to the timber and mill dynamic, there is a delicate balance between incumbent real estate and the builders. The less builders build, the better off incumbent real estate is. COVID dramatically curbed labor supply both by mandates shutting down work and the secondary effects in which it became difficult to find labor.

COVID was obviously a tragedy, so I am not suggesting it is good in any way, this is merely a critical analysis of its outcomes and by shutting down the labor to builders it was hugely beneficial to incumbent real estate. It created a situation in which all forms of housing are dramatically undersupplied.

This is great for the owners of residential real estate now and great for the builders in the future as they catch up to proper supply levels.

I think there are still a few years of abnormally strong rent and occupancy growth for apartments as labor costs and lumber costs remain so remarkably high that supply is kept somewhat low despite the incredible demand. BRT Apartments (BRT) has the most amplified exposure to the growth over the next few years as their JVs afford a shareholder the most bang for the buck. Put simply, BRT controls billions of dollars of apartments but has a market cap of $450 million so as apartments rise in rental income and value BRT shareholders are getting amplified benefit. Over the next few years, BRT is buying in their JVs which will make the off-the-books value appreciation suddenly visible to wall street.

Over time, labor supply will normalize which will allow the builders to kick into high gear. The downside of this is that rental rate growth will drop back down to a normal 2%-5% a year, but the upside is increased volume for the builders. I think most of the home builders are ripe for the picking right now given how cheap their prices have gotten but Lennar (LEN) (LEN.B) really stands out from the pack for 2 reasons:

- Phenomenal track record of fundamental performance and shareholder returns

- Anomalous pricing of LEN.B

Lennar class B shares have an obvious advantage over the class A shares in that they get 10X the voting rights and are currently 15.06% cheaper. If one were to buy a random stock at a 15% discount it would be a great deal, but the opportunity to buy a blue chip stock like Lennar at a 15% discount to market price is not something that happens all that often. When a deal is that good, I’m willing to shop outside of REITs to get it.

The spread between LEN and LEN.B can be tracked in real time in the arbitrage tracker spreadsheet on Portfolio Income Solutions.

Continuing along the discussion of the residential vertical, manufactured housing is a bit different than apartments and homes as it is somewhat permanently supply constrained. NIMBY (not in my back yard) style red tape prevents or delays zoning which makes it difficult to form new communities. This grants increased value to existing communities as they can expand much more easily than new competition can be built.

UMH Properties (UMH) has a decade long runway of adding 800 rental units a year to its communities. They already own the land; it is already zoned and the community amenities are already in place which makes this abnormally high return on investment. It is also worth noting that UMH’s rents are currently about 20% below fair market rent which provides a long runway to their standard ~4% a year rate hikes. This company will be growing for a long time and it is not yet fully priced into the stock.

We owned UMH back when it was too small for most institutions to take notice and I find it funny that only now AFTER the double are the big firms considering it.

Returning to the alphabetical review of the portfolio stocks:

Farmland Partners (FPI)

The farmland market is quite efficient as any farm sold will be looked at by local farmers as well as bigger buyers. As such, it is not really possible to consistently buy land at an advantaged price. However, one can still buy a land REIT at an advantaged price because while the land markets are efficient the public REIT market is remarkably inefficient.

FPI’s asset value is somewhere around $16-$17 per share applying USDA land value adjustments to purchase price of their farms. At $13.75 an investor buying FPI gets to functionally buy the land for cheaper than it could be bought as a raw asset.

Global Medical REIT (GMRE)

GMRE epitomizes the thrust of this article as they are adamantly not spread buyers. They specifically avoid the types of assets that go to the institutional bidding war, opting instead for smaller off the beaten path medical office properties. GMRE specializes in finding assets that have some sort of advantage that is being overlooked so that they can get a quality asset at a much higher cap rate. Most MOBs (medical office buildings) go for 5% cap rates, but GMRE is still buying north of 7%. This superior ROIC has resulted in GMRE growing faster than peers.

Gladstone Commercial (GOOD)

What GMRE does in terms of underwriting properties, GOOD does in underwriting tenants. Credit rated tenants are highly sought after so triple net properties tied to rent streams from investment grade tenants go for significantly lower cap rates. GOOD buys properties associated with unrated tenants and underwrites the tenants themselves to assess their ability to pay rent. In many cases they can find unrated tenants who are the financial equivalent of investment grade, but because they don’t have an official BBB associated with them the cap rate is significantly higher.

GOOD gets the high credit tenant AND the higher cap rate. That is an enduring advantage and has helped GOOD outperform triple net peers.

Healthcare Trust of America (HTA)

Healthcare Realty (HR) is a solid company, but a standard spread buyer which as discussed is fine, but not what I typically go for. At fair value I don’t think I would buy HR, but we are buying it at a double discount. HR itself is trading at 82.3% of NAV and it is buying HTA at a fixed exchange ratio. The HTA leg is 3.95% cheaper than what it will convert into when it becomes HR.

So, in owning HTA, we are functionally getting HR 3.95% cheaper than the already existing 82.3% of NAV. That is clean compounding of advantage.

MGM Growth Properties (MGP)

Similar to HTA, MGP is really a play on its acquirer as it is being merged into VICI.

VICI got into casinos before they were the hot asset class, getting cap rates as much as 200 basis points higher than they are today. 200 basis points on a cap rate may not sound like much but let’s do some quick math on that. If a property bought at an 8% cap rate now goes for a 6% cap rate that means it has appreciated by 33%.

That is VICI’s early mover advantage and it is trading at an attractive valuation of only 14.8X FFO. MGP is basically just a slightly cheaper way to buy VICI as there is about a half a percentage point arbitrage between their prices.

This spread, along with the HTA/HR spread is available in real time on the Portfolio Income Solutions arbitrage tracker sheet.

Iron Mountain (IRM)

When Iron Mountain first got into data centers the general consensus was that they would be outcompeted by the incumbent giants like Equinix (EQIX). IRM has since proven that not only can it handle the space but that it is a superior buyer.

See, IRM has pre-existing relationships with most of the Fortune 500 through their legacy data storage and retrieval business and it is using these connections to lease up their new data centers at blazing speed. IRM’s data center leasing is putting some of the pure-play data center REITs to shame.

Medical Properties Trust (MPW)

It would seem as though all the low-conviction holders have already been shaken out of MPW as it has been the victim of a series of hit pieces run by the Wall Street Journal. The first two both focused on their relationship with Steward and had fairly significant impacts on the stock as they aired. The third was about a failed property that was thoroughly discussed in their 10-Q as well as the earnings conference call. All three were dredging up old information that well-researched shareholders of MPW already knew.

MPW actually traded up on the day when the third article hit the press. I read this as the shareholders in MPW now know the issue very well and are high conviction. This a great base from which the price can rise closer to fair value. MPW trades at a tragically low multiple relative to its pace of growth.

Simon Property Group (SPG)

Malls are not a great form of real estate in the modern world, but SPG is the best of the best. I actually think the broader mall carnage of recent years will benefit SPG as so much competing square footage has been repurposed to other uses.

I also think SPG’s purchases of retailers is worth a case study at some university. Not only did David Simon buy them at near bottom of the barrel prices as the retailers neared bankruptcy, but he could present them with immediate synergies by strategically locating them in SPG malls. The result was IRRs that in some cases were over 100%.

STAG Industrial (STAG)

STAG is positioned for later in the industrial boom cycle than most of the other industrial REITs. The coastal A+ locations have both bigger booms and bigger busts as compared to the logistics properties located throughout America that STAG owns. Right now, we are in the middle of that boom so the market is loving the coastal stuff and rewarding it with extreme multiples.

STAG is trading at just 19X FFO compared to nearly 30X for industrial peers. When the cycle turns and the middle America locations start to have a gentler landing than the boom and bust coastal properties that valuation disparity is going to look rather silly.

Uniti Group (UNIT)

Uniti’s advantage is not in its acquisition process but rather in its ownership of an asset that can’t be efficiently replaced. Our investment in Uniti is predicated on three ideas:

- Fiber is valuable as it will be increasingly used as data usage propagates.

- It is substantially cheaper to route data through pre-existing fiber networks than laying a new network

- Uniti is the most cost-effective way to buy fiber.

Recent quarters featured a distinct ramp in leasing activity for UNIT and if this continues it can move to a growth multiple from its current deep value multiple.

W.P. Carey (WPC)

While most triple net REITs are spread buyers, WPC is a sale leaseback originator. They negotiate directly with property owner/operators to create sale-leaseback transactions. In exchange for this legwork they get a superior combination of tenant credit, property quality and cap rate as compared to the heavily marketed pre-existing leases.

Additionally, WPC’s industrial portion of their portfolio is not being priced into the stock. As this percentage ticks higher, WPC’s multiple will trend toward that of the industrial REITs.

Whitestone (WSR)

We just wrote a full length analysis on WSR so I will refer you to that.

Perpetual pursuit of higher returns

This review is a static snapshot of the portfolio as it existed at the end of the quarter. While I believe these stocks are well positioned, the holdings will change as the information changes. It is a matter of continuously weighing fundamental prospects of each stock against market price.

Be the first to comment