zhongguo

Dear readers/followers,

If you recall my work on Ørsted A/S (OTCPK:DOGEF), you’ll remember that I view it as one of the world’s leading players in renewables, specifically wind power. The company has very specific ownership circumstances that, if you consider it in a certain way, could make it one of the safer energy investments around. Not the greatest yielder for sure, but a damn good investment nonetheless.

Let me show you what we have going on here.

But first, a small recap – Because this is a comparatively small Danish stock, and we want to know what we’re getting.

Revisiting Ørsted A/S

The basic investment premise for Ørsted A/S is that you’re investing in an ESG play – and one of the largest ones out there. The company views itself as wanting to achieve a world running entirely on what’s viewed as “green energy”, with an energy system supported by wind farms, solar farms, renewable hydrogens, smart energy, and similar projects. This vision includes massive potential upside in the form of future renewable opportunities. The company would here be active in Offshore, Onshore, and Renewables/Green Fuels.

This is the world’s current overall vision.

Orsted IR (Orsted IR)

To fund these ambitions, Ørsted carries a BBB+ credit rating, has a very meager dividend yield of between 1-1.5%, and a total market capitalization of over 360B DKK, which comes to around $35B at current value.

What makes the company interesting here is, as I mentioned, the fact that it’s majority-owned by the Government of Denmark. This makes this a state-owned business with a 50.1% voting right on the part of the state, which makes outside control extremely limited. The company targets a debt ratio of no higher than 25% to be conservative, and the net debt/EBITDA ratio stands between 1-2X depending on earnings.

This should be part of your core thesis when investing – that you want to be aligning yourself with the Danish vision for a green future. This hasn’t always been the case either, as Ørsted at one point was one of the coal-heaviest businesses around.

This changed with new policies in Europe and higher international competition. Since its formation in 2006, the company has made one of the most impressive business turnarounds I’ve ever seen, from being a coal-heavy utility to becoming a global leader in renewables. It’s also completely moving away from anything oil & gas.

So what was coal/oil/gas is now just renewables, and it’s a market leader here.

What constitutes a renewable market leader?

Well, Ørsted owns 22% of the global offshore in terms of GW. The company’s portfolio contains the largest farms in all of Europe and is expected to bring massive amounts of capacity online in Vietnam, Taiwan, France, Japan, Norway, the USA, and other areas. Onshore is also expanding across the globe.

A key driver to the shift to renewables and wind is obviously subsidies offered by the government – and the way governments do this differs greatly from nation to nation. This is not to say Ørsted is dependent on subsidies to construct its farms – they are not. In Germany, three wind farms were built during the mid-2020s by Ørsted (2×240MW) and EnBW (1×900MW) with no subsidies at all. The most recent subsidy-free wind farm, Thor in Denmark, has been awarded to RWE.

Because the company has positioned itself as a market leader with expertise and scale, the company’s plan is working fairly well. The simple truth is, the company is well ahead of smaller players in getting things to work not only in terms of capacity but in terms of cost. The typical cost structure of an offshore wind farm is 35% turbine, 25% transmission, 25% foundation, and only 15% installation. Transmission costs are charged to the operators – meaning Ørsted has control over the turbines, the foundation, and the overall installation – 3 out of 4. This puts the company in one of the best positions out there and is what is causing the potential long-term upside (in part).

3Q22 was in large, confirmation of the positive ongoing thesis for the company.

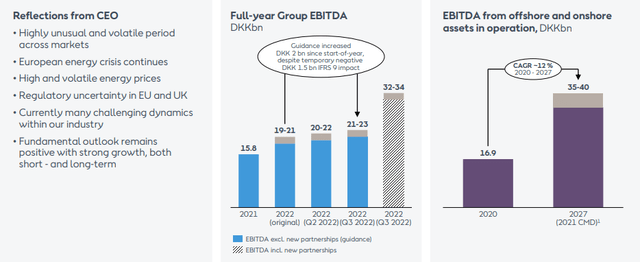

The company increased its EBITDA guidance – once again – and its long-term EPS growth from renewable investments is, despite ongoing cost pressures and inflation, very much intact at this time. The company even achieved significant milestones, starting with the Hornsea 2 offshore farm 50% completed in terms of farm-down, a new partnership with CIP to develop another 5.2 GW of wind offshore for Denmark, US capacity for 862 MW, and completion of a German/French platform of Ostwind. The company was able to issue 15B DKK of green bonds, and a new executive team is in place with a new organizational structure.

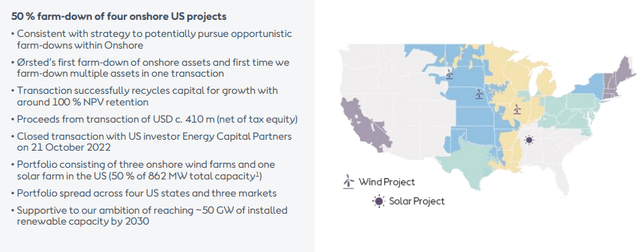

The company, for the first time, did some on-shore projects.

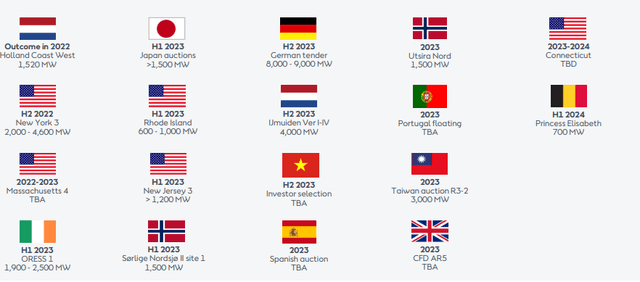

And in terms of construction program and pipeline as well as backlog, the company’s award and under-construction portfolio are massive, with 29,426 MW either awarded or under construction. Ørsted isn’t going anywhere – it’s here to stay. The interest in the company’s offerings across the world is increasing – take a look at what’s already coming in the pipeline.

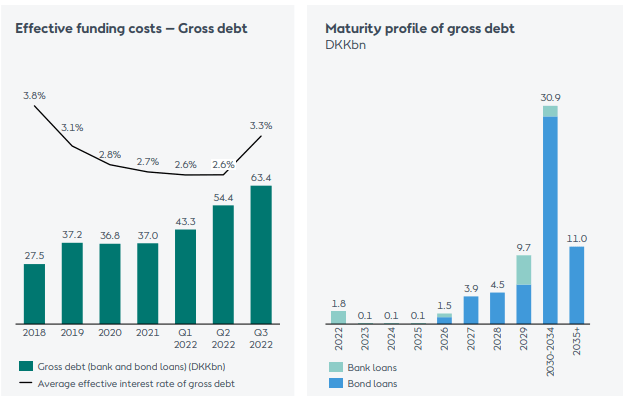

Top line and bottom line is very much intact. A robust 3Q22 EBITDA highlights what is a solid portfolio composition, driving increases in net profit, ROCE, and solid equity. Debt is up somewhat, but this is due to projects, and if we look at an adjusted FFO to net debt on an adjusted basis, that is down 8% to 35% at this time. Company liquidity reserves are excellent, with undrawn facilities, cash, and securities amounting to around 88B DKK. Funding costs are up to around 3.3% on gross debt, but the company’s maturity profile is by far one of the best in the entire industry.

Ørsted IR

Very few things could ever truly de-rail this conservative company. It’s one of the cleanest players on earth, with a green energy share of 92% of total, and a taxonomy-eligible KPI of 99% of CapEx.

This is reflected in guidance as well, as mentioned, which is now up. The company continues to forecast strong capacity buildout for the renewable side of things – not just in Europe, but in APAC and NA as well. We’re talking about installations of Onshore and Offshore Wind, Biomass, batteries, small and large-scale PV installations, and others. The company expects a growth rate of 8% per year in NA alone, and on a global basis, closer to an 11% rate when looking at 2030E on a Post-COVID-19 basis.

Based on current industry trends and the company’s pipeline, I would agree with these forecasts. The interest in future projects within the company’s capabilities is very high. This combined with ongoing expertise and state ownership makes the company’s only drawback its very meager yield. This is especially relevant and highlighted in the current interest rate environment.

Let’s look at the valuation we’re expected to pay to acquire parts of this company.

Ørsted’s updated Valuation

The company is an alternative energy company with a potential growth story, which explains the spike it saw in the 2020 green bubble. Since then, the price has come down significantly, and the returns since 2020 have been negative, and more than negative 18% in one year. That’s why I haven’t invested until 2022, and why my position, for the time being, remains rather small.

I would like to go deeper into the company. You must realize that Ørsted deserves a valuation premium due to its expertise, and this is applied liberally at ranges of 30-40% compared to legacy players used as comps, such as Engie (OTCPK:ENGIY), Iberdrola (OTCPK:IBDRY), Enel (OTCPK:ENLAY) and others.

In order to allow a positive market-beating RoR for the company, you need to accept an increase in a DCF model that’s more or less on par with the growth in renewables overall – that 8-11% that I was talking about. Me, I believe that based on government ownership, fundamentals, and a positive base case for Wind Power expansion, this premium is justified. Even based on a 10-12% EBITDA and sales earnings growth rate, the DCF scenario does not give us an undervaluation.

I bought a few shares back a few weeks ago when the company very briefly touched under 600 DKK. Seeing an undervaluation at over 850 DKK would require sales growth rates of over 15-20%, without tandem CapEx development, while protecting those 30-40% EBITDA margins. At double-digit, 10-12% sales growth multiples, our terminal valuation implies an EV/Share of no more than 580-620 DKK/share. The share price is above these levels again today, and you’d need to apply further, massive premiums to the company here to see an upside.

As I mentioned in my last article, 2022E results will be massive – the farm-down on HS2 is finished, and it’s led to massive cash proceeds on a forward base, which has driven down debt and jacked up EPS. I’m not disregarding the low targets in my DCF – but I am trying to stay conservative nonetheless.

Analysts remain very positive about the company in the longer term. The current average PT is now lower than my last article from S&P Global – around 800 DKK – which is down significantly from the last target.

At the current PT, the company is 16% undervalued to 800 DKK, which puts 14 out of 24 analysts at a “BUY” or equivalent target for the company. I would tendentially agree with the PT, and based on inflation and cost increases impair my previous target to around 800/share, giving the company a 16% upside to a conservative level.

The company still isn’t cheap – I doubt it will ever be cheap for a long time. But like with other massive-quality companies, Ørsted doesn’t exist in a different iteration – if you want quality, you’ll have to pay for it. Ørsted is a volatile company, for sure. The way that the company operates makes sure that there’s a significant lumpiness in results that give the company a volatile character over time – But the company’s 5-year returns have been superb – over 200%, despite the ongoing horror show in the market in terms of things like Tech.

Ørsted is also a valuation lesson – if you bought it at the top, you’ve still lost around 30% to declines here. Do not buy the company for a four-digit price – the conservative PT seems to normalize at between 780-850 DKK at this time, looking at various methods, and that’s where I would consider it attractive.

Thesis

My thesis for Ørsted is as follows.

- Ørsted is a solid renewables company, and one of the relevant market leaders in the entire segment. It is, in fact, a market leader in Wind. It’s also state-owned, has a well-filled pipeline, and one of the most conservative financing pipelines and maturities when it comes to utilities. This makes it a class-A business.

- However, a meager yield and premiums make valuation important – and I would only buy the company as long as it stays within its range. At current numbers, I would not buy it above 800 DKK per share.

- That means that as of right now, Ørsted is a “BUY” for me.

Remember, I’m all about:

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1. If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills all but one of my criteria, making it relatively clear why I view it as a “BUY” here.

Thank you for reading.

Be the first to comment