Otter Tail Corporation (NASDAQ:OTTR) is a regulated electric utility serving customers in Minnesota and both of the Dakotas. The utility sector is generally a favorite among conservative investors such as retirees due to its general stability through any sort of macroeconomic environment. Otter Tail Corporation is something of an oddity among utilities though since the company also has a manufacturing arm. This manufacturing arm proved to be something of a liability for the company during the pandemic because the shut downs had quite an adverse effect on the businesses that comprise this area. They have since recovered in a very big way, however, and today the corporation’s performance is largely back to normal. In fact, the company’s most recent results show considerable growth compared to 2020, which is largely what I predicted in my last article on the company. Otter Tail is positioned to continue to deliver growth over the coming years and when we combine this with a very reasonable valuation, it might be worth considering for your portfolio.

About Otter Tail Corporation

As stated in the introduction, Otter Tail Corporation is primarily a regulated electric utility serving customers in parts of Minnesota and the Dakotas:

Otter Tail Investor Presentation

The company also has a few materials manufacturing businesses that will be discussed later in this report. However, since 70% of the company’s profits come from the electric utility, it should be largely thought of in this way. This is a fortunate thing for a certain type of investor because utility companies tend to enjoy remarkably stable finances over time and through any economic conditions. This is because utilities provide a product that is generally considered to be a necessity for our modern way of life. As a result, people will typically prioritize paying their utility bills ahead of other more discretionary expenses during times when money gets tight. This was especially helpful during the events of 2020 as utilities like Otter Tail Corporation were able to weather through the economic calamities of that year much better than companies in numerous other industries.

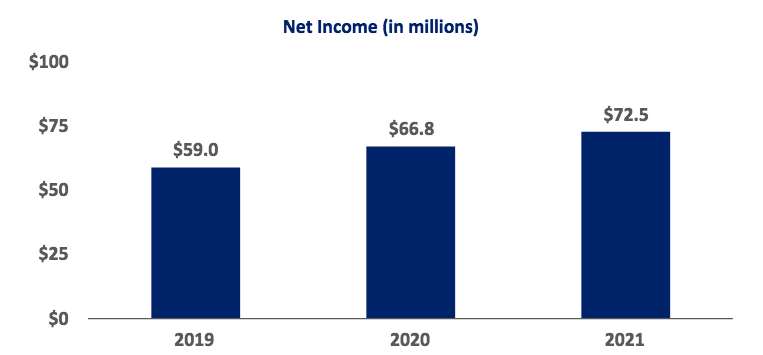

Another defining characteristic of utilities is that they typically deliver slow but steady growth. Otter Tail has not been an exception to this as it has grown the net income from its utility operations during each of the past three years:

Otter Tail Investor Presentation

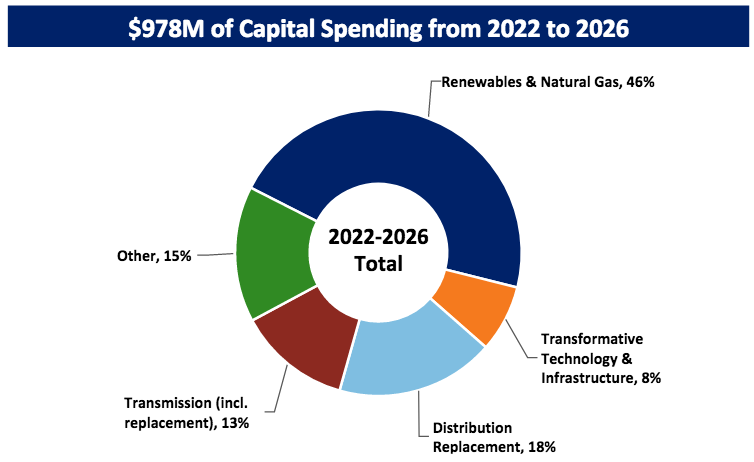

This is due to the fact that these companies are constantly growing their rate bases. The rate base is the value of the utility’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to its value allows the company to increase the prices that it charges its customers in order to earn that rate of return. The usual way that a utility increases its rate base is by investing money into upgrading, modernizing, and even expanding its utility infrastructure. This is exactly what Otter Tail Corporation has been doing, a trend that it intends to continue going forward. Over the 2022 to 2026 period, the company plans to invest $978 million into growing its rate base:

Otter Tail Investor Presentation

This should have the effect of growing the company’s rate base at a 5.9% compound annual growth rate over the period, taking it from $1.58 billion today to $2.10 billion by the end of 2026. As some astute readers may point out, this is a lower value increase than the amount of money that the company is investing. There are two reasons for this. The first reason is that some of the company’s spending is earmarked for the purchase of items that will replace assets being taken out of service. In particular, Otter Tail is expecting to shut down the Hoot Lake Coal Plant in the near future. Once this plant is retired, its value will be immediately removed from the company’s rate base, which will naturally offset some of the spending impacts. The second reason why the rate base growth will not be as great as the amount of money that the company is investing in it is depreciation. Basically, the value of the company’s assets is always decreasing so something that it buys in 2022 at the start of this investment program will be worth far less in 2026. In short, the company’s rate base would gradually decline if the company is not constantly investing money into it. While this does provide some tax benefits, it also, unfortunately, offsets some of the company’s spending, forcing it to invest more than it otherwise would. The company has guided for midpoint earnings per share of $1.83 from its electric utility operation in 2022, which would be a 5.78% increase over the figure that it had in 2021. However, since 30% of the corporation’s profits come from other sources, we should not project an investment return based solely on this figure.

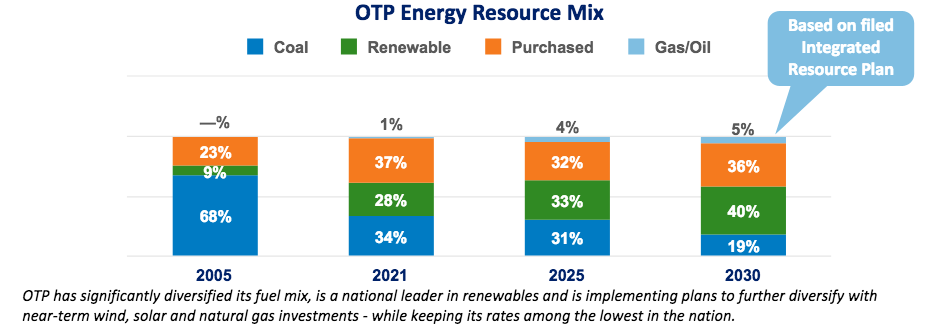

One area where Otter Tail is investing heavily in is the development and deployment of renewables, as we can see in the chart above. This is an area in which many electric utilities are investing, which is largely due to the demands of regulators and customers. However, Otter Tail is not being as aggressive about its sustainability goals as some of its peers. As I have noted in a few recent articles, there are several utilities that have stated their intentions to retire all of their remaining operational coal power plants by 2025. This is largely due to the fact that coal power, in general, is much more heavily polluting than any other method of generating electricity. Otter Tail, meanwhile, is only planning to reduce the proportion of its electricity that is generated by coal but not remove it entirely in the near term. Indeed, by 2030, the company expects 19% of its electricity to come from coal as compared to 34% today:

Otter Tail Investor Presentation

Unfortunately, this may cause Otter Tail to underperform some of the other electric utilities in the industry. This is because it will not have the advantage of support from the various environmental, social, and governance funds that have sprung up over the past few years. These funds ostensibly invest in those companies that have an emphasis on sustainability and diversity in their business models, which would generally mean those electric utilities with a heavy reliance on renewables at the expense of coal. As I discussed in a recent article, the popularity of these funds has grown to the point where they now control 10% of all worldwide mutual fund assets. This is more than enough money to push up the stock price of any utility and it seems far more likely that these funds would opt to invest in one of Otter Tail’s peers that is not utilizing coal rather than Otter Tail. Ultimately, this could cause Otter Tail to underperform some of its peers.

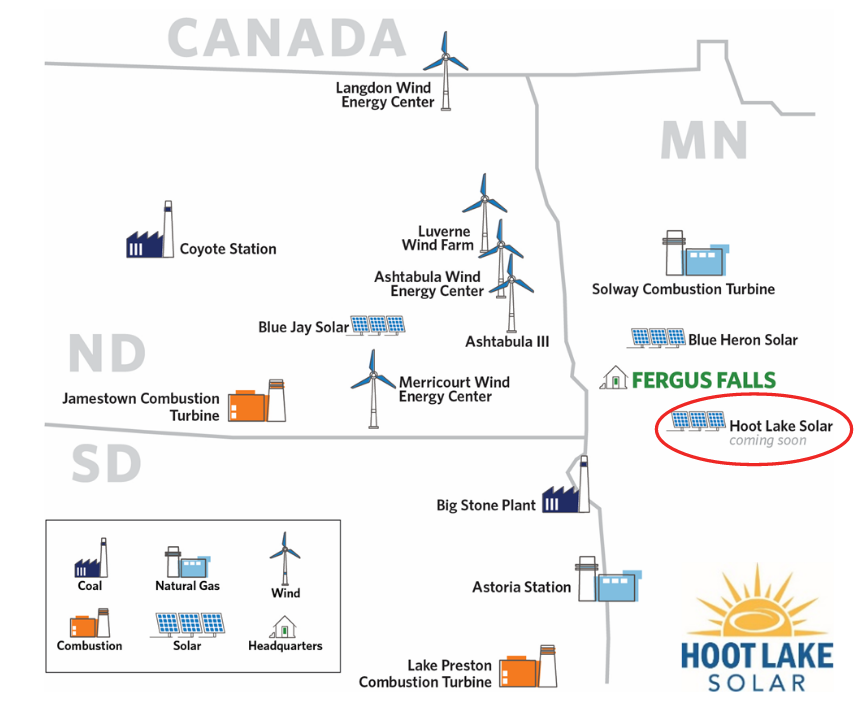

Otter Tail is certainly not without a portfolio of renewable projects, however. One of the company’s current projects is the Hoot Lake Solar Plant, which it is constructing near Fergus Falls, Minnesota:

Otter Tail Investor Presentation

The Hoot Lake Solar Plant is capable of generating 49.9 megawatts of electricity at full capacity, which is admittedly nowhere close to what a fossil fuel-driven plant could produce but at least it is still something. This facility is expected to come online in 2023 and it will help offset some of the lost generation capacity from the retirement of the Hoot Lake Coal Plant.

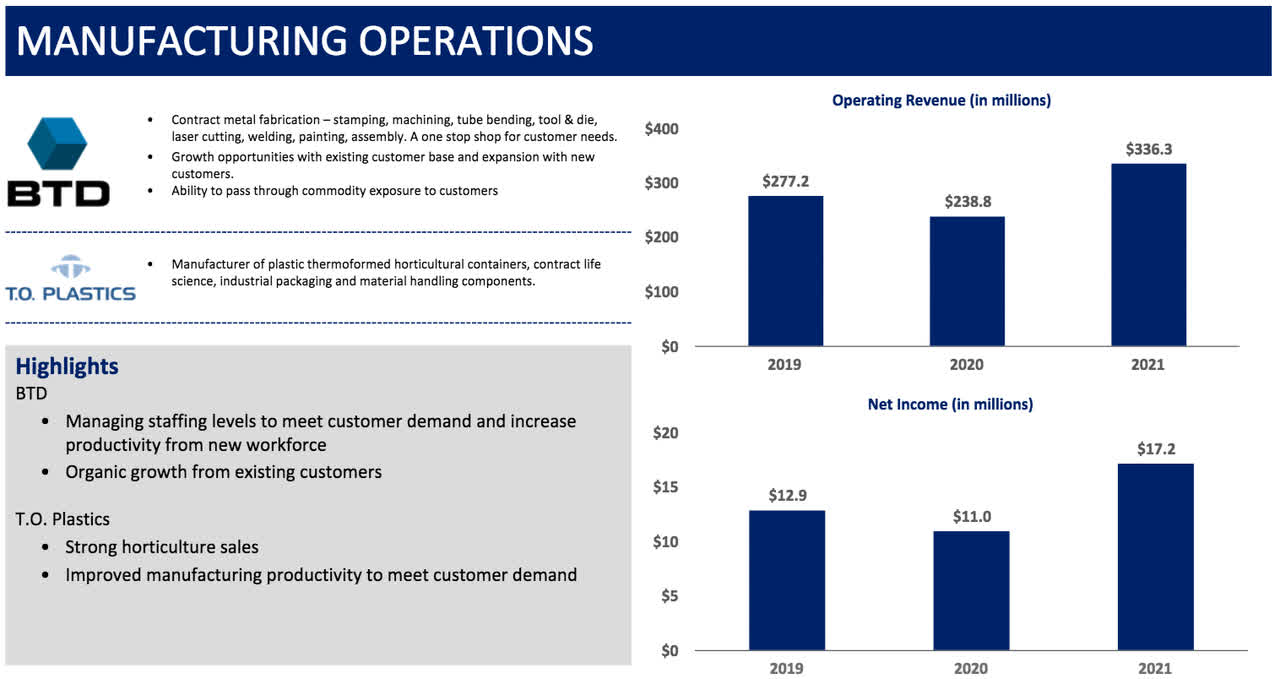

As stated earlier, about 30% of Otter Tail’s profits come from its various manufacturing businesses. These businesses primarily manufacture things such as customized plastic items such as containers for various horticultural products as well as commodity items such as PVC pipes. One of the nice things about many of these products is that the demand for them is somewhat recession-resistant, which allowed the corporation’s manufacturing arm to hold up reasonably well through the coronavirus lockdowns and the following recession. This is certainly not to say that they performed perfectly though as the company’s metal-stamping business did see revenue and net income decline in 2020 compared to 2019. However, it has since recovered and the 2021 numbers came in much better than either 2019 or 2020:

Otter Tail Investor Presentation

This is certainly a good sign, particularly since the demand for these products is unlikely to go away. As such, the company’s manufacturing unit could prove to be a further avenue of growth for Otter Tail Corporation going forward.

Fundamentals Of Electricity

As approximately 70% of Otter Tail’s profits come from its electric utility, we should take a look at the fundamentals of these companies. Electric utilities, in general, have been in the investment media an abnormally large amount lately, which is probably due to the electrification trend. This is something that has been very heavily promoted by politicians and progressive futurists and it refers to the conversion of things that are traditionally powered by fossil fuels to the use of electricity instead. The most commonly cited targets for conversion are transportation (electric cars) and space heating but there are certainly other things that could be converted as well. Naturally, as this trend progresses, it can be expected to substantially increase the consumption of electricity and by extension the revenues and profits of electric utilities.

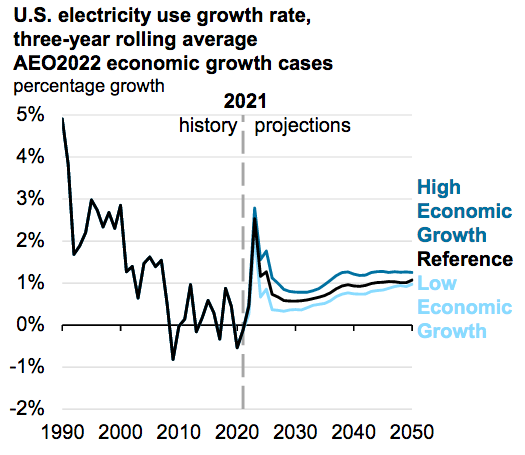

Unfortunately, the U.S. Energy Information Administration does not believe that this trend will progress anywhere near as quickly as its proponents expect. According to the government agency, the national consumption of electricity will increase at a 1% to 2% rate over the next thirty years:

U.S. EIA 2022 Annual Energy Outlook

This is nowhere close to the growth rate that would result were wide swathes of the economy converting from fossil fuels to electricity. Indeed, I discussed the impact that electric cars alone would have in a recent article. The agency is most likely correct that the conversion to an all-electric economy will be a very slow process since building out the electric grid to the point where it can actually support the widespread use of electricity to the degree that the proponents of electrification desire is extremely cost-prohibitive. Thus, it appears that electric utilities such as Otter Tail will likely deliver the same slow and steady growth that they always have.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment into it. This is because debt is a riskier way to finance a company than equity because debt must be repaid. As few companies have sufficient cash to completely pay off their debt as it matures, this repayment is usually accomplished by issuing new debt and using the money from that issuance to pay off the maturing debt. Depending on the market conditions, this may result in the company’s interest costs increasing. In addition to this, the company must make regular payments on its debt if it is to remain solvent. Thus, a decline in cash flows could push it into financial distress if it has too much debt. Although utilities tend to enjoy remarkably stable cash flows, bankruptcies are certainly not unheard of in the sector.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. In addition, this ratio tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of December 31, 2021, Otter Tail Corporation had $873.1 million in net debt against $990.8 million in shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.88. This is a remarkably low ratio for an electric utility, as we can see here:

|

Company |

Net Debt-to-Equity Ratio |

|

Otter Tail Corporation |

0.88 |

|

NextEra Energy (NEE) |

1.19 |

|

Exelon Corporation (EXC) |

1.22 |

|

DTE Energy (DTE) |

2.09 |

|

CMS Energy (CMS) |

1.68 |

|

AES Corporation (AES) |

3.68 |

As we can see, Otter Tail Corporation is substantially less leveraged than its peers, which is probably due to the company’s manufacturing arm. This is because manufacturing is inherently a somewhat riskier activity than operating a utility so manufacturers are not able to support as much leverage. Either way though, we can clearly see that Otter Tail’s debt load should not pose a particularly outsized risk to investors.

Dividend Analysis

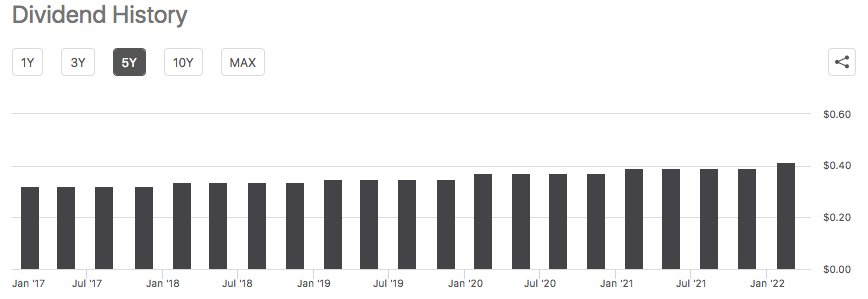

One of the biggest reasons why investors purchase shares of utility companies is because they typically have a higher dividend yield than companies in many other industries. This is due to the generally slow growth of the sector, which results in them returning a higher proportion of their total return in the form of direct payments to investors than companies in many other sectors. Otter Tail Corporation is certainly no exception to this as the company yields 2.70% at the current stock price, which is quite a bit higher than the 1.31% yield on the S&P 500 index (SPY). As is also often the case with utilities, Otter Tail Corporation has a long history of steadily raising its dividend over time:

Seeking Alpha

This history of dividend increases is something that is quite attractive, particularly in today’s inflationary environment. This is because inflation is constantly reducing the number of things that we can purchase with the dividend. As such then, the fact that the company is giving us a larger amount of money every year helps to offset this effect and maintain the purchasing power of the dividend in the face of rising prices. Naturally, though, it is always critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to reverse course and cut the dividend since that would both reduce our incomes and likely cause the share price to decline.

The usual way that we analyze a company’s ability to pay its dividend is by looking at its free cash flow. The free cash flow is the amount of money that is generated by the company’s ordinary operations that is left over after it pays all its bills and makes all necessary capital expenditures. This is the money that is available to do things such as reduce debt, buy back stock, or pay a dividend. In the fourth quarter of 2021, Otter Tail Corporation had a negative levered free cash flow of $6.3 million. This is obviously not enough to pay any dividend, let alone the $16.2 million that the company actually paid out.

However, it is fairly common for utilities to finance their capital expenditures through the issuance of debt and equity and pay their dividend out of operating cash flow. This is mostly due to the incredibly high cost of constructing and maintaining utility-grade infrastructure over a wide geographic area. During the fourth quarter, Otter Tail Corporation had an operating cash flow of $76.5 million. This is easily enough to cover the company’s dividend with money left over for other purposes. Overall then, it does appear that Otter Tail Corporation’s dividend is quite sustainable. There does not appear to be anything to worry about here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return off that asset. In the case of a utility like Otter Tail Corporation, one way that we can value it is by looking at the forward price-to-earnings ratio. This tells us how much we are paying today for each dollar of earnings that the company will generate over the next year. Overall, the lower the number, the better the value that the stock currently has. Thus, when we compare the stock to that of the peer companies, the company with the lowest forward price-to-earnings could represent the best value.

According to Zacks Investment Research, Otter Tail Corporation currently has a forward price-to-earnings ratio of 15.63. Here is how that compares to the company’s peer group:

|

Company |

Forward Price-to-Earnings |

|

Otter Tail Corporation |

15.63 |

|

NextEra Energy |

29.54 |

|

Exelon Corporation |

17.76 |

|

DTE Energy |

21.23 |

|

CMS Energy |

23.02 |

|

AES Corporation |

14.58 |

As we can see here, Otter Tail Corporation appears to offer a more attractive valuation than any of its peers except for AES Corporation. However, as we saw earlier in our discussion about the company’s financial structure, AES has a substantially higher debt load so it is likely cheaper for a very good reason. Thus, we can conclude that Otter Tail is fairly attractively valued relative to its peers.

Conclusion

In conclusion, Otter Tail is a somewhat unique electric utility in that it derives a significant proportion of its profits from activities other than utility operations. The company still has the same qualities that investors tend to appreciate with utilities, however, particularly their stable cash flows. When we combine this with the company’s very solid balance sheet and its attractive valuation, we can see that the company has a great deal to offer. Overall, investors may want to consider this company for their portfolios.

Be the first to comment