Darren415

A lot of the Canadian cannabis licensed producers have made progress this year in improving financial results, but a lot more work needs to be done. OrganiGram Holdings (NASDAQ:OGI) has seen a lot of growth turned into very limited profits. My investment thesis remains Neutral on the stock until the company can generate sustainable EBITDA growth.

Impressive Growth, But…

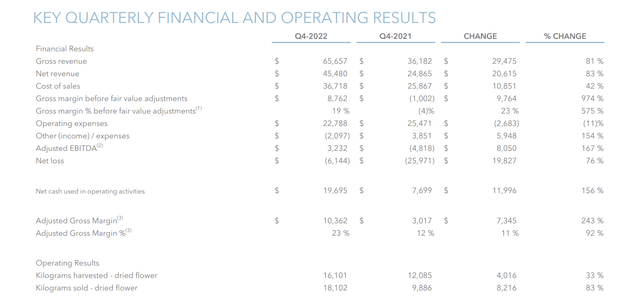

OrganiGram reported FQ4’22 net revenues grew 19% sequentially to C$45.5 million. The problem is that despite net revenues surging 83% over the FQ4’21 numbers is that adjusted gross margins were only 23%. The margin was stuck at about 23% all year despite the revenue growth.

What really sticks out regarding the financials of OrganiGram and all of the Canadian companies is the ongoing excise tax hit. The company posted FQ4 gross revenues of C$65.7 million with excise taxes of C$20.2 million.

Source: Organigram FQ4’22 MD&A

OrganiGram just isn’t able to generate the amount of sales to overcome the excise tax. The costs of sales still amount to over 50% of gross revenues in a sign of how far the cannabis producer is from generating the margins needed for strong profits.

What starts out as C$65.7 million ends up in only $33.4 million in sales. Even small multi-state operators in the US like MariMed (OTCQX:MRMD) hardly known by investors produced $33.9 million quarterly sales.

OrganiGram only produced an adjusted EBITDA in FQ4 of C$3.2 million, but the net loss was C$6.1 million. The Canadian LP appears to exclude C$2.3 million in R&D expenses from adjusted EBITDA that are standard costs in the cannabis space.

More importantly, the net cash used in operating activities during the October quarter was an absurd C$19.7 million. Even with all of the progress in growing revenues, OrganiGram can’t cut off the large cash burn. In fact, the rate surged from the prior year period due to working capital needs, including ongoing impairments of inventories.

The international components of revenue was impressive at C$6.0 million in the quarter and C$15.4 million for the year. OrganiGram forecasts FY23 revenue increasing to Australia and Israel due to additional shipments next year.

As with other Canadian cannabis firms, a big part of the low gross margins and lack of any significant EBITDA profits is this path of chasing each other around the globe. A company the size of OrganiGram now has sales in 3 different countries without any country serving as a profit base to serve the growth plans in other destinations.

More Dilution

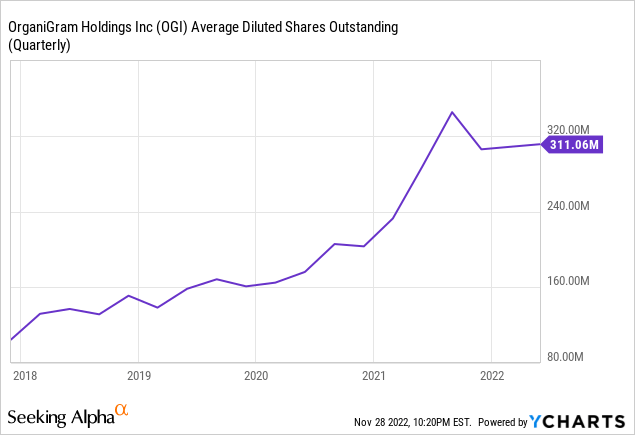

OrganiGram reported FQ4’22 diluted shares reached 352.0 million, up from 331.7 million in the prior year period. The diluted share count has already risen to 356.1 million shares as of November 28.

The company had grown the share count dramatically in the last 5 years completely diluting the shareholders at the point of recreational cannabis legalization in Canada back in 2018. In just the last FY, the share count jumped by over 21 million shares leading to a current market cap of $350 million.

The problem is that the cash position has fallen from C$183.6 million to C$98.6 million during this period. OrganiGram generated solid revenue growth due in part to acquisitions, but the company had substantial cash spend and share dilution during the period without a ton of progress in getting adjusted EBITDA to a legitimate positive margin.

OrganiGram guided to FY23 growth, but the company didn’t provide any measurable metric. The massive problem of the Canadian cannabis firms has been the inability to sustain growth.

Following improving results, the LPs constantly run into growth issues while still being EBITDA breakeven at best. OrganiGram guided to significant EBITDA growth in FY23, but the company needs to substantially grow adjusted EBITDA above the FY22 level of C$3.5 million. Besides, the number is actually negative when excluding the R&D expense of C$5.7 million.

Takeaway

The key investor takeaway is that OrganiGram has turned around the business to eliminate a lot of the large operating losses, but the company still has to prove the ability to actually produce profits. The stock already trades at 3x sales targets with limited EBITDA. Until this scenario changes, investors should continue watching the stock from the sidelines.

Be the first to comment