Enes Evren

REIT Rankings: Mall REITs

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on November 27th.

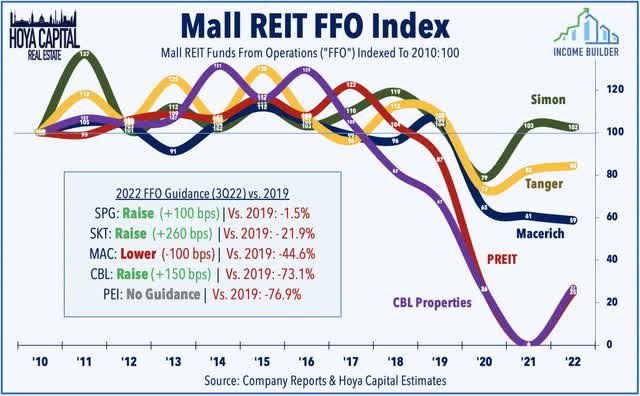

Mall REITs – which endured a dismal stretch of underperformance from 2015 through 2020 – enter the critical holiday season on surprisingly stable-footing as resilient consumer spending has offset broader macro-headwinds. For the REITs that managed to survive the pandemic in tact – Simon Property (SPG), Macerich (MAC), Tanger Factory Outlet (SKT) – foot traffic returned to pre-pandemic levels by mid-2022 as record-low store closings since 2020 have helped to stabilize fundamentals and restore some modest pricing power. For the lower-tier mall segment – the focus of Pennsylvania REIT (PEI), CBL & Associates Properties (CBL) – a return to the pre-pandemic trend isn’t going to cut it and will require a favorable secular shift in retail industry dynamics or face an endless loop in-and-out of Chapter 11 restructurings and exchange de-listings.

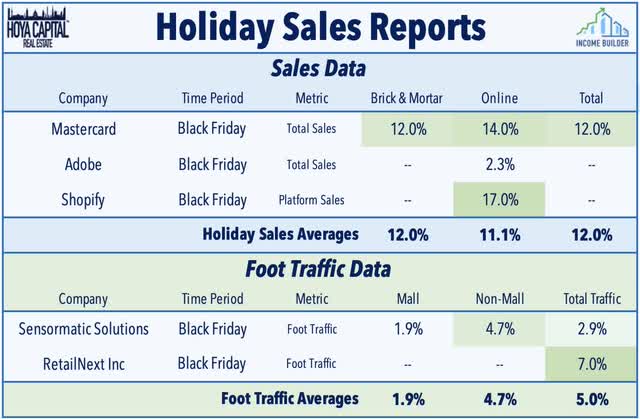

Preliminary holiday spending and foot traffic data from the critical Black Friday weekend generally showed continued resilience in U.S. consumer spending despite the broader cooldown in economic growth and recessionary levels of consumer confidence. Per data from Sensormatic and RetailNext, total in-store foot traffic was up by about 5% year-over-year on Black Friday, but traffic at indoor malls was more muted than at strip centers and other non-mall locations. Mastercard reported that in-store sales were up 12% from last year while online sales rose 14%, while other firms have seen more muted sales growth including Adobe, which reported online sales growth of 2.3%.

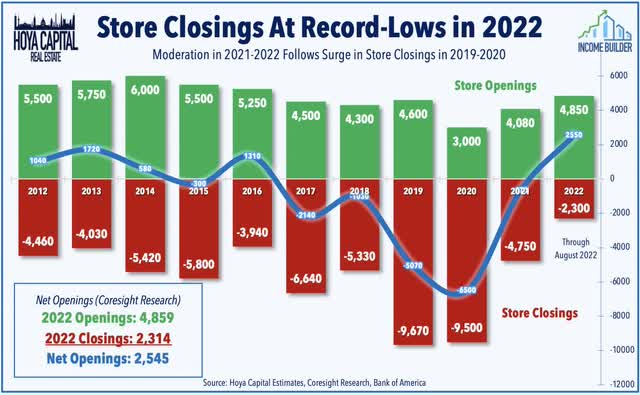

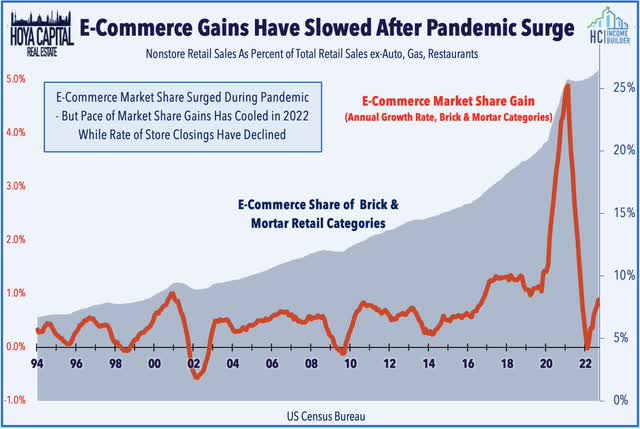

The momentum from the stimulus-fueled ‘spending spree’ has been apparent in retail fundamentals as well. Store openings continue to outpace store closings in 2022 by the widest margin in at least two decades, per recent data from Coresight Research, which has tracked nearly 4,900 new store openings announced this year compared to roughly 2,300 store closings – the first year of net store openings since 2016. Combined with net supply declines in total retail space over the past half-decade – resulting from minimal new development and the repurposing of vacated space – retail occupancy rates are back to pre-COVID levels while many landlords are enjoying some degree of pricing power for the first time since the mid-2010s.

CBRE noted in its Q3 retail report that the availability of retail space at all types of properties including malls in the U.S. hit a 10-year low in the third-quarter. CBRE notes that a mix of factors has fueled the improved trends, including online brands looking to expand by opening up brick-and-mortar locations and the “thinning-out” of the Class C and D malls that have pushed retailers to focus on upper-tier locations. Retail asking rents rose by 2.5% year-over-year in Q3 – the strongest since 2015. The level of net store openings – representing less than 1% of the existing store count – is actually rather muted compared to the level of retail sales growth seen since the start of the pandemic. Remarkably, total retail sales were 33% higher in October 2022 compared to October 2019 with brick and mortar sales higher by 26%.

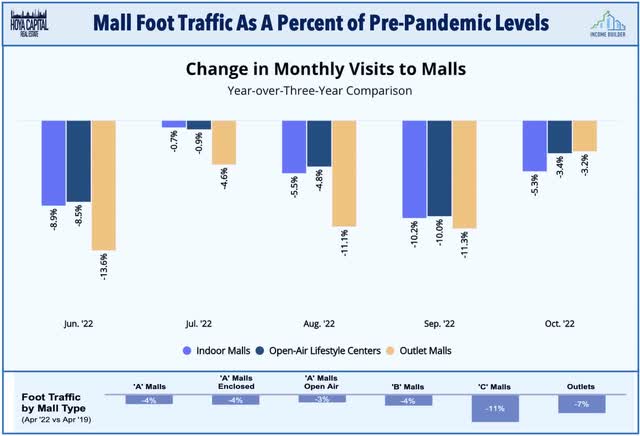

A microcosm of broader retail trends, however, mall sector dynamics remain a story of “haves and have not.” Consistent with the reports and commentary from these REITs, data from Placer – which uses phone geolocation and proximity data to track foot traffic – shows that foot traffic at upper-tier indoor U.S. malls rebounded to within 5% of pre-pandemic levels early this summer – and has remained at roughly those levels in the subsequent months. These indexes analyze data from more than 300 Class A and B indoor malls, open-air lifestyle centers, and outlet malls across the country, in both urban and suburban areas. Traffic at lower-tier malls, however, remains about 10% below pre-pandemic levels – no doubt hurt by persistently high inflation which has been particularly taxing on middle- and lower-income earners.

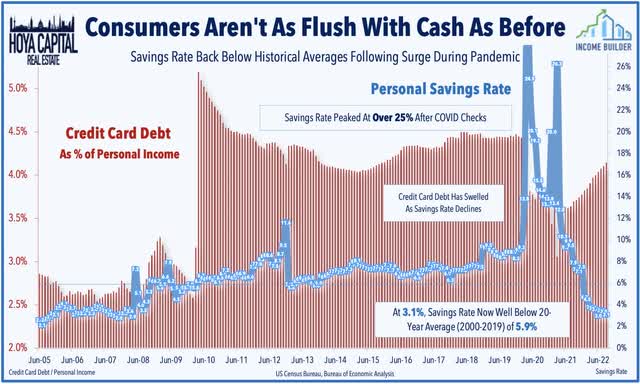

The momentum from the stimulus-fueled ‘spending spree’ appears likely to be enough to carry retailers through the holiday season – even without the cash in the pocketbooks – but the longer-term sustainability of this momentum is in question as credit card balances have swelled to pre-stimulus levels while the personal savings rate has dipped to nearly 15-year lows – suggesting that a recession could be particularly painful to retailers that were banking on the pandemic-era retail spending boom to continue indefinitely. Importantly, however, while the nominal level of credit card debt will surely generate some negative headlines, credit card debt as a percent of personal incomes – 4.2% in October – is still below the 2010-2019 average of roughly 4.4%.

Mall REIT Earnings: Much-Needed Stabilization

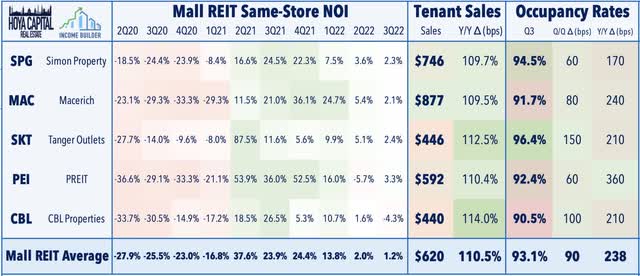

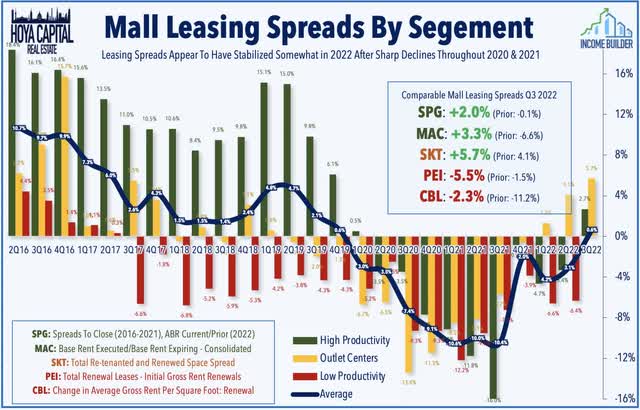

As discussed in our REIT Earnings Recap, mall REITs earnings results were quite solid, fueling a 20% rebound for the sector from early October through late November. Simon raised its full-year guidance along with its quarterly dividend. Driven by an uptick in occupancy rates and a stabilization in rents, SPG now sees its FFO/share roughly matching that of the prior year driven by comparable leasing spreads are “wildly positive. Tanger also raised its full-year outlook, driven by its strongest quarter for rental rate spreads in a half-decade at 5.7% – its third straight quarter of positive spreads following a streak of eight straight quarters of negative growth. Macerich, however, lowered its FFO target on asset sale timing, but core results were solid with positive rental rate spreads of 3.3% – up from -6.6% in the prior quarter – its best quarter of leasing since the pandemic began.

For the pair of lower-tier mall REITs that remain – both of which entered and emerged from Chapter 11 over the past year – a return to pre-pandemic FFO remains unlikely, but third-quarter results were at least a small step in the right direction. CBL & Associates Properties reported improving occupancy rates and leasing spreads, driving a boost to its full-year FFO outlook. CBL recorded spreads on new and renewal leases of +5.2% driven primarily by a jump in new lease rates, which offset a 2.3% decline in renewal rates. Results from PREIT (PEI) were highlighted by much-needed progress on its debt reduction plan and a 360 basis point year-over-year improvement in its total portfolio occupancy – the best among mall REITs in the third quarter.

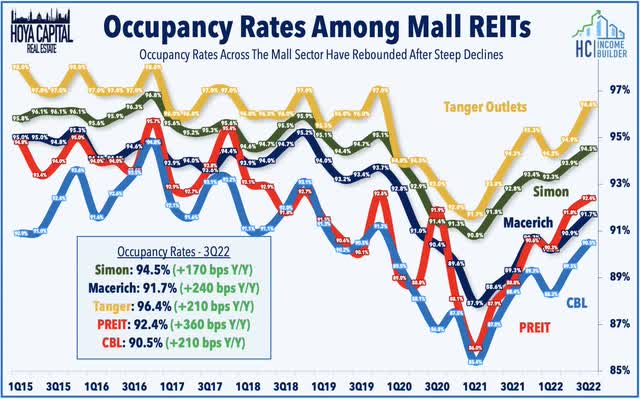

Encouragingly, occupancy rates appear to have stabilized and halted a multi-year downtrend – at least for the moment – as each of these five REITs reported a sequential improvement in same-store occupancy for a third-straight quarter. Helping to juice these occupancy figures a bit, however, has been the increased use of shorter-term lease structures and temporary “pop-up” stores which would also likely be quick to vacate the space if we are indeed heading for a recession. Improving tenant sales were also a highlight in the third-quarter with all five REITs reporting that sales per square foot were back above pre-pandemic levels in Q3. CBRE’s most recent Retail Outlook noted, “Existing retail space is more efficient, with sales per sq. ft. improving due to few new stores being built and rising retail sales. From 2010 to 2020, retail sales grew 42%, while retail supply grew just 4%.”

In addition to short-term rental agreements, landlords have also made increased use of “percentage rent” deals which can result in higher rent payments when times are good, but sharper declines in rent during downturns. Leasing spreads – perhaps the best leading indicator of future same-store NOI – have finally stabilized following a period of sustained deceleration from 2015 to 2019 and outright declines from early 2020 through early 2021. Of note, Tanger recorded a 5.7% increase in blended rental rate on renewed leases, the third-straight quarter of positive spreads following a twelve-quarter streak of negative rent spreads dating back to Q1 of 2019. While Simon no longer provides leasing spreads, the change in average base rents are now rising after two years of declines.

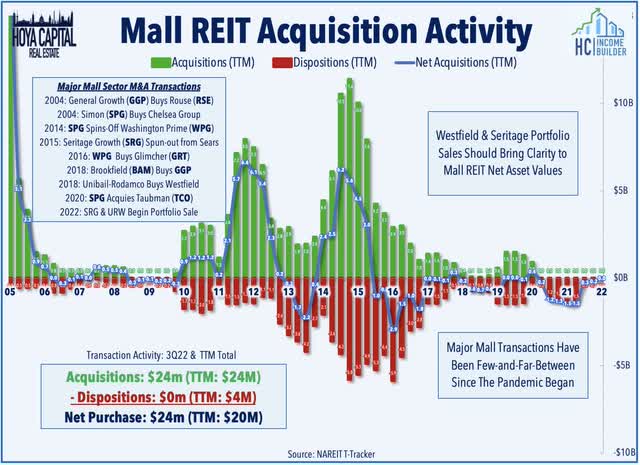

Mall Sector Shake-Up Continues

The mall sector remains highly concentrated with these six REITs owning the majority of regional malls in the United States. Other major U.S. mall owners include France-based Unibail-Rodamco-Westfield (OTCPK: UNBLF) – which also announced earlier this year that it wants to sell most of its two-dozen U.S. properties by the end of 2023. Canada-based Brookfield Asset Management (BAM) is the other major player following its acquisition of General Growth Properties in 2018 – formerly a U.S. listed REIT. Seritage Growth (SRG) – which emerged from the Sears bankruptcy – announced in July that its board has recommended a plan to liquidate its properties and return the proceeds to shareholders. Seritage’s announcement came several months after it announced that it will no longer will elect to be a REIT.

Mall asset sales have been few-and-far-between over the past decade – particularly when excluding the trades and mergers between these REITs’ themselves – so the Westfield and Seritage portfolio sales should be a very illuminating valuation read-through for these mall REITs. Seritage has seen notably firm pricing for redevelopment/land-oriented asset sales adjacent to upper-tier malls through its nearly $600M in asset sales this year with developers seeing value in adjacent multifamily, industrial, and/or self-storage uses. In late August, Unibail-Rodamco-Westfield announced that it sold the Westfield Santa Anita mall in California for $540m to an unnamed buyer at a sub-6% cap rate – the largest mall transaction since 2018.

The largest mall owner – Simon – has been notably absent from major mall acquisitions since its ill-timed purchase of Taubman Centers announced several weeks before the pandemic shutdowns. Instead, Simon has invested in non-real estate assets including a retail brands portfolio through its 50/50 joint venture with Authentic Brands on the SPARC Group – and a separate partnership with Brookfield. This vertical retail integration strategy is consistent with our long-held view that mall REITs would actually benefit if they performed more like retailers – which have substantially outperformed their REIT landlords across most measurement periods – and has provided the immediate benefit of keeping these tenants in business and paying rent.

We believe that well-located high-productivity malls that have the critical mass and “network effects” to offer a value-added retail experience can remain relevant, but we see more attractive valuations in non-mall retail REITs with a format better aligned with the bricks-and-clicks retail strategy. We see “sum-of-the-part” value in Simon, which owns a valuable retail brands portfolio alongside its property portfolio, and we see value in its position as the “last man standing” in the sector with ample access to capital, which we believe will eventually translate into accretive consolidation of high-productivity assets.

Hoya Capital

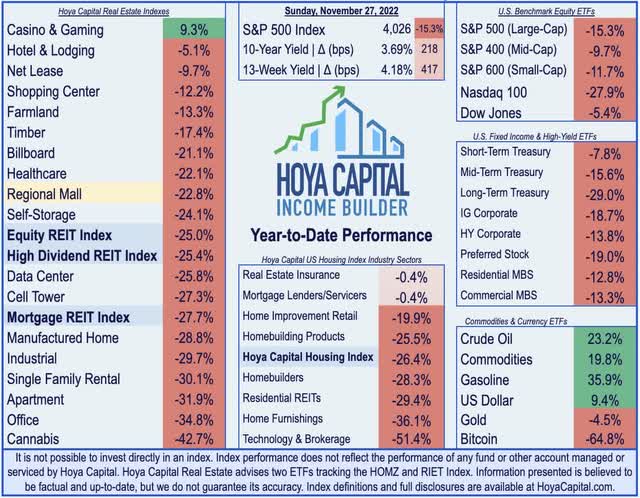

Mall REITs Now Outperforming REIT Index

Fueled by a roughly 20% rebound from the lows in early October, mall REITs are now on pace to outperform the broader REIT Index for a second straight year – a notable turnaround following a record-setting six consecutive years of underperformance. The Hoya Capital Mall REIT Index is lower by 22.8% this year – slightly more muted declines compared to the 25.0% decline on the broad-based Vanguard Real Estate ETF (VNQ), but still below the 15.3% decline on the SPDR S&P 500 Trust ETF (SPY). Among the individual names, Tanger Factory Outlet is one of just a handful of REITs in positive territory this year while Pennsylvania REIT has been the laggard, continuing a slide that began in mid-2021 as the clock is ticking for the troubled landlord to raise capital through asset sales to pay down its substantial debt load.

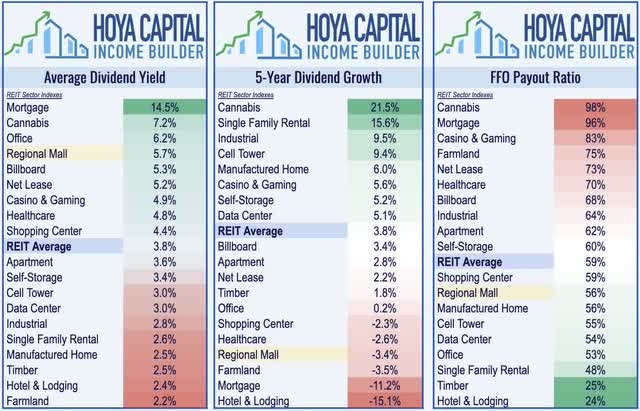

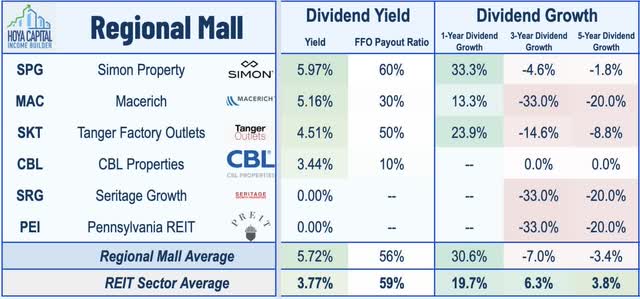

Mall REIT Dividend Yields

Helped by a series of dividend increases from the higher-tier mall REITs this year, malls have now become one of the higher-yielding REIT sectors with an average yield of 5.7% – well above the REIT sector average of 3.8%. Helped by the large weighting of Simon Property and Macerich which have relatively low payout ratios, mall REITs appear to have plenty of dividend-paying capacity remaining as the sector distributes less than 60% of their FFO.

Four mall REITs – SKT, WPG, CBL, PEI – eliminated their dividend in 2020 while two others – SPG and MAC – reduced their dividend during the pandemic. The tide has turned – at least for the higher-tier mall REITs – since mid-2021 as Simon has raised its dividend seven times over the past eighteen months while SKT – which was formerly a so-called “dividend aristocrat” – resumed its dividend in 2021, as did MAC. Both REITs, however, continue to pay dividends well below their pre-pandemic rate and mall REITs remain near the basement of the REIT Rankings on 3 and 5-year dividend growth.

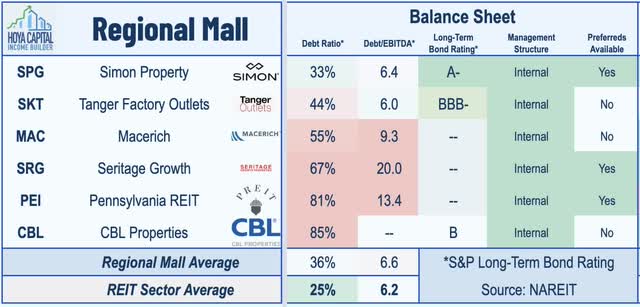

Balance sheet quality is a key determinant of dividend-paying capacity and future dividend increases. Mall REITs entered the pandemic with elevated debt ratios, which subsequently surged to nosebleed levels during the worst of the drawdown with all mall REITs besides Simon reporting debt ratios above 80% in mid-2020. Improving fundamentals have stabilized balance sheets, particularly for Simon Property – which still owns one of the few coveted A-ratings from S&P on its long-term debt and completed a very timely, $1.2 billion note offering earlier this year at a 10-year fixed rate of just 2.65% while it also refinanced seven mortgages for a total of $1.1 billion at an average interest rate of 2.92%. Elsewhere, Tanger’s balance sheet has essentially been fully-repaired after seeing its debt ratio spike in 2020, but Macerich still has work to do. The situation is far more urgent for the lower-tier mall REITs – CBL and PEI – which operate with debt levels above 80%.

Takeaways: The Bleeding Has Stopped, For Now

Mall REITs – which endured a dismal stretch of underperformance from 2015-2020 – enter the critical holiday season on surprisingly stable-footing as resilient consumer spending has offset broader macro-headwinds. Store openings continue to outpace store closings in 2022 by the widest margin in decades and following nearly three-years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding mall REITs with some long-elusive pricing power. While lower-tier mall REITs can’t afford a deep recession, upper-tier malls are no longer teetering dangerously on the edge. That said, we see more attractive valuations in non-mall retail REITs with a format better aligned with the bricks-and-clicks retail strategy of using retail locations not just as “showrooms” but as “last-mile” fulfillment hubs within a broader distribution network.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment