Darren415

This article was first released to Systematic Income subscribers and free trials on July 19.

June brought another upside surprise in the headline rate of inflation. With upside surprises happening seemingly every month, this no longer feels very surprising to many income investors. In this article we discuss the scenario where inflation remains elevated and well outside of the Fed’s comfort zone, which income assets can benefit, and how investors can position for this scenario.

Back To The Old Normal?

That inflation is likely to subside in the medium term has become market consensus over the last few months. It’s supported by a number of key indicators. Core inflation has indeed been moving lower recently, commodity prices have fallen sharply in the last few weeks, a sharp rally in the dollar will lower the cost of imports and leading demand indicators are coming off the boil. Even consumer inflation expectations have fallen quickly to just 2.8% over the next 5 to 10 years, down from 3.1% in June – the lowest level of the past year.

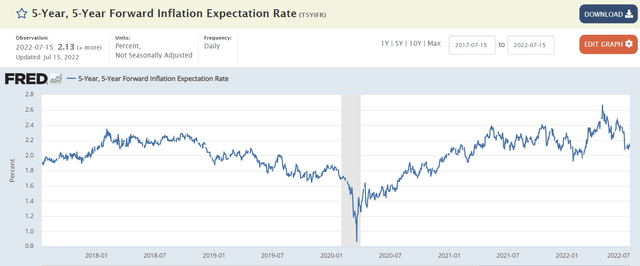

5Y inflation breakevens (i.e. expectation for headline inflation over the next 5 years based on TIPS pricing) have fallen nearly a full percentage point to 2.59% though it stands about 1% above its pre-COVID level.

5Y breakevens don’t tell us how the market thinks inflation will evolve between the short and longer-term, however. For this we need to look at 5Y5Y inflation breakevens which show market-implied inflation over a 5Y period starting in 5 years. Here, the market thinks that inflation is only going to be higher by 0.3% relative to its pre-COVID level and on par with its 2018 level. In short, it seems that the market is convinced we are going back to the old normal of inflation running not far from its 2% level.

And while we are sympathetic that many of the disinflationary drivers of the last 20 years are still in place, it is also true that a number of new deglobalization and geopolitical friction factors may result in a persistently higher level of inflation – perhaps not double its previous level, but above its previous trend. This is not something we have much confidence in projecting, however, the risk that inflation settles down above its pre-COVID level seems pretty high. In short, the market consensus seems to have run ahead of itself in pricing a nearly full reversal of inflation back to its 2% level.

Will Inflation Remain Elevated?

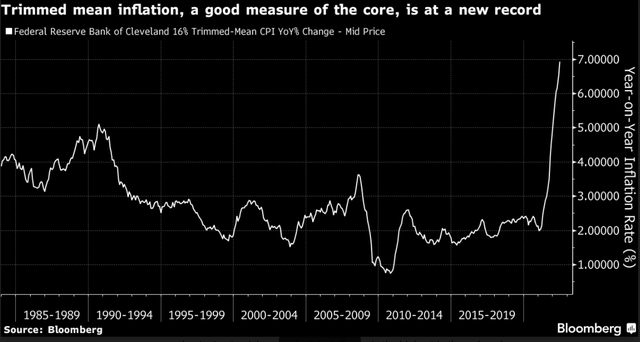

The transitory case for inflation held that inflation was pushed higher by a few outliers. This argument was supported by some inflation metrics, such as the trimmed mean remaining subdued as the headline index was rising sharply. However, this is now falling away as inflation is feeding into a broader set of prices as shown below.

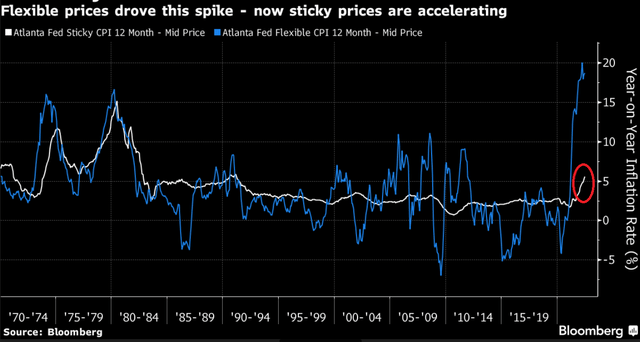

What is particularly worrying is that inflation is also now feeding into “sticky” prices which are hard to change or require longer-term planning. The concern is that if inflation becomes entrenched in these sticky prices it can be much harder to wring out of the system later on.

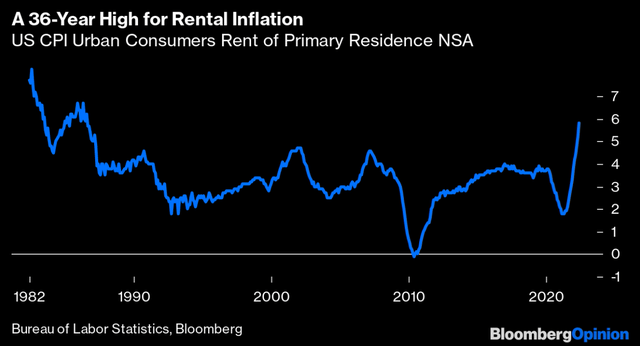

Finally, rental inflation, which makes up a third of the CPI, has begun to rise as well. The fact that this driver only shows up with a lag since it only looks at all the leases outstanding (rather than only the recently signed) suggests it will continue to keep inflation elevated, all else equal, for some time as older lower-priced leases fall out and are replaced by higher-cost ones.

There are two ways in which inflation can remain elevated over the medium term. One is that the Fed moderates its tightening path so long as it sees a clear peak in inflation and a steady, if incremental, slide lower. This dovish approach can allow inflation to remain elevated for a longer period of time even as it descends slowly to a more “normal” level. If this is true, inflation could remain closer to 3-4% over the longer term, requiring the Fed to keep short-term rates somewhat elevated as well, perhaps in the same 3-4% range.

The second way inflation can remain elevated is if it is not all that responsive to the Fed’s actions. A big chunk of the recent inflation rise is due to supply chain disruptions and the European conflict pushing up food and energy prices. Clearly, the Fed is not well placed to address either one of these major factors so it may be left pushing on a string in its attempt to bring inflation lower. A drop in aggregate demand may have some effect, clearly, but it might not be nearly enough to push inflation decisively lower. In this more hawkish scenario the Fed’s policy rate could remain in the 3-5% range.

Some Ideas

Typical recommendations for an inflationary market environment are commodities and real estate securities. And it’s true that these sectors can take advantage of rising prices. However, this upside comes with a certain downside which is that this pair of sectors are highly cyclical as well and they depend on a robust macro environment.

For instance, it’s no coincidence that, despite an upside surprise in the headline CPI over June, WTI (and MLPs) have fallen by 20% over the last 4 weeks. REITs have fallen by about the same amount from their April peak. The reason, in our view, is that investors have begun to price in a high probability of recession which can be a much bigger driver of these securities than what is happening to inflation.

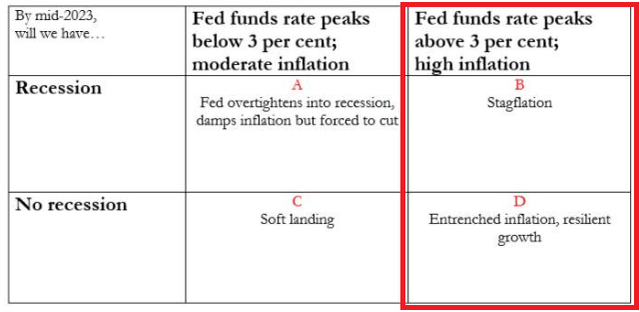

What this suggests is that investors should diversify their inflation exposure. At the very least they should consider two inflationary scenarios – B and D in the All-Weather matrix below which span both weak and strong macroeconomic scenarios.

We have to admit upfront what we don’t know in the scenario inflation remains above consensus levels. We don’t know exactly where the Fed Funds rate will be, we don’t know exactly where longer-term rates will be and we don’t know where the broader macro picture will be.

That said, it’s fair to say that the short-term rates are more likely to remain elevated given the Fed’s desire to remain credible. There is less we can say about longer-term rates and the broader economy. If that’s right then it makes sense to tilt to securities that can benefit from higher short-term rates or those that boast a very low duration level and won’t be harmed by longer-term rates that could be all over the place. It also makes sense to diversify across the quality spectrum from higher to lower-quality securities given the uncertainty about the macro picture in a period of elevated inflation.

The following list of securities is worth highlighting in the scenario where inflation remains elevated and above the current consensus.

The Janus Henderson B-BBB CLO ETF (JBBB) allocates primarily to investment-grade rated CLO tranches. It has a low distribution yield but a 4.3% SEC yield which will increase further as short-term rates continue to rise in line with Fed’s hikes. Historically, investment-grade rated CLOs have been highly resilient to defaults owing to significant protections baked into the CLO structure (particularly the post-GFC 2.0 structure).

Short-dated high-yield corporate bonds have been relatively resilient this year. A fund like the SPDR Barclays Capital Short Term High Yield Bond ETF (SJNK) is more sensitive to macro-economic conditions and corporate health. That said, it’s going to behave like a lower-beta asset whatever happens to interest rates or credit spreads than the more typical high-yield corporate funds. The 9.3% portfolio yield-to-worst of the fund (its distribution rate is below this level) is also quite attractive and provides a significant margin of safety in case the macro picture worsens.

The Western Asset Mortgage Opportunity Fund (DMO) is a CEF focused primarily on the non-agency mortgage sector. It also boasts primarily floating-rate exposure which will allow it to benefit from rising short-term rates, particularly if they remain elevated over the medium term. The fund trades at a 10.2% current yield.

In the preferreds space we like higher-quality bank and high-coverage mortgage REIT preferreds. We like the investment-grade rated PNC Financial Group Series P (PNC.PP) which has a 3-month Libor + 4.0675% coupon and trades right near $25. With Libor currently at 2.5% this translates to a 6.56% yield on an investment-grade security which will likely grow to 7.5% as short-term rates rise toward 3.5%.

In the mREIT space, the New Residential Investment Corp Series D (NRZ.PD) trades at a 8.41% current yield which will rise to 11.1% on its first call date in 2026 (when it switches to a 5Y Treasury yield + 6.22% coupon) if the 5Y Treasury yield remains at its current 3.06% level. The side benefit is that the book value of NRZ will likely rise if interest rates move higher (as it did in Q1), further improving the relatively high 5.5x asset coverage of the preferred.

Takeaways

It’s impossible to know where inflation will be over the next few years. However, the risk that inflation remains higher than what’s priced into markets is fairly high in our view and something that investors should take into account when constructing their income portfolio. In our view, a combination of securities that can remain resilient and even benefit from elevated inflation are worth holding.

Be the first to comment