DarioGaona/iStock via Getty Images

It’s been a rough year for investors in the Gold Juniors Index (GDXJ), and while Orla Mining (NYSE:ORLA) had briefly found a way to buck the sector-wide bear market, the stock has since suffered a violent decline. This can be attributed to weak metal prices, but it’s also likely because many producers underperform after announcing acquisitions as the market digests the news. With the stock down 50% from its all-time highs, there’s no question that there’s value here, but with Orla in the less favorable post-M&A window and having potential warrant overhang, I don’t see a low-risk buying opportunity just yet.

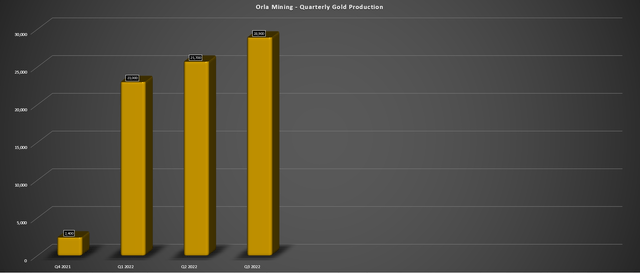

Q3 Production

Orla Mining released its preliminary Q3 results last month, reporting quarterly production of ~28,900 ounces, placing its year-to-date production at ~77,600 ounces. This figure is tracking miles ahead of its initial FY2021 guidance of 90,000 ounces to 100,000 ounces, with the strong performance in Q3 helped by higher stacked grades at its new Camino Rojo Oxides mine. Given the exceptional performance year-to-date despite bringing a new mine online in a challenging operating environment, the company has raised guidance by over 10% at the mid-point, with FY2022 guidance adjusted to 100,000 to 110,000 ounces, representing one of the most significant raises in the sector this year.

Orla – Quarterly Production (Company Filings, Author’s Chart)

Looking at the chart above, we can see that Orla enjoyed its second consecutive quarter of double-digit sequential production increases since Q1 2022, and the company reported that daily stacked throughput rates were 7% above nameplate capacity at 19,200 tonnes per day in Q3. Combined with solid grade reconciliation and mined tonnes/grades reconciling well with its block model, this is one of the few successful new mine start-ups in the past two years among sub $1.0 billion market caps, which speaks to the quality of the team. Meanwhile, ore tonnes mined and stacked grades were also up in Q3, with Orla mining ~2.17 million tonnes at 0.91 grams per tonne of gold (Q3 2022: 0.88 stacked grade), setting up another solid quarter in Q4.

Assuming Orla can produce 105,000 ounces in FY2022, this would represent a more than 10% beat vs. its initial guidance mid-point, and it should allow the company to deliver into the lower end of its cost guidance range ($600/oz to $700/oz). This would make Orla’s Camino Rojo one of the lowest-cost mines in 2022 and potentially make Orla the lowest-cost producer, with few miners enjoying all-in-sustaining costs [AISC] below $800/oz. Let’s take a closer look at the costs and margins below:

Costs & Margins

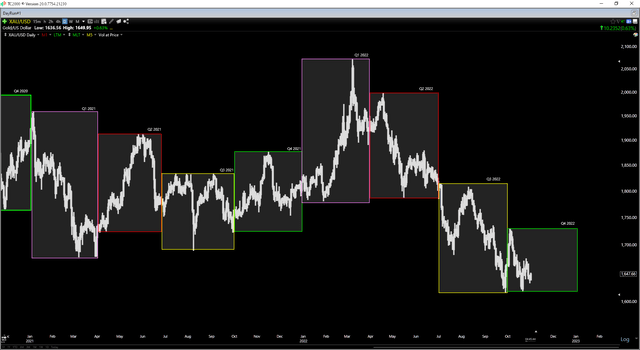

Given the record quarter in Q3 for Orla and the fact that the company has seen offsets to higher consumables prices with less electricity, diesel, and cyanide usage than planned, the company should report industry-leading of sub $570/oz in Q3, a 5% improvement on a sequential basis (Q3 2022 vs. Q2 2022). Unfortunately, this dip in unit costs is expected to be more than offset by the weaker gold price, which appears to be coming in below $1,730/oz on average based on companies that have reported to date. So, assuming a more conservative average realized gold price of $1,715/oz and AISC of $570/oz in Q3, Orla’s margins will actually decline from $1,271/oz to ~$1,145/oz.

Gold Futures Price (TC2000.com)

It’s important to note that these are still incredible margins. In fact, Orla’s margins will dwarf industry average AISC margins that are likely to come in at sub $500/oz in Q3 and have led to some operations being shuttered (Tucano, Madsen). So, while the stock could come under pressure if gold prices weaken further due to short-term margin compression, Orla is beating in every area that is in its control and also completed a well-timed acquisition of Gold Standard, waiting for a near trough in the cycle to add another project to its pipeline that also happens to be a perfect fit (oxide heap-leach in a top mining jurisdiction).

In addition to this timely acquisition which should push Orla’s production profile north of 270,000 ounces by 2026 (270% production growth), the company continues to enjoy exploration success at its two other growth opportunities: Camino Rojo Sulphides and Cerro Quema. At Cerro Quema, Orla is successfully hitting oxide gold and gold-copper mineralization at new targets, which include La Pelona and La Prieta, completely separate from the La Pava and Quema deposits that formed the basis of its Pre-Feasibility Study. Meanwhile, at Camino Rojo Sulphides, grades appear to improve at depth, possibly opening up the potential for an underground opportunity. As stated in the September update:

“This new geological information implies the possibility of continuous, higher-grade domains, which could be amenable to underground mining. Historical drilling, conducted by the previous project owners, indicated the grade of the ore body to be widely disseminated and a large, open-pit mining scenario was the favored development pathway. However, the newly oriented drilling has demonstrated the potential for a more targeted mining method which may focus on priority extraction of the higher-grade material.”

While Camino Rojo Sulphides looks to be the final leg of potential growth for Orla on a path to 450,000-ounce plus producer status, the high-grade drill results well below the Camino Rojo Pit are quite exciting, with highlight intercepts including 20.0 meters at 5.25 grams per tonne of gold, 52.5 meters at 3.08 grams per tonne of gold, and 36.6 meters at 3.20 grams per tonne of gold. Orla noted that it would complete Phase 2 directional drilling in Q4 and support a multi-year plan it expects to release later this quarter. Overall, I see this as a slight upgrade to the investment thesis, with what appears to be an abundance of 2.0+ grams per tonne gold mineralization at depth, well above average resource grades. Let’s take a look at the valuation:

Valuation

Orla has approximately 346 million fully-diluted shares and a share price of US$3.15, translating to a market cap of $1.09 billion. While this may appear like a steep valuation at first glance for a junior producer (sub-150,000-ounce production profile), the company’s Camino Rojo Oxides Project and its free cash flow generation don’t accurately capture the value in Orla’s portfolio. This is because it has one massive asset (Camino Rojo Sulphides) near existing infrastructure and two solid oxide projects (Railroad South and Cerro Quema). Based on this strong pipeline, the best way to value the company is on a P/NAV basis, and I see a fair value for Orla of US$4.40 based on a 0.80x P/NAV multiple and an estimated net asset value of $1.90 billion.

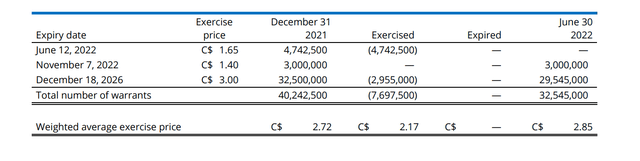

Orla – Warrants Outstanding (Company Filings)

Assuming the company is successful in its growth plans, Orla appears to have a path to becoming a 325,000-ounce plus producer with its three oxide assets, with the potential to push production north of 450,000 ounces with Camino Rojo Sulphides. So, for investors looking for a growth story, this is certainly one of the better ones sector-wide. However, one thing that could weigh on the stock in the short term is that it’s busy digesting its Gold Standard deal, with many producers underperforming the index following acquisitions. In addition, a considerable amount of warrants are outstanding at much lower levels, with exercise prices ranging from US$1.05 (November 2022 expiry) to US$2.25 (December 2026 expiry). So, while the stock may be undervalued, we could see continued warrant overhang until more of these are exercised.

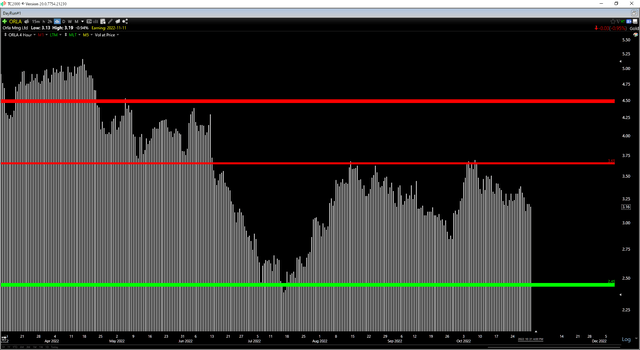

Technical Picture

Moving to the technical picture, Orla Mining continues to trade in the upper portion of its support/resistance range, sitting just $0.50 shy of potential resistance at US$3.65 and $0.70 above support at US$2.45. This translates to a reward/risk ratio of 0.71 to 1.0, which is nowhere near my criteria of a 5 to 1 reward/risk ratio to justify starting new positions. Therefore, if I were looking to start a position in Orla Mining, I would be waiting for lower prices. Obviously, there’s no guarantee that lower prices will materialize. Still, when buying small-cap names in a turbulent market environment, I prefer to wait for the right setup or pass entirely.

Summary

In an inflationary environment where industry average all-in-sustaining costs [AISC] could come in above $1,250/oz, Orla Mining should enjoy operating costs more than $600/oz below the average. This outperformance from a margin standpoint is set to continue in 2023 and 2024, and this distinction from its peers is backed up by a top-10 growth story sector-wide. That said, Orla is in the less favorable window post-M&A, where underperformance has been the norm even when it makes little sense from a valuation standpoint, similar to what we saw with Kirkland Lake post-Detour acquisition and Kinross (KGC) post-Great Bear acquisition. So, while I think Orla is a name to keep a close eye on, I don’t see a low-risk buying opportunity just yet.

Be the first to comment