ArtistGNDphotography

Otter Tail Corporation (NASDAQ:NASDAQ:OTTR) is an electric utility operating primarily in rural Minnesota and the surrounding states. However, it is without a doubt one of the more unique utilities in the market as it derives a relatively substantial proportion of its cash flows from a variety of manufacturing businesses. This makes it a bit less stable financially than most other utilities but also provides it with a few opportunities that many of its peers do not possess. These ancillary businesses helped the company significantly during the second quarter of 2022 as the company’s revenue and net income surged substantially year-over-year due to the contributions of these operations. Otter Tail Corporation boasts more than just impressive growth potential however as the firm also has a reasonably attractive 2.26% dividend yield and one of the strongest balance sheets in the industry. When we combine this with a very attractive valuation, there may be some reasons to consider adding Otter Tail to your portfolio today.

About Otter Tail Corporation

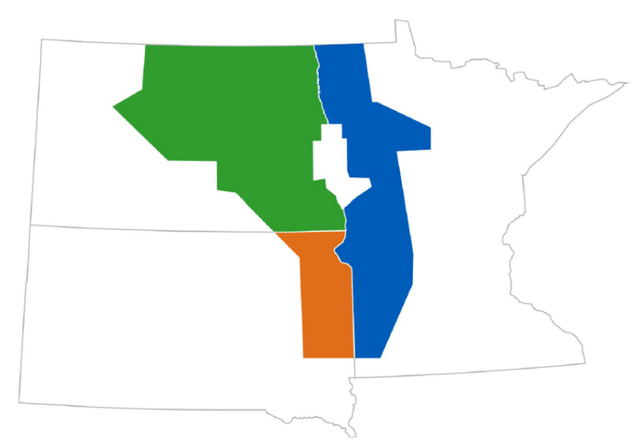

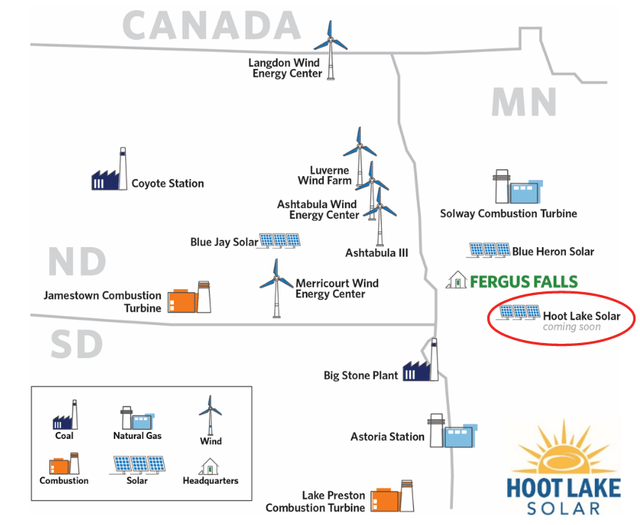

As stated in the introduction, Otter Tail Corporation is primarily a regulated electric utility that operates in Western Minnesota and the eastern parts of the Dakotas:

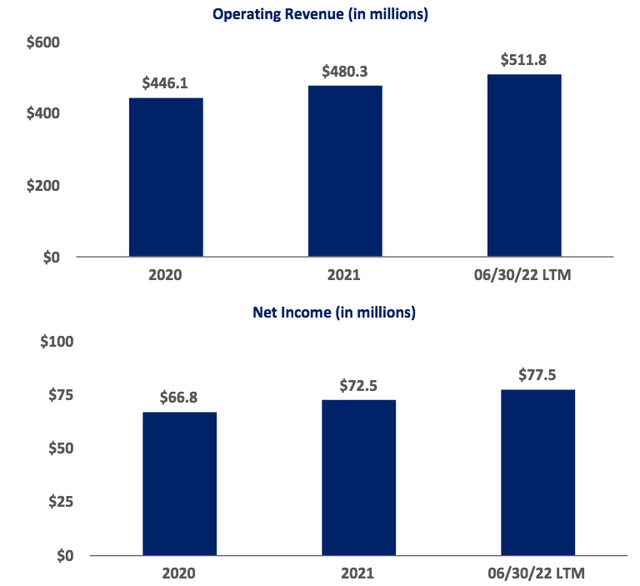

This is primarily a rural area so the company does not have a particularly large customer base considering the size of the geographic area that it covers, although Otter Tail has not actually been disclosing the customer numbers in recent quarters. This has not prevented it from having many of the characteristics that we typically appreciate in electric utilities, though. The most important of these characteristics is that the company enjoys remarkably stable cash flows. This makes a great deal of sense. After all, electricity is generally considered to be a necessity for our modern way of life so people will generally prioritize paying their electric bills ahead of other discretionary expenses during times when money gets tight. This is something that tends to happen during recessions and as the United States has now experienced two consecutive quarters of declines in gross domestic product, it is technically in a recession. We certainly see some of that stability reflected in Otter Tail’s second-quarter 2022 earnings results. As we can see here, the electric utility’s revenue and net income have been steadily growing over time on a trailing twelve-month basis:

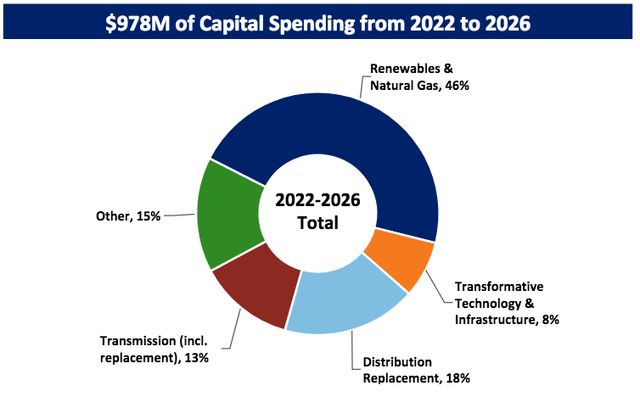

This general growth over time is something that Otter Tail shares with just about any other utility in the sector. The biggest reason for this is that the company has been steadily growing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to adjust the prices that it charges its customers in order to earn that rate of return. The usual way that a utility grows its rate base is by spending money on upgrading, modernizing, or possibly even expanding its utility-grade infrastructure. Otter Tail Corporation is planning to do exactly this as the company intends to spend $978 million over the 2022 to 2026 period on growing its rate base:

This should have the effect of growing the company’s rate base at a 5.9% compound annual growth rate over the period. There is no guarantee that the utility’s earnings per share will grow at the same rate, however. This is because Otter Tail will need to finance this spending program somehow and this could include issuing common stock, which would offset some of the earnings per share growth that would otherwise result from this. It is still quite nice to see that the company is not resting on its laurels and is indeed working towards growth. With that said, the electric utility has historically grown its earnings per share at an 8.8% compound annual growth rate so if 5.9% is now all that it can accomplish, it is very disappointing.

One of the areas in which Otter Tail is investing heavily is renewable power generation. This is probably not a huge surprise as most electric utilities in the United States are attempting to increase the proportion of their energy mix that comes from renewables. As with most of its peers, the two types of renewables that the company is currently focusing its efforts on are wind and solar, which actually work pretty well in the area in which Otter Tail operates since the land is relatively flat with few trees to obstruct the wind. This makes it much easier for wind farms to work effectively compared to placing the turbines in a mountainous or forested area. One of the most significant projects that Otter Tail is currently working on is the Hoot Lake Solar plant, which is being constructed in the city of Fergus Falls, Minnesota:

When complete, this plant will be capable of generating 49 megawatts of electricity, which admittedly is not an especially large plant but Otter Tail also does not have an exceptionally large customer base to support. The plant is expected to cost about $60 million to construct and is expected to be completed sometime in 2023. Otter Tail appears to want to develop more solar facilities going forward, although the company has not announced the development of any further projects. It has stated that it wants to add a total of 150 megawatts of solar capacity within its footprint over the next five years though, which reinforces this conclusion. This will require the construction of at least two more plants that are the same size as Hoot Lake Solar, which partly explains why 46% of the company’s planned capital spending over the period is devoted to the construction of renewable and natural gas power plants.

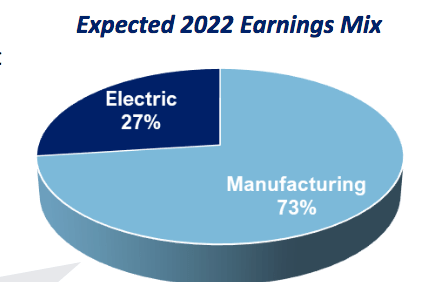

As I mentioned in my last article on Otter Tail Corporation, the company’s electric utility business typically accounts for the majority of its profits. The second quarter of 2022 was a notable exception to this. In fact, the company currently expects the electric utility to account for only 27% of its full-year 2022 earnings:

Otter Tail Corporation

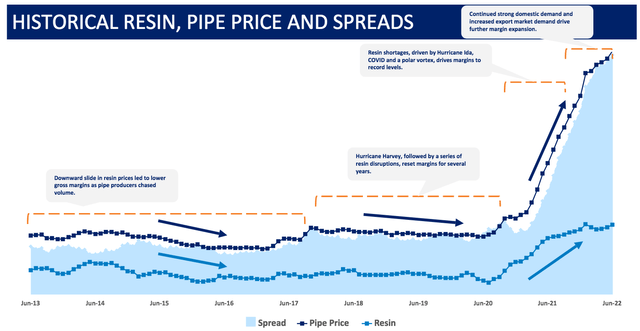

This performance came from the incredibly high prices and demand for plastics and steel during the quarter, which the company’s manufacturing businesses were able to pass on to the customers. As we can see here, the market price of resins and PVC pipe, which are two of the main products that Otter Tail manufactures, has been very strongly appreciating over the past two years, a trend that continued in the second quarter:

This is expected to continue in the near term, which is why Otter Tail’s management is currently expecting the manufacturing arm to generate the overwhelming majority of the company’s profits this year. However, eventually, the market will calm down and stabilize as the electric utility can be expected to generate about 60% of the company’s profits over the long term.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid at maturity. This is typically accomplished by issuing new debt to repay the existing debt. This can cause the company’s interest costs to increase following the rollover depending on the conditions in the market. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, a decline in cash flows could push a company into insolvency if it has too much debt. Historically, Otter Tail Corporation has had very stable cash flows but it is possible for any company to go bankrupt so we should not ignore this risk.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity can cover its distributions in the event of bankruptcy or liquidation, which is arguably more important. As of June 30, 2022, Otter Tail Corporation had a net debt of $791.7 million compared to $1.1160 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.71, which is one of the lowest ratios in the industry. We can clearly see this by comparing the company’s ratio against its peers:

| Company | Net Debt-to-Equity Ratio |

| Otter Tail Corporation | 0.71 |

| DTE Energy (DTE) | 2.23 |

| Eversource Energy (ES) | 1.41 |

| Entergy Corporation (ETR) | 2.18 |

| OGE Energy Corp. (OGE) | 1.17 |

This chart confirms the statement that Otter Tail Corporation does indeed have one of the strongest balance sheets in the industry as it has very minimal debt. This may be due to the company’s manufacturing arm, which generally is not as stable as its utility business and so cannot support as high a debt load. This does not overall change the fact that there should be a minimal risk with regard to the company’s leverage, though, as it does not appear to be using an outsized amount of debt.

Dividend Analysis

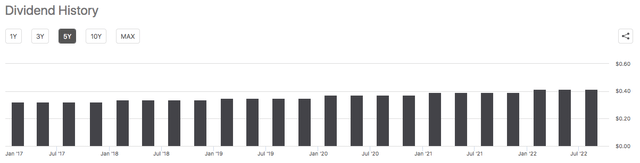

As stated in the introduction, one of the attractive things about Otter Tail is that it has a reasonable dividend. As of the time of writing, the stock yields 2.26%, which is quite a bit higher than the 1.53% yield of the S&P 500 index (SPY). As is the case with most utilities, Otter Tail also has a history of raising its dividend on an annual basis:

A history of dividend growth is very nice to see during inflationary periods, such as the one that we are experiencing in the United States. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays us. As a result, it can feel as though we are getting poorer and poorer. The fact that Otter Tail increases its dividend annually helps to offset this effect since the higher amount of money allows us to purchase the same items with the dividend over time. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to suddenly be forced to reverse course and cut the dividend since that would reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. Free cash flow is the money that was generated by the company’s ordinary operations that is left over after the firm pays all its bills and makes all necessary capital expenditures. This is therefore the money that is available to reduce debt, buy back stock, or pay a dividend. During the second quarter of 2022, Otter Tail reported a levered free cash flow of $57.0 million but only paid out $17.2 million in dividends to its investors. This is certainly a good sign as it indicates that the company is generating substantially more than it needs. While this may only be a temporary situation due to the strength of the manufacturing operation, it still allows the company to stockpile money to help it weather tougher times. Overall, this dividend appears to be quite safe.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a company like Otter Tail, one way that we can value it is by looking at the forward price-to-earnings ratio. This ratio tells us how much we are paying for each dollar of earnings that the company is expected to generate over the next year. As a general rule, a lower number indicates a more attractive valuation.

According to Zacks Investment Research, Otter Tail has a forward price-to-earnings ratio of 10.67 at the current market price of $73.15 based on expected earnings of $7.05 per share for the current year. Here is how that compares to the company’s peer group:

| Company | Forward P/E Ratio |

| Otter Tail Corporation | 10.67 |

| DTE Energy | 22.60 |

| Eversource Energy | 22.50 |

| Entergy Corporation | 19.13 |

| OGE Energy Corp. | 19.57 |

(all figures courtesy of Zacks Investment Research)

This is quite interesting. We can see that the company’s peers all generally appear to be relatively in line with each other but Otter Tail appears to be remarkably cheap. This is likely because the company’s earnings are currently being driven by incredibly strong margins in its manufacturing arm, which are expected to be temporary. Otter Tail is expected to earn $4.27 per share next year, which would give it a price-to-earnings ratio of 17.13 for that year. This is closer to its peers but still cheaper than all of them. I will admit that I somewhat doubt that the supply shortage that is currently responsible for the incredibly high prices for steel and plastic will end that quickly but even if it does, Otter Tail appears to be very attractively priced.

Conclusion

In conclusion, there appears to be a lot to recommend Otter Tail Corporation right now. The company’s manufacturing arm is currently providing it with a strength that no other utility has but yet it still has a very attractive valuation. Otter Tail also has a very clear path to growth by building out its traditional electric utility business and any investor should appreciate growth. When we combine this with a reasonable dividend yield, the company appears to be a worthy addition to a portfolio.

Be the first to comment