V2images

With the Chinese tech giant reporting Q2 earnings tomorrow, there is a mirror of a Q1 earnings surprise in store with a revenue beat. Growth in its core business, non-online marketing and cloud services saw particular strength last quarter and with expectations at $4.24B, a revenue beat could see a significant move in the share price.

Baidu’s (NASDAQ:BIDU) most macro recent bottoming was in March 2020 when the share price dropped to $82.01 which saw an initial but relatively small three wave pattern which propelled the stock to $353.86. Since then, it has made a bearish three wave pattern and not until now, has it shown signs of a bullish turn around.

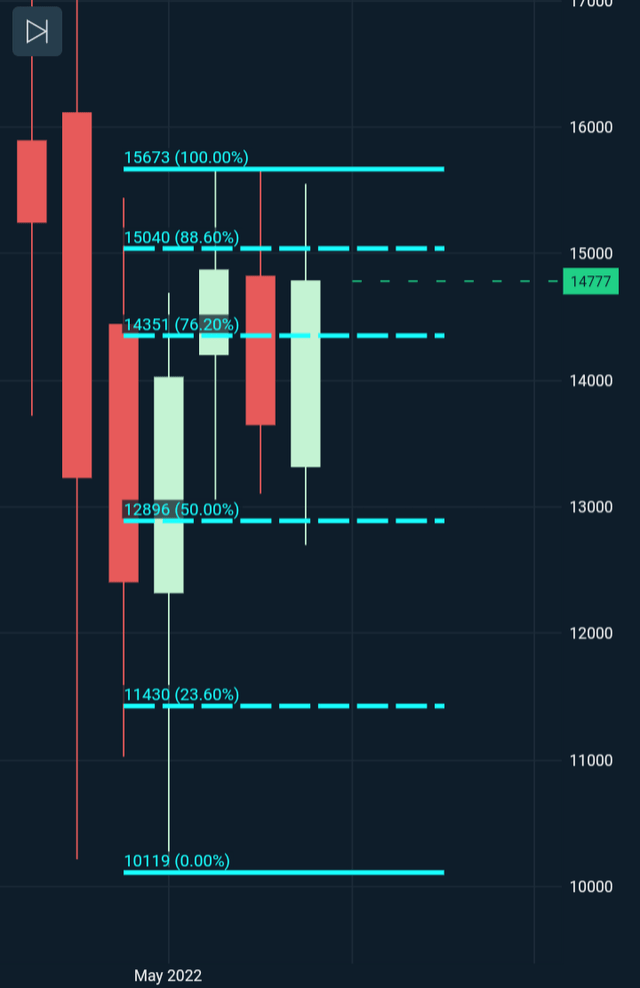

Now we can move to the monthly chart to examine the bounce of the May low which was formulated by a beat in expectations for Q1 earnings.

If we look at the monthly chart, we can see the low in this current structure at $101.62. A very bullish wick heavy bottoming candle saw a bounce upwards, followed by an additional bullish candle that has since topped out at $156.71. A bullish wave pattern should ideally consist of two to three candles that carry price upwards to make way for the rejection wave two. In this case we can see a clear bullish wave upwards along with the rejection wave two candle $156.67 – $ 131.08. This pattern can be perceived as a bullish wave one two structure but not until the third wave has driven price above the high of both of those candles can the wave three be confirmed.

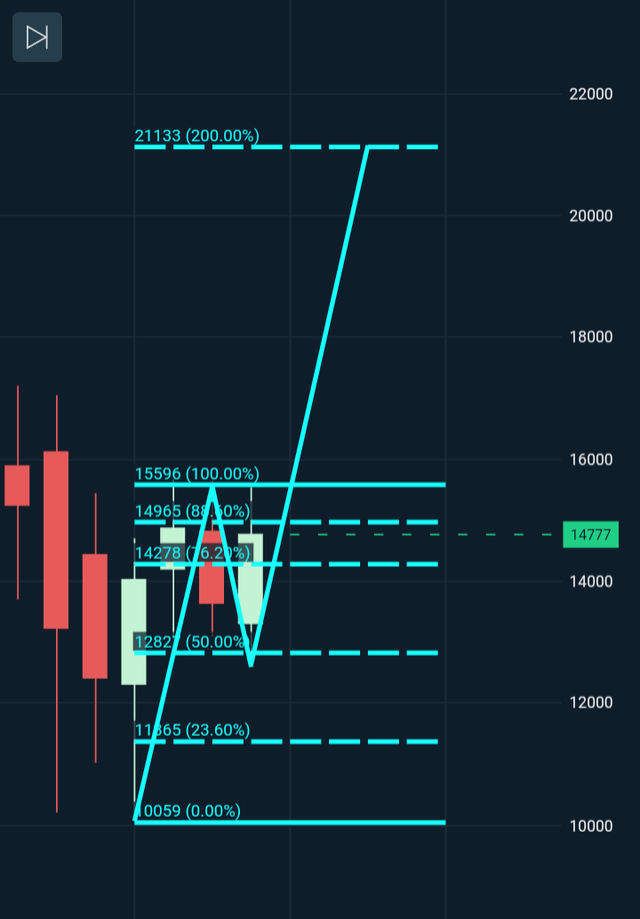

So where can this share price go if the third wave was to break out? We have evidence of the wave one $101-$156 so if we look at the third wave to numerically copy it, our target would be $201.00.

Below we can see the structure with target should the third wave break out above $156.

Last quarter’s earnings beat saw shares soar in May and this has resulted in the map of the current wave one and two being set out and tomorrow’s earnings could see a follow on with a third wave breakout upwards.

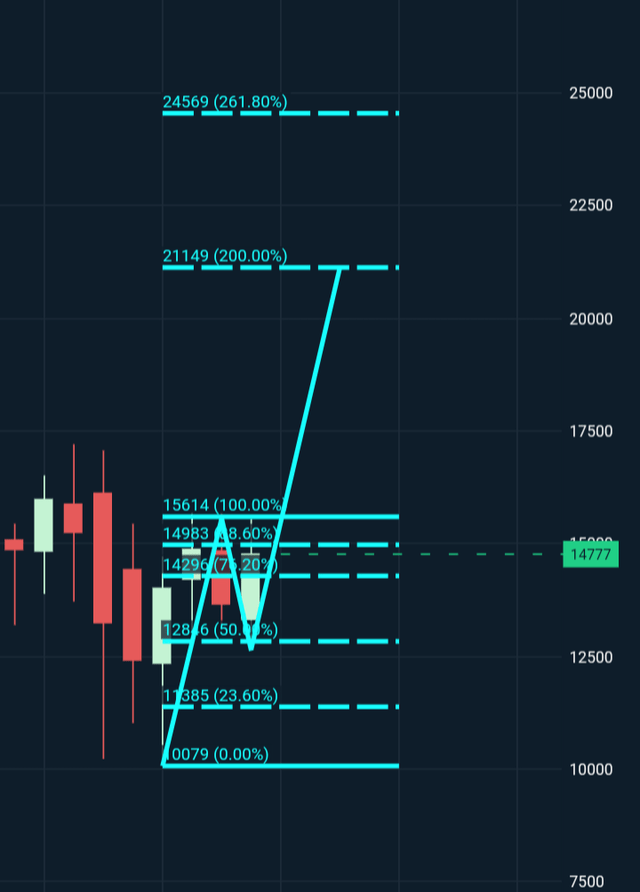

If the market gets a number it perceives as strong, the third wave to $201 could breakout off the back of that number. If so, it is entirely possible Baidu could rise further if it was to hit $201.00 and complete the third wave, but there is no technical printed evidence of this. Given this structure is coming off an area which could be associated with a low, we can also see the further Fibonacci numbers that would outline possibilities of price areas where Baidu may challenge.

Below is a further extension of where Baidu’s third wave may land at if it breaks out.

To finalize, if Baidu provides a strong revenue number and the third wave does break out above $156, I would expect Baidu to reach its third wave target of $201 within the next 60-90 days.

About the Three Wave Theory

The three wave theory was designed to be able to identify the exact probable price action of a financial instrument. A financial market cannot navigate it’s way significantly higher or lower without making waves. Waves are essentially a mismatch between buyers and sellers and print a picture of a probable direction and target for a financial instrument. When waves one and two have been formed, it is the point of higher high/lower low that gives the technical indication of the future direction. A wave one will continue from a low to a high point before it finds significant enough rejection to then form the wave two. When a third wave breaks into a higher high/lower low the only probable numerical target bearing available on a financial chart is the equivalent of the wave one low to high point. It is highly probable that the wave three will look to numerically replicate wave one before it makes it’s future directional decision. It may continue past its third wave target but it is only the wave one evidence that a price was able to continue before rejection that is available to look to as a probable target for a third wave.

Be the first to comment