Sundry Photography/iStock Editorial via Getty Images

The market continues to be rough-and-tumble these days, with investors seemingly unsure whether a deeper recession is coming or if the indices will stage a broad recovery in the back half of the year. The mood has turned more bearish over the past two weeks, which is why it’s more important than ever that investors overweight value stocks in their portfolio.

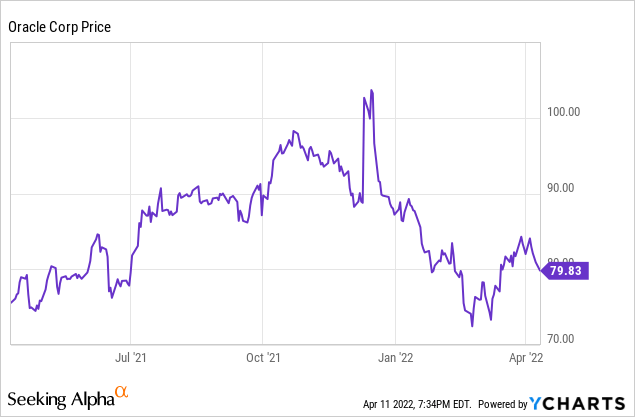

Oracle (NYSE:ORCL), in particular, remains a mainstay in my portfolio. This software giant is one of the most prevalent pieces of infrastructure in modern IT, and though Oracle has lost its overall growth shine, the company’s progress in cloud and its long history of stellar earnings performance make it a very safe bet. Predictably, while Oracle is down ~9% year-to-date, its losses are far more benign than its peers in small/mid-cap software.

The bullish thesis for Oracle, revisited

I remain bullish on Oracle and recommend that investors add this position or take advantage of dips to expand an existing one.

For investors who are newer to this name, here’s a rundown of what I think to be the key drivers of upside for Oracle:

- Oracle’s portfolio is broad and covers every spectrum of enterprise technology. Oracle now has a full suite of front-end applications covering functions such as supply chain, finance, HR, sales – everything under the sun. The company has also retained its traditional strength in backend infrastructure, with products like the Oracle Autonomous Database. Not all of Oracle’s products have to be winners: at the moment, cloud apps continue to see 20-30% growth, offsetting declines in legacy segments.

- Sales machine. Oracle essentially invented the sales playbook in Silicon Valley. Its late co-CEO, Mark Hurd, is often credited with institutionalizing the position of a “business development representative”, the cold-calling army that now represents among the most common entry-level positions in the industry. Oracle has among the best-oiled sales processes in enterprise technology, and continues to leverage that playbook to grow its business.

- Profitability has long been core to Oracle’s DNA. Oracle has retained enormous profitability, even with its shift to cloud and away from lucrative license/maintenance contracts. Its mid-40s pro forma operating margins are among the highest in the software industry.

- Recent personnel decisions could boost profitability. More to that point, Oracle’s decision to move its headquarters from Redwood Shores (a small town in the San Francisco Bay Area that is almost exclusively dedicated to Oracle’s headquarters) to Texas could help lower Oracle’s overall personnel costs. It has also announced a flexible remote work policy that is also slated to reduce overhead (Larry Ellison himself has committed to working out of Hawaii for the time being).

The other major factor to be aware of is that Oracle spent $28 billion to purchase Cerner, which needless to say is Oracle’s largest deal ever. What is agitating investors at the moment is that Oracle has offered very little detail to justify the acquisition or specify what synergies it expects to drive from it.

However, for level-setting here: Cerner is already a well-oiled producer and earner. Over the trailing twelve months, the company generated $5.8 billion in revenue and $0.6 billion of GAAP net income (which will boost Oracle’s annual revenue and earnings by ~14% and ~5%, respectively). But where I think Cerner is most critical is giving Oracle the distinction to be the only large-cap software company that has taken a major step in healthcare, which is arguably the industry that has been least disrupted by technology to date. In other words, on top of immediately contributing to Oracle’s revenue and earnings, Cerner opens the door to tremendous TAM expansion and category leadership in healthcare going forward. The acquisition is slated to close in the fourth quarter of FY22.

Lastly, a check on valuation: at current share prices near $80, Oracle trades at just a 15.2x forward P/E multiple based on Wall Street’s $5.26 pro forma EPS consensus for FY23 (the year for Oracle ending in May 2023; data from Yahoo Finance). This still represents a discount to the S&P 500.

The bottom line here: Oracle software continues to permeate every layer of modern IT, from the front-end applications to backend infrastructure and databases. The company’s Cerner acquisition gives Oracle a major differentiating factor versus its other large-cap software competitors, and its relatively cheap valuation signals a great entry point.

Q3 download

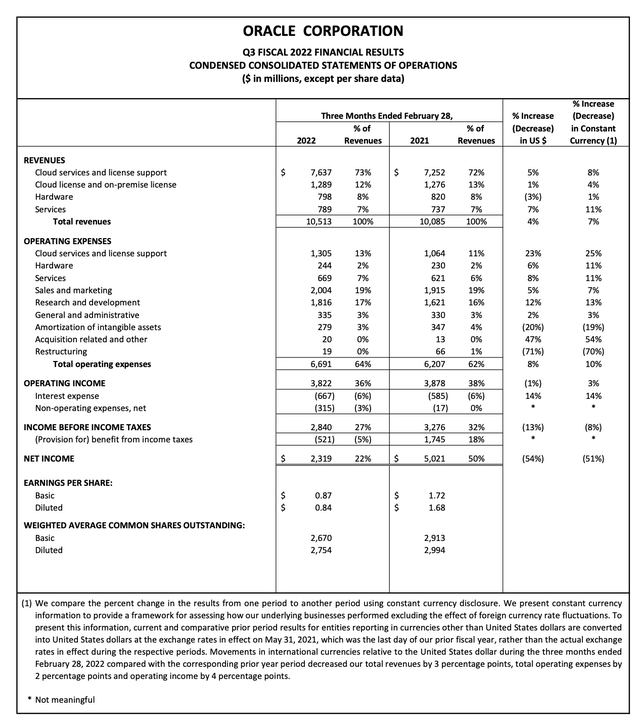

Let’s now touch on the highlights of Oracle’s most recent quarterly results in greater detail. The Q3 earnings summary is shown below:

Oracle Q3 results (Oracle Q3 earnings release)

Oracle’s revenue grew 4% y/y to $10.51 billion, in-line with Wall Street’s expectations and above the midpoint of the company’s own revenue guidance for the quarter. On a constant currency basis, meanwhile, the company’s revenue growth was actually three points stronger at 7% y/y. Oracle management noted that Q3 represented the strongest quarter for organic y/y growth since the company began its cloud transition – which is an indicator of the fact that the cloud shift has matured and cloud growth is more than offsetting declines in legacy license products. Note as well that Oracle CEO Safra Catz mentioned on the Q3 earnings call that the company is pushing for double-digit revenue growth in FY23, though it has not yet issued formal guidance targets.

Total cloud revenue in the quarter grew 26% y/y on a constant currency basis to $2.8 billion, representing just over one-quarter of Oracle’s total. The company’s flagship Fusion Cloud ERP product, meanwhile, saw even stronger 35% y/y growth. Netsuite, the small/mid-cap ERP system that Oracle acquired in 2016, is also still showing strong 29% y/y growth (in fact, in the five years under Oracle’s ownership, Netsuite’s growth rates have barely waned from pre-acquisition levels).

Here’s some insightful commentary from founder/CTO Larry Ellison on the company’s go-to-market progress, including how Oracle is progressing in the healthcare space, taken from his prepared remarks on the Q3 earnings call:

First, how is our SaaS business doing right now? Overall, we have incredible progress, winning more and more in the ERP and HCM back office. Q3 was an exceptionally strong quarter for ERP cloud sales. We now have over 10,000 Fusion ERP, HCM customers. And for the first time, we’re beginning to see — we’ve been in this business long enough. We’re beginning to see us roll up certain industries, starting with the largest industry on Earth, health care.

Okay. So how are we doing in health care? We already have Tenet Health, Kaiser, Mayo Clinic, Cleveland Clinic, Northwell Health, Mount Sinai, Atrium Health. I can go a long list of ERP and HCM wins in the health care — those are all health care providers. We’ve added some additional health care providers, mainly hospitals and clinics. We’ve added the CHS Community Health Services. That’s a consortium, that’s 83 hospitals, and it’s an ERP, HCM, SCM win there. And we’re replacing Kronos.

Kronos, per Ellison’s commentary, is currently the “gold standard” in hospitals for flexible scheduling – responsible for assembling the armada of doctors, nurses, and physicians assistants that work disjointed schedules across multiple hospitals. The company is beginning to rip out Kronos in community hospitals, as well as winning competitive bake-offs against Workday (WDAY) and SAP (SAP).

On the innovation front, Ellison is leading the charge for Oracle to develop a MySQL (open source database offering) to compete against Amazon AWS’ Aurora (AMZN), claiming to provide transaction processing at 7x the speed of Amazon’s offerings and at 2.5-5x lower cost. Database products have always been Oracle’s typical dominion of strength, and it’s encouraging to see the company continue to chase revenue growth opportunities in this space.

Now, earnings did take a dip this quarter – GAAP net income fell -54% y/y to $2.32 billion. However, do note that operating margins stayed relatively flat year over year – the majority of the earnings decline was driven by the stock market drop in calendar Q1, which drove mark-to-market losses in earnings this quarter. The positive news on margin is that for the full year FY22, Oracle is still expecting pro forma operating margins of 45-46% – far higher than most software peers, and 1-2 points higher than Oracle’s pre-pandemic margin of 44%; indicating a business that is adept at scaling especially as the cloud transition has matured.

Key takeaways

Oracle remains a solid long-term software investment that has its claws in various areas of enterprise software. In particular, contrary to many investors who think the Cerner deal poses risk, I think Oracle’s intensified stance on healthcare uniquely positions the company against its other large-cap software peers. Stay long here – the opportunity to pick up Oracle at a ~15x forward P/E is attractive.

Be the first to comment