Editor’s note: Seeking Alpha is proud to welcome Rabih Aridi, CFA as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

SOPA Images/LightRocket via Getty Images

Introduction

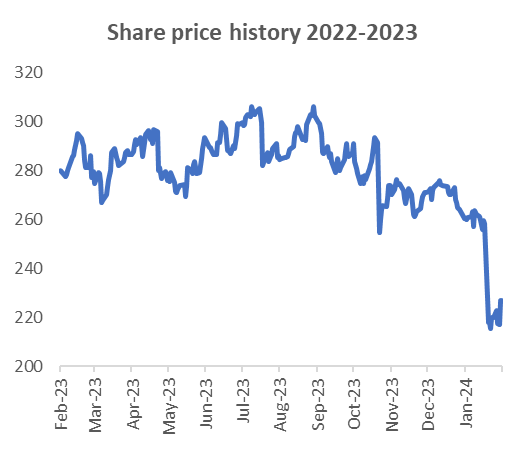

I recommend buying Air Products and Chemicals (NYSE:APD) stock with a target price of $285 over the next 12 months following its 16% drop over the Q1 2024 earnings release.

I believe the market has overacted to management’s guidance around slow growth in China and delays in its 8 major upcoming hydrogen projects. Especially since China’s manufacturing activity has already begun to recover and the demand for industrial gases in Asia is forecast to grow at a CAGR of 6%+ (according to Modor Intelligence) until 2030.

The market has been penalizing Air Products’ negative cash flow, which arises from its 50%+ capex/sales ratio, which is 5x that of its peers. I believe that the company’s aggressive investment strategy will begin to materialize over the next 2-3 years, despite the minor delays in the projects, as it reduces its capital expenditure and deleverages its balance sheet.

Company Description

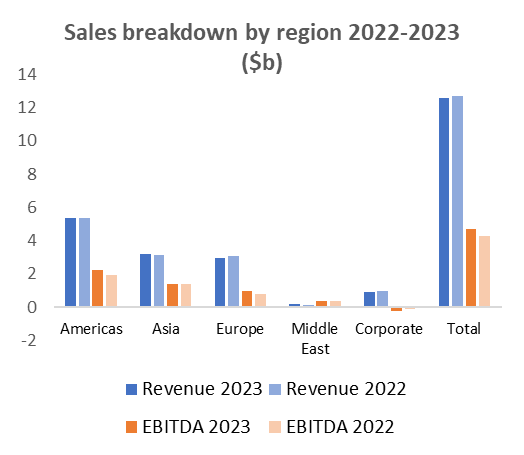

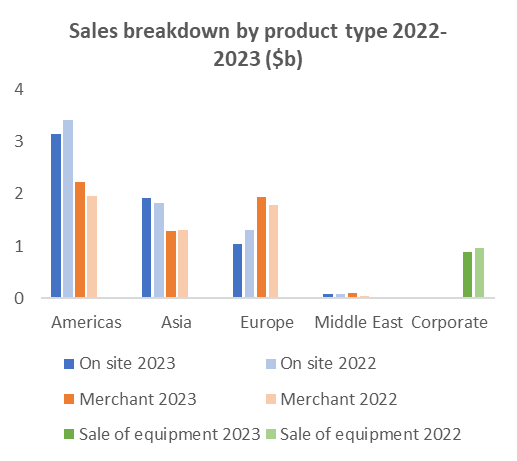

Air Products is the third-largest industrial gas company in the world. The company builds, owns, and operates major gasification plants around the world and is among the leaders in the sale of liquid hydrogen. As per the 2023 annual report, the company classifies its revenue geographically, where the revenue contribution is as follows: America (42%), Asia (25%), Europe (24%), Middle East (1%), and Corporate (8%). Air Products also provides revenue segmentation by product type across these geographies in 2023: America (59% on-site vs. 41% merchant), Asia (60% on-site vs. 40% merchant), Europe (35% on-site vs. 65% merchant), Middle East (47% on-site vs. 53% merchant), and Corporate (100% sale of equipment). The table below was extracted from the company’s 2023 annual report and provides an additional explanation of each product type.

|

Product Type Breakdown |

||

|

Supply Mode |

Description |

Contracts |

|

On-site / Pipeline |

For customers that require large volumes of gases and have relatively constant demand and are principally in the energy production and refining, chemical, gasification, and metals industries |

15-20+ years |

|

Liquid Bulk |

Delivered in bulk (as liquid or gaseous form) by a tanker or tube trailer, and stored on the customer’s site within vaporizing equipment |

3-5 year |

|

Packaged Gas |

Small quantities delivered in cylinders or dewars (most commonly helium and for the electronics and magnetic resonance imaging industries) |

Short-term |

|

Equipment and Services |

Design and manufacture equipment for air separation, hydrocarbon recovery and purification, natural gas liquefaction, and other transport and storage options |

Purchase order based |

As per Air Products’ Q1 2024 investor meeting presentation, the company has eight long-term projects in the pipeline, with an investment exceeding $18b, that are expected to be completed within the next two to three years. Factors contributing to the company’s growth in 2024 include the completion of new projects, effective cost management, and robust pricing policies. Especially, given that the company has mentioned in its 2023 annual earnings call that it intends to adjust its pricing policy in its new projects to reflect its target double-digit IRR.

Below is the breakdown of the 8 projects as per the company’s Q1 2024 investor meeting presentation and its 2023 annual report. Green hydrogen projects relate to hydrogen production projects that use 100% green energy. Blue hydrogen projects relate to those that produce hydrogen using fossil fuels but significantly minimize their emissions using carbon capture technologies.

|

Project |

Location |

Cost ($m) |

Expected completion date |

Description |

|

NEOM Green Hydrogen and Ammonia Complex |

Neom – Saudi Arabia |

8,400 |

2027 |

2.2-Gigawatt green hydrogen and ammonia production plant |

|

Louisiana Clean Energy Complex |

Louisiana – USA |

7,000 (for both Louisiana projects) |

2026 |

Blue hydrogen and blue ammonia production with carbon capture capabilities |

|

Blue Hydrogen Sequestration and Shipping |

Louisiana – USA |

7,000 (for both Louisiana projects) |

2026 |

Sequestration and Shipping of carbon dioxide |

|

Net-Zero Hydrogen Energy Complex |

Alberta – Canada |

1,000 |

2024 |

Blue hydrogen production |

|

World Energy Sustainable Aviation Fuel |

California – USA |

2,000+ |

2024 |

Sustainable aviation fuel production from renewable resources |

|

Rotterdam Hydrogen Plant |

Rotterdam -The Netherlands |

Not disclosed |

2026 |

Largest production of blue hydrogen in Europe |

|

Green Hydrogen Plant |

New York – USA |

1,400 |

2027 |

Production of liquid hydrogen using hydroelectric power |

|

Hydrogen fuel cell truck development with Cummins |

Global |

Not disclosed |

2030 |

Convert the existing delivery liquid gas delivery trucks to hydrogen fuel cell power |

Sales breakdown by region 2022-2023 ($b) (Author’s compilation from the company’s annual financial statements 2022-223)

Sales breakdown by product type 2022-2023 ($b) (Author’s compilation from the company’s annual financial statements 2022-2023)

Company Performance Overview

Following the Q1 2024 earnings, the share price fell around 16%. The main takeaways of the earnings call were mainly delays in the completion of the long-term projects as well as revenue slowdown in Asia, resulting from slow economic growth in China. Q1 2024 revenue decreased by 6%, out of which 11% was due to lower energy pass through cost, while it was partially offset by a 3% increase in volumes and a 2% increase in pricing. EBITDA increased by 8.4% to reach $1,175m in Q1 2024 however it missed estimates of $1,245m. EPS increased by 6.8% to reach $2.82 but missed estimates of $3.00.

Total debt increased by 12.5% in Q1 2024 vs. Q4 2023; however, the company has sufficient resources to manage its debt. The LT debt/equity ratio increased from 58.3x in Q1 2023 to 84.1x in Q1 2024, but the quick ratio decreased from 1.74x to 1.58x over the same period. The debt is primarily used for the Neom Green Hydrogen Project (one of the 8 long-term projects in the pipeline) that is expected to commence operations in 2026. The company has a debt covenant that does not allow it to exceed debt to total capitalization of 70%, while the current level is 38.7% up from 36.1% in Q4 2023. S&P’s “A” rating for the total debt to capitalization ratio for this industry is up to 40%.

The company has been consistently raising its dividends. It raised its dividend in Q1 2024 to $1.77 per share and has previously raised it to $1.75 per share in Q4 2023 and to $1.62 per share in Q2 2022 (up from $1.50 per share).

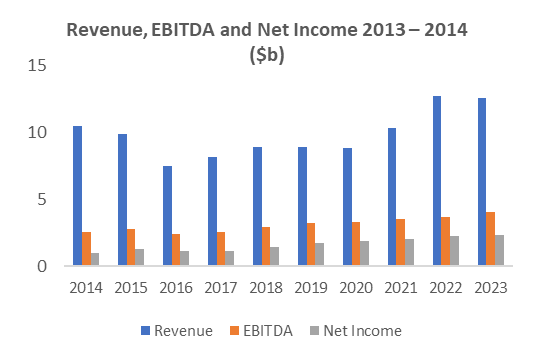

Historically, the company has been consistently increasing its revenue since 2016 with a CAGR of 7.7%. The drop in revenue in 2016 is related to the carve-out of its electronics materials division, which generated around $1b annually. This division mainly supplied chemicals and gases to the semiconductor industry. Air Products believed that this division could be more competitive as an independent entity, especially since the semiconductor industry was experiencing a large trend of consolidation, and the separation allowed them to pursue different growth strategies. The division was then separated into an independent entity called Versum Materials, which underwent an IPO in 2016 and was fully acquired by Merck KGaA in 2019. In terms of profitability, Air Products has maintained a constant YoY growth in EBITDA and net income with CAGRs of 7.7% and 11.1% respectively since 2016.

Revenue, EBITDA and Net Income 2013 – 2014 ($b) (Author’s compilation from FactSet)

Share price history 2022-2023 (Author’s compilation from FactSet)

Industry Overview

According to Mordor Intelligence, the industrial gas market is expected to grow at a CAGR of 4.4% over 2024-2030. Key value drivers:

- Projected industrial growth in Asia-Pacific and Africa is expected to raise the demand for industrial gases

- The Asia-Pacific region is expected to exhibit the highest demand in this industry over the next 5 years

- Increasing demand for alternative energy sources and increased healthcare requirements are anticipated to drive the short-term market growth

- Environmental regulations are also expected to weigh in on the market’s expansion

Based on Modor Intelligence’s Helium market report, the global market for helium was estimated at $2.3b in 2022 and is projected to reach $3.4b in 2023, growing at a CAGR of 5%. China is expected to achieve a market size of around $505m by 2030, with a CAGR of 6.7% over the same period. Notable growth is also anticipated in Japan and Canada, with forecasted CAGRs of 3.5% and 4.7%, respectively, from 2023 to 2030. In Europe, Germany is projected to experience a CAGR of approximately 3.9%.

According to Grand View Research, the global markets for other industrial gases such as oxygen, nitrogen, hydrogen, and Argon are expected to grow at CAGRs of 6.3%, 6.8%, 6.0%, and 4.4% respectively over 2023-2030.

Investment Thesis

1. Robust Fundamentals and Temporary Market Slowdown. Despite the company missing Q1 2024 analyst estimates, I strongly believe that it still has strong fundamentals. First, it’s important to note that despite the drop in revenue, 11% of the drop was related to energy pass through costs that contribute positively to the bottom line as they also decrease the operating costs. On the volumes and pricing aspect, the company increased its revenue by 6%.

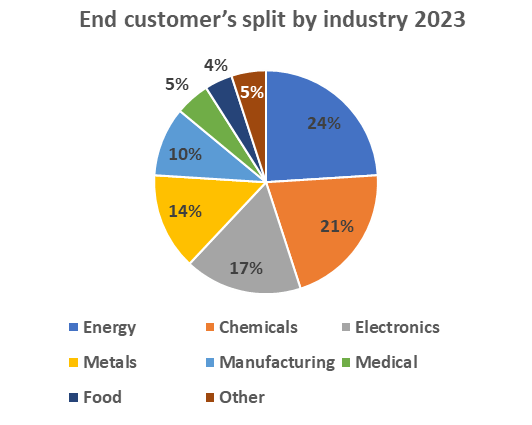

- Currently, the company’s end customers are split as per the below figure, as per the company’s annual 2023 report. The Americas contribute the most to the energy and chemicals revenue stream, which is expected to grow significantly given that the North American market has begun to recover from the 2023 economic slowdown. Moreover, management has indicated its intention to adopt an enhanced pricing strategy in this region, which is expected to also drive revenues. Revenues in this region are expected to grow by a CAGR of 15% over 2024-2027 due to volume and price increases.

End customer’s split by industry 2023 (Author’s compilation from the company’s annual financial statements 2023 and 10-Q Q1 24 report)

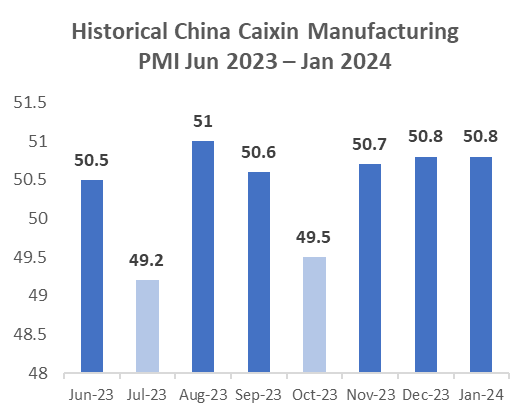

- The end customer split also shows that 41% (electronics, metals, and manufacturing) of the company’s revenues are generated from industrial demand. This segment is dominated by Asia, which has seen a temporary economic slowdown in China resulting from weak global demand and a real estate crisis. The manufacturing/industrial activity is expected to pick up in China with the pick up in global demand and exports. I expect revenues from this segment to be driven by a pick up in volumes and to grow at a CAGR of 10% over 2024-2027 (especially with the current global interest rate cuts expectations). The below figure presents the Caixin China General Manufacturing PMI, which shows a slow recovery in China, with figures above 50 indicating an expansion in the manufacturing sector. In addition, most of the company’s sales to China involve helium and the Asian demand for helium is expected to increase at a CAGR of 6.7% over 2023-2030.

Historical China Caixin Manufacturing PMI Jun 2023 to Jan 2024 (PMI SandP China Caixin Manufacturing Q1 2024 release)

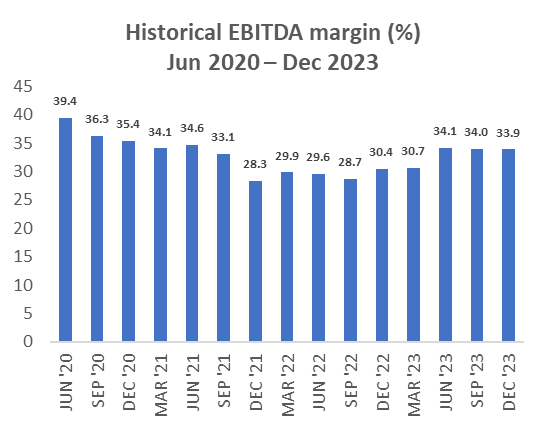

• Looking at EBITDA margin, the below figure shows the company’s robustness over the past year. The company has been able to raise its EBITDA margin to 33.9% in Dec. 2023 from 30.4% and 28.3% in Dec. 2022 and Dec. 2021 respectively. I expect the company to maintain its EBITDA margins as inflation eases and its operating costs stabilize.

Historical EBITDA margin (%) Jun 2020 – Dec 2023 (Author’s compilation from FactSet)

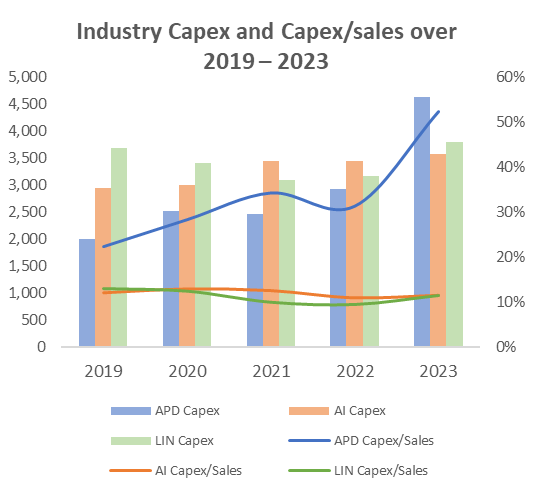

2. Aggressive Long-Term Investments. The company has been increasing its capex significantly over the past 3 years. Its capex has increased from $2.46b in 2021 to $4.63b in 2023 (88% increase). The management has also mentioned in its 2023 annual report that it expects capex in 2024 to reach $5.50b. The below figure shows the comparison in capex/sales of Air Products and Chemicals with its competitors Linde plc (LIN) and Air Liquide SA (OTCPK:AIQUF). APD’s capex to sales ratio reached 52% in 2023 and averaged 39% over the past 3 years, while LIN and AI had a three-year average of 10% and 11% respectively. This highlights the company’s commitment towards long-term growth, which it expects to realize over the 2025-2027 period.

Industry Capex and Capex/sales over 2019 – 2023 (Author’s compilation from FactSet)

- The company is currently executing 8 new hydrogen projects with a target IRR > 10% due to their long-term onsite contracts. The company is using its “A” credit rating to finance these expansionary projects. This has led the company to consistently generate negative cash flow as its growing positive cash flow is being offset by the expansionary investments. I believe that this trend is expected to reverse post 2025 as the new projects generate returns for the company, allowing it to deleverage. It is also worth mentioning that the company does have a maturity wall in 2024 which it intends to refinance through the US debt market.

- In addition, the company recognizes income from some of its projects in the Equity Affiliate’s Income account in operating income (instead of revenue) as these projects are structured as JVs with a local partner. As per the company’s 2023 annual report, income from these JVs amounted to $0.60b, $0.48b, and $0.29b in 2023, 2022, and 2021 respectively. These amounts represent around 5% of total revenue per year, and I expect them to increase as additional phases of these undergoing projects become operational in 2025.

Valuation Analysis

Based on my valuation analysis, I expect the company’s share price to reach $285 with a 23% increase in price from the current share price of $232.

Discounted Cash Flow Analysis

I have run a 10-year DCF analysis with the below results.

The implied share price from this analysis is $285.

The valuation assumes a WACC of 7.8% broken down as follows:

- The risk-free rate corresponds to the US 10-year bond yield as of February 2024.

- Equity risk premium assumption is obtained from Professor Damodaran’s NYU database.

- Levered beta corresponds to the peer average leverage beta of Linde (0.87) and Air Liquide (0.89). Source: FactSet

- Similarly, D/E is taken as the average of that of the peer companies (Linde 0.34 and Air Liquide 0.42). Source: FactSet

- The marginal tax rate is assumed to be the US corporate tax rate.

- Company-specific risk was assumed to be 0.5% as the company is the third-largest producer of industrial gases in the world.

- Cost of debt is calculated as the post-tax weighted average interest cost on all of Air Products’ outstanding bonds, as the company mentioned in its Q1 2024 statement that it aims to refinance its loans in the US bond market. Source: Bloomberg Terminal

| WACC | |

| Risk-free rate | 4.3% |

| Equity risk premium | 5.0% |

| Levered Beta | 0.88 |

| Peer D/E | 0.38 |

| Tax rate | 21% |

| Unlevered Beta | 0.68 |

| APD D/E | 0.84 |

| Relevered Beta | 1.13 |

| Company specific risk | 0.5% |

| Cost of equity | 10.4% |

| Interest cost | 4.8% |

| Cost of debt | 3.8% |

| Weight of equity | 54.3% |

| Weight of debt | 45.7% |

| WACC | 7.8% |

The terminal growth rate is assumed to be 2%, in line with the long-term US growth rate as per the IMF data mapper.

I have assumed a revenue CAGR of 8.5% for the forecast period. This includes an expected 12% CAGR in the first 3 years, which is mainly driven by the partial completion of the new projects and to gradually converge towards 5% in year 10. In the first three years, I have forecasted the revenue drivers as per the below CAGRs:

- Americas: 15%, driven by an increase in volume due to the opening of the new plants and increase in price as the company adjusts its pricing to pass on inflationary pressure

- Asia: 10%, mainly volume driven as manufacturing outputs and exports return to pre-crisis levels

- Europe: 5%, price driven as the company has been hit the most with inflation in this region and will aim to pass on its higher costs

- Middle East: 15%, driven by the completion of new phases of its outstanding projects, the already ongoing Jazan Project (JV with local partners) just completed its phase 2 in 2024 and is expected to contribute to the company’s revenue this year

- Corporate: 7.5%, in line with analysts’ estimates

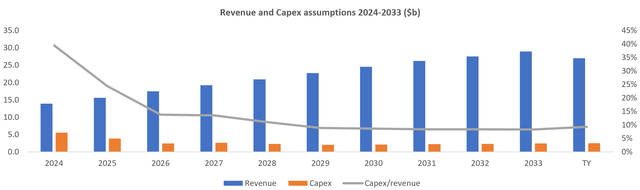

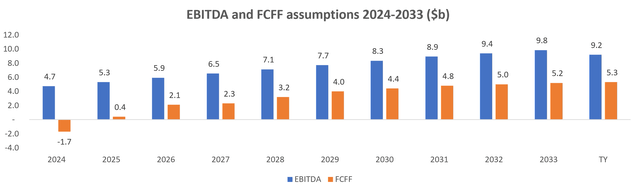

I expect free cash flow to remain negative in 2024 and become positive in 2025 as the capex is assumed to be greatly reduced from 52% of sales in 2023 to 25% in 2025.

I expect EBITDA margin to conservatively remain constant at 34% (management has guided 37% for 2024) as the new major projects are operated under a long-term onsite contract with high margins.

Revenue and Capex assumptions 2024-2033 ($b) (Author’s Calculation) EBITDA and FCFF assumptions 2024-2033 ($b) (Author’s Calculation)

Relative Valuation

Based on a relative valuation analysis, the estimated share price is $251-345 ($298 midpoint).

The analysis was based on Tier 1 competitors: Linde and Air Liquide. These companies represent the top 1 and top 2 companies respectively by revenue (Linde: $32.9b, Air Liquide: $29.9b, Air Products: $12.6b) followed by Air Products. Tier 2 competitors include the Japanese company Nippon Sanso and the Chinese Hangzhou Oxygen Plant. Both companies have a regional focus and less international reach than the top 3 players.

I have relied on the following calculation to derive the estimated equity value of the company, using both average and median values for each ratio (sourced from FactSet):

- P/E: $332 – $345 using estimated net income of $3.0b for 2024

- EV/EBITDA: $252 – $274 using EBITDA of $4.7b, LT debt of $12.6b and cash of $2.2b for 2024

- EV/EBIT: $251 -$263 using EBIT of $3.1b, LT debt of $12.6 and cash of $2.2b for 2024

|

Peer Analysis (forward ratios) |

P/E |

EV/EBITDA |

EV/EBIT |

|

Air Products and Chemicals Inc |

18.9 |

12.5 |

21.4 |

|

Linde PLC |

29.1 |

18.4 |

24.8 |

|

Air Liquide SA |

27.3 |

13.9 |

20.5 |

|

Nippon Sanso Holdings Corp |

23.4 |

9.3 |

15.6 |

|

Hangzhou Oxygen Plant Group Co Ltd |

17.7 |

9.8 |

14.7 |

|

Average (excluding APD) |

24.4 |

10.6 |

19.1 |

|

Median (excluding APD) |

25.4 |

10.1 |

20.1 |

Key Risks

- Persisting low manufacturing levels in China. As previously mentioned China is a major contributor to the company’s revenue and its manufacturing activity is forecast to grow over the coming years as global demand picks up and increasing Chinese exports. A persistent slowdown in China’s manufacturing could significantly reduce the company’s volumes produced and eventually reduce total revenue, given that Asian revenues already account for 25% of the total revenue.

- Delays and budget overruns in major projects. The company’s growth prospects are heavily dependent on its ability to deliver its major projects. Any major delays on these projects have severe consequences as these projects are mainly funded through debt. This means that delays would instantly reduce expected revenues, increasing operational costs as well as financing costs.

- Unexpected losses triggering debt covenants/credit rating downgrade. The company has a debt covenant of a maximum of 70% of debt to capitalization, while its current level is 38.7%. If the company incurs consistent losses, its equity value would shrink and its debt to capitalization ratio would instantly increase, triggering a technical default or a rating downgrade. In this industry, an “A” rating assumes a 40% debt to capitalization, which means the company is on the edge of a downgrade (it is also important to note that other ratios are also taken into consideration for the rating).

Conclusion

I believe that Air Products has enough growth potential to reach a share price of $285 driven by its 8 major hydrogen projects and sustainable earnings. The company’s negative cash flows are expected to reverse over the next 2 years as it decreases its aggressive capex to average industry levels and as the new projects become operational and contribute to its bottom line.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment