ssucsy/iStock Unreleased via Getty Images

Introduction

Montreal-based Osisko Gold Royalties (NYSE:OR) released the first quarter of 2022 results on May 12, 2022.

Important Note: I have followed OR quarterly since 2018 with 16 articles and counting. This new article is a quarterly update of my article published on January 26, 2022. All numbers indicated in this article are converted into US$

Osisko Gold Royalties owns 70% of Osisko Development Corp. As a result, the assets, liabilities, results of operations, and cash flows of the Company consolidate the activities of Osisko Development and its subsidiaries.

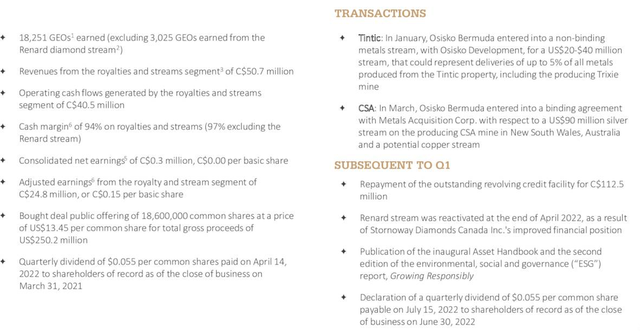

Also, After Bermuda development acquired 100% of Tintic Consolidated Metals LLC, Osisko Bermuda Ltd. entered a non-binding metals stream term sheet with a wholly-owned subsidiary of Osisko Development.

1 – 1Q22 Results snapshot

Net earnings attributable to Osisko’s shareholders were US$1.42 million or US$0.01 per share; adjusted earnings were US$18.22 million or $0.11 per basic share.

One negative element for shareholders is that the company initiated a bought deal of 18.6 million shares at $13.45 for $250.2 million.

OR 1Q22 Highlights (Osisko Gold Royalties)

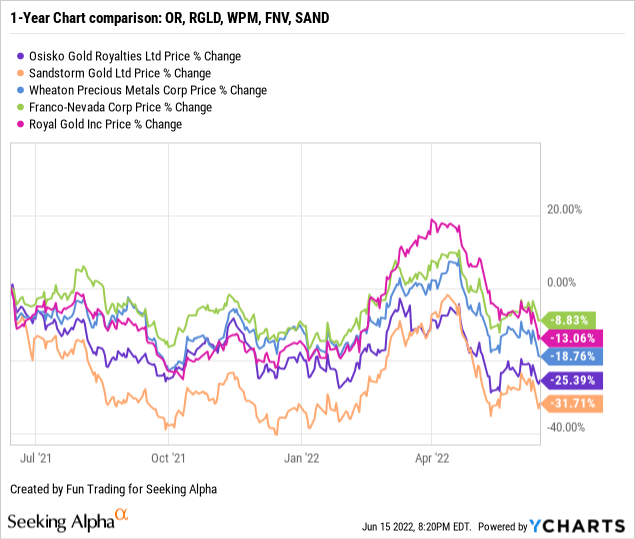

2 – Stock performance

Osisko Gold Royalties belongs to the five streamers I regularly cover on Seeking Alpha.

My long-term streamers are Wheaton Precious Metals (WPM) and Franco-Nevada (FNV). I consider the company a good alternative in the streamer segment, especially for those who want to trade the sector short term. We can compare OR positively with Sandstorm Gold (SAND).

OR is underperforming the group and is now down 25% yearly, beating only SAND.

Osisko Gold Royalties – Financials And Production In 1Q22 (in US$)

Note: Values can differ slightly due to the conversion from CAD to USD. Osisko Gold Royalties indicates CAD$ results with an exchange rate (CAD vs. USD) of 0.79 in 1Q22. It is what I applied to the table below.

| Osisko Gold Royalties | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Total Revenues (included off-take interest) in US$ Million | 53.24 | 46.85 | 39.49 | 39.59 | 46.92 |

| Net Income in US$ Million | 8.4 | -12.1 | 1.4 | -16.55 | 0.26 |

| EBITDA US$ Million | 25.1 | -2.8 | 13.7 | -9.95 | 16.76 |

| EPS diluted in US$/share | 0.05 | -0.07 | 0.01 | -0.10 | 0.00 |

| Operating cash flow in US$ Million | 17.0 | 25.3 | 32.4 | 9.98 | 18.65 |

| Capital Expenditure in US$ Million | 31.5 | 76.0 | 63.7 | 49.22 | 17.63 |

| Free Cash Flow in US$ Million | -14.5 | -50.7 | -31.3 | -39.24 | 1.02 |

| Total Cash US$ Million | 257.85 | 211.43 | 119.92 | 90.39 | 357.35 |

| Long-term Debt in US$ Million | 319.25 | 328.93 | 319.87 | 320.65 | 327.30 |

| Dividends per share are US$ | 0.038 | 0.038 | 0.038 | 0.044 | 0.044 |

| Shares outstanding (diluted) in Million | 167.17 | 167.90 | 168.22 | 167.15 | 185.9* |

| GEOs | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Estimated Production gold equivalent Oz Eq. | 19,960 | 20,178 | 20,032 | 19,830 | 18,251 |

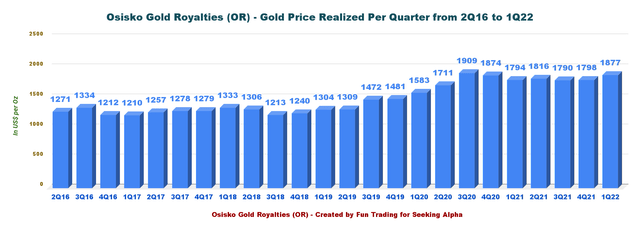

| Gold price realized in US$ per ounce | 1,794 | 1,816 | 1,790 | 1,798 | 1,877 |

| Silver price realized in $US per ounce | 26.26 | 27.00 | 24.00 | 23.51 | 24.01 |

Source: Company release. More data are available to subscribers only.

* Osisko Development closed private placements for aggregate gross proceeds of approximately $251 million during the quarter. To date, the company has received gross proceeds of $42.4 million. The remainder of the funds are held in escrow and will be released upon certain conditions, including completion of the listing of the common shares on the New York Stock Exchange and closing of the Tintic acquisition

Analysis: Revenues, Earnings Details, Free Cash Flow, Debt, And Production Details (in US$)

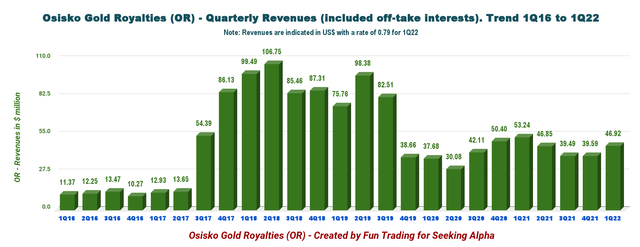

1 – Revenues were US$46.92 million in 1Q22 (including revenues from offtake interests).

OR Quarterly Revenues history (Fun Trading)

Osisko Gold Royalties posted revenues of US$46.92 million in the first quarter of 2022, down from US$53.24 million in the same quarter a year ago.

On a consolidated basis, net income for the first quarter was US$0.26 million, compared to US$8.40 million in the 1Q21. The adjusted earnings were US$17.2 million or US$0.12 per share.

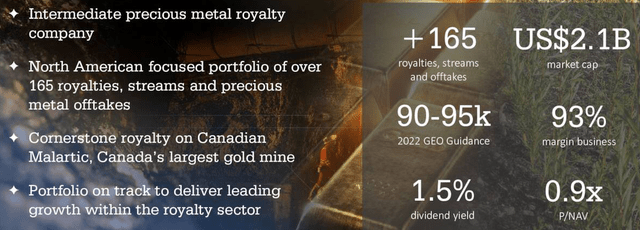

Cash operating margin was 94% from royalty and stream interests. The company owns over 165 royalties, streams, and offtakes.

OR 1Q22 important data Presentation (Fun Trading)

CEO Sandeep Singh said in the conference call:

So we continue to benefit from our business model with the highest cash margins in our history last quarter, obviously based on the gold price having been quite strong. The margin at 94%, again, continues to track exactly towards our guidance.

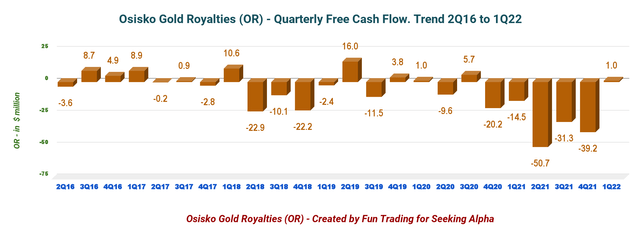

2 – Free cash flow was a loss of US$1.02 million in 1Q22

OR Quarterly Free cash flow history (Fun Trading)

Note: The generic free cash flow is the cash from operating activity minus Capex.

Free cash flow for the first quarter of 2022 was $1.02 million, with a trailing 12-month free cash flow loss of $120.23 million.

Osisko also announced a first-quarter 2022 dividend of C$0.05 or US$0.044 per common share. OR acquired in 1Q22 250K shares under the company’s NCIB program for C$ 4.9 million.

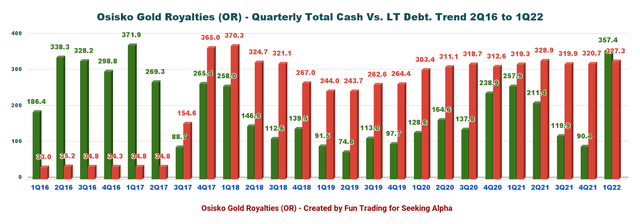

3 – No Net debt in 1Q22

OR Quarterly cash versus Debt history (Fun Trading)

No more Net debt this quarter, with a total cash position of $357.35 million and total debt of $327.30 million in 1Q22.

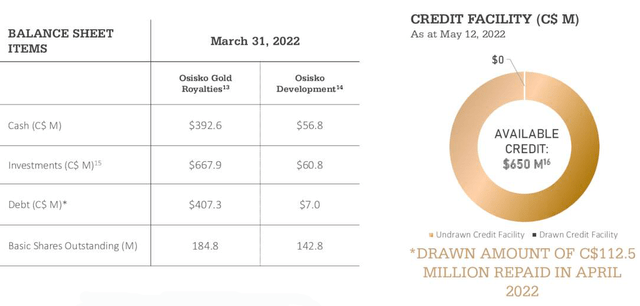

Below are the details (in CAN$):

OR Liquidity (Osisko Gold Royalty)

The massive increase in cash was due to the bought deal of 18.6 million shares sold at $13.45 for total proceeds of $250.2 million. The shares outstanding diluted are estimated at 185.9 million.

After 1Q22, OR repaid in full of the outstanding revolving credit facility in April 2022 for $112.5 million and has now a C$650 million in liquidity.

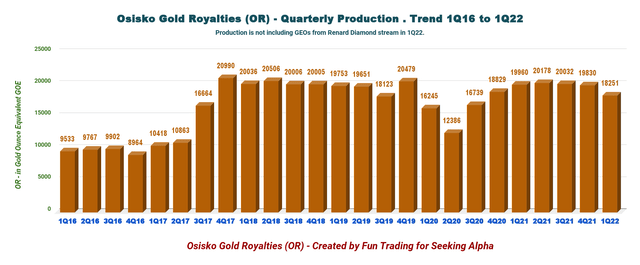

4 – Production in gold equivalent ounce and details

OR Quarterly Gold Equivalent History (Fun Trading)

Osisko Gold Royalties produced 18,251 GEOs (excluding 3,025 GEOs from Renard) in the first quarter of 2022, down 8.6% from 1Q21 and 8% sequentially.

Gold price increased this quarter to $1,877 per oz, and silver was $24.01 per ounce.

OR Quarterly gold price per GEO history (Fun Trading)

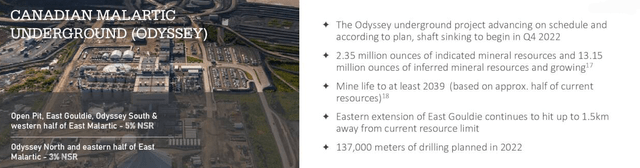

5 – Guidance 2022 and Odyssey project.

The company expects between 90K and 95K GEOs in 2022.

Also, at the Canadian Malartic underground, also called Odyssey, the shaft sinking is scheduled to begin in 4Q22.

OR: Odyssey project at Canadian Malartic 3% NRI (Osisko Gold Royalties)

Technical Analysis and Commentary

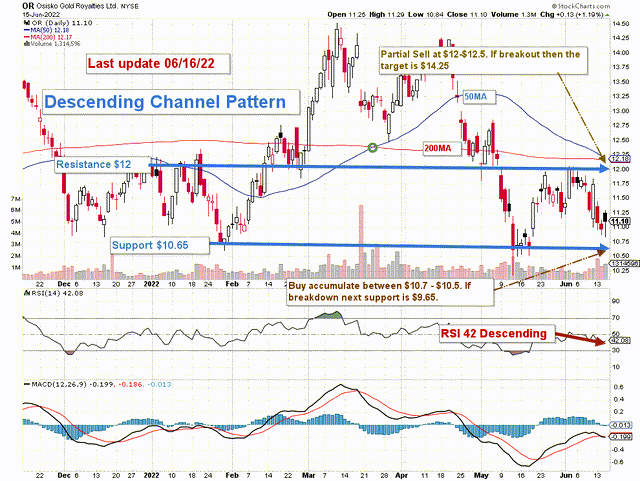

OR: TA Chart short-term (Fun Trading)

The stock OR forms a descending channel pattern with resistance at $12 and support at $10.65.

The short-term trading strategy is to trade LIFO about 60%-65% of your position. I suggest selling between $12 and $12.5 and waiting for a retracement below $10.65 to accumulate again with potential lower support at $9.50.

If the gold price loses momentum and crosses $1,800 per ounce, depending on the inflation threat, and after the FED hiked by 75-point this month, OR may break down and retest $9.50.

Conversely, if inflation gets more potent and the FED’s action is not producing the desired effect, the gold price could eventually strengthen and reach $1,900 per ounce. In this unlikely case, OR could reach $14.25.

Watch gold like a hawk.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long-term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote for support. Thanks.

Be the first to comment