Sundry Photography/iStock Editorial via Getty Images

Whether you like it or not, we live in a globalized world today. Not only that, but we also have a materialistic world. The combination of these two things has led to a significant demand for the transportation of goods, commodities, and more. As a result, a number of players have developed in the space and, right now, some of them seem to be trading at fundamentally attractive levels. One player that investors should be paying attention to that is fairly valued compared to similar firms but looks attractively priced on an absolute basis, is Knight-Swift Transportation Holdings (NYSE:KNX). Recent fundamental performance from the company has been particularly robust and the near-term outlook for shareholders is positive. Management is also actively engaged in share buybacks in an effort to add value to shareholders. But in recent months, shares of the company have taken a step back. In all, the company does appear to offer nice upside, leading me to rate it a ‘buy’ at this time.

The picture has gotten better… mostly

Back in November of 2021, I wrote an article that took a bullish stance on Knight-Swift Transportation. In that article, I called the company a solid opportunity for trucking fans. I acknowledged that the company had experienced a rocky operating history over the prior few years but that the 2021 fiscal year was really looking up for shareholders. I ultimately concluded that shares looked attractive on an absolute basis and were no worse than being fairly valued relative to similar firms. And that led me to rate the enterprise a ‘buy’. Since then, things have not gone precisely as planned. However, the company has outperformed the broader market, with shares falling by 10.1% compared to the 12.8% decline experienced by the S&P 500.

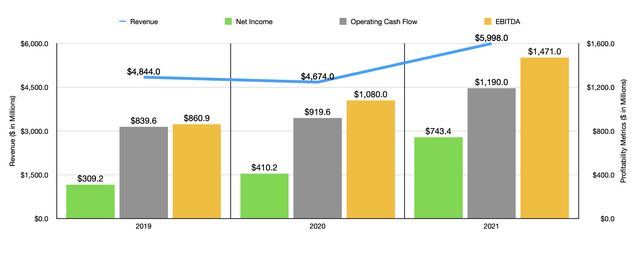

Author – SEC EDGAR Data

Although this return disparity is not terribly significant, it is positive and it underscores the quality of the business. To see what I mean about quality, we need only look at recent financial performance reported by management. For starters, let’s touch on how the company ended its 2021 fiscal year. For that year, revenue came in at just under $6 billion. That represented a 28.3% increase over the $4.67 billion generated in 2020. It was also the best single year in terms of revenue for the company throughout its entire history. Although the company did benefit from an 8.2% increase in revenue associated with its Truckload segment, the real driver of growth was a 117.4% rise in revenue associated with its Logistics segment. Revenue here jumped from $375.8 million to $817 million. This was driven by robust demand for the company’s services, with the load count transported by the company climbing 51.5% while revenue per load grew by 44.4%.

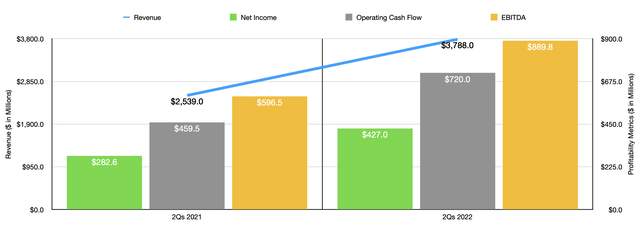

That growth for the company has continued into the 2022 fiscal year. Revenue in the first half of the year, for instance, came in strong at $3.79 billion. That’s 49.2% higher than the $2.54 billion generated the same time last year. The company experienced a lot of strength across the spectrum. But once again, the Logistics segment for the firm did much of the heavy lifting, with revenue skyrocketing 85.8% from $285.6 million to $530.7 million. Robust demand allowed the business to generate revenue per load of $2,471. That’s 18% above the $2,094 per load in revenue achieved the same time last year. Load count in this segment expanded by 60.9% despite the increase in pricing. Of course, as I mentioned already, other segments fared quite well. The Intermodal segment, for instance, saw revenue rise by 8.8%, while the Truckload segment reported a 16.4% rise even as total miles driven per tractor dropped by 8.1%.

Author – SEC EDGAR Data

The most important thing to remember about low-margin, asset-intensive businesses, is that a small positive impact in margin or a small increase in revenue relative to the size of the asset base, can be incredibly profitable for the business in question. Once again, the fundamentals tell the story. For the 2021 fiscal year, net income came in at $743.4 million. That’s significantly higher than the $410.2 million generated in 2020. Operating cash flow rose more modestly, climbing from $919.6 million to $1.19 billion, while EBITDA expanded from $1.08 billion to $1.47 billion. For the first half of the year, bottom line growth continued to be strong. Net income jumped from $282.6 million to $427.8 million. Operating cash flow expanded from $459.5 million to $720 million. And EBITDA for the company grew from $596.5 million to $889.8 million.

This rise in profitability has made management bullish when it comes to share buybacks. In April of this year, the company announced a new $350 million share buyback program. At the same time, they retired their previous $250 million plan, $207.2 million of which had already been spent. This year alone, the company has been particularly active in buying back stock, with 2.8 million shares, or $149.9 million, repurchased by the firm. More likely than not, the company will continue to buy back stock throughout the rest of this year. That’s because they have high expectations regarding the 2022 fiscal year as a whole. Earnings per share are now forecasted to be between $5.30 and $5.45. That compares to the prior expected range of $5.20 to $5.40. At the midpoint, this should translate to net income of $877 million. That’s 18% higher than what the company achieved last year. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that earnings should, we should anticipate operating cash flow of $1.40 billion and EBITDA of $1.74 billion.

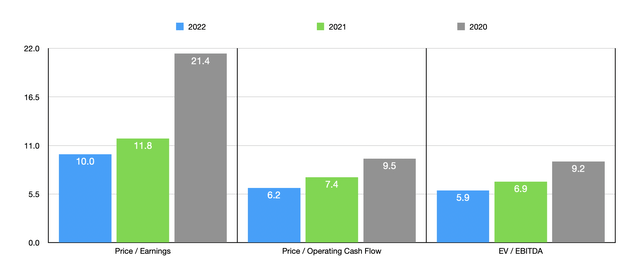

Author – SEC EDGAR Data

If these numbers come to fruition, then shares of the company look quite cheap. The firm would be trading at a forward price-to-earnings multiple of 10. The price to operating cash flow multiple is 6.2, while the EV to EBITDA multiple should come out to 5.9. Of course, investors would be wise to assume that current strong market conditions will not continue indefinitely. Between fears of a recession, higher inflation, and higher interest rates, not to mention the very real likelihood that supply chain constraints will eventually ease through overinvestment if nothing else impacts the supply situation first, these strong market conditions could eventually come to cease. The good news for investors, however, is that shares are attractive even if this comes to pass. If we were to use the firm’s 2021 results, for instance, its multiples should be 11.8, 7.4, and 6.9, respectively. Even if we go back to the 2020 fiscal year, shares do not look all that bad, with a price to operating cash flow multiple of 9.5 and an EV to EBITDA multiple of 9.2. The only way in which shares might be a bit lofty in this case is from the price-to-earnings perspective, with the company trading at a multiple of 21.4.

As part of my analysis, I compared the business to five similar firms. On a price-to-earnings basis, these companies range from a low of 5.6 to a high of 16.7. Using the EV to EBITDA approach, the range is between 3.5 and 9.4. In both of these cases, three of the five companies are cheaper than Knight-Swift Transportation. Using, instead, the price to operating cash flow approach, the range is between 2 and 12.2, with two of the five companies being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Knight-Swift Transportation Holdings | 10.0 | 6.2 | 5.9 |

| ArcBest Corporation (ARCB) | 6.9 | 5.6 | 3.8 |

| Yellow Corporation (YELL) | 4.4 | 6.6 | 4.2 |

| Ryder System (R) | 5.6 | 2.0 | 3.5 |

| Saia (SAIA) | 16.7 | 12.2 | 9.4 |

| TFI International (TFII) | 13.2 | 9.8 | 7.9 |

Takeaway

At this point in time, I understand why investors might be a bit concerned about the longer-term picture. Having said that, the company has done well over the past few years now and that picture looks set to continue through at least this year. Management continues to buy back stock and, even if the firm were to revert to levels seen back in 2020, I have a difficult time believing that there would be much, if any, real downside for shareholders. In the worst case, shares do look fairly valued compared to similar firms. All in all, I believe that this is worth keeping the ‘buy’ rating that I had on the company previously.

Be the first to comment