Eoneren

REITs, along with utilities and energy, are often the sectors to which people turn for dividend income. Within each sector, there are widely varying dividends which can either be excellent sustainable income or money losing traps. This article will focus on the best REIT dividends for stability, growth over time and absolute yield. Often a composite of these attributes will outperform reaching for any of the extremes.

In my opinion, these are the opportunistic dividend REITs right now in descending current yield order

- Slate Grocery REIT (OTC:SRRTF).

- Gladstone Commercial Corporation (GOOD).

- Armada Hoffler Properties, Inc. (AHH).

- Getty Realty Corp. (GTY).

- Equinix, Inc. (EQIX).

The rest of this article will explain the analysis. Essentially, it boils down to having the most favorable mix of key dividend attributes.

Key dividend attributes

- Current yield.

- Stability of yield.

- Pace of dividend growth.

Clearly, an investor would want all 3 of these attributes in as high of quantity as possible. However, they should not exist together in an efficiently priced market. If a stock had a large yield well-supported by stable earnings and had the potential to grow the dividend, that stock would obviously be a great investment, so the market price would be bid up to such a point that the yield was no longer large.

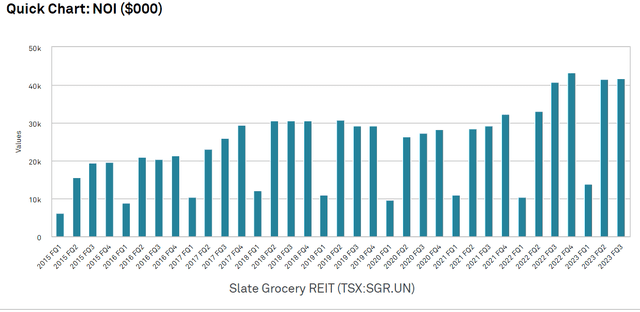

The math itself is quite simple, and I suspect everyone reading this is already familiar with the equation.

Definition

However, the implication of this is profound. Since the denominator is market price, the best dividend stocks are necessarily going to be stocks that the market does not like.

- A properly priced stock will offer a fair mix of the 3 attributes: current yield, stability, and dividend growth.

- A loved stock will offer a worse than fair mix of the 3 attributes.

- A disliked stock will offer a better than fair mix.

So, if one goes around asking which REITs are the best dividend REITs and a few stocks routinely show up on that list, those stocks are probably NOT good dividend REITs. The cacophony of pundits will invariably point to stocks where positive sentiment is causing the market price to trade above fair value, at least relative to the other potential choices.

Instead, I would strongly encourage independent assessment of the fundamentals. Each of the dividend factors can be fundamentally calculated or estimated. There is quite a bit of mispricing in the market and through measuring these factors one can uncover stocks that pose a better than fair mix of current yield, stability, and growth.

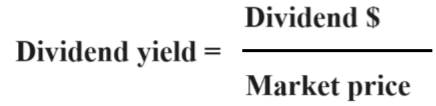

Current yield

Here are the 15 highest yielding equity REITs.

S&P Global Market Intelligence

Highest yielding equity REITs as of 2/26/24 source: S&P Global Market Intelligence.

A stock can only be properly priced with a yield this high if either the fundamentals are shaky or the dividend is at risk of a significant cut. Indeed, that is the case with most of this list. Many of these are office REITs, which have inherently risky fundamentals in the current environment.

Others are stocks with idiosyncratic risks such as bad management, extremely high debt, tenant troubles, or special situations with adverse potential outcomes.

A few on this list, however, have high yields due to mispricing and I believe are quite opportunistic. It comes down to analysis of stability of yield and forward dividend growth.

Stability of yield

Certain fundamental factors are causally linked to the stability of dividends. The biggest ticket items are:

- Payout ratio.

- Natural payout ratio of type of business.

- Stability of NOI.

- Leverage.

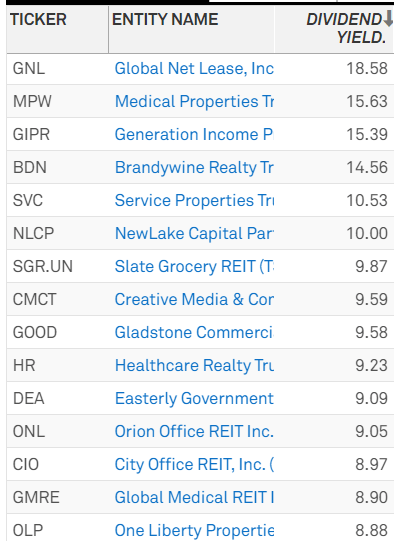

Let us look at Slate Grocery REIT (SRRTF) in regard to these parameters. Slate owns a $2.4B grocery anchored retail portfolio. The current earnings cleanly support the dividend with a payout ratio of 74%

S&P Global Market Intelligence

Many people incorrectly view under 100% as being the key threshold. Perhaps that is the level at which the company can pay dividends presently, but the required payout ratio to make dividends truly sustainable varies by industry.

- Triple net REITs can have sustainable payout ratios up to 90%.

- Office REITs should be below 50%.

- Industrial and retail should be somewhere between 60% and 80%.

- Farmland can be close to 100% for row crops.

Essentially, it depends on the amount of capex required to sustain and grow the business.

As a grocery anchored shopping center REIT, 74% is an okay payout ratio. I would like to see it slightly lower since retail can generate quite a bit of NOI growth from capex in the present environment, but I do not consider 74% a concerning level.

Given the payout ratio above, Slate’s current level of NOI is enough to sustain the dividend, but it behooves us to look at the stability of that level of NOI.

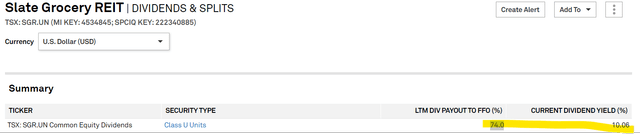

Stability of NOI

Slate has had nice NOI growth, although most of the below has come from acquisitions rather than organic.

S&P Global Market Intelligence

Going forward, organic NOI growth looks solidly positive due to the strength of shopping center fundamentals. I think Slate’s growth rate will be slower than that of peers due to location in submarkets with lower population/job growth, but supply and demand fundamentals still look favorable.

Somewhere around 3%-7% annual FFO/share growth is my base case scenario.

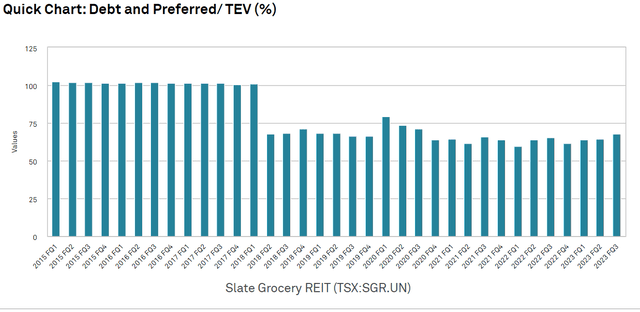

Leverage

Slate was previously a very high leverage REIT but has significantly lowered its leverage over time.

S&P Global Market Intelligence

It remains somewhat high leverage at 63% debt to total capital. Earnings fully cover debt service cost with a recurring EBITDA to interest expense of 1.6X.

Since FFO already accounts for interest expense, any ratio over 1.0X does not interfere with dividend coverage.

These metrics are primarily useful for determining the sensitivity to disruption. Given the somewhat high leverage, it would take less business interruption to derail Slate’s dividend than it would for a lower leverage peer.

For high dividend stability, I would generally like to see EBITDA coverage of recurring expenses above 3.0X and perhaps debt to total capital closer to 40%.

Putting it into context

There is no ultra-high dividend stock that will also score great on NOI stability and leverage. So while Slate has high leverage and only moderate organic NOI growth, its overall mix of parameters looks significantly superior to the other ultra-high yielding REITs.

Looking at the other 10%+ yielding REITs there are much more significant risk factors which makes them less desirable as income plays.

Slate’s dividend risk level is closer to the average REIT, yielding around 7%. At a 10% dividend yield, I think investors are getting a highly favorable reward to risk ratio, which makes it my top dividend pick among the ultra-high yielders.

Dividend growth

In addition to large dividends, most investors want their income stream to grow over time.

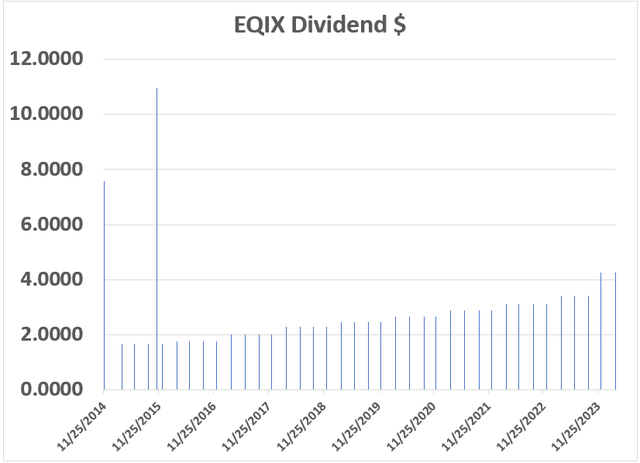

An example of a company with phenomenal dividend growth potential is Equinix, Inc. (EQIX). Over the past 10 years, it has more than doubled its dividend.

S&P Global Market Intelligence

However, I would caution against using historical dividend growth as an indicator of future dividend growth. In fact, I think this sort of backward looking analysis is often misleading. Instead, future dividend growth potential is related to fundamental factors.

The reasons EQIX will likely be able to grow its dividend rapidly in the future are:

- 64% payout ratio.

- Rapid AFFO/share growth (discussed further here).

- A track record of only issuing stock when it is clearly accretive to earnings on a per share basis.

The downside here is that the current dividend yield is only 1.9%. One might have to wait quite a long time before it becomes a true income play, but I do think the dividend growth rate will be among the highest going forward.

Mispricing as the key driver of opportunistic dividends

Dividend growth rate and dividend stability are often highly correlated, as they are largely driven by the same underlying fundamental strength.

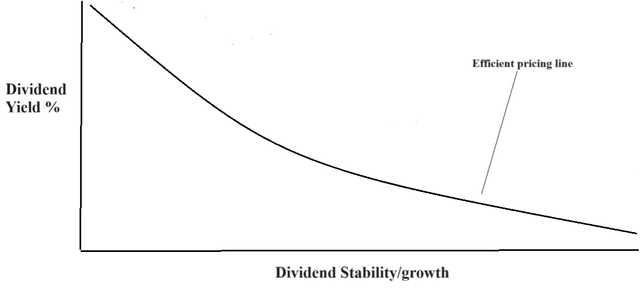

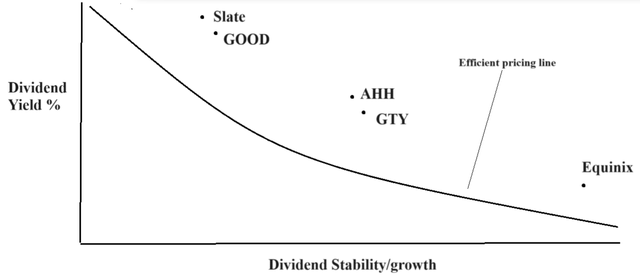

Current dividend yield is inversely correlated with the stability and growth.

Thus, if the market is efficiently priced, there would be the following efficient pricing line.

I think of it in terms of marginal tradeoff. You have to give up a certain amount of stability to get a certain amount of extra current yield.

Fortunately, the market in reality is not efficient and the mispricing affords getting additional current yield without having to give up stability. Each individual stock could be plotted as a dot on the above graph. It would form a sort of cloud of dots around the line. Those below the line have unfavorable mixes of current yield and stability/growth, while those above the line have more yield than one would expect relative to the growth/stability outlook. Below are 5 REITs that, I think, are particularly opportunistic for dividends income.

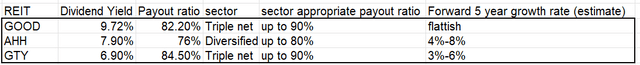

We have already discussed Slate and Equinix, so let us go over the parameters making Armada Hoffler Properties, Inc. (AHH) Gladstone Commercial Corporation (GOOD) and Getty Realty Corp. (GTY) opportunistic.

All 3 have payout ratios that are comfortable for their sectors.

Gladstone Commercial’s flat FFO/share in forward years will likely start with a slight down tick as unfavorable assets are sold and replaced with higher growth assets. So far, the leasing and repositioning has happened more favorably than expected. Over time, the 60% of GOOD’s portfolio that is industrial will start to outweigh the office repositioning headwind. So I see the forward trajectory of FFO as roughly flat over the next 5 years, followed by consistent long-term growth.

Armada Hoffler has a significant portion of its assets tied up in developments that are not yet cash flowing, which is holding back its growth rate in 2023 and 2024. I think this is being interpreted as a negative, but pre-leasing of the developments is ahead of schedule and the physical construction appears on time and on budget. Successful and accretive delivery would be on par with AHH’s history and I think once the revenues start flowing on these large properties, dividend growth will ensue.

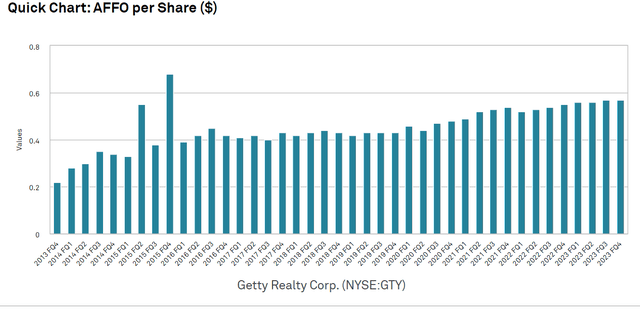

Getty Realty has amassed a long streak of AFFO/share growth.

S&P Global Market Intelligence

It is a fairly repeatable process of acquiring convenience stores at cap rates above GTY’s cost of capital. As the company grows assets, AFFO/share rises slowly and predictably. The company has, and I think will continue to keep the AFFO payout ratio at around the same level such that forward AFFO growth will translate proportionally into dividend growth.

Wrapping it up

Don’t buy dividend stocks based solely on their dividend history. It is the earnings and forward fundamentals that determine future ability to pay and grow the dividend.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment